Any Company Closing Withdrawing Funds

Description

How to fill out Sample Stock Purchase Agreement General Form To Be Used Across The United States?

Managing legal documentation can be overwhelming, even for seasoned experts.

If you are interested in a Any Company Closing Withdrawing Funds and lack the time to locate the appropriate and current version, the process may become daunting.

US Legal Forms addresses all your requirements, from personal to business documents, all in one location.

Use advanced tools to complete and manage your Any Company Closing Withdrawing Funds.

Follow these steps after obtaining the form you require: Confirm it is the correct document by previewing it and reviewing its details.

- Access a database of articles, guides, and references pertinent to your circumstances and requirements.

- Save time and effort searching for the documents you need and leverage US Legal Forms' advanced search and Review tool to locate Any Company Closing Withdrawing Funds and download it.

- If you have a subscription, Log In to your US Legal Forms account, find the form, and download it.

- Check the My documents tab to view the forms you've previously saved and organize your folders as desired.

- If you are a first-time user of US Legal Forms, create an account for unlimited access to all platform benefits.

- Utilize a powerful web form library that can transform how individuals handle these circumstances efficiently.

- US Legal Forms is a frontrunner in online legal forms, offering over 85,000 state-specific legal documents accessible at any time.

- With US Legal Forms, you can access state- or county-specific legal and corporate forms.

Form popularity

FAQ

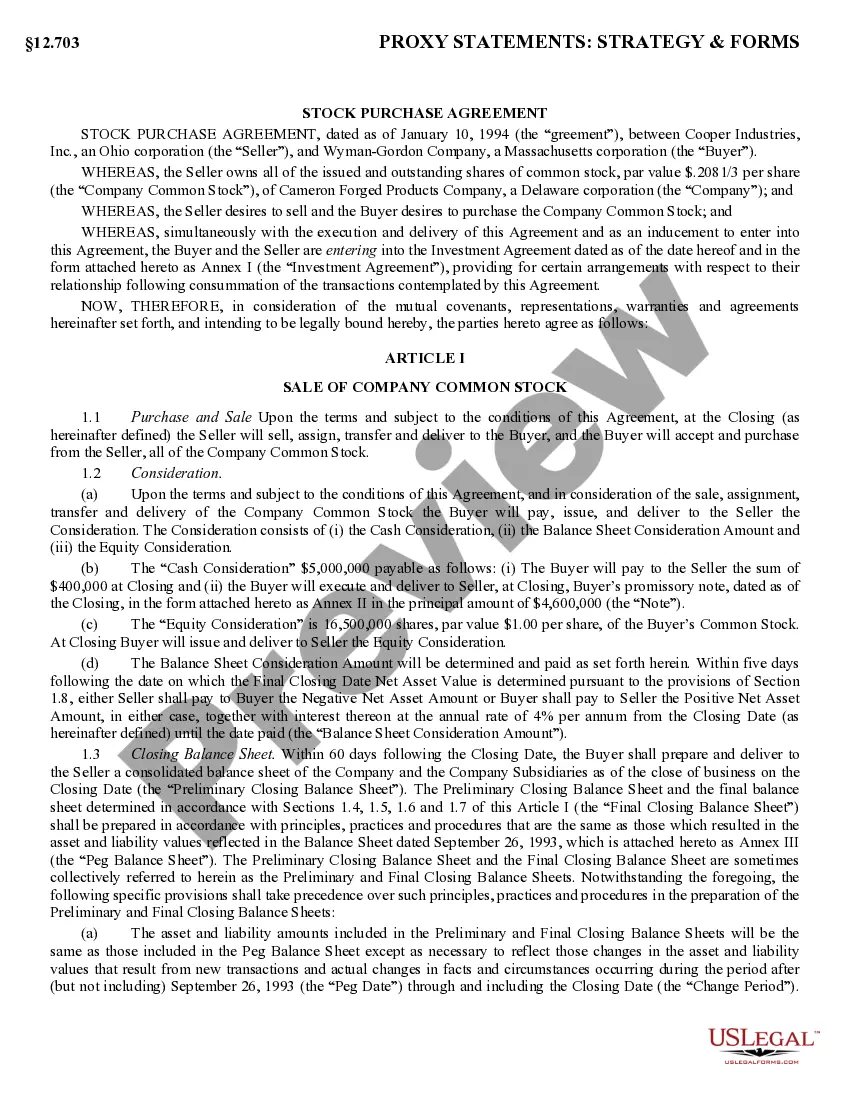

When any company closing withdrawing funds, the distribution of assets becomes a key concern. Typically, the company's remaining assets will first settle any outstanding debts and obligations. After that, any leftover assets can be distributed to the owners or shareholders. It is crucial to follow proper legal procedures, and using platforms like US Legal Forms can provide the guidance you need to ensure everything is handled correctly.

To qualify for a hardship distribution, a 401(k) participant must meet two criteria. First, they must have an ?immediate and heavy financial need.? Second, the distribution must be limited to the amount ?necessary to satisfy? the financial need.

If your company closes, you may have the option of rolling over 401(k) savings to a retirement plan with your new employer or to an individual retirement account (IRA).

How to Withdraw Money from Your Bank Account How to Withdraw Money from Your Bank Account. Have you finally made the upgrade from a piggy bank and moved your stash of cash into a bank account? ... Use an ATM. ... Write a Check for Cash. ... Fill Out a Withdrawal Slip. ... Link Your Account to a Peer-to-Peer Payment Service.

What Happens When a Bank Closes Your Account? Your bank may notify you that it has closed your account, but it normally isn't required to do so. The bank is required, however, to return your money, minus any unpaid fees or charges. The returned money likely will come in the form of a check.

If you have money in the account at the time it's closed, the bank is required to return it to you minus any outstanding fees. If an automatic deposit is made into that account after it's closed, those funds must also be returned. Typically, the bank will send a check.