Stock Redemption With Withdrawals

Description

How to fill out Stock Redemption Agreements With Exhibits Of Fair Lanes, Inc.?

Whether for commercial reasons or personal matters, everyone must confront legal issues at some point in their lives.

Completing legal documents requires meticulous care, starting with selecting the correct form template. For example, if you choose an incorrect version of the Stock Redemption With Withdrawals, it will be denied upon submission.

With an extensive US Legal Forms catalog available, you do not need to waste time looking for the correct sample online. Utilize the library’s user-friendly navigation to find the suitable template for any occasion.

- Acquire the template you need using the search bar or catalog navigation.

- Review the form’s details to ensure it aligns with your situation, state, and county.

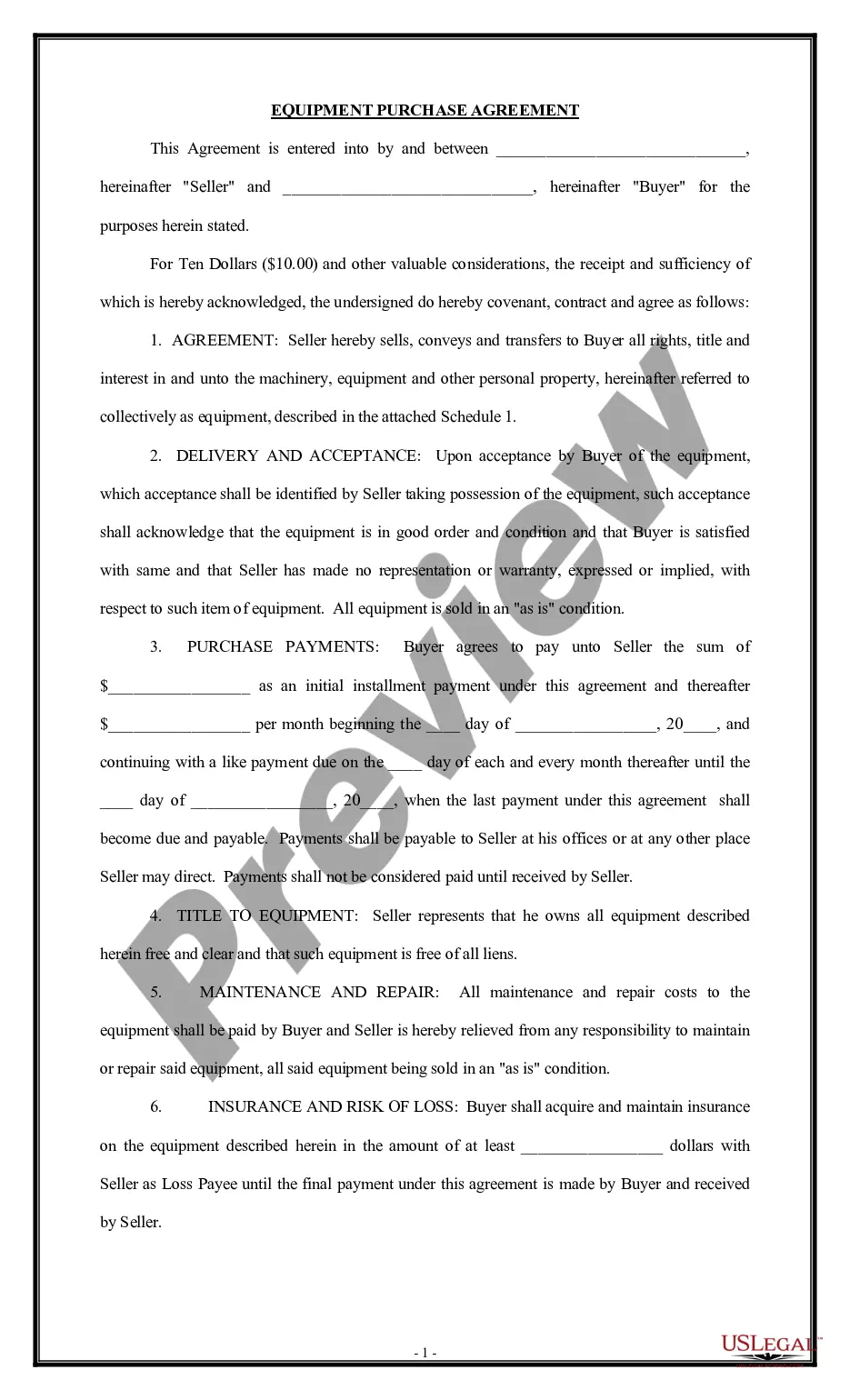

- Click on the form’s preview to view it.

- If it is the incorrect form, return to the search tool to locate the Stock Redemption With Withdrawals sample you need.

- Download the document when it fulfills your requirements.

- If you have a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- In case you do not have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the profile registration form.

- Select your payment method: you can utilize a credit card or PayPal account.

- Choose the document format you prefer and download the Stock Redemption With Withdrawals.

- Once it is saved, you can complete the form using editing software or print it and finish it manually.

Form popularity

FAQ

In mutual funds, the term redemption means withdrawing your investment from the fund. As an investor, you may choose to redeem your money from a mutual fund for various reasons like the requirement of funds, if the fund is not delivering the desired returns, if you meet your investment objective, etc.

Withdrawing money when you need to sell stocks to come up with the cash Choose the stocks you want to sell and enter the appropriate trades with your broker. Wait until the trades settle, which typically takes two business days. Request the cash withdrawal once the proceeds of the sale hit your account.

Hear this out loud PauseYou can only withdraw cash from your brokerage account. If you want to withdraw more than you have available as cash, you'll need to sell stocks or other investments first. Keep in mind that after you sell stocks, you must wait for the trade to settle before you can withdraw money from your brokerage account.

How long does it take to withdraw money from a brokerage account? It generally takes one to three business days for an ACH transfer to a bank account, less than 24 hours for a wire transfer, and seven to 10 days for a check.

When a corporation withdraws money from retained earnings to give to shareholders, it is called paying dividends. The corporation first declares that dividends will be paid, at which point a debit entry is made to the retained earnings account and a credit entry is made to the dividends payable account.