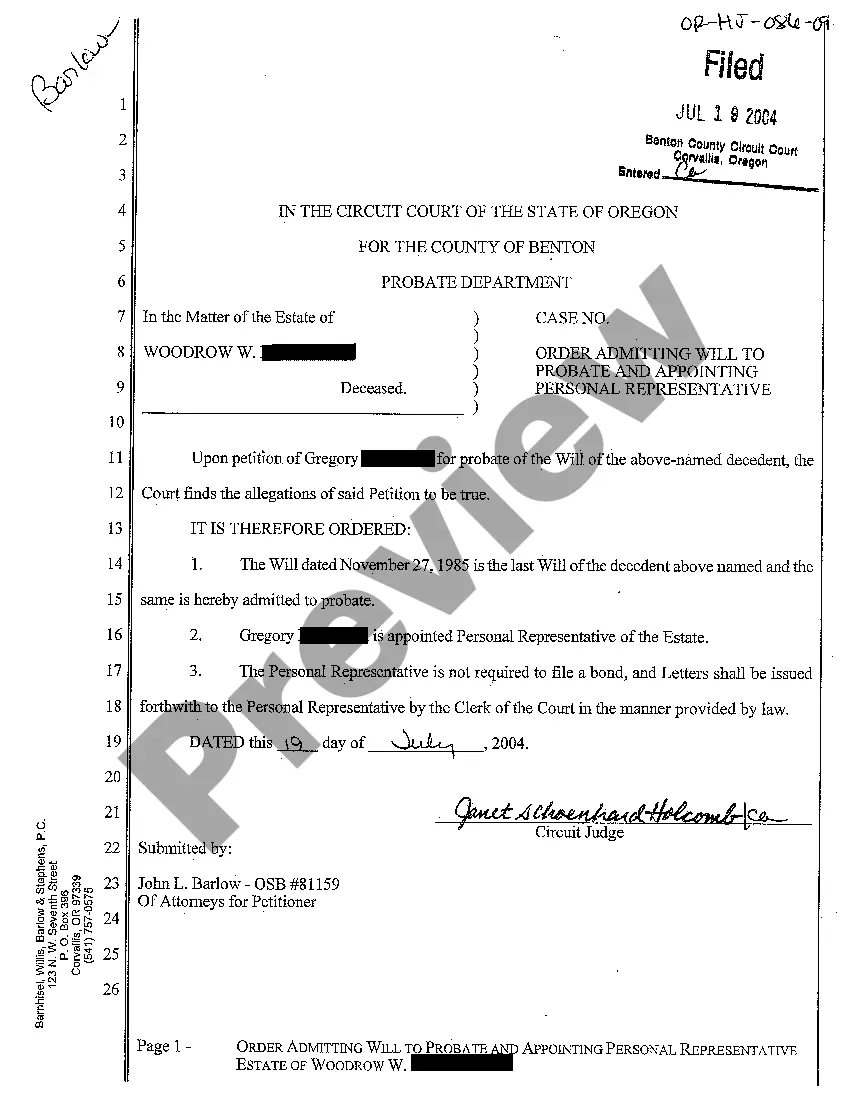

Proxy Corporation Statement With Sec

Description

How to fill out Proxy Corporation Statement With Sec?

Bureaucracy necessitates exactness and correctness.

If you do not engage with completing documents like Proxy Corporation Statement With Sec daily, it may result in some misinterpretations.

Selecting the proper sample from the start will ensure that your document submission proceeds seamlessly and avert any hassles of re-sending a file or repeating the same task from scratch.

Obtaining the correct and current samples for your documentation takes only a few minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and enhance your efficiency in handling forms.

- Identify the template using the search bar.

- Confirm that the Proxy Corporation Statement With Sec you found is applicable for your state or region.

- View the preview or check the description that includes the details regarding the utilization of the template.

- If the result aligns with your query, click the Buy Now button.

- Choose the suitable option among the presented subscription plans.

- Sign in to your account or create a new one.

- Finalize the purchase using a credit card or PayPal account.

- Store the form in the file format you prefer.

Form popularity

FAQ

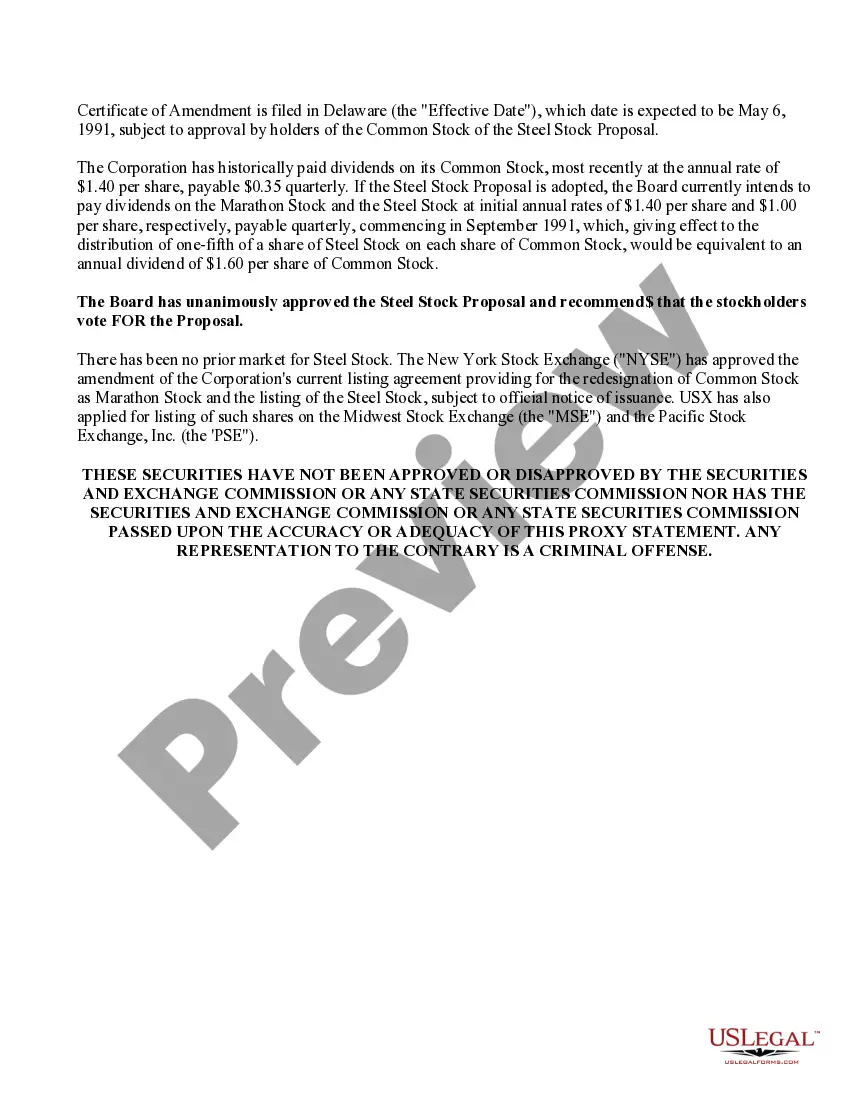

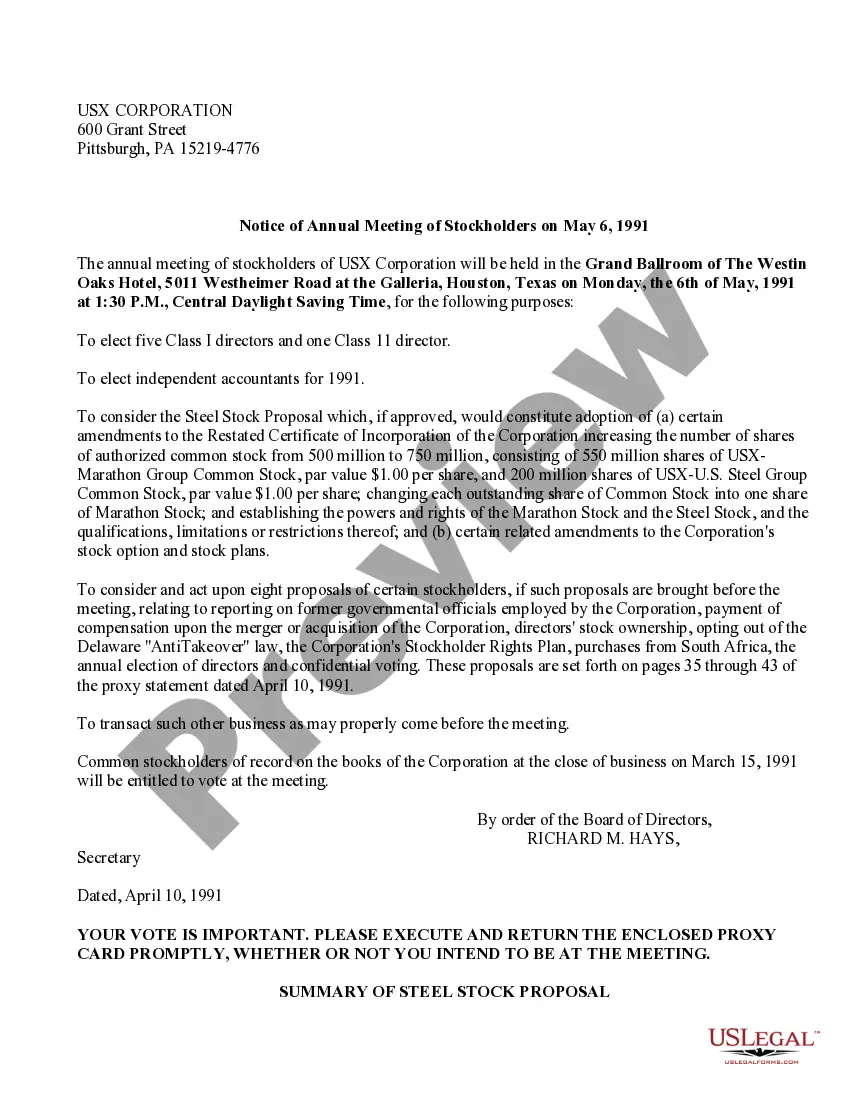

Filling up a proxy form allows shareholders to authorize someone else to vote on their behalf at a corporate meeting. The form includes essential details such as the shareholder's name, address, and the specific voting instructions. By completing this process, you ensure that your voice is heard even if you cannot attend the meeting. The US Legal Forms platform simplifies this process, providing templates to create an accurate proxy corporation statement with SEC.

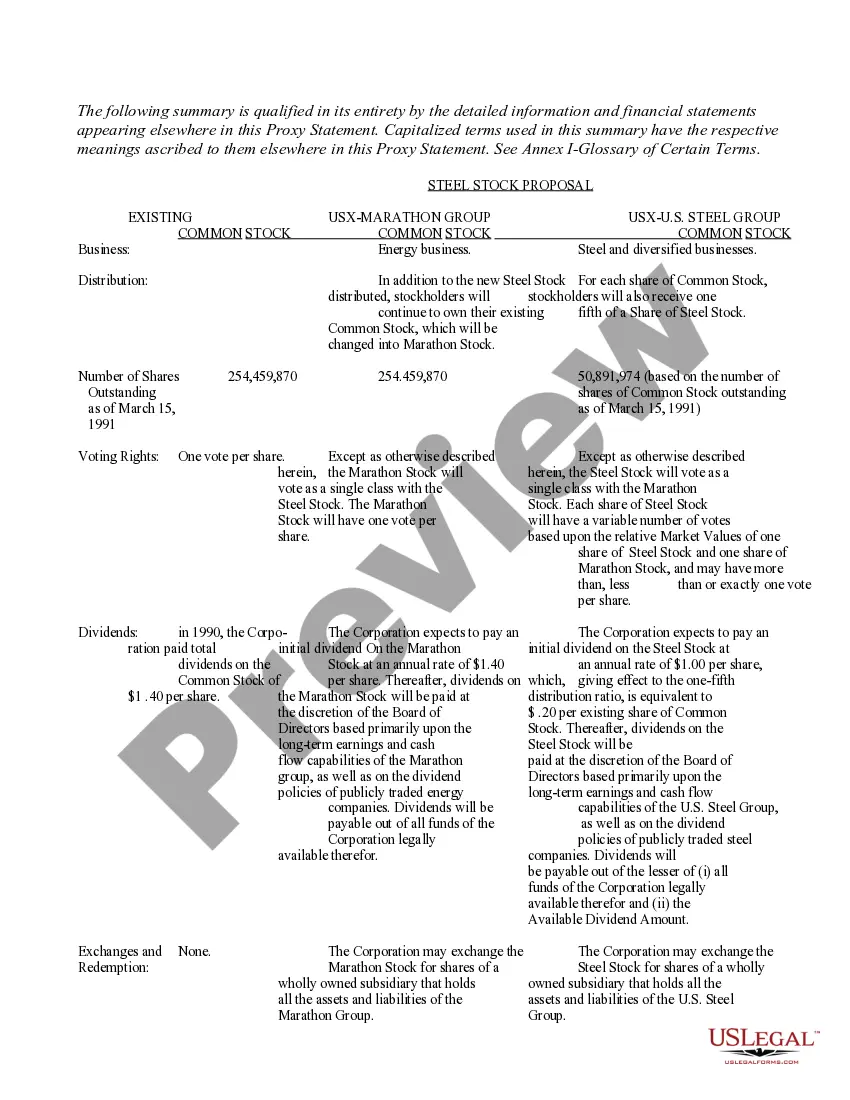

A proxy corporation statement with SEC must include various key details. Typically, it requires information about the company, the meeting agenda, and the identities of the proxy holders. Additionally, it should disclose any significant transactions or conflicts of interest. This information helps shareholders make informed decisions before voting.

The form number for the SEC proxy statement is typically DEF 14A when referring to the definitive proxy statement. This designation helps regulators and stakeholders track filings efficiently. Thus, ensuring your proxy corporation statement with SEC reflects this form number can facilitate proper regulatory compliance and enhance transparency.

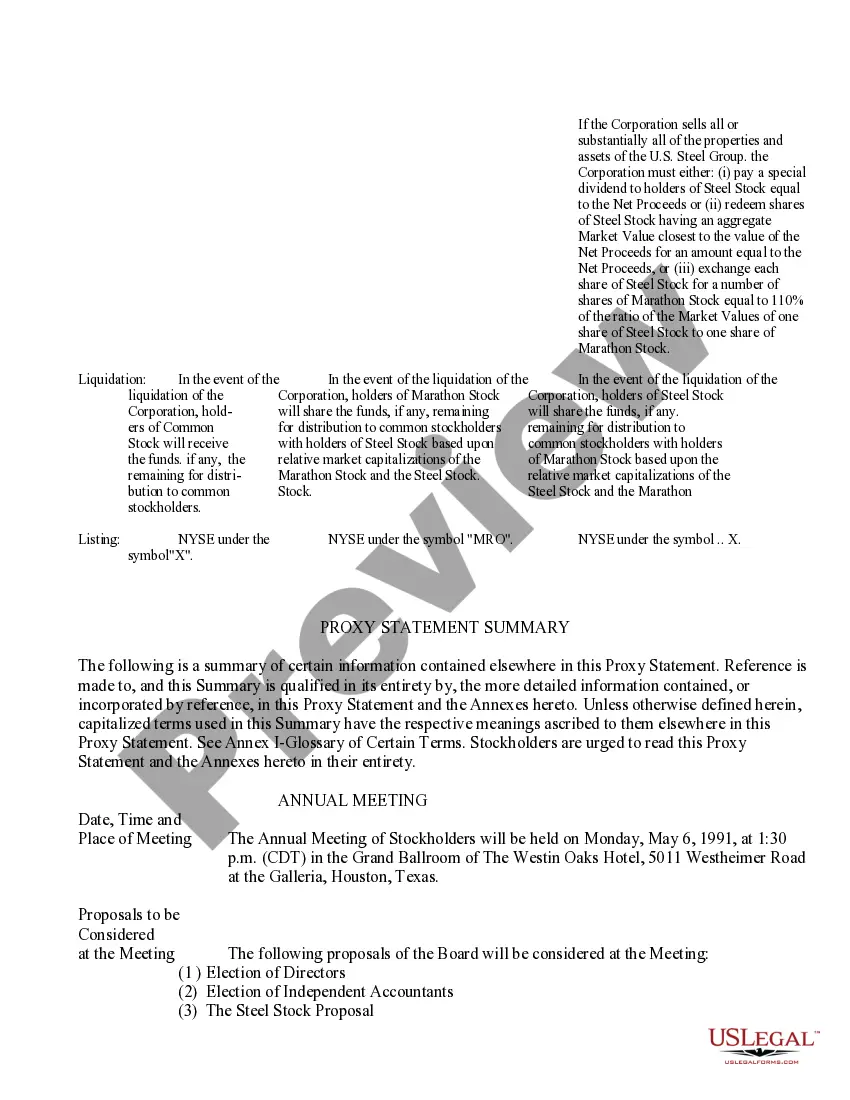

A proxy statement typically includes details about the company's governance structure, the matters to be voted on, and background information about board nominees. It may also share insights about executive compensation and potential conflicts of interest. Having an informative proxy corporation statement with the SEC is vital for keeping shareholders well-informed before voting.

Yes, a proxy statement must be filed with the SEC, especially if the company is publicly traded or seeks to solicit votes from shareholders. This filing ensures that all necessary information is disclosed to investors. A thorough proxy corporation statement with SEC compliance fosters transparency and builds trust among shareholders.

Form S-4 is a proxy statement related to mergers and acquisitions when companies seek shareholder approval. This form includes detailed financial and operational information about the companies involved and the proposed transaction's implications. Ensuring compliance with SEC regulations when creating your proxy corporation statement with SEC is essential for a successful transaction.

When reviewing a proxy statement, focus on important details such as board member recommendations, executive compensation packages, and any potential conflicts of interest. Understanding these elements can help investors make informed voting decisions. Ultimately, a well-structured proxy corporation statement with the SEC highlights critical information for shareholders.

To prepare a compelling proxy statement, gather detailed information about future company initiatives and significant management changes. Clearly list the items shareholders will be voting on, and ensure all required disclosures are included. Using resources like US Legal Forms can help streamline the drafting process for your proxy corporation statement with the SEC.

SEC Form 10 is a registration statement for companies that plan to register under Section 12 of the Securities Exchange Act. It provides comprehensive information about the company, its financial condition, and management. This form ensures that the proxy corporation statement with SEC is well-informed by the company's foundational data.

Writing a proxy statement requires clarity and organization. Start by outlining key voting issues, providing insightful information about the board of directors, executive compensation, and a detailed breakdown of agenda items. Adhering to SEC guidelines will strengthen your proxy corporation statement with the SEC, aiding in shareholder communication.