Stockholders Rights Purchase With A Credit Note

Description

How to fill out Stockholders' Rights Plan Of Datascope Corp.?

- Log in to your US Legal Forms account. If you haven't used our service before, create an account to start your journey.

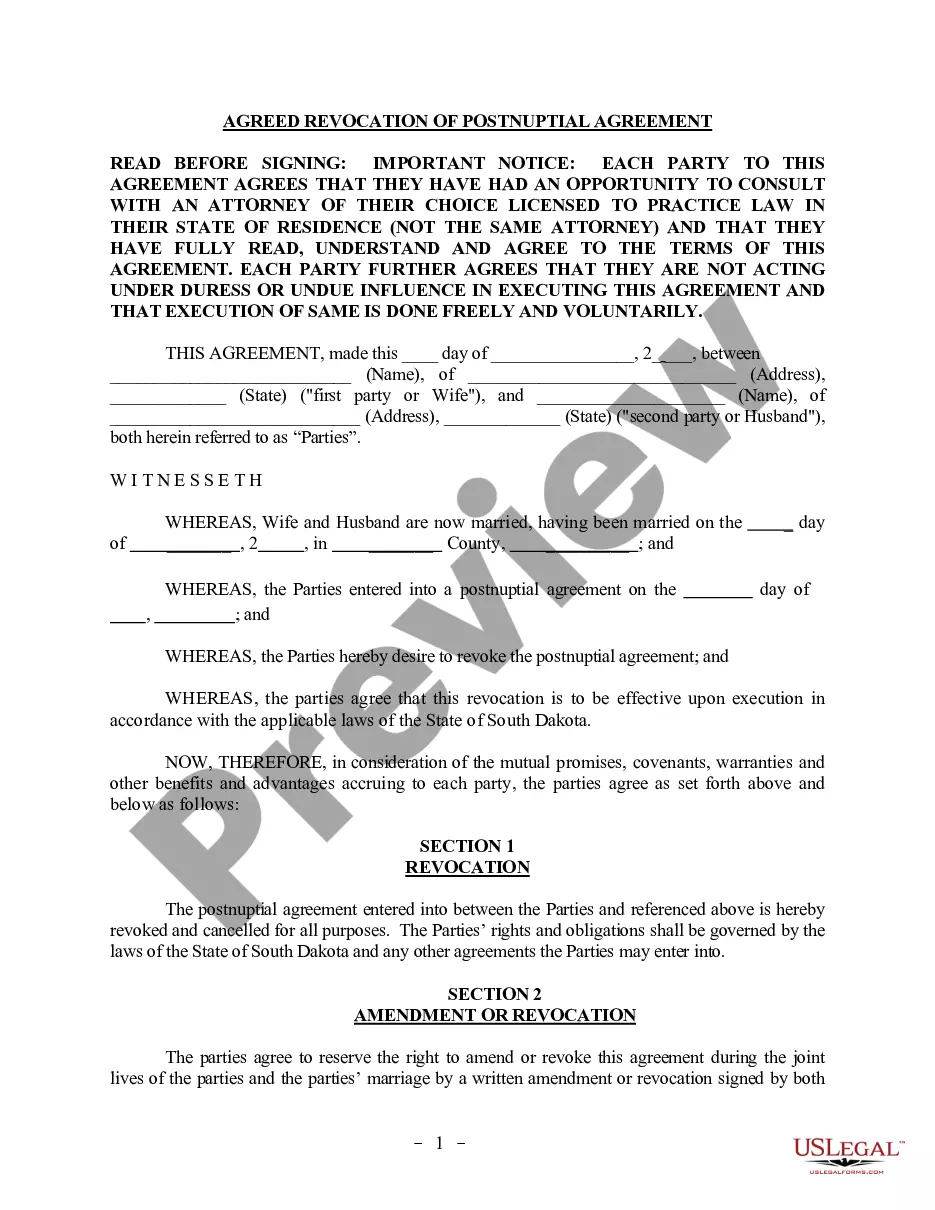

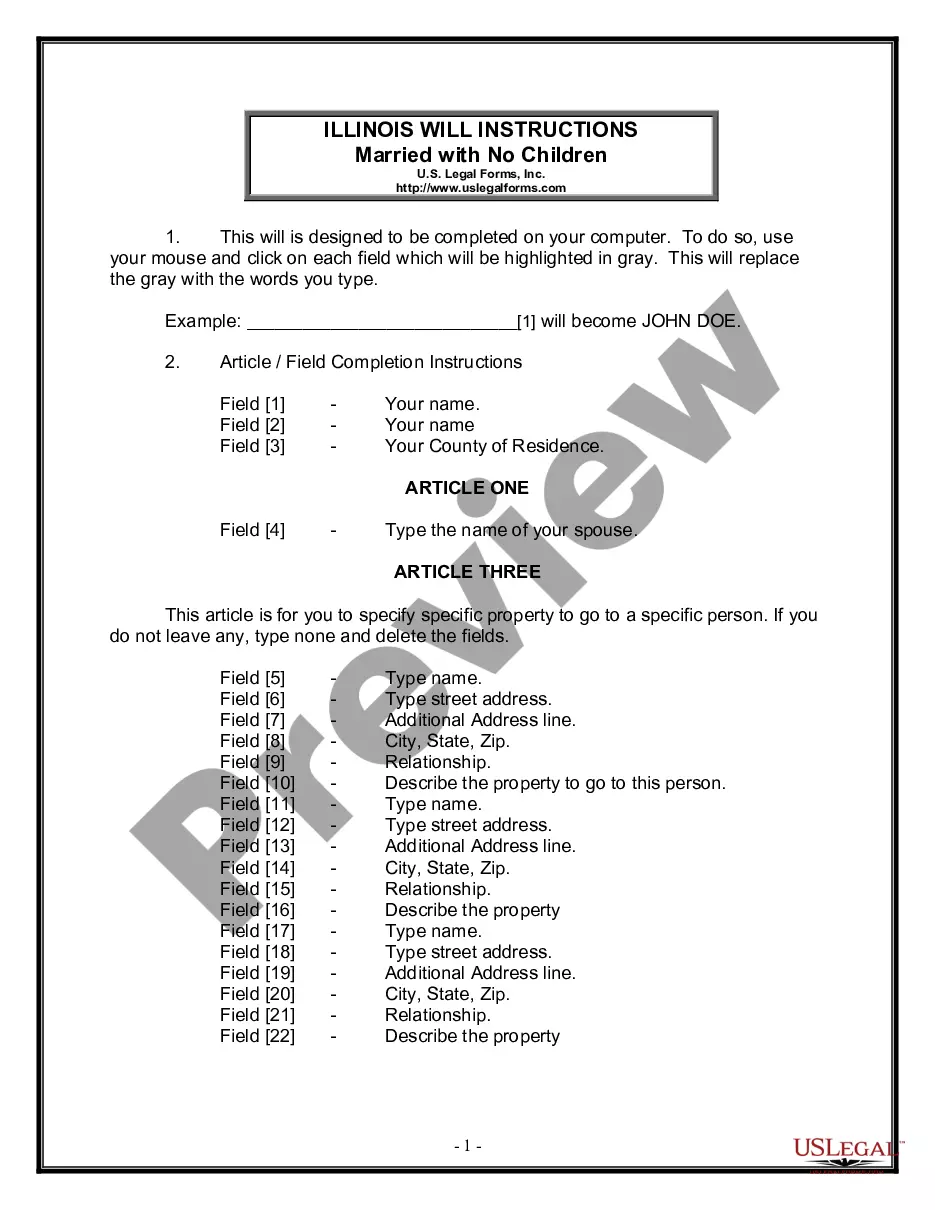

- Browse through the legal form library. Use the Preview mode to check the form descriptions and ensure it aligns with your needs and local jurisdiction.

- In case of discrepancies, utilize the Search tab to find a suitable template that meets your criteria.

- Select the desired document and click the Buy Now button. Choose a subscription plan that works best for you.

- Enter your payment details, either through credit card or PayPal, to finalize your purchase.

- Once the transaction is complete, download the form to your device. You can also access it anytime from the My Forms section of your profile.

In conclusion, US Legal Forms not only offers a robust collection of over 85,000 fillable legal forms but also provides access to premium experts for assistance, ensuring that your documents are accurate and compliant. By following these steps, you can efficiently leverage your stockholders' rights.

Don't wait—start using US Legal Forms today and take control of your stockholder rights with confidence!

Form popularity

FAQ

The journal entry for a customer credit memo typically involves debiting the sales returns and allowances account, which reflects the return of goods or services. Next, you must credit the accounts receivable, reducing the amount the customer owes. This process ensures tracking customer transactions is straightforward, especially when dealing with stockholders rights purchases using a credit note.

When you receive a credit memo, you should first verify its details against your transaction records. After confirming accuracy, consider applying it to future stockholders rights purchases with a credit note, or use it to offset outstanding balances. Keeping meticulous records of credit memos helps you manage finances effectively. If you're unsure how to utilize credit memos, platforms like uslegalforms can provide valuable guidance.

The accounting treatment for a credit note involves recording it as a reduction in revenue or returns allowance. This method ensures that financial statements accurately reflect transactions. For stockholders rights purchases with a credit note, proper accounting treatment supports financial accuracy and compliance with reporting standards.

A credit note indicates a reduction in the amount owed, while a receipt confirms a completed payment. Essentially, a credit note alters the transaction amount, whereas a receipt documents a financial transaction. Understanding this difference is vital for stockholders rights purchases with a credit note to manage their finances effectively.

The journal entry for a credit note records a debit to the sales returns and allowances account and a credit to accounts receivable. This entry shows the reversed revenue and reflects how the business acknowledges the customer's return. If you're handling stockholders rights purchases with a credit note, proper accounting ensures clarity in your financial reports.

A credit note is not considered proof of payment; it serves as documentation of a reduction in the amount payable. It indicates an agreement between the buyer and seller regarding a returned item or service. For stockholders making rights purchases with a credit note, this distinction is critical for maintaining accurate financial records.

When a buyer receives a credit memo, the journal entry typically includes a debit to the accounts payable and a credit to inventory or expense accounts. This reflects the reduction in liability and adjusts the inventory or expense recognized. Therefore, understanding the journal entry is essential for accurate accounting when making stockholders rights purchases with a credit note.