Restricted Stock Vs Stock Options

Description

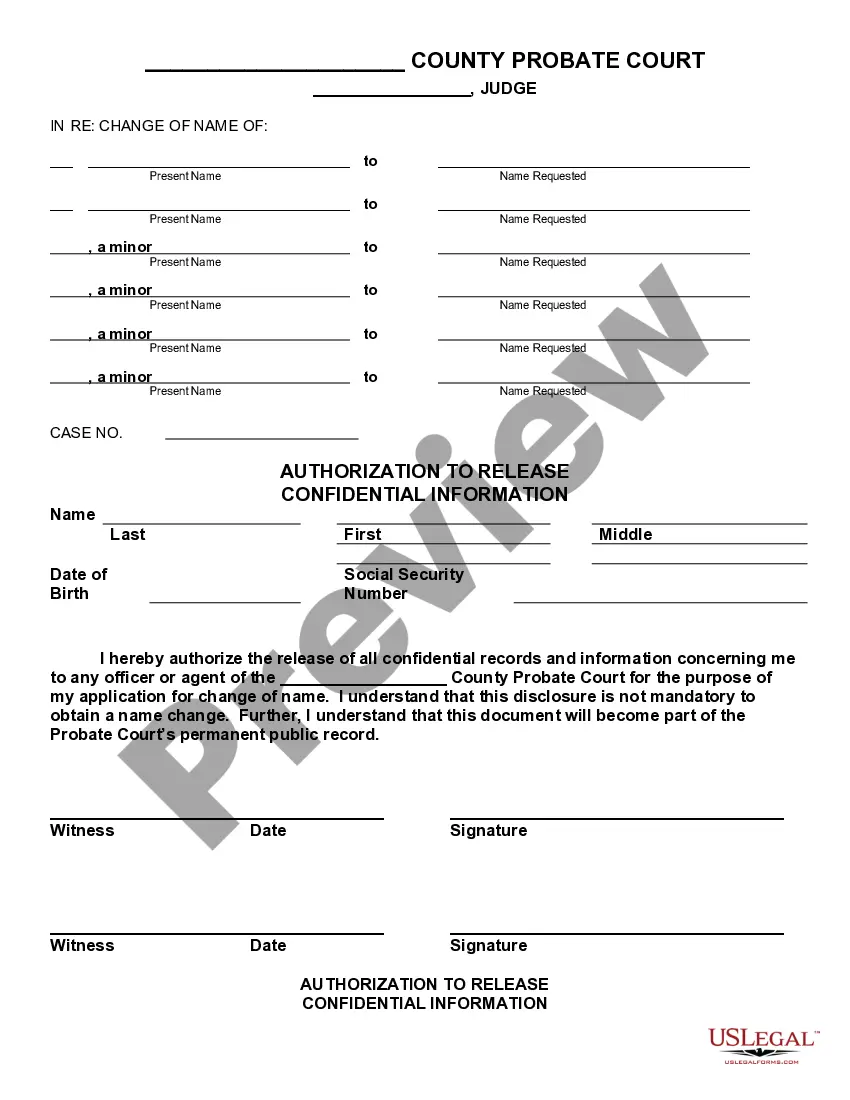

How to fill out Sample Restricted Stock Purchase Agreement Between Intermark, Inc. And Purchasers?

Whether for commercial intentions or personal matters, everyone must confront legal circumstances at some point in their lifetime.

Completing legal documents necessitates meticulous care, beginning with selecting the correct form template.

With a comprehensive US Legal Forms collection available, you don't need to waste time searching for the correct template online. Take advantage of the library’s easy navigation to find the suitable template for any circumstance.

- Obtain the template you require through the search bar or catalog browsing.

- Review the form’s description to confirm it aligns with your situation, jurisdiction, and area.

- Click on the form’s preview to inspect it.

- If it is not the right form, return to the search feature to find the Restricted Stock Vs Stock Options template you need.

- Acquire the template if it satisfies your requirements.

- If you possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you don't have an account yet, you can obtain the template by selecting Buy now.

- Select the appropriate payment option.

- Complete the profile registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you desire and download the Restricted Stock Vs Stock Options.

- After saving it, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

To acquire restricted stocks, you typically receive them as part of your compensation package from your employer. These stocks will be subject to a vesting period, requiring you to meet certain conditions, like tenure or performance goals. Engaging in discussions with your employer about your compensation preferences can lead to successful negotiations. Knowing the distinctions between restricted stock vs stock options can aid you in making better choices.

RSUs themselves do not generally have an expiration date, but employees must be cautious about the term set by the company. Most companies have a vesting schedule, and if you leave before it is fulfilled, you may lose unvested units. Always review your company's guidelines, as each situation can differ greatly. Understanding the differences between restricted stock vs stock options can prove beneficial in making informed decisions.

Choosing between stock options and RSUs often depends on your financial situation and risk tolerance. Stock options might offer greater upside potential if the company's stock performs well, while RSUs generally provide more certainty, as they have intrinsic value upon vesting. Evaluating your long-term goals will help you make the right decision tailored to your needs. Consider using US Legal Forms to explore documentation that clarifies restricted stock vs stock options.

The so-called tax loophole for RSUs often refers to using specific investment strategies to manage taxes. One common approach is delaying the sale of vested shares until rates are more favorable. Another strategy includes offsetting gains with losses in other investments. Consult with a financial advisor who understands the differences between restricted stock vs stock options to leverage these opportunities.

While it is challenging to avoid taxes on RSU vesting, employing strategic methods can minimize your tax burden. One effective way is to hold onto the stocks until you reach a lower tax bracket after vesting. You may also consider utilizing tax-advantaged accounts for holding RSUs. Be sure to consult a tax advisor to navigate the complexities of restricted stock vs stock options in this context.

The rule of 65 relates to retirement benefits, including restricted stock units. It suggests that employees combine their age and years of service; if the total equals 65 or more, they may qualify for accelerated vesting of RSUs. Understanding this rule can be vital for planning your financial future. Consider discussing this with your HR department to evaluate your situation regarding restricted stock vs stock options.

When it comes to how RSUs are reported on your W2, the value of the shares is included as income when they vest. This means you should expect the total fair market value of the vested shares to appear in the 'Wages, tips, other compensation' section of your W2. This reporting can complicate your tax situation, emphasizing the importance of understanding restricted stock vs stock options. Using platforms like US Legal Forms can help clarify any tax implications and ensure proper compliance.

You might choose not to accept RSUs due to various reasons, including concerns about tax implications or lack of flexibility. RSUs are often subject to vesting schedules, which can limit your immediate financial options. Additionally, if the company's stock underperforms, RSUs may not provide the desired return on investment. Evaluating your priorities and financial goals is vital when making this decision.

The '7-year rule' for RSUs refers to the time frame that influences the tax treatment of these shares. Generally, the IRS allows you to avoid being taxed on unauthorized RSUs for seven years, provided they are not sold or transferred during this time. This concept can be somewhat complex, so consulting with a tax professional is advisable for tailored guidance in navigating RSUs. Understanding your options is crucial for effectively managing your investments.

When you leave a company, any unvested RSUs are typically forfeited, meaning you lose those shares. Conversely, vested RSUs will remain yours, but taxes will apply upon sale. It's crucial to understand the specific terms of your RSU agreement, as they can vary by employer. Planning your exit strategy with these factors in mind can help you maximize your benefits.