Bond Claim Letter Example With Insurance

Description

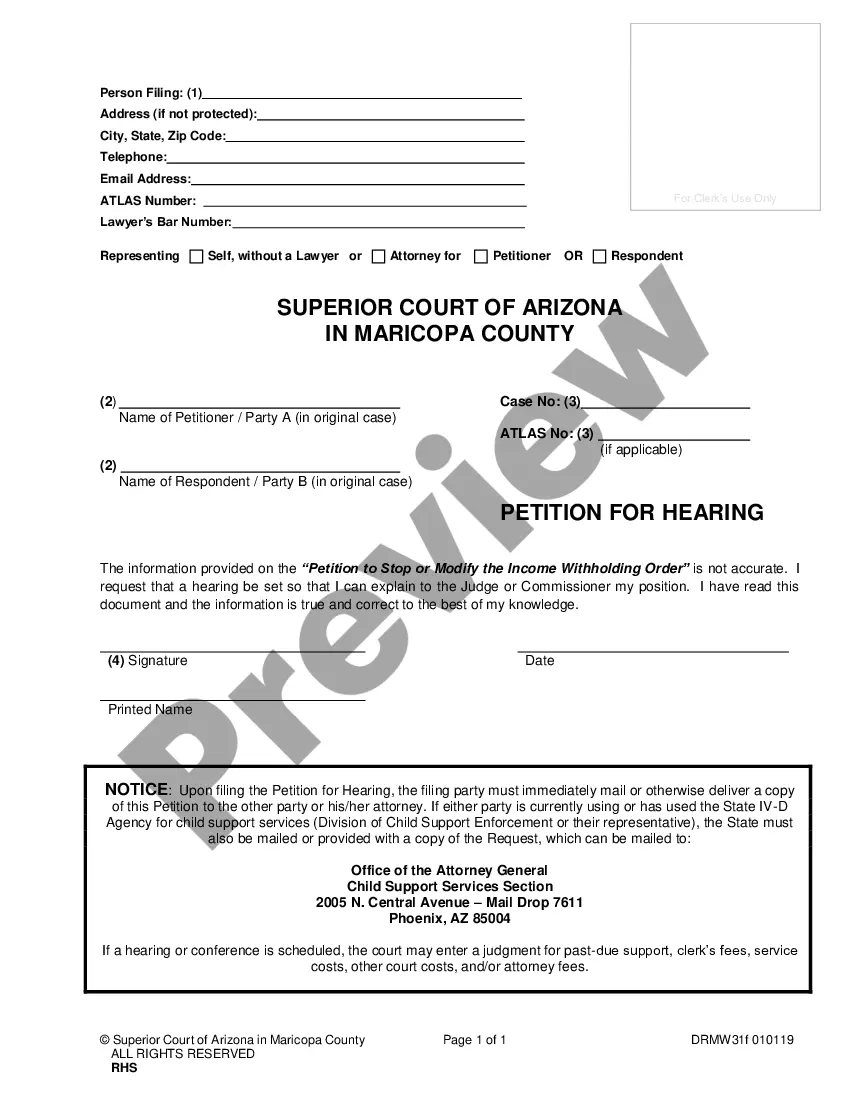

How to fill out Bond Claim Notice?

Acquiring legal documents that adhere to federal and local regulations is essential, and the web provides numerous choices to select from.

However, why squander time hunting for the appropriate Bond Claim Letter Example With Insurance template online when the US Legal Forms digital library has so many examples gathered in one location.

US Legal Forms is the largest online legal repository with more than 85,000 fillable documents prepared by attorneys for any business and personal requirement.

Review the template using the Preview feature or via the text outline to confirm it satisfies your requirements. Search for another sample using the search tool at the top of the page if needed. Click Buy Now when you’ve identified the correct form and select a subscription plan. Create an account or Log In and complete your payment using PayPal or a credit card. Choose the format for your Bond Claim Letter Example With Insurance and download it. All templates you find through US Legal Forms are reusable. To re-download and fill out previously acquired documents, visit the My documents tab in your account. Enjoy the most comprehensive and user-friendly legal documentation service!

- They are straightforward to navigate, with all documents categorized by state and intended use.

- Our experts stay informed about legislative changes, ensuring your documentation remains current and compliant when acquiring a Bond Claim Letter Example With Insurance from our site.

- Acquiring a Bond Claim Letter Example With Insurance is quick and efficient for both existing and new customers.

- If you already possess an account with a valid subscription, Log In and save the required document sample in the appropriate format.

- For new users, follow the steps outlined below.

Form popularity

FAQ

Preparing a letter of claim involves outlining the key components of your case. Begin with your contact information, followed by the insurance company’s details, and then state the purpose of the letter. Include all relevant information about the claim, such as dates, amounts, and supporting documentation to substantiate your request. Using a bond claim letter example with insurance can streamline this process significantly.

To write a good claim letter, start by clearly stating your request and describing the situation at hand. Use a straightforward structure: introduction, body, and conclusion, providing all necessary details and documentation. Maintain a respectful tone throughout your letter and double-check for any errors before sending. You might find inspiration by reviewing a bond claim letter example with insurance to help you craft your letter.

An example of a bond claim occurs when a business fails to fulfill its contractual obligations, leading a client to file a claim against the business's surety bond. For instance, if a contractor does not complete a construction project, the client may claim against the contractor's bond for financial restitution. This process can be complicated, so reviewing a bond claim letter example with insurance may help you navigate through it.

Writing a letter for an insurance claim starts with a clear statement of intent. Include your policy number, a description of the incident, and any supporting documents you may have. Ensure your letter is polite and professional, outlining your request clearly. A bond claim letter example with insurance can provide you with a structured format to follow.

To file a claim against a broker's bond, begin by gathering necessary documentation supporting your claim, such as contracts or invoices. Next, draft a claim letter that details your issue and the amount you seek, referencing the broker's bond. Ensure you submit this letter to the bond company, following their required process. For a better understanding, consult a bond claim letter example with insurance.

A bond in insurance acts as a form of financial guarantee. For example, a contractor might provide a surety bond to guarantee their performance on a project, assuring the client that they will fulfill their obligations. This type of bond protects the client from financial loss, should the contractor fail to complete the work as promised. Understanding various bond types is crucial, so consider looking at a bond claim letter example with insurance for clarity.

To write a bond claim letter, start by clearly stating the purpose of your letter. Include essential details, such as the bond number, the name of the bond issuer, and a brief explanation of your claim. Be concise and factual while ensuring you express your request for compensation related to the bond. For a practical perspective, refer to a bond claim letter example with insurance to guide your writing.

A bond serves as a guarantee that one party will fulfill their obligations to another party. In the context of insurance, this means that if a policyholder does not meet their contractual duties, the bond provides financial protection to the affected party. This is where a bond claim letter example with insurance becomes essential, as it outlines the necessary steps for filing a claim. Understanding how to use these documents helps ensure that you can navigate the process effectively and secure your rights.