Agreement Home Form with Collateral: An Agreement Home Form with Collateral refers to a legal agreement between a lender and a borrower, which involves securing a loan or mortgage with collateral in the form of a property or home. This agreement is commonly used in real estate transactions where the borrower pledges their home as security to the lender. The main purpose of an Agreement Home Form with Collateral is to protect the lender's interest in providing them with a means to recover their investment in case the borrower fails to repay the loan as per the agreed terms. The collateral, in this case, acts as a form of security and ensures that the lender can seize and sell the property to recover the outstanding balance. There are different types of Agreement Home Forms with Collateral, depending on the specifics of the loan or mortgage. Some commonly known types include: 1. Mortgage Agreement: In this type of Agreement Home Form with Collateral, the borrower pledges their property as collateral to secure a loan from the lender. The property's title is transferred or mortgaged to the lender until the loan is repaid in full. 2. Deed of Trust: This form of agreement is often used in some jurisdictions instead of a mortgage. It involves three parties: the borrower, the lender, and a trustee who holds the title until the loan is fully paid. If the borrower defaults on the loan, the trustee can initiate foreclosure proceedings. 3. Home Equity Line of Credit (HELOT) Agreement: This agreement allows homeowners to use their property's equity as collateral to obtain a line of credit. The borrower can draw funds up to a predetermined limit and repay them over time. Failure to repay the debt may result in the lender foreclosing on the property. 4. Home Loan Agreement or Promissory Note: This type of agreement outlines the terms and conditions of a home loan, where the borrower promises to repay a specific amount borrowed from the lender, along with any interest agreed upon. Collateral in this case is the property itself. It is essential for both borrowers and lenders to carefully review and understand the terms mentioned in the Agreement Home Form with Collateral. Clear information regarding repayment schedules, interest rates, default consequences, and foreclosure procedures must be included. This ensures that both parties' rights and obligations are protected throughout the loan term. In conclusion, an Agreement Home Form with Collateral is a legal document that establishes a loan or mortgage secured by property or a home. By choosing the appropriate type of agreement, borrowers and lenders can efficiently manage their financial transactions while minimizing risks.

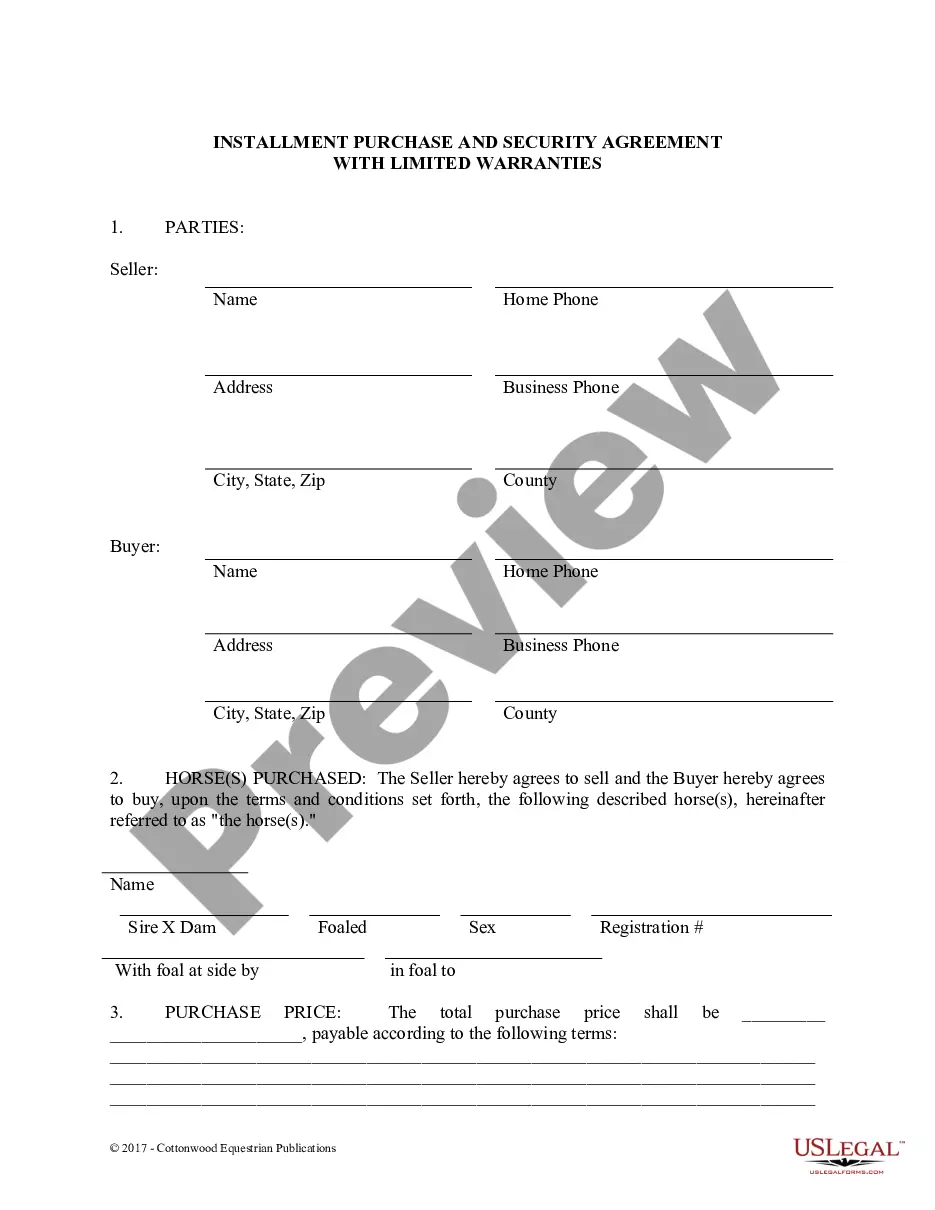

Agreement Home Form With Collateral

Description

How to fill out Agreement Home Form With Collateral?

Whether for business purposes or for personal affairs, everybody has to handle legal situations sooner or later in their life. Filling out legal documents demands careful attention, beginning from picking the right form sample. For instance, if you pick a wrong edition of the Agreement Home Form With Collateral, it will be rejected once you send it. It is therefore essential to have a dependable source of legal documents like US Legal Forms.

If you need to obtain a Agreement Home Form With Collateral sample, stick to these easy steps:

- Find the sample you need by utilizing the search field or catalog navigation.

- Examine the form’s information to ensure it fits your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the wrong document, go back to the search function to find the Agreement Home Form With Collateral sample you require.

- Download the file if it meets your needs.

- If you have a US Legal Forms account, simply click Log in to gain access to previously saved files in My Forms.

- In the event you do not have an account yet, you can obtain the form by clicking Buy now.

- Pick the appropriate pricing option.

- Finish the account registration form.

- Pick your transaction method: use a credit card or PayPal account.

- Pick the file format you want and download the Agreement Home Form With Collateral.

- After it is downloaded, you can complete the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you do not have to spend time looking for the right sample across the web. Take advantage of the library’s easy navigation to find the appropriate form for any situation.

Form popularity

FAQ

Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone ? 800-TAX-FORM (800-829-3676).

No, Post Offices do not have tax forms available for customers. However, you can view, download, and print specific tax forms and publications at the "Forms, Instructions & Publications" page of the IRS website.

If you're planning to file paper forms for both your federal and state returns, you can file your state return before your federal return. You may be considering this option if your goal is to use your state refund to pay for your federal tax liability.

Get federal tax forms Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

These forms and publications are available on the Internet, on CD-ROM, through fax on demand, over the telephone, through the mail, at local IRS offices, at some banks, post offices, and libraries, and even at some grocery stores, copy centers and office supply stores.

A West Virginia Tax Power of Attorney (Form WV-2848) is a required submission when a taxpayer wants to gain approval from the West Virginia State Tax Department for their delegation of principal authority to an agent.

In IRS Taxpayer Assistance Centers. To find the Center nearest to you, visit IRS.gov and click on ?Help & Resources? and then ?Contact Your Local IRS Office.? Select your state for a list of offices, as well as a list of services available at each office.

If you are domiciled in West Virginia and spent more than 30 days in the state, you must file a resident return and report all of your income to West Virginia.