Change Business Name With Texas Comptroller

Description

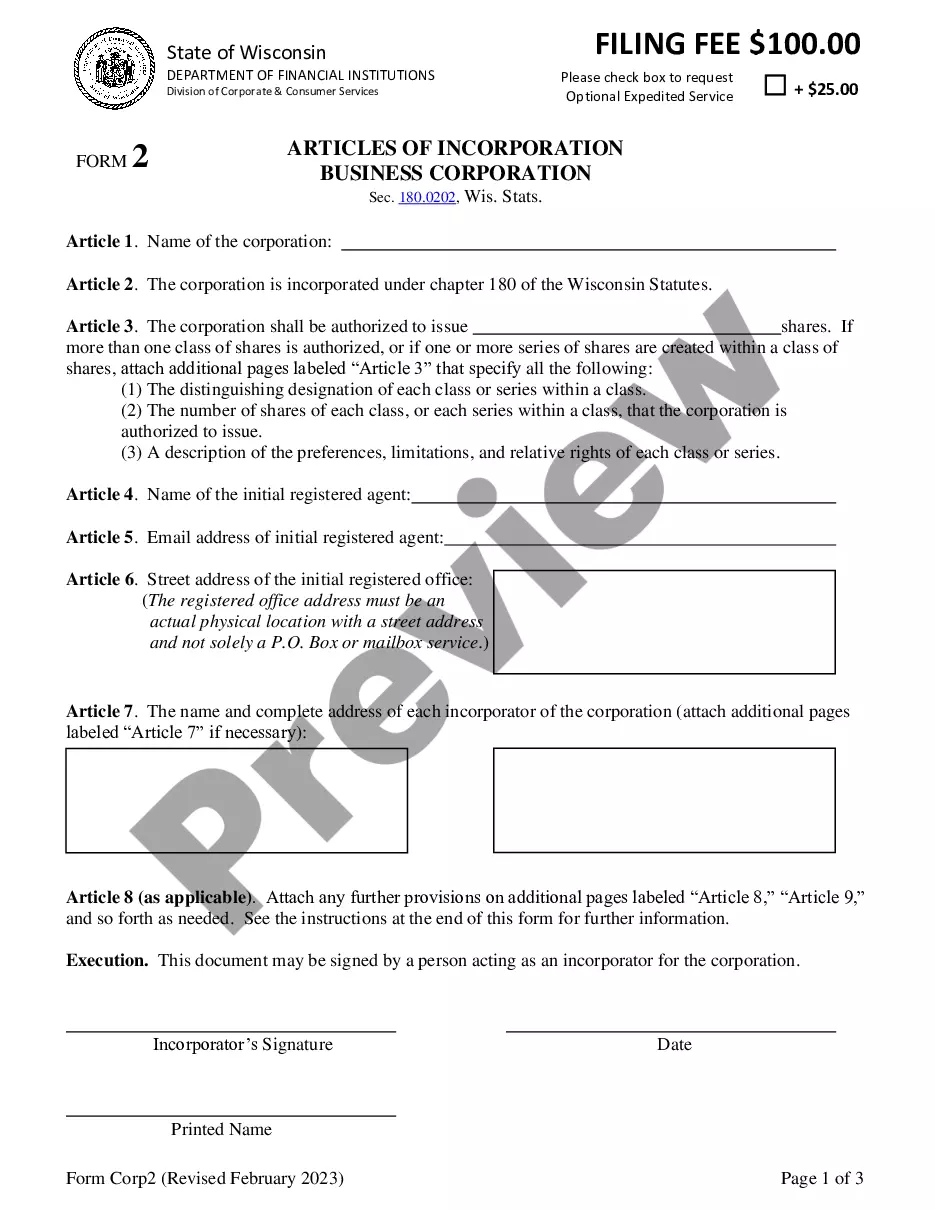

How to fill out Proposal To Amend Certificate Of Incorporation To Change Corporate Name?

Whether for commercial purposes or for personal matters, everyone must deal with legal situations at some point in their lives.

Filling out legal documents necessitates meticulous care, starting with choosing the appropriate form template.

Once it is downloaded, you can complete the form using editing software or print it out and finish it by hand. With a comprehensive US Legal Forms catalog available, you do not need to waste time searching for the correct template online. Utilize the library’s straightforward navigation to find the right template for any situation.

- Locate the template you require by utilizing the search bar or catalog navigation.

- Review the form’s details to ensure it aligns with your circumstances, state, and area.

- Click on the form’s preview to view it.

- If it is the wrong document, return to the search option to find the Change Business Name With Texas Comptroller sample you require.

- Download the file if it meets your needs.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Choose the suitable pricing option.

- Fill out the profile registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Choose the document format you desire and download the Change Business Name With Texas Comptroller.

Form popularity

FAQ

To change the name of a business in Texas, start by checking name availability on the Texas Secretary of State's website. After confirming your new name is unique, complete the necessary forms for the Texas Comptroller and submit them along with the required fees. Using US Legal Forms can simplify this process, providing step-by-step guidance to ensure you accurately change your business name with the Texas Comptroller. Following these steps will help you smoothly transition to your new business identity.

Yes, you can change the name of an existing business in Texas. To do this, you must file the appropriate forms and fees with the Texas Comptroller. It's essential to ensure that your new business name complies with state regulations and does not duplicate another registered name. Consider using the US Legal Forms platform to streamline the process and help you navigate the requirements to change your business name with the Texas Comptroller.

Changing your business name with the IRS is important to keep your records accurate. You can notify the IRS by filling out Form 8822, which notifies them of your name change. Additionally, you should inform the Texas Comptroller to ensure all state-level records are appropriately updated as you change your business name.

To remove an owner from an LLC in Texas, first, check your operating agreement for procedures related to the removal process. You will then need to file an amendment with the Texas Secretary of State to update ownership records. Don't forget to inform the Texas Comptroller to ensure your tax records accurately reflect the current ownership structure.

Changing ownership of an LLC in Texas is a matter of updating your records and notifying the relevant authorities. Start by reviewing your operating agreement for guidance, and then file the change with the Texas Secretary of State. Remember to report this change to the Texas Comptroller to maintain compliance with state regulations.

The duration for a business name change in Texas can vary depending on several factors, including filing method. If you file online, it may take about 24 hours, while mail submissions can take several weeks. Therefore, to expedite your process, consider using the US Legal Forms platform, which helps streamline the necessary filings with the Texas Comptroller.

Changing ownership of an LLC with the IRS involves updating your EIN information. You need to fill out Form 8822-B to notify the IRS of the new ownership details. Additionally, it is crucial to inform the Texas Comptroller, as any changes to ownership may affect tax responsibilities and compliance.

To change the name of your business in Texas, start by checking the availability of your desired new name through the Texas Secretary of State's website. Once confirmed, prepare and file a Certificate of Amendment form with the Texas Secretary of State, ensuring you also notify the Texas Comptroller about the change. This keeps your business records updated and compliant.

To change ownership on your LLC in Texas, you need to follow a set of simple steps. First, review your operating agreement to see how ownership transfers are handled. Next, file the necessary paperwork with the Texas Secretary of State, alongside updating your records with the Texas Comptroller. Utilizing the US Legal Forms platform can make this process smoother and ensure you have the correct documentation.