Solicitation Purchase With Credit Card

Description

How to fill out Solicitation Purchase With Credit Card?

Precisely composed official documents are a crucial assurance for preventing complications and legal disputes, but acquiring them without the aid of an attorney can be time-consuming.

Whether you need to swiftly locate an updated Solicitation Purchase With Credit Card or other forms related to employment, family, or business matters, US Legal Forms is always ready to assist.

The process is even more straightforward for current users of the US Legal Forms database. If your subscription is active, you just need to Log In to your account and press the Download button next to the desired document. Additionally, you can access the Solicitation Purchase With Credit Card at any time later, as all documents ever downloaded from the platform remain available under the My documents tab of your profile. Conserve time and money when preparing official documents. Utilize US Legal Forms today!

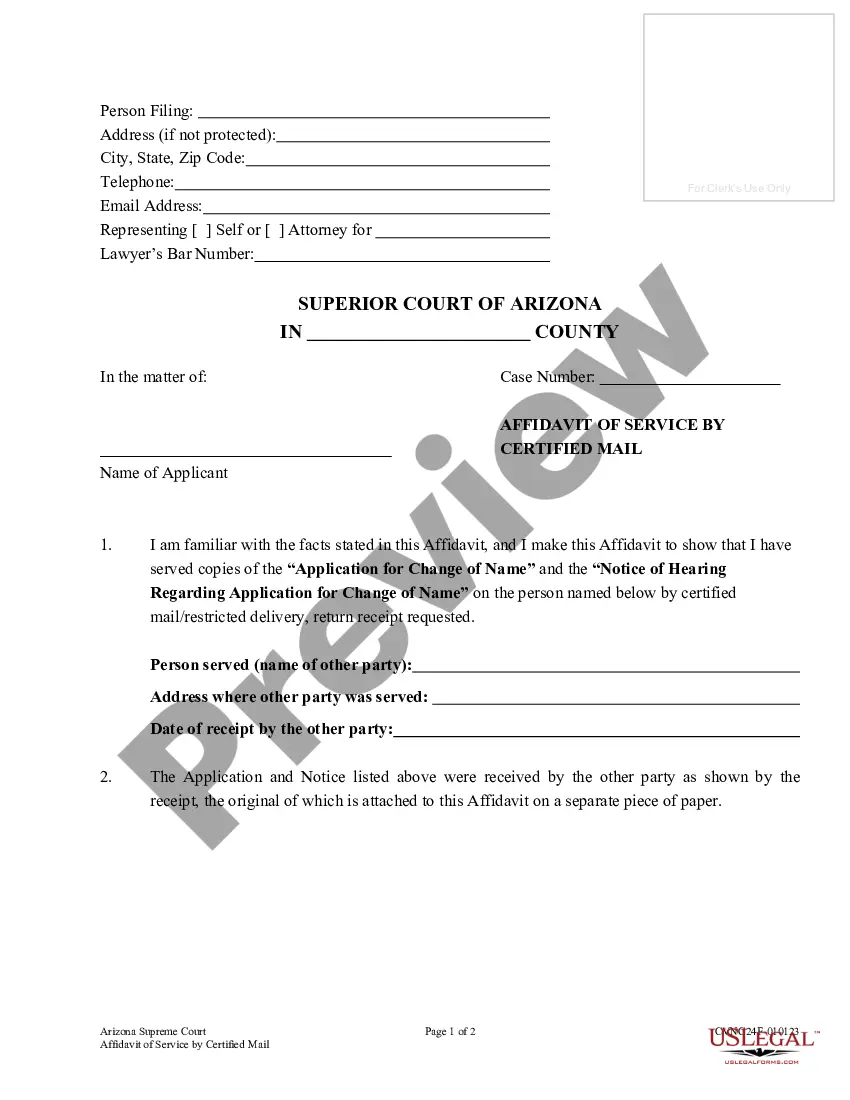

- Ensure that the template is appropriate for your situation and location by reviewing the description and preview.

- Search for an alternative sample (if necessary) using the Search bar at the top of the page.

- Click Buy Now once you discover the suitable template.

- Choose a pricing plan, Log Into your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (via a credit card or PayPal).

- Choose either PDF or DOCX file format for your Solicitation Purchase With Credit Card.

- Click Download, then print the form to complete it or upload it to an online editor.

Form popularity

FAQ

Yes, paying your credit card twice a month can positively impact your credit score. This practice reduces your outstanding balance and helps maintain a lower credit utilization ratio. By doing so, you can make more informed solicitation purchases with credit card while also demonstrating responsible credit behavior. Regular payments can lead to better credit opportunities in the future.

The 50 30 20 rule is a budgeting strategy where you allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This framework helps you manage your finances wisely, making it easier to plan for solicitation purchases with credit card. By adhering to this rule, you can maintain financial stability while enjoying the flexibility of credit.

To achieve an 800 credit score, the number of credit cards can vary, but typically having three to five accounts is optimal. It's more about managing credit utilization and payment history than simply the number of cards. Regularly making timely payments can boost your score, allowing you to make savvy solicitation purchases with credit card. Balance variety and responsibility for the best results.

Credit solicitation is the process where financial organizations reach out to potential customers to present credit opportunities. This often involves encouraging individuals to consider credit cards or loans that may enhance their purchasing power. When navigating solicitation purchases with credit cards, it's important to analyze each offer thoroughly. The US Legal Forms platform can assist you in understanding the details and implications of these solicitations to make better financial decisions.

Credit card solicitation refers to the marketing efforts from banks and financial institutions aimed at encouraging consumers to apply for credit cards. These solicitations often highlight rewards, low-interest rates, and promotional offers. Understanding credit card solicitation is crucial, especially when considering your solicitation purchases with credit cards. By evaluating these offers carefully, you can choose the option that best fits your financial goals.

If you're overwhelmed by credit card solicitations, there are effective steps you can take to stop them. One option is to register with the National Do Not Call Registry, which can significantly reduce unsolicited calls. Additionally, contacting the credit bureaus allows you to opt-out of pre-approved credit offers, thereby minimizing unwanted solicitation purchases with credit cards. Taking these actions enables you to regain control over your credit offers.

A credit solicitation is an offer from a financial institution or company that invites individuals to apply for credit cards or loans. These solicitations often come in the form of emails, phone calls, or physical mail. When it comes to solicitation purchases with credit cards, companies aim to attract new customers by presenting favorable terms and benefits for credit utilization. Understanding these solicitations helps you make informed choices about your credit options.