Restricted Stock Between Withholding Choices

Description

How to fill out Sample Restricted Stock Purchase Agreement Between Intermark, Inc. And Purchasers?

Obtaining legal document samples that adhere to federal and state laws is essential, and the web provides many alternatives.

However, what's the use in expending time searching for the accurately prepared Restricted Stock Between Withholding Choices sample online when the US Legal Forms online repository already compiles such templates in one location.

US Legal Forms stands as the largest online legal directory with over 85,000 fillable templates crafted by attorneys for any professional and personal scenario. They are straightforward to navigate with all documents categorized by state and intended use. Our specialists keep updated with legal changes, ensuring you can always trust that your documents are current and compliant when acquiring a Restricted Stock Between Withholding Choices from our site.

Click Buy Now when you’ve found the right form and choose a subscription plan. Create an account or Log In, and make a payment with PayPal or a credit card. Then, choose the best format for your Restricted Stock Between Withholding Choices and download it. All templates you find through US Legal Forms are reusable. To re-download and fill out previously purchased forms, navigate to the My documents section in your profile. Take advantage of the most comprehensive and user-friendly legal document service!

- Acquiring a Restricted Stock Between Withholding Choices is easy and quick for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you need in the appropriate format.

- If you are a newcomer to our website, follow the steps outlined below.

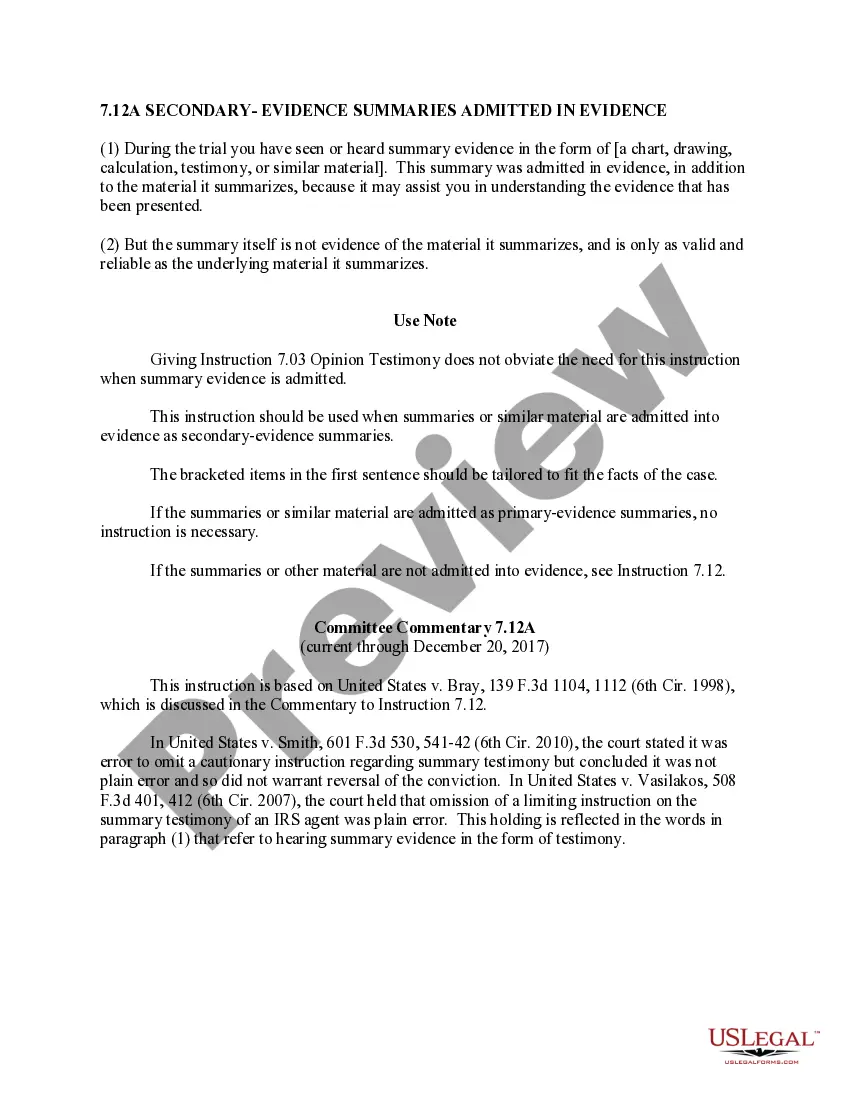

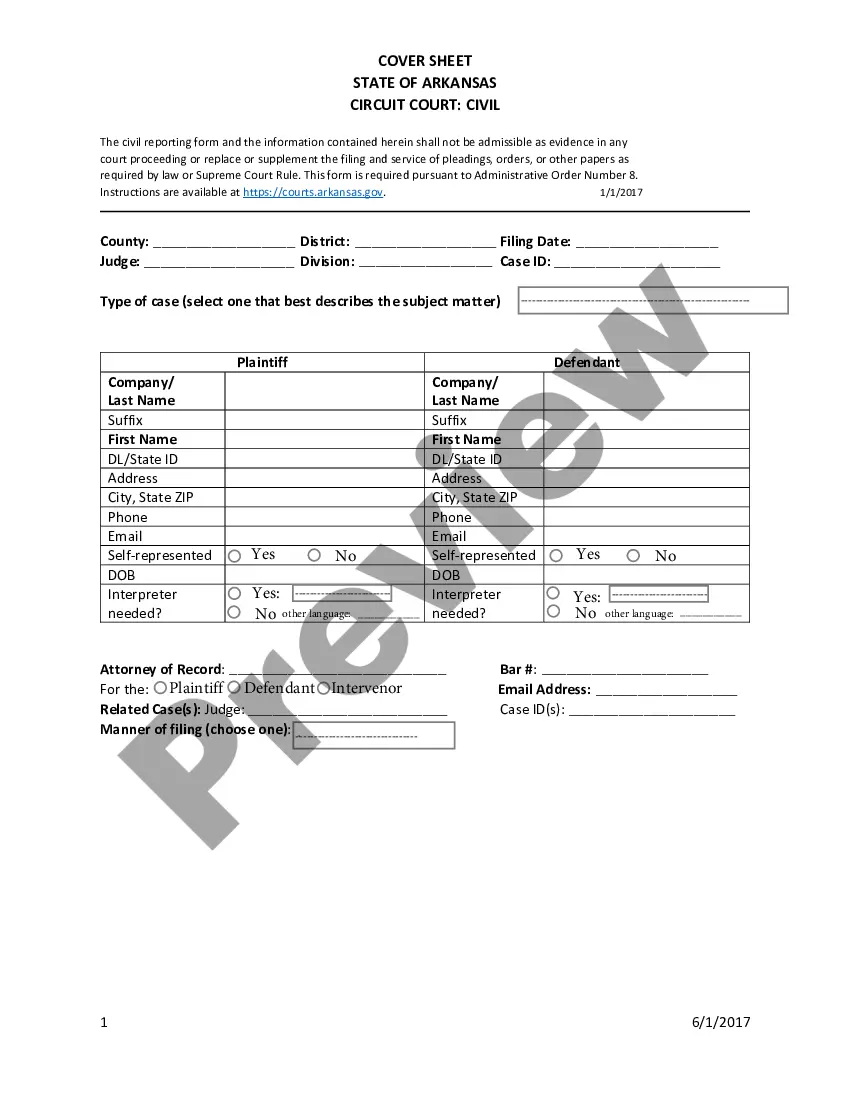

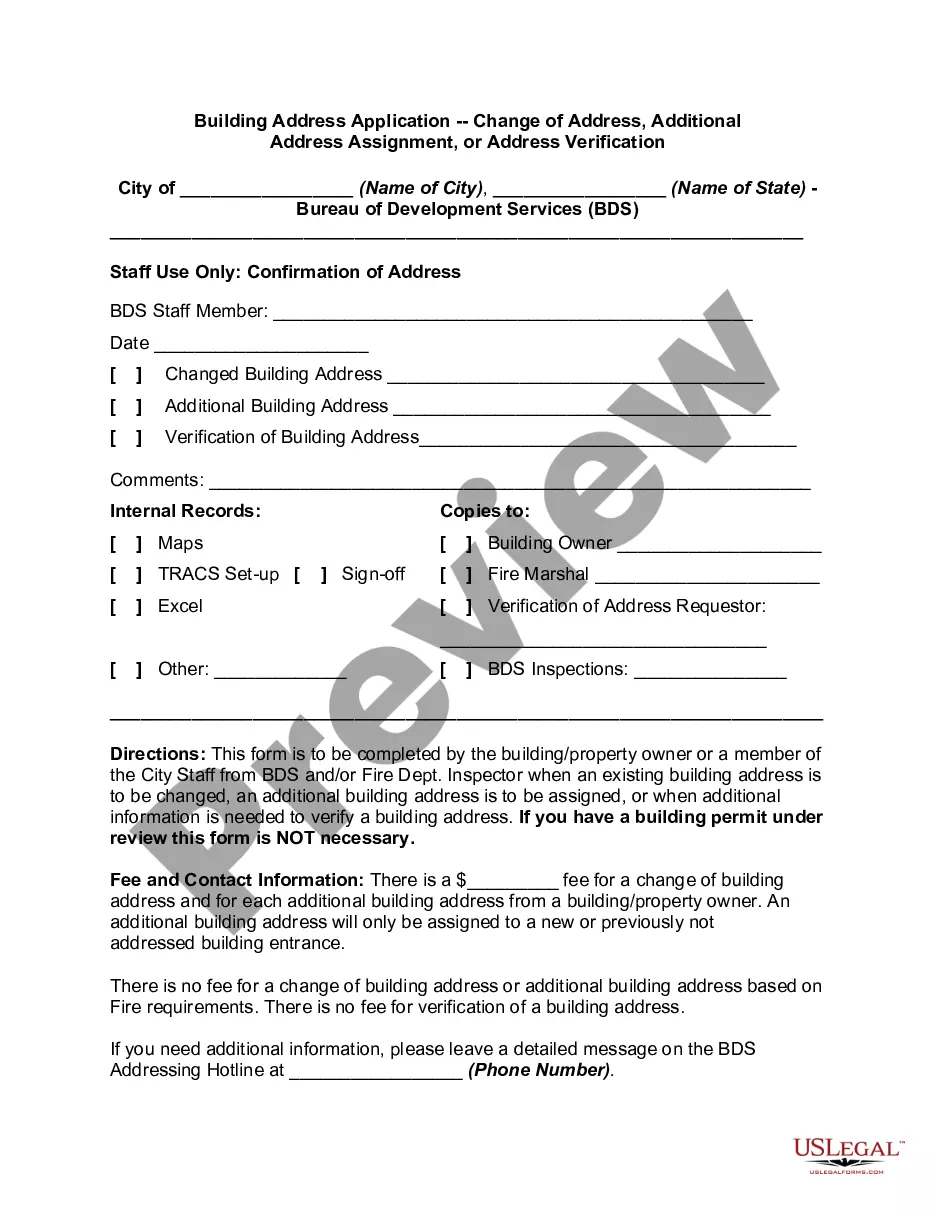

- Examine the template using the Preview option or via the text outline to ensure it fulfills your requirements.

- Search for an alternative sample using the search feature at the top of the page if necessary.

Form popularity

FAQ

RSUs are considered supplemental income, and as such, the income you receive from them is subject to withholding taxes. The IRS requires a federal withholding rate of 22% for supplemental income up to $1 million, and 37% for income exceeding that amount.

RSUs are taxed as income to you when they vest. If you sell your shares immediately, there is no capital gain tax, and you only pay ordinary income taxes. If instead, the shares are held beyond the vesting date, any gain (or loss) is taxed as a capital gain (or loss).

If you have RSUs the amount should be shown in box 14 of your W-2 copy. This amount should also be included in the wages (box 1) of your W-2. Box 14 is used by employers to list various items and there is not a standard list of codes, you can use the options for "Other Not Listed Here" in place of RSU Gain.

Income in the form of RSUs will typically be listed on the taxpayer's W-2 in the ?Other? category (Box 14). Taxpayers will simply translate the figure listed in Box 14 to their federal tax return and, if applicable, state tax return(s).

RSUs are considered a form of compensation and are included in your taxable income when they vest. Because RSU income is considered supplemental, the withholding rate can vary between 22% and 37%. Usually, your employer will liquidate a percentage of the shares to cover the withholding requirement.