Loan Promissory Note With Personal Guarantee Template

Description

How to fill out Executive Director Loan Plan With Copy Of Promissory Note By Hathaway Instruments, Inc.?

What is the most trustworthy service to obtain the Loan Promissory Note With Personal Guarantee Template and other recent versions of legal documents? US Legal Forms is the answer!

It boasts the largest assortment of legal forms for any occasion. Each template is expertly prepared and verified for adherence to federal and local regulations. They are organized by category and applicable state, making it easy to find what you need.

US Legal Forms is an excellent resource for anyone needing to manage legal documentation. Premium users have the capability to fill out and approve previously saved documents electronically at any time using the built-in PDF editing tool. Try it out today!

- Veteran users of the platform simply need to Log In to their account, verify the validity of their subscription, and click the Download button next to the Loan Promissory Note With Personal Guarantee Template to obtain it.

- After saving, the template is accessible for additional use within the My documents section of your profile.

- If you do not have an account within our library, follow these steps to create one.

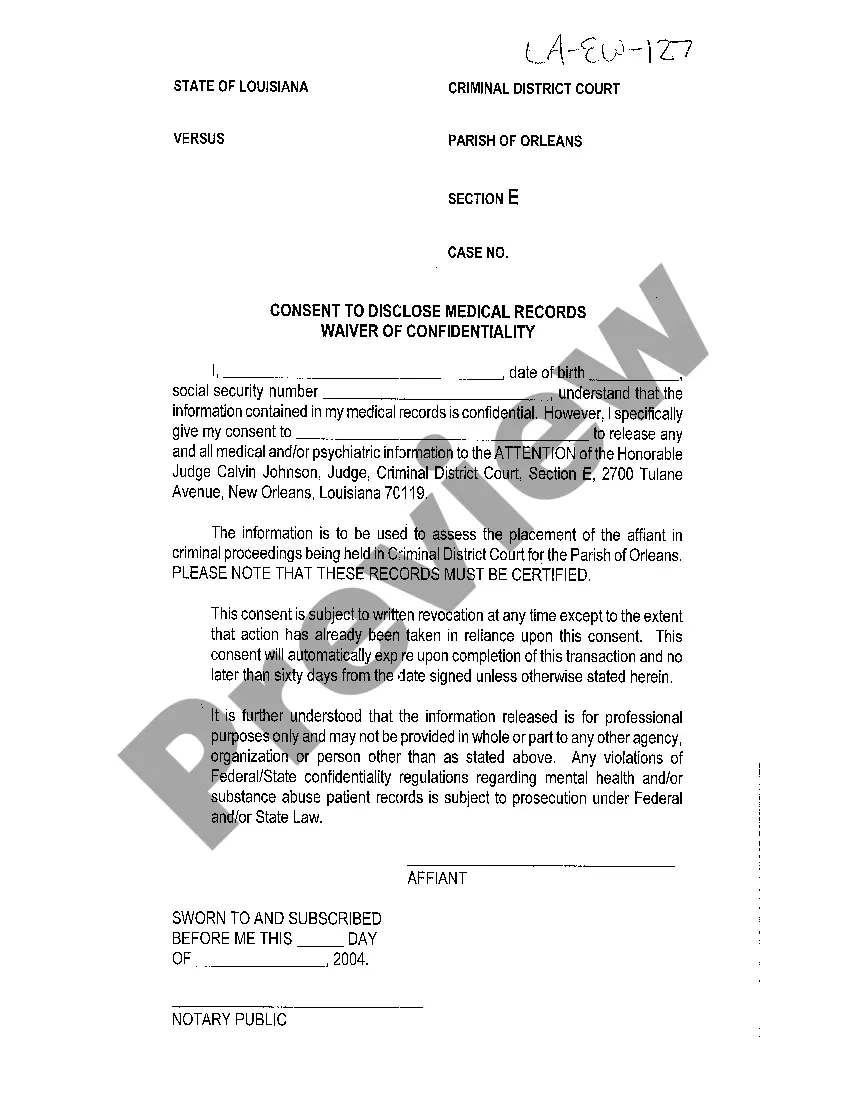

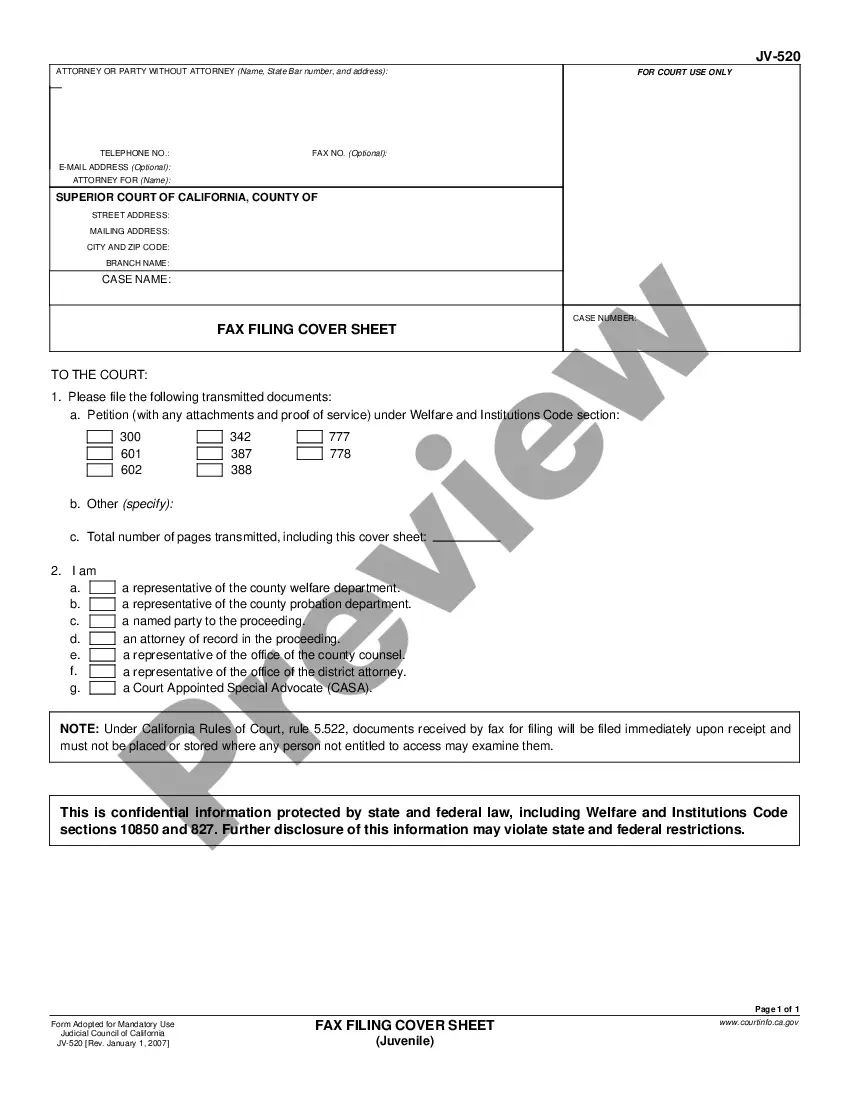

- Form compliance review. Before obtaining any template, ensure it meets your usage requirements and adheres to your state's or county's regulations. Review the form description and use the Preview if available.

Form popularity

FAQ

A guarantor's form should include a space to fill in the home address, work address, phone number, and email address. The contact details are what will be used to contact the guarantor in the future if the principal fails to meet agreement terms. This is a very important feature of the guarantor's form.

How to Write a Personal Guarantee?Information About the Parties.Information About the Loan.Subject of the Guarantee.Terms and Conditions.Contact Information.Signatures.Witness.

This Standard Document creates the guarantor's obligation to guaranty payment of the borrower's obligations under a loan agreement. This form is a personal guaranty (or guarantee) to be entered into by an individual rather than a corporate entity.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Personal Guarantee: Taking Responsibility A promissory note alone may not be enough to secure the loan your business needs. That's why your promissory note could include a personal guarantee. Since a promissory note is basically just an IOU, a lender will want some kind of collateral to secure the loan.