Malpractice Insurance Tail Coverage Cost

Description

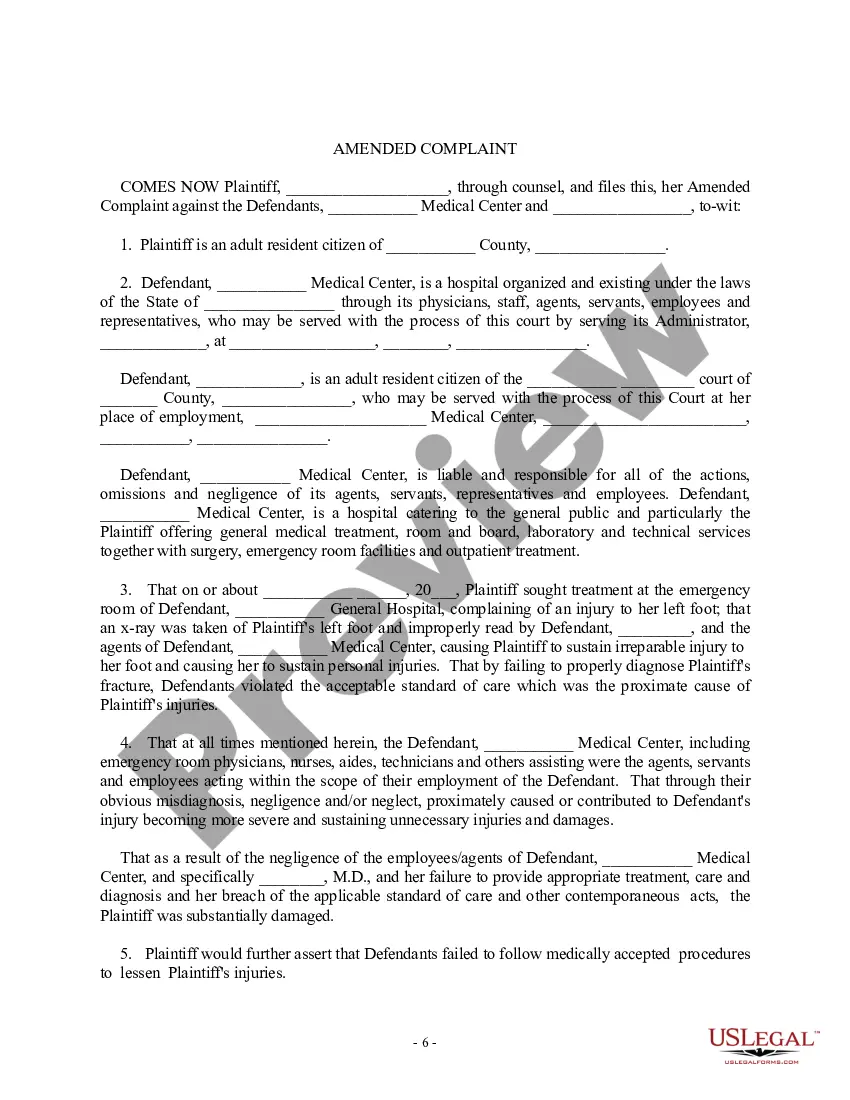

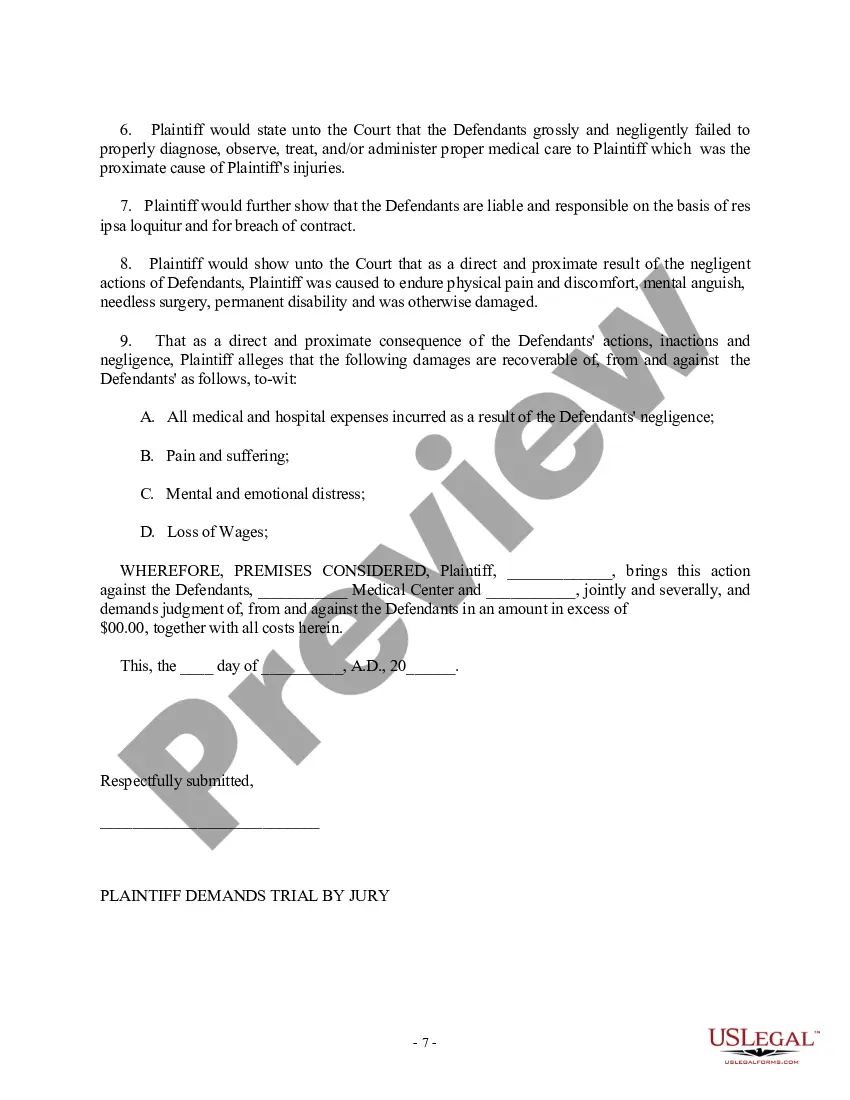

How to fill out Complaint For Medical Malpractice Regarding Surgical Procedure?

Whether for professional objectives or personal matters, everyone must confront legal issues at some stage in their life.

Filling out legal paperwork calls for meticulous care, beginning with selecting the appropriate form template.

With an extensive US Legal Forms catalog available, you won’t need to waste time searching for the correct template online. Utilize the library’s easy navigation to find the appropriate template for any situation.

- Locate the template you require by utilizing the search function or navigating through the catalog.

- Review the document’s details to confirm it is suitable for your circumstances, region, and county.

- Click on the document’s preview to see it.

- If it is the wrong document, return to the search feature to find the Malpractice Insurance Tail Coverage Cost template you need.

- Download the file once it meets your specifications.

- If you already possess a US Legal Forms account, click Log in to access previously stored templates in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the suitable pricing plan.

- Complete the account registration form.

- Select your method of payment: use a credit card or PayPal.

- Choose the desired file format and download the Malpractice Insurance Tail Coverage Cost.

- After it is downloaded, you can fill out the form with editing software or print it and complete it by hand.

Form popularity

FAQ

Tail coverage is not legally required, but it is highly recommended for healthcare providers transitioning from one practice to another. This coverage protects you from potential claims that may arise after you stop practicing, offering peace of mind. Evaluating the malpractice insurance tail coverage cost is crucial to making informed decisions about your financial protection, especially if you're considering a career change.

Often, standard malpractice insurance policies do not automatically include tail coverage; it's commonly an add-on option. This means that healthcare providers need to consider the malpractice insurance tail coverage cost when purchasing their policy. Understanding your policy fully ensures you have the right coverage when it’s time to transition from a practice.

In most cases, the healthcare provider is responsible for covering the cost of malpractice insurance tail coverage. This additional coverage is necessary when a provider leaves a practice or retires, ensuring protection against future claims. Understandably, the malpractice insurance tail coverage cost can vary significantly based on factors such as the provider's specialty and claims history.

The cost of tail coverage varies based on several factors, including your specialty, location, and the amount of coverage you require. Typically, industry averages suggest that malpractice insurance tail coverage costs can range from a few thousand dollars up to tens of thousands. To get an accurate quote, it's essential to evaluate your specific needs and consult platforms such as US Legal Forms, which can help you navigate the options available for your situation.

Calculating tail spend involves identifying the specific liabilities that will be covered after your primary malpractice insurance policy ends. You should consider factors such as the duration of coverage, the expected costs associated with claims, and any outstanding legal fees. Understanding these elements helps you estimate the total malpractice insurance tail coverage cost you may need. Utilizing platforms like US Legal Forms can simplify this calculation, providing you with straightforward tools and guidance.

Enacted in 1970, the FCRA grants to consumers strong rights regarding information that companies like Defendant trade about them. Specifically, Congress has emphasized that ?the consumer has a right . . . to correct any erroneous information in his credit file.? S. Rep.

In summary, federal and state laws, including the FCRA, FCCPA, and FDUTPA, apply to Florida's credit reporting and debt collection practices.

Some states limit the time a conviction can be reported to seven years, despite the lack of any such limit under the FCRA. The seven-year states include California, Kansas, Maryland, Massachusetts, Montana, Nevada, New Hampshire, New Mexico, New York, and Washington.

A Summary of Your Rights Under the Fair Credit Reporting Act. The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of. information in the files of consumer reporting agencies. There are many types of consumer.

The Fair Credit Reporting Act (FCRA) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. The law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your consumer reports.