Shareholders Meeting Company Law

Description

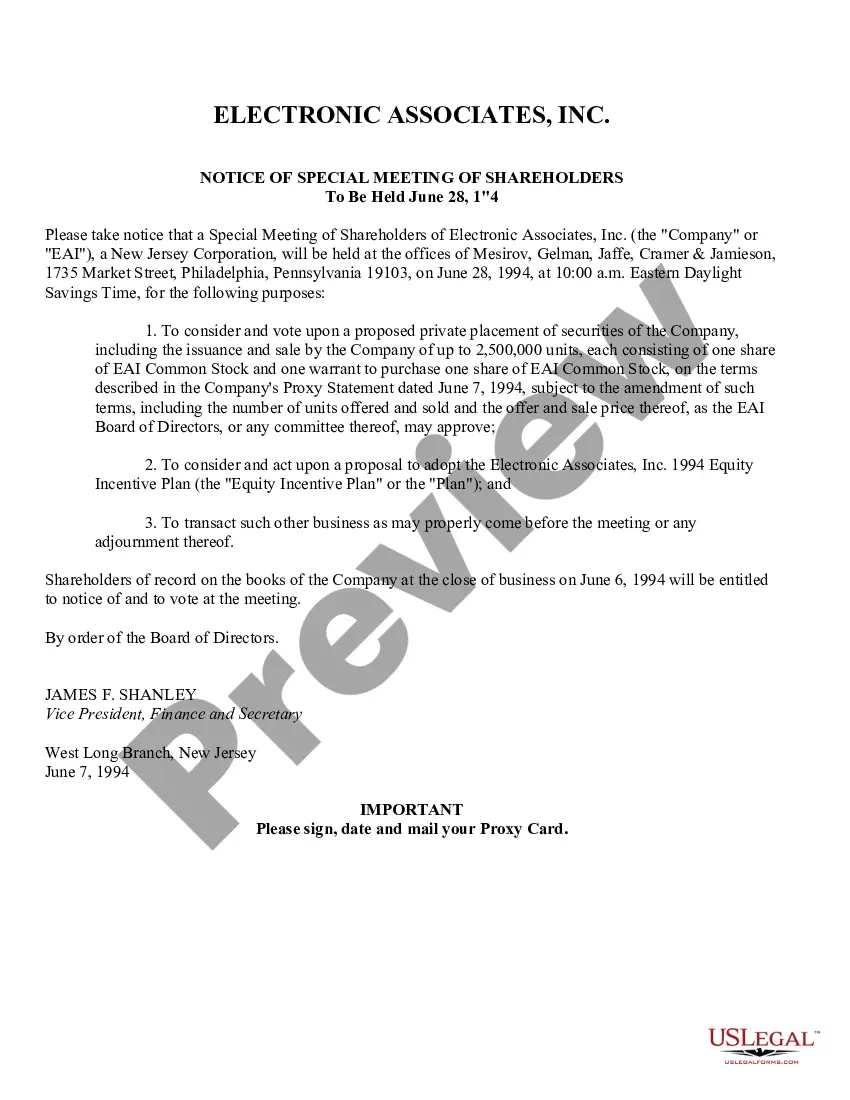

How to fill out Notice Of Special Meeting Of Shareholders Of West Point-Pepperell, Inc.?

- If you're an existing user, log in to your account and download the necessary form template by clicking the 'Download' button. Ensure your subscription is active.

- For first-time users, begin by reviewing the form descriptions in Preview mode. Confirm that the form meets your specific legal needs and complies with local jurisdiction regulations.

- If the chosen template doesn't meet your criteria, utilize the search feature at the top to find a more suitable document.

- After identifying the correct form, click on the 'Buy Now' button and select your preferred subscription plan. You will need to create an account to explore the full library.

- Complete your purchase by entering your credit card information or using your PayPal account for payment.

- Once purchased, download your completed form. You can access and manage your forms anytime in the My Forms section of your profile.

US Legal Forms empowers both individuals and attorneys by providing an extensive library of over 85,000 easy-to-fill legal documents. Their robust collection often surpasses competitors, ensuring you have the resources you need at a competitive price.

With access to premium legal experts, you can ensure your documents are completed accurately and legally. Start simplifying your legal form retrieval today!

Form popularity

FAQ

A shareholders meeting in company law is a formal gathering of a company’s shareholders to discuss vital issues and make decisions. During these meetings, shareholders vote on important matters, including elections for the board of directors and approval of major corporate actions. Thus, shareholders meeting company law aims to promote transparency and accountability within the company. To navigate the complexities of these meetings, USLegalForms can provide essential templates and information you might need to facilitate your participation.

The quorum required for a shareholders meeting is usually defined in the company's bylaws. Generally, a majority of outstanding shares must be represented, either in person or by proxy, to conduct the meeting legitimately. Understanding the quorum is essential because it ensures valid decision-making, an important aspect of shareholders meeting company law. If you have questions about your company's specific requirements, you can consult resources like USLegalForms for comprehensive guidance.

To attend a shareholder meeting, you typically need to hold at least one share of the company's stock. This is because shareholders are often entitled to vote on important decisions concerning the company. By holding shares, you engage in the shareholders meeting process, which is a crucial part of shareholders meeting company law. If you’re unsure about your eligibility, consider checking your ownership documentation or consult with a financial advisor.

A general meeting of shareholders is a gathering where shareholders come together to discuss company affairs and make decisions that impact the organization. These meetings can be annual or extraordinary and serve as essential forums for open dialogue between the company's management and its owners. Understanding the dynamics of these meetings is fundamental to navigating shareholders meeting company law successfully, ensuring that every shareholder's voice counts.

Under company law, the Annual General Meeting (AGM) is a legally required gathering of a company's shareholders. This meeting provides a forum for shareholders to obtain information about the company's performance, ask questions, and vote on important decisions. Familiarity with AGM procedures is crucial for shareholders, as they actively shape the company's direction through this engagement, reflecting the key aspects of shareholders meeting company law.

While attendance is not mandatory, it is highly beneficial for shareholders to participate in AGMs. Appropriately, attending allows shareholders to voice their opinions, ask questions, and engage in discussions that may influence company decisions. Thus, involvement in the AGM aligns with the essence of shareholders meeting company law, ensuring that all voices are heard and considered.

The Annual General Meeting (AGM) serves as a key platform for shareholders to discuss the company's performance and future direction. During this meeting, shareholders receive updates on financial results, elect board members, and address any crucial corporate matters. Essentially, the AGM is vital in fostering transparency and accountability within a company, which is a cornerstone of shareholders meeting company law.

Shareholders may request access to board minutes based on company law provisions, although this access can vary. Generally, these minutes are recorded documents that reflect important decisions made by the board. Transparency regarding board activities strengthens shareholder trust and reinforces their rights.

A shareholders meeting is a formal gathering where shareholders vote on important issues, such as electing directors or approving financial statements. Company law mandates these meetings to ensure that shareholders have a voice in governance. Understanding this process empowers shareholders to actively participate in shaping company policies.

While shareholders do not have to attend meetings, participation is encouraged since it allows them to voice their opinions and vote on critical matters. Company law often outlines the rules regarding attendance and voting. Engaging in these meetings enables shareholders to influence company direction.