Promissory Note Common Contract With Security

Description

How to fill out Form Of Convertible Promissory Note, Common Stock?

Administrative systems necessitate exactness and correctness.

If you do not routinely manage the completion of documents like the Promissory Note Common Contract With Security, it may result in some confusion.

Choosing the appropriate template from the beginning will ensure that your document submission proceeds smoothly and avert any hassles of resubmitting a document or starting the same task anew.

If you are not a registered user, finding the necessary template may take a few extra steps: Search for the template using the search box. Ensure the Promissory Note Common Contract With Security you have found is applicable to your state or region. Review the preview or inspect the description containing the details on how to use the template. If the result matches your search, click the Buy Now button. Choose the appropriate option from the available pricing plans. Log In to your account or set up a new one. Finalize the purchase using a credit card or PayPal account. Save the document in your preferred file format. Obtaining the correct and updated templates for your paperwork takes just a few minutes with an account at US Legal Forms. Avoid the complexities of bureaucracy and streamline your document management.

- Locate the precise template for your paperwork at US Legal Forms.

- US Legal Forms is the largest online collection of forms presenting over 85 thousand templates across various domains.

- You can easily acquire the most recent and applicable version of the Promissory Note Common Contract With Security by searching it on the site.

- Identify, save, and download forms in your account or refer to the description to verify that you possess the correct one.

- With an account at US Legal Forms, you can quickly gather, save in one location, and navigate through the templates you keep to access them with just a few clicks.

- While on the website, click the Log In button to authenticate.

- Next, proceed to the My documents section, where your form history is maintained.

- Review the form descriptions and download the ones you require at any moment.

Form popularity

FAQ

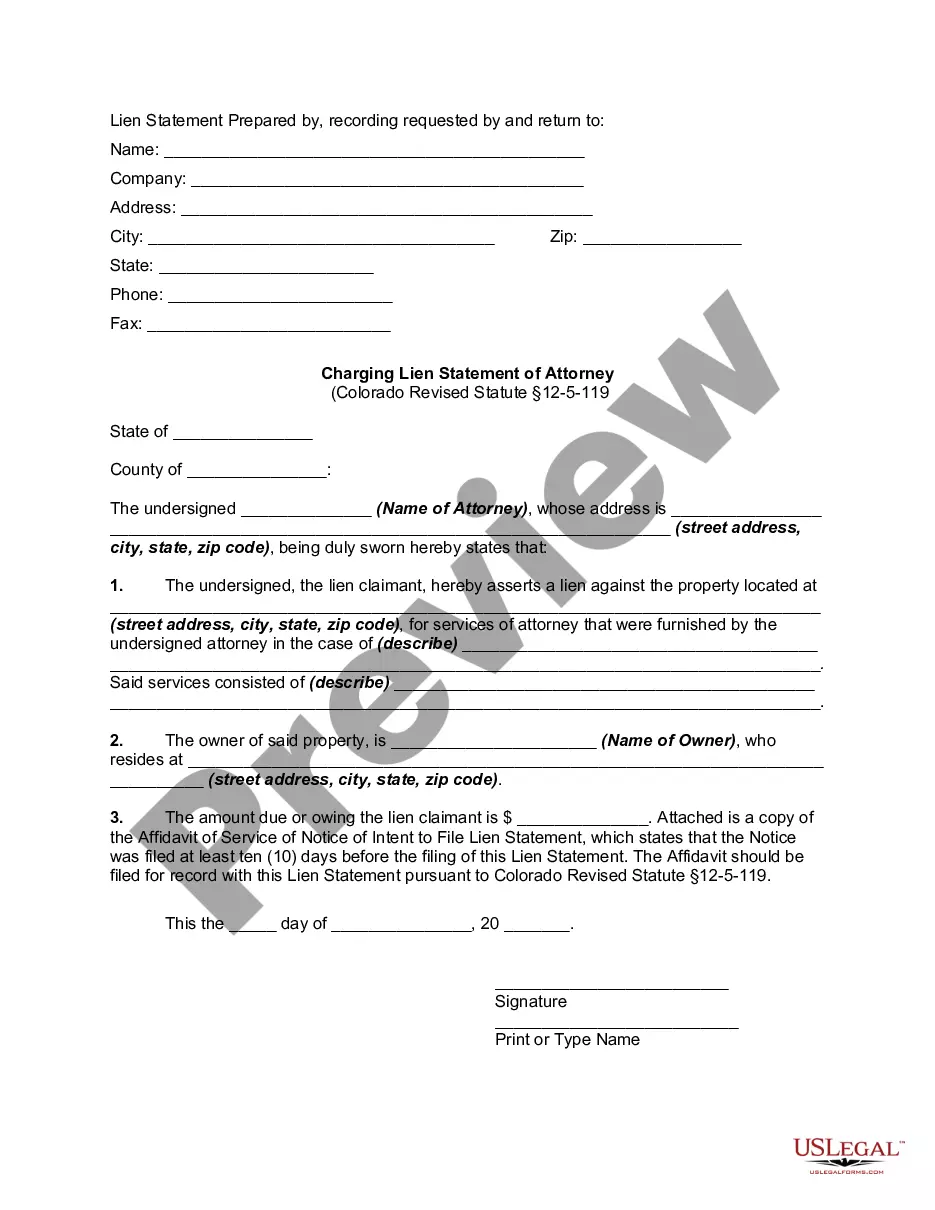

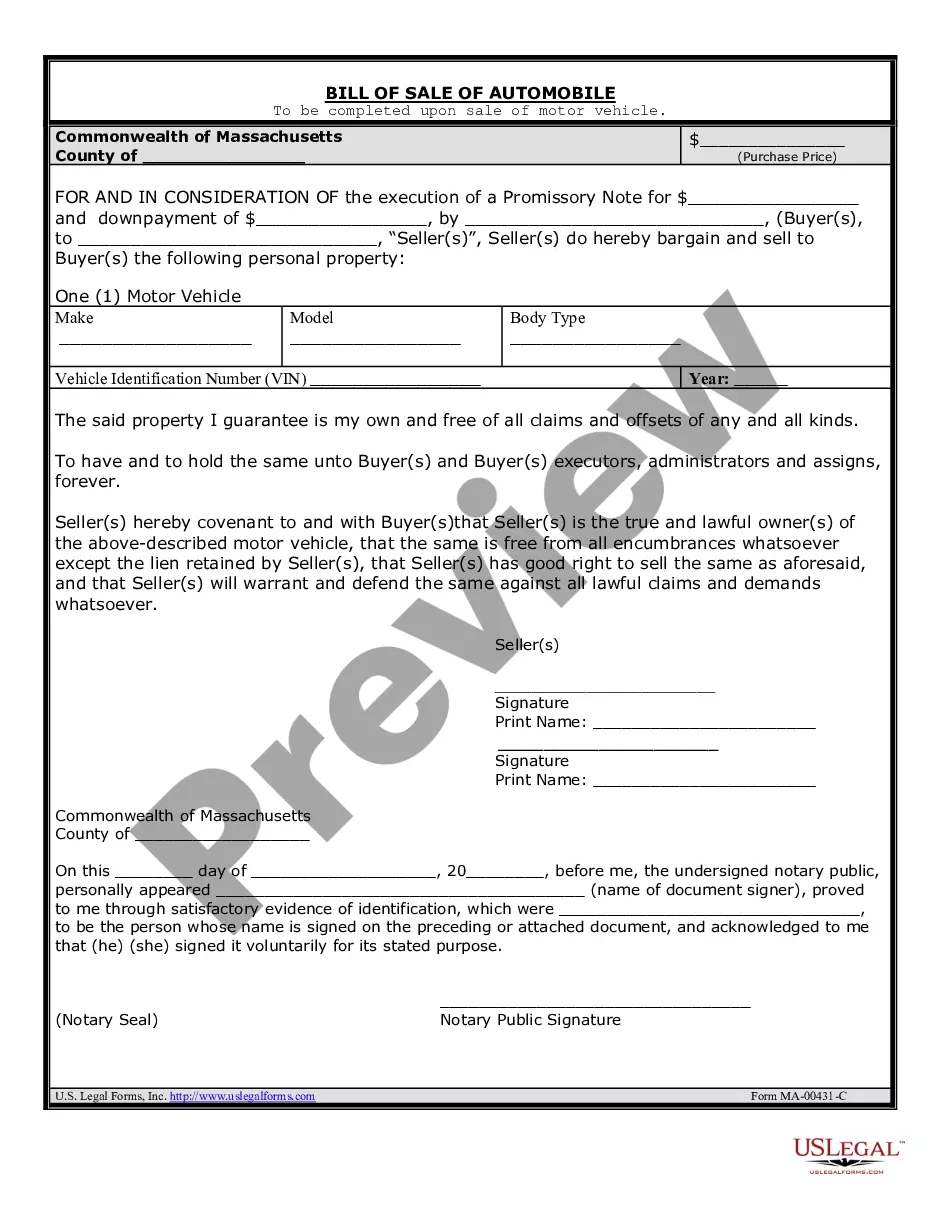

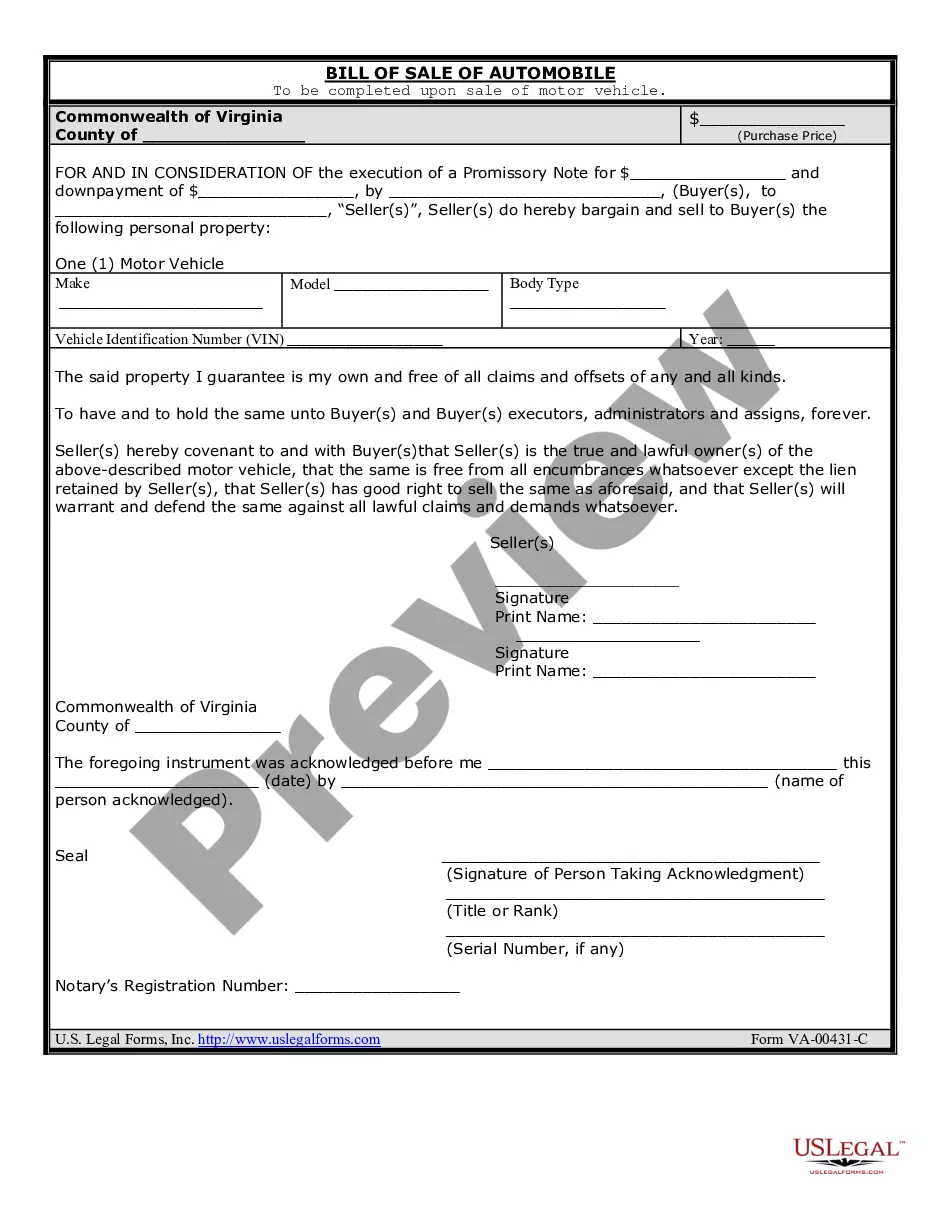

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

General Definition. Promissory notes are defined as securities under the Securities Act. However, notes that have a maturity of nine months or less are not considered securities.

The Deed of Trust (or Mortgage or Security Instrument) is a legal document that grants the lender the rights to take the property if the borrower goes into default and does not pay under the terms of the Note. The lender holds title to the property until the borrower has repaid the debt in full.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.