Share Capital Without Par Value

Description

How to fill out Amendment Of Common Stock Par Value?

Regardless of whether for professional reasons or personal issues, everyone must confront legal circumstances at some juncture in their lives.

Completing legal paperwork necessitates meticulous care, starting with selecting the correct form template.

With a vast US Legal Forms catalog available, you do not have to waste time searching for the suitable sample online. Take advantage of the library's easy navigation to find the right form for any situation.

- For example, if you choose an incorrect version of a Share Capital Without Par Value, it will be denied once submitted.

- Thus, it is vital to have a trustworthy source of legal documents like US Legal Forms.

- If you need to acquire a Share Capital Without Par Value template, adhere to these straightforward steps.

- Locate the sample you require using the search bar or catalog navigation.

- Review the information on the form to ensure it aligns with your circumstances, state, and area.

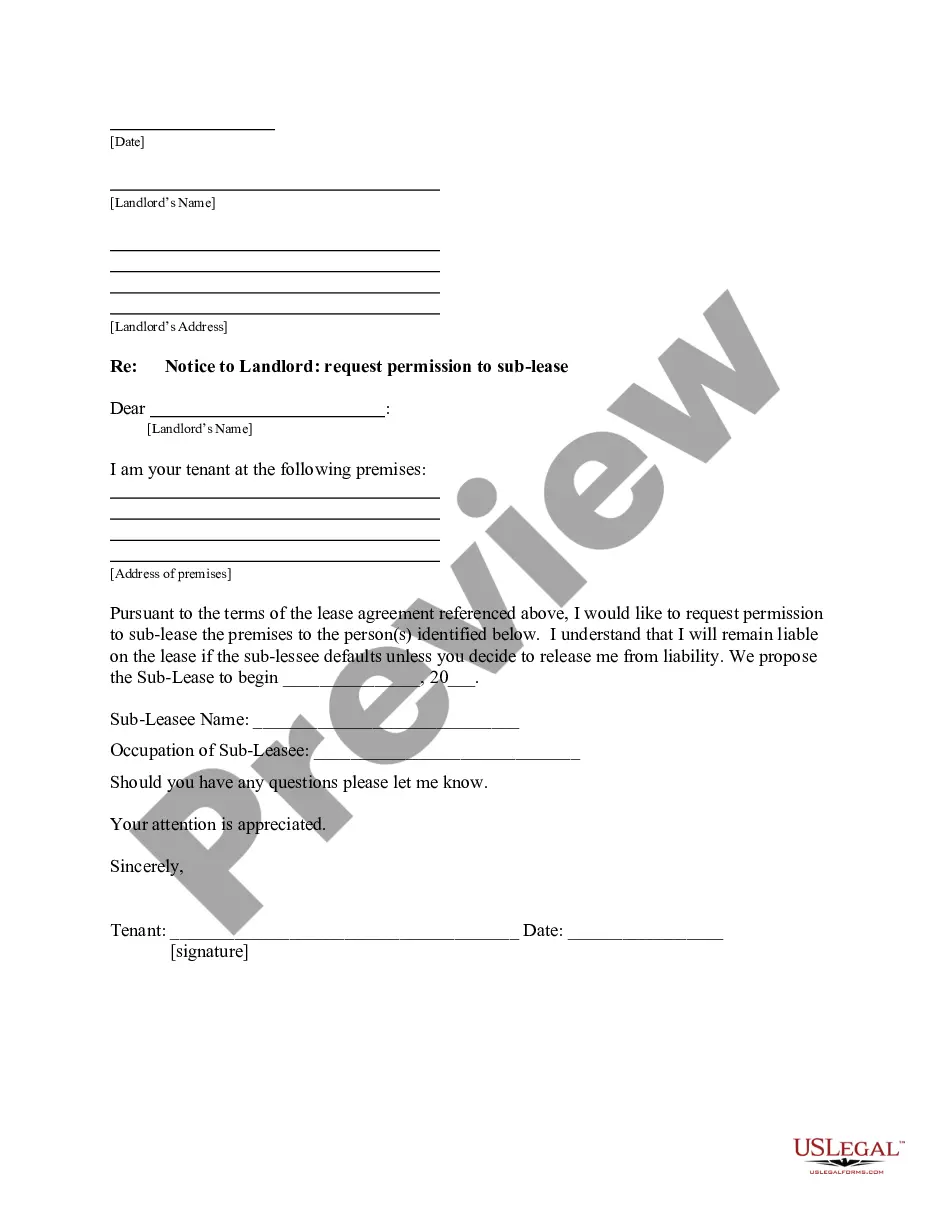

- Click on the form's preview to examine it.

- If it is the wrong document, return to the search feature to locate the Share Capital Without Par Value sample you need.

- Obtain the file when it meets your specifications.

- If you possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- Should you not have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: you can utilize a credit card or PayPal account.

- Choose the file format you desire and download the Share Capital Without Par Value.

- Once downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

If a company has sold no-par-value stocks, the proceeds from the transaction will be credited to the common stock account only. Hence, the accounting entry will be a debit to cash and credit to the common stock account.

No-par value stock doesn't have a redeemable price, rather prices are determined by the amount that investors are willing to pay for the stocks on the open market. Most shares issued today are identified as being either no-par value or low-par value stock.

Par value, which is also called par, nominal value, or face value, is the amount at which a security is issued or can be redeemed. No-par value stock doesn't have a redeemable price, rather prices are determined by the amount that investors are willing to pay for the stocks on the open market.

No-par stocks are those where the value of the stocks relies completely on the market, not at all based upon any guaranteed value (the par value) set at the issuance of the stocks.

Par value is the minimum share price, while market value is the current trading price. Par value is set in the certificate of incorporation. For most startups, the par value is set incredibly low, generally $0.0001 or $0.00001 per share.