Bond Claim Letter Example For Bid

Description

How to fill out Bond Claim Notice?

The Bond Claim Letter Sample For Bid displayed on this site is a reusable legal format created by expert lawyers in compliance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, companies, and legal professionals with over 85,000 confirmed, state-specific documents for any business and personal needs.

Sign up for US Legal Forms to access verified legal templates for all of life’s circumstances available at your fingertips.

- Search for the document you require and review it.

- Browse through the file you searched and view it or check the document description to confirm it meets your requirements. If it doesn't, use the search bar to find the appropriate one. Click Buy Now once you've found the template you need.

- Register and Log In.

- Select the subscription plan that works best for you and create an account. Pay quickly using PayPal or a credit card. If you already have an account, Log In to check your subscription and proceed.

- Obtain the editable template.

Form popularity

FAQ

Writing a simple claim letter involves clearly stating your purpose and providing relevant details about your claim. Start by addressing the recipient, then explain the issue concisely, including any necessary documentation. To make it easier, look for a Bond claim letter example for bid that you can adapt to your needs. This ensures your claim is clear and professional, increasing your chances of a positive response.

To obtain a bonding letter, you need to contact your surety provider or bonding company. They will require specific information about the project and your financial standing. Once you provide the necessary details, they will issue a bonding letter. For a useful Bond claim letter example for bid, you can refer to various templates available online.

Writing a claim letter involves clearly stating the nature of your claim and including all relevant details. Start by providing your contact information, followed by a concise description of the issue at hand, and reference any binding agreements. For assistance and to find a well-structured Bond claim letter example for bid, consider using uslegalforms, which offers templates tailored to meet your writing needs.

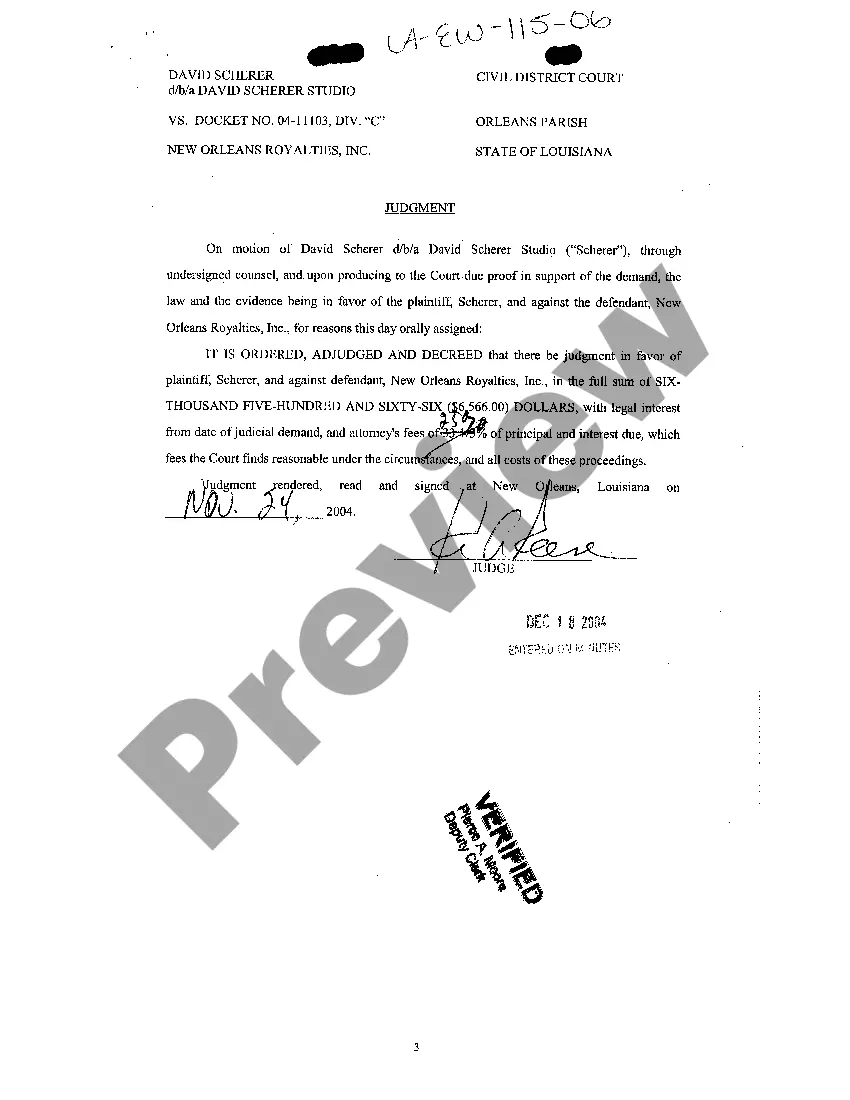

A bid bond letter is a crucial document that guarantees the contractor will enter into a contract if awarded the bid. This letter protects project owners by ensuring that they have recourse if the winning bidder fails to fulfill their obligations. For those seeking a clear Bond claim letter example for bid, this letter serves as a formal representation of the contractor's commitment and reliability.

To write a good claim letter, focus on clarity and structure. Start with the purpose of your letter, detailing the context of your claim. Use specific examples and facts to support your claim, ensuring it is easy to read. Reviewing a bond claim letter example for bid can provide useful insights into the format and content needed to communicate effectively with the recipient.

Preparing a letter of claim involves several key steps. Begin by clearly identifying the parties involved, including your contact information and the recipient's details. Then, articulate the basis of your claim, providing concise details of the issue at hand. Reference any related documents to support your position, which can draw from a bond claim letter example for bid for effective structure.

An example of a bid bond can be seen when a contractor submits a proposal for a construction project. This document guarantees that if the contractor wins the bid, they will follow through with the contract obligations. In the event they fail to do so, the project owner can invoke the bid bond, often illustrated in a bond claim letter example for bid. This protects the owner from losses during the bidding process.

To file a claim against a broker's bond, begin by gathering all relevant documentation that supports your claim. This includes contracts, invoices, and communications related to the dispute. Next, draft a bond claim letter, ensuring it details the reasons for your claim, as influenced by a bond claim letter example for bid. Finally, send your claim to the surety company that issued the bond.

Filling out a bid bond request form requires you to provide specific information. Start with your business details, including your name, address, and contact information. Then, clearly specify the project details and the bond amount requested. To ensure correctness, refer to a bond claim letter example for bid if you need clarity on required sections.

To write an effective bond claim letter, begin with your contact information and the date. Clearly state the purpose of the letter and provide details about the bond, including the project name and identification numbers. Include a concise explanation of the reasons for the claim, referencing any supporting documents. A solid bond claim letter example for bid demonstrates your clear intent and directly communicates your needs.