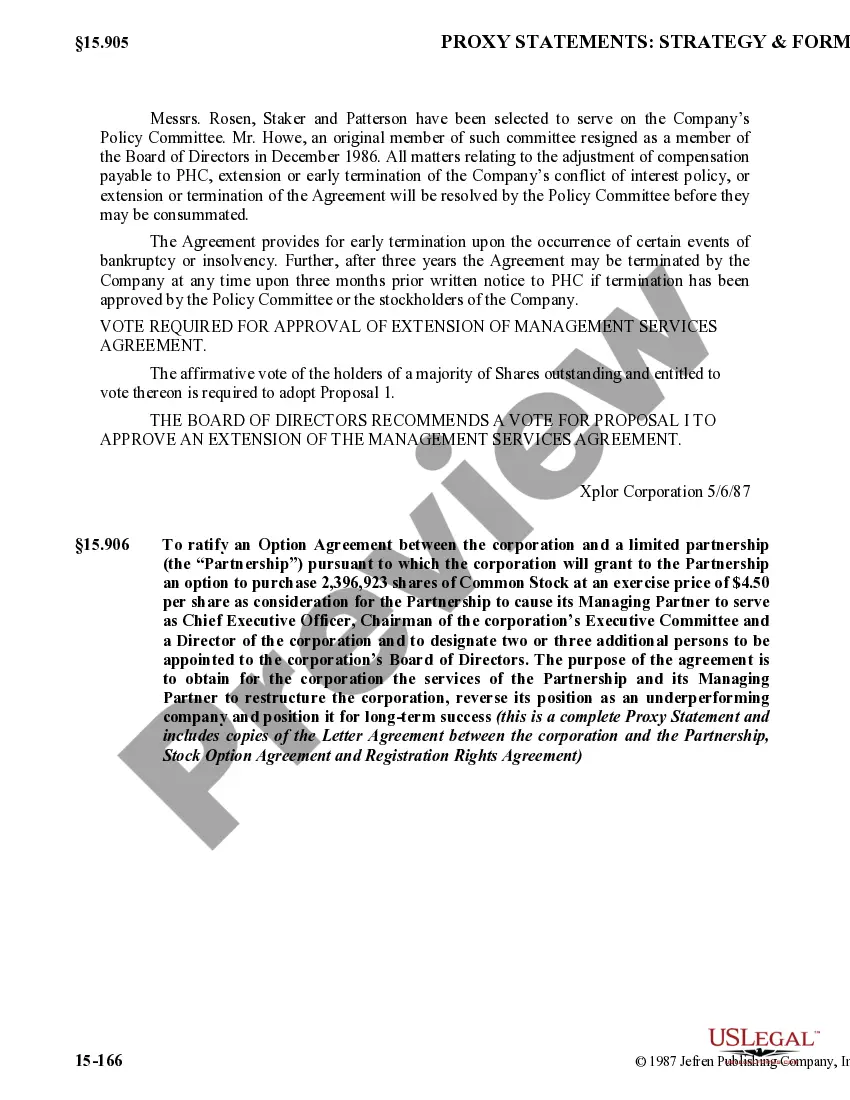

Extension Services Agreement With Withdrawal

Description

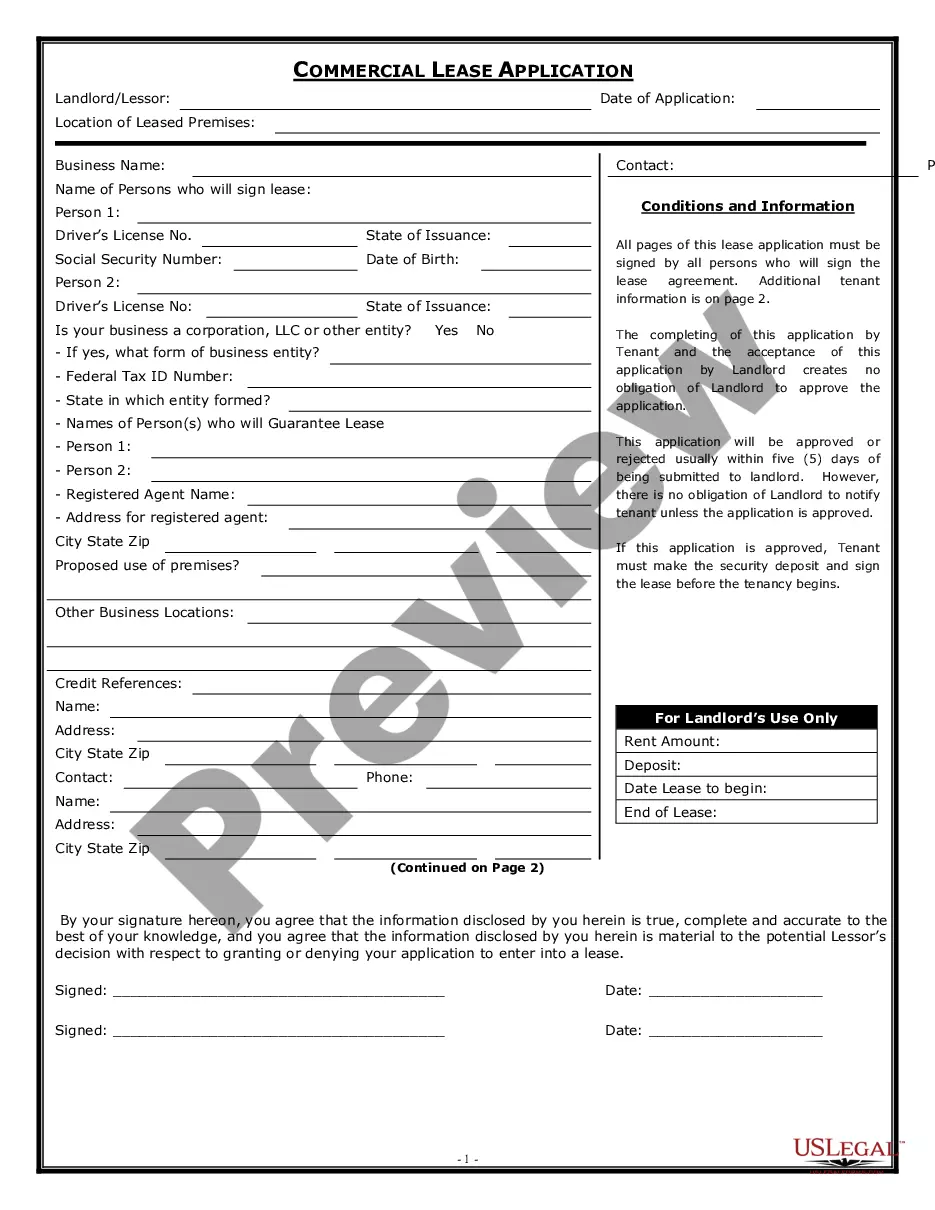

How to fill out Approval Of Extension Of Management Services Agreement?

Whether you handle paperwork frequently or occasionally need to submit a legal document, it is essential to have a reliable resource containing all the relevant and current samples.

The first step you should take with an Extension Services Agreement With Withdrawal is to ensure that it is the latest version, as this determines if it can be submitted.

If you want to streamline your search for the most recent document samples, look for them on US Legal Forms.

Utilize the search menu to locate the form you desire.

- US Legal Forms is a directory of legal documents that includes nearly every document template you might be seeking.

- Search for the templates you require, assess their relevance immediately, and learn more about their application.

- With US Legal Forms, you have access to over 85,000 document templates across various fields.

- Obtain the Extension Services Agreement With Withdrawal samples in a few clicks and store them at any time in your account.

- A US Legal Forms account enables you to access all the necessary samples with greater ease and reduced hassle.

- Simply click Log In in the website header and navigate to the My documents section where you will find all the forms you need at your fingertips, without having to spend time searching for the right template or verifying its validity.

- To obtain a form without an account, follow these steps.

Form popularity

FAQ

Attach a letter of explanation to Form 5329. The letter should include why the RMD was missed, the fact that it has now been taken, and describe the steps taken to ensure that future RMDs will be taken as required.

You are required to fill out Form 5329 if you exceed the eligible contributions allowed for an IRA. Traditional and Roth IRA contributions cannot exceed $5,500 annually for individuals under the age of 50. Or, for people age 50 or older, they can contribute up to $6,500 to a traditional or Roth IRA each year.

If you've missed an RMD, here's what to do to correct the errorTake the RMD as soon as you discover you have missed it.After taking the RMD, file Form 5329 for each year an RMD was missed.Repeat this procedure for each tax year an RMD shortfall occurred, using Form 5329 for that year.More items...?

If you want to revoke a previously executed power of attorney and do not want to name a new representative, you must write REVOKE across the top of the first page with a current signature and date below this annotation.

How to Make an Electronic Funds Withdrawal Payment:Use commercial software, a paid preparer, or IRS Free File to e-file your federal tax return and at the same time submit an EFW payment request.Upon selection of the electronic funds withdrawal option, a payment record will display for entry of payment information.