List Chapter 7 Format

Description

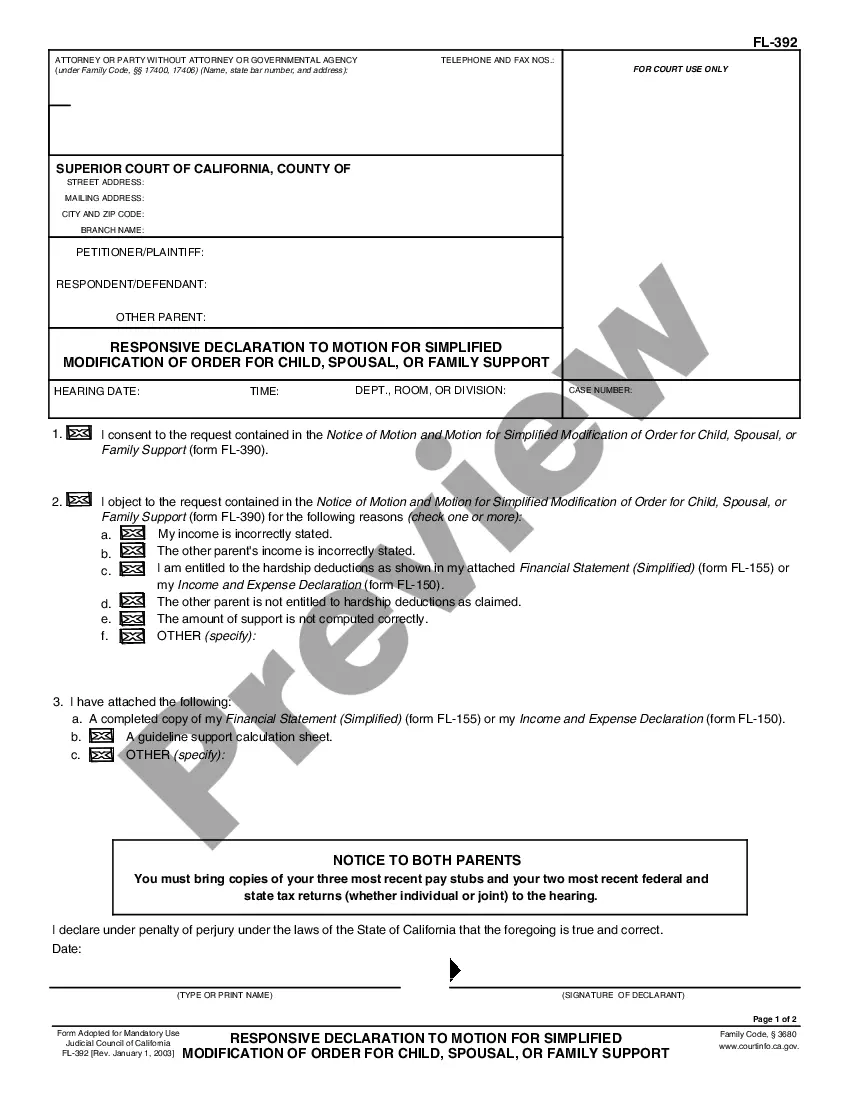

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

Managing legal documents and processes can be a lengthy addition to your daily routine.

List Chapter 7 Format and similar forms typically necessitate you to search for them and comprehend how to fill them out efficiently.

As a result, whether you are handling financial, legal, or personal issues, having a detailed and user-friendly online library of forms readily available will greatly assist.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific forms and a variety of resources that will enable you to finalize your documents swiftly.

Is this your first time using US Legal Forms? Sign up and create your account in just a few minutes, and you will have access to the form library and List Chapter 7 Format. Then, follow the steps below to complete your form: Ensure you have located the correct form using the Preview feature and reviewing the form details. Select Buy Now when you are ready, and choose the monthly subscription plan that suits you best. Click Download, then fill out, eSign, and print the form. US Legal Forms has 25 years of experience helping users manage their legal documents. Get the form you need now and streamline any process effortlessly.

- Explore the collection of relevant documents accessible with just one click.

- US Legal Forms provides you with state- and county-specific forms that can be downloaded at any time.

- Protect your document management processes with a reliable service that allows you to create any form within minutes without any extra or concealed fees.

- Simply Log In to your account, locate List Chapter 7 Format, and obtain it instantly from the My documents section.

- You can also access forms you have downloaded previously.

Form popularity

FAQ

3 to 6 months of bank statements ? The courts use bank statements to look for any potentially missed assets, sources of income, transfers, or payments to family members or preference payments to creditors.

A bankruptcy trustee will look for recent financial transactions see if any are reversable, voidable or claw-back transactions (the money is being ?clawed back? from where it went). They are financial transactions that can be canceled so that the money can be returned to the estate to pay creditors.

A creditor matrix contains each creditor's name and mailing address. This information is used for noticing and claims information. The debtor is required to provide a list of ALL creditors.

You can prepare a List of Creditors by creating one using a computer and word?processing software. After completing the List of Creditors, you then submit the List of Creditors to the Court as a . txt file on electronic media (such as a CD, DVD, or flash / thumb drive).

Examples of nonexempt assets that can be subject to liquidation: Additional home or residential property that is not your primary residence. Investments that are not part of your retirement accounts. An expensive vehicle(s) not covered by bankruptcy exemptions.