Transfer Stock Agreement Form For Stamping

Description

How to fill out Approval Of Transfer Of Outstanding Stock With Copy Of Liquidating Trust Agreement?

There’s no longer a need to spend time looking for legal documents to fulfill your local state obligations.

US Legal Forms has collected all of them in one location and made their access easier.

Our website features over 85k templates for any business and personal legal situations organized by state and type of use.

Preparing legal documents in accordance with federal and state regulations is quick and simple with our library. Test US Legal Forms today to keep your documentation organized!

- All forms are accurately drafted and verified for legitimacy, so you can be confident in acquiring an up-to-date Transfer Stock Agreement Form For Stamping.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any time by opening the My documents tab in your profile.

- If you've never engaged with our service before, the procedure will require a few additional steps to complete.

- Here’s how new users can find the Transfer Stock Agreement Form For Stamping in our collection.

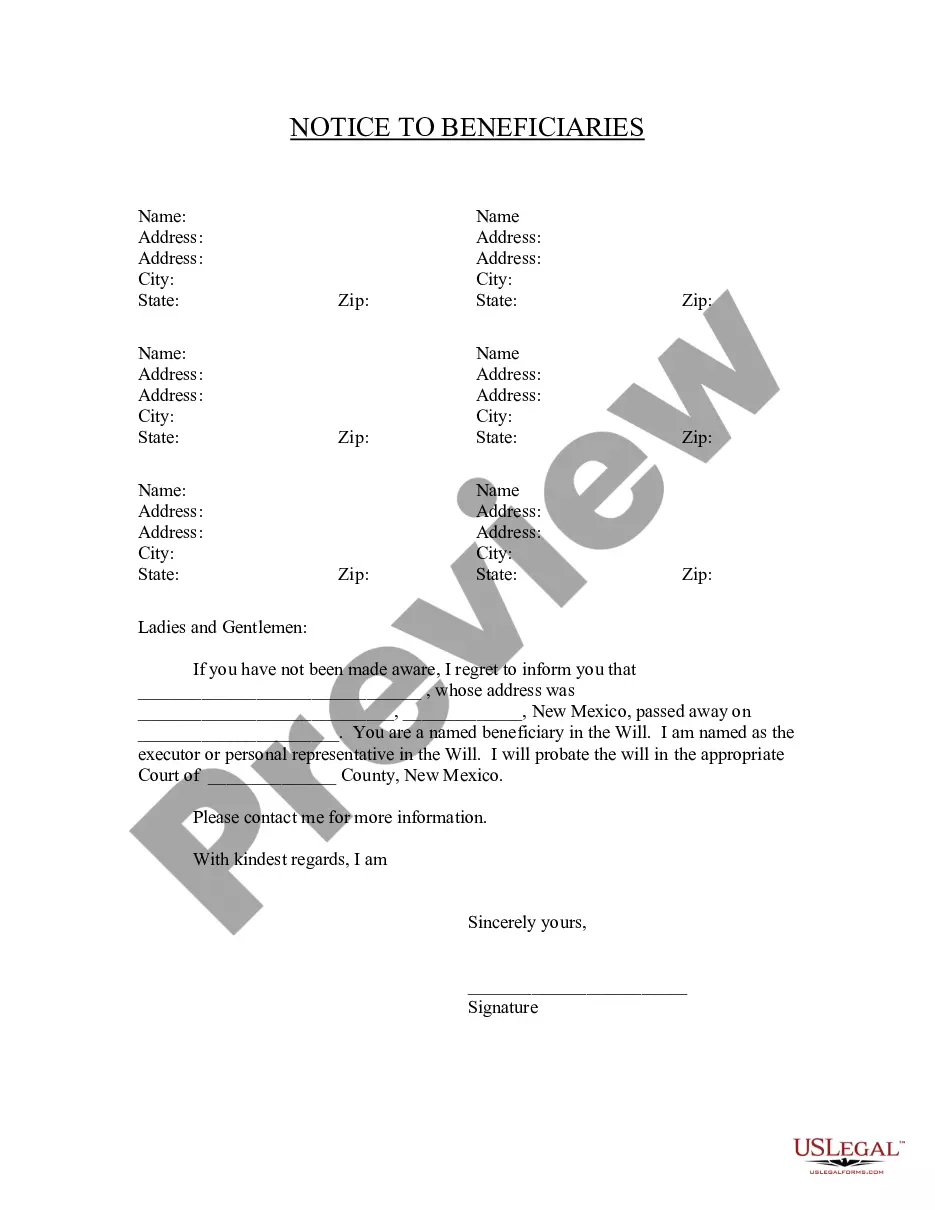

- Examine the page content thoroughly to ensure it includes the example you need.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

This is when the stock transfer form must be completed and sent to HMRC's stamp duty office for stamping within 30 days of the date of the transfer. The form must be accompanied by the existing share certificate and a covering letter.

Transfer BasisTax is paid on the capital gain only when the recipient sells the stock. The recipient of your transferred stock usually obtains your cost basis. However, the basis used to calculate the future capital gain of the recipient also depends upon the stock's fair market value on the gift date.

How to complete a stock transfer form in 10 Steps1 Consideration money.2 Full name of Undertaking.3 Full description of Security.4 Number or amount of Shares, Stock or other security.5 Name(s) and address of registered holder(s)6 Signature(s)7 Name(s) and address of person(s) receiving the shares.More items...?31-Jan-2019

Duty will be paid on the market value of shares or debentures. 7. Buyer will pay the stamp duty.

Stock transfer stamps were issued for the purpose of collecting federal taxes on sales, transfers, and certificates of stock. All stock transfer stamps from 1918 to 1940 are US documentary stamps that are overprinted "STOCK TRANSFER".