Corporate Dissolution Plan Template

Description

How to fill out Plan Of Liquidation?

Finding a go-to place to take the most recent and appropriate legal samples is half the struggle of dealing with bureaucracy. Choosing the right legal documents needs accuracy and attention to detail, which is the reason it is vital to take samples of Corporate Dissolution Plan Template only from reputable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and check all the information regarding the document’s use and relevance for the situation and in your state or county.

Take the listed steps to finish your Corporate Dissolution Plan Template:

- Use the library navigation or search field to find your template.

- View the form’s description to see if it matches the requirements of your state and county.

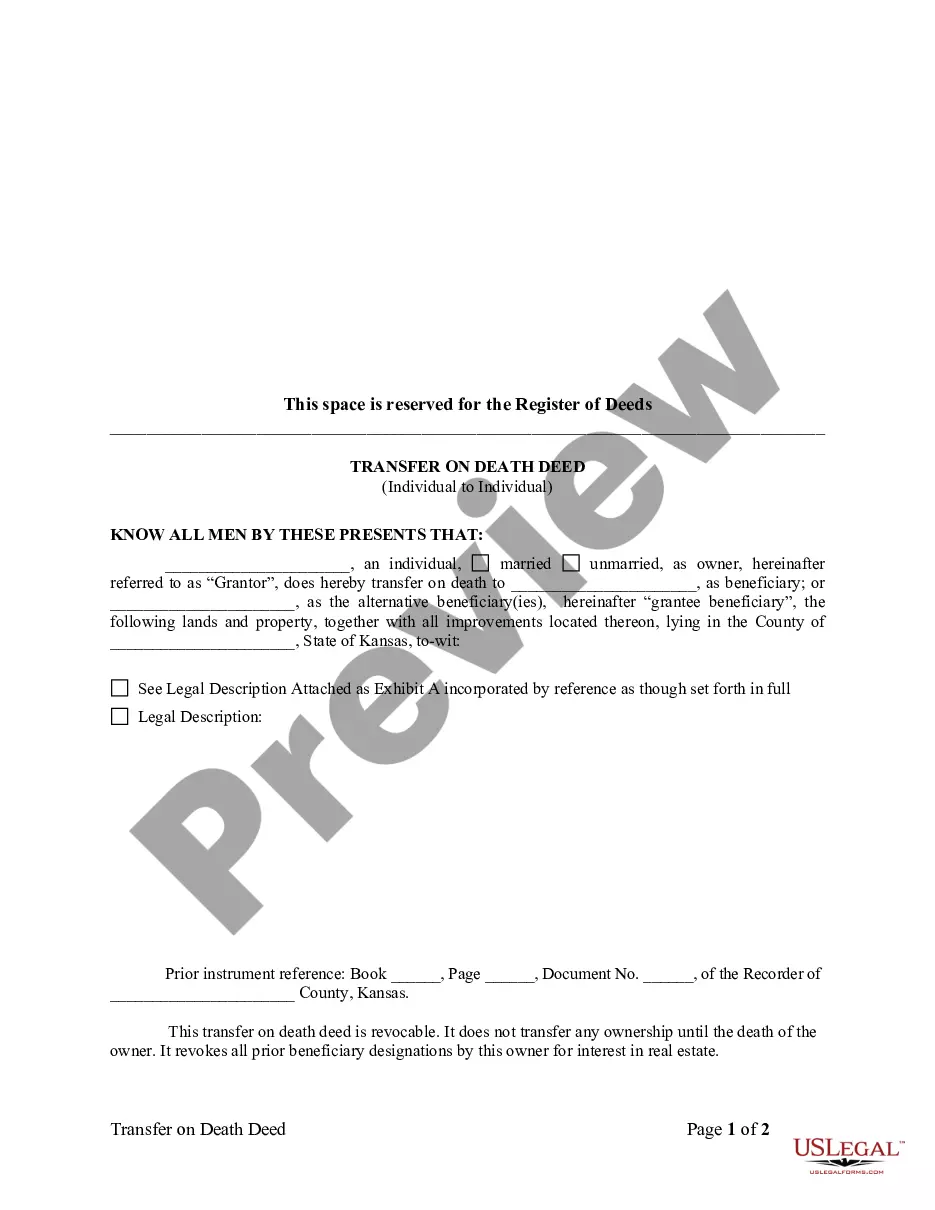

- View the form preview, if available, to make sure the template is definitely the one you are looking for.

- Get back to the search and look for the proper template if the Corporate Dissolution Plan Template does not fit your needs.

- When you are positive regarding the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and gain access to your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Choose the pricing plan that fits your requirements.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by selecting a transaction method (bank card or PayPal).

- Choose the file format for downloading Corporate Dissolution Plan Template.

- When you have the form on your device, you can alter it using the editor or print it and complete it manually.

Eliminate the inconvenience that comes with your legal paperwork. Discover the comprehensive US Legal Forms collection to find legal samples, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

Dissolution. The first step to closing up shop is receiving shareholder approval to formally close the corporation. The board of directors should adopt a resolution to dissolve the corporation and receive approval for the action.

What Questions does IRS Form 966 Ask? Name of corporation. Employer Identification Number. Address. Type of return 1120 1120-L 1120-IC-DISC 1120S. Date incorporated. Place incorporated. Type of liquidation (Complete or Partial) Date resolution or plan of complete or partial liquidation was adopted.

Completing IRS Form 966 Write your business's name, address, and EIN at the top of the form. Complete Box 1 with the date of incorporation. Complete Box 2 with the location of incorporations. Use Box 3 to indicate whether this is a complete or partial liquidation.

What is a Plan Of Dissolution? A plan of dissolution is a written description of how an entity intends to dissolve, or officially and formally close the business. A plan of dissolution will include a description of how any remaining assets and liabilities will be distributed.

However, if an LLC elected to be taxed as a C corporation at any time, it would need to file Form 966 if it decides to dissolve or liquidate.