Case Bankruptcy File With Irs

Description

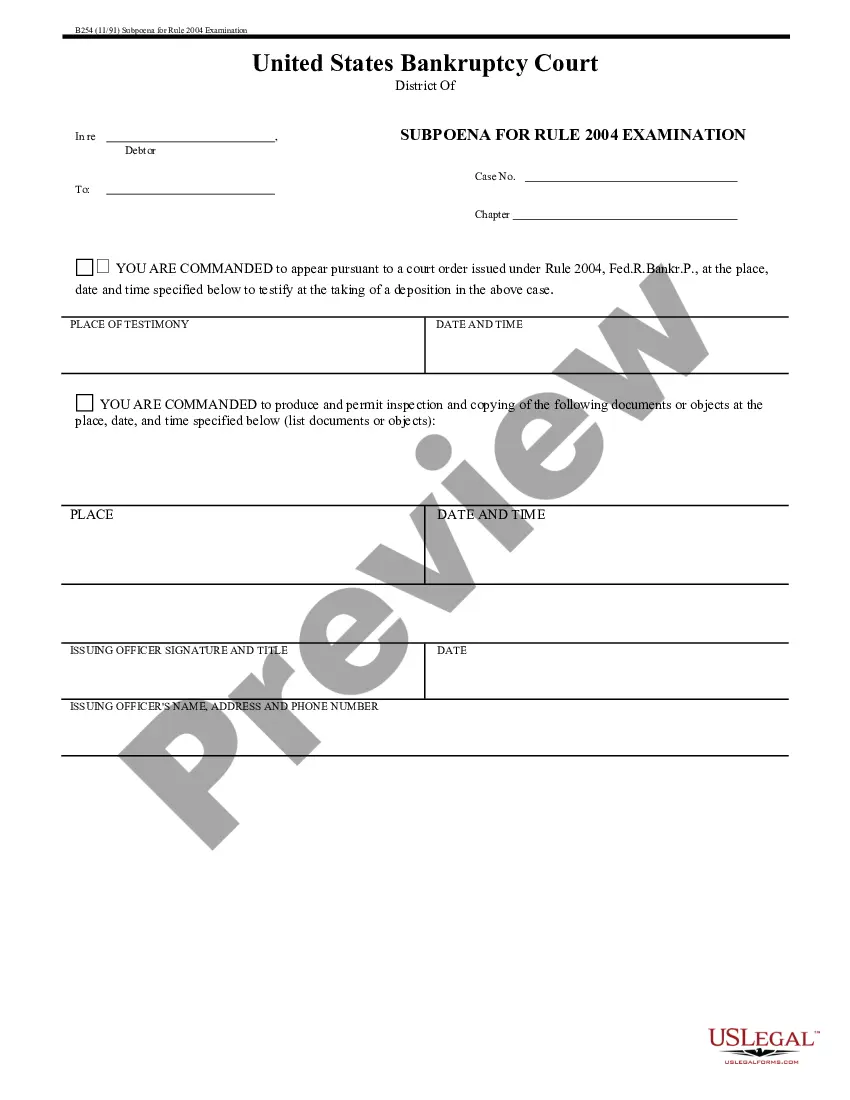

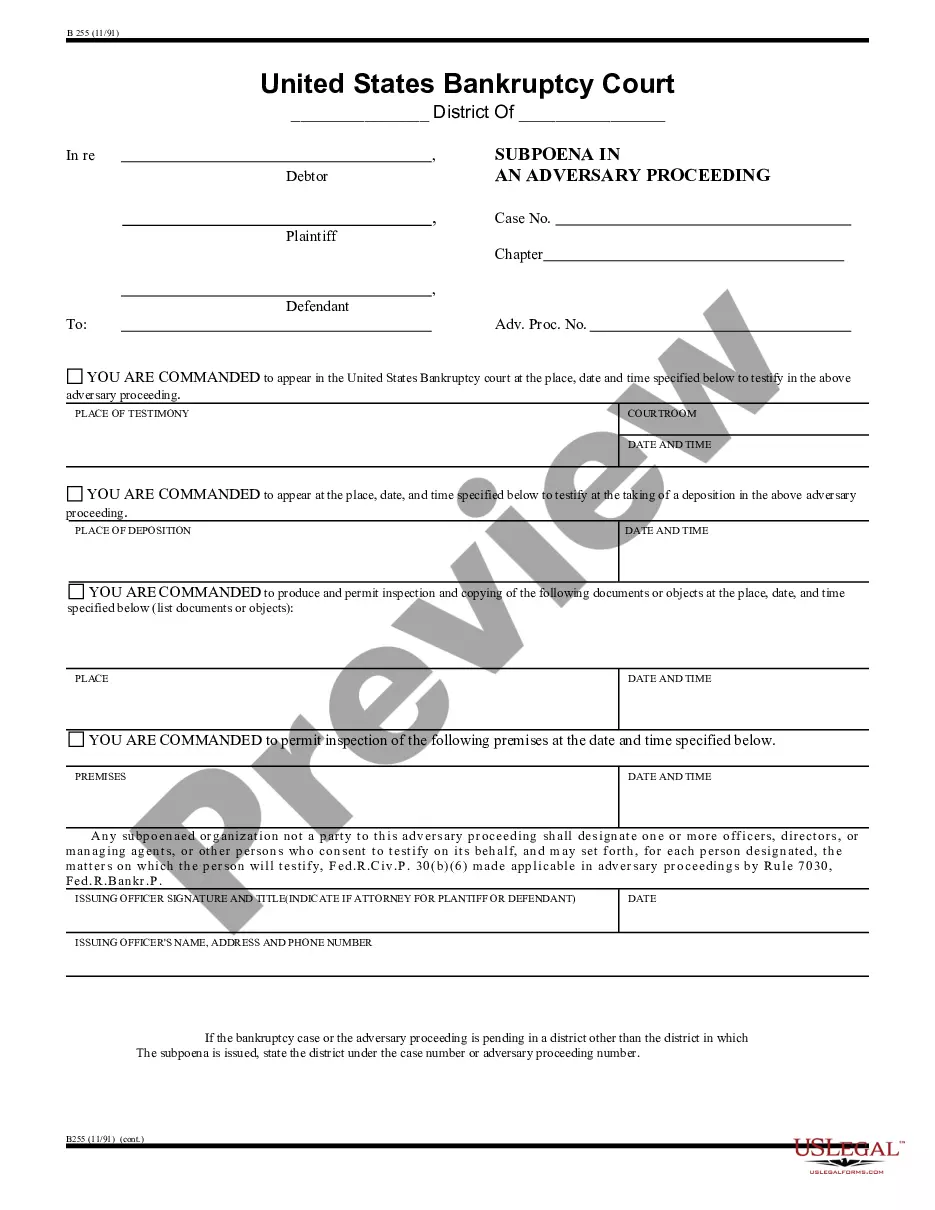

How to fill out Subpoena In A Case Under The Bankruptcy Code - B 256?

It’s well-known that you cannot become a legal authority instantly, nor is it possible to swiftly prepare a Case Bankruptcy File With Irs without having a specialized background. Assembling legal documents is a lengthy task that demands specific training and expertise. So why not entrust the development of the Case Bankruptcy File With Irs to the experts.

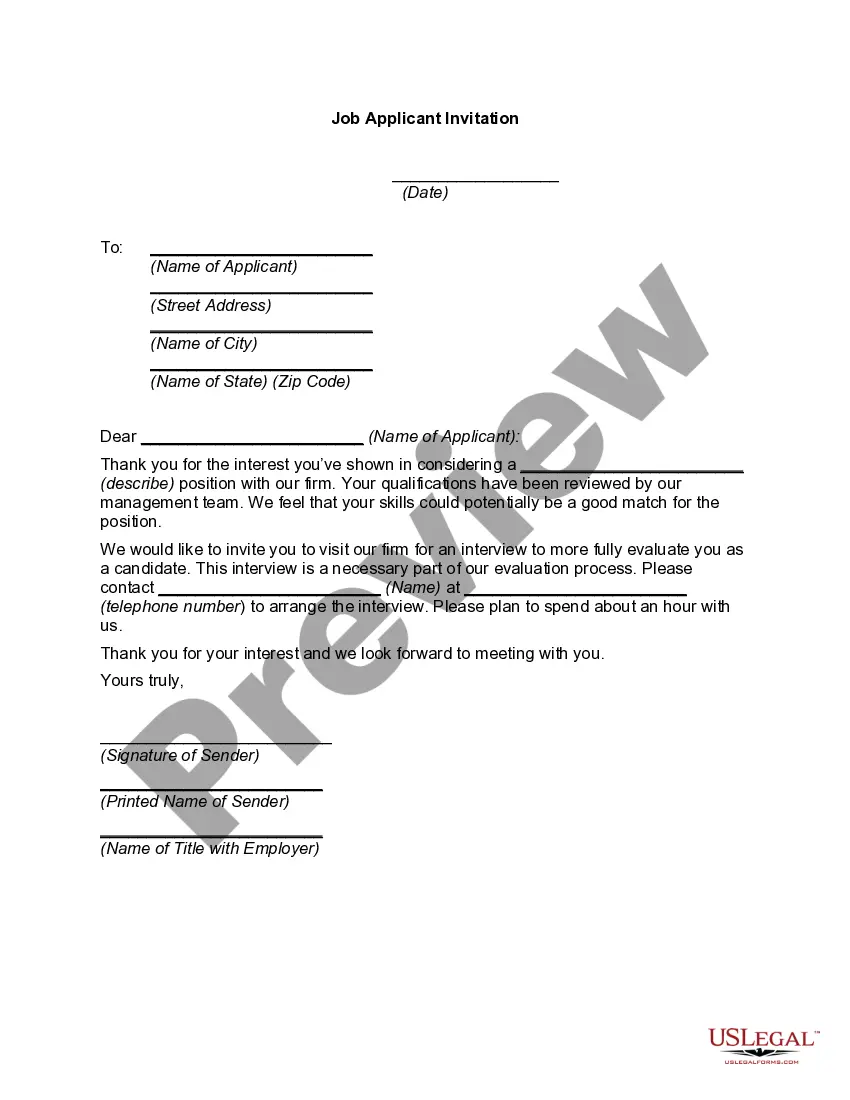

With US Legal Forms, one of the most extensive legal template repositories, you can discover everything from court documents to templates for internal business communication. We understand how vital compliance and adherence to federal and local regulations are. That’s why, on our platform, all forms are location-specific and updated.

Here’s how you can begin with our website and acquire the document you need in just a few minutes.

You can regain access to your forms from the My documents tab at any time. If you’re an existing client, you can simply Log In, and find and download the template from the same tab.

Regardless of the intent of your forms—whether it’s financial and legal, or personal—our website has got you covered. Try US Legal Forms now!

- Locate the form you require using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine if Case Bankruptcy File With Irs is what you seek.

- Start your search again if you need a different form.

- Sign up for a complimentary account and choose a subscription plan to purchase the template.

- Click Buy now. Once the transaction is complete, you can obtain the Case Bankruptcy File With Irs, fill it out, print it, and send or mail it to the necessary individuals or organizations.

Form popularity

FAQ

When you file for bankruptcy, the notice is sent to the IRS automatically by the bankruptcy court. However, if you need to provide additional documentation, you can send it to the IRS office that handles your tax account. In a case bankruptcy file with IRS, ensuring that documentation is correct and submitted promptly can prevent future complications. For assistance, consider using resources from uslegalforms, which can help streamline the process.

Bankruptcy can eliminate some IRS debts under certain conditions, particularly through Chapter 7. However, not all tax debts are dischargeable, so it's important to understand which ones can be affected. If you are exploring a case bankruptcy file with IRS, knowing the specifics can save you time and confusion. Consulting with an expert can guide you through this complex landscape.

Yes, the IRS is notified when you file for bankruptcy. The bankruptcy court sends a notice to the IRS, informing them of your filing. This is an important step when you consider a case bankruptcy file with IRS, as it triggers their review of your tax debts. Staying informed about this process can help you manage your expectations and prepare for the next steps.

Chapter 7 bankruptcy can clear certain IRS debts, allowing you to start fresh. However, this depends on specific conditions, such as the age of the tax debt and whether you filed your tax returns on time. If you are considering a case bankruptcy file with IRS, understanding these nuances is crucial. Consulting with a legal expert can provide clarity on your situation.

If the IRS is listed as a creditor in their bankruptcy, the IRS will receive electronic notice about their case from the U.S. Bankruptcy Courts. People can check by calling the IRS' Centralized Insolvency Operation at 800-973-0424 and giving them the bankruptcy case number.

For the average individual consumer, filing bankruptcy and discharging debts has no tax consequences. In contrast, if your debts are forgiven or settled outside of bankruptcy, the forgiven amount may be added to your income and subject to tax. That's called cancellation of debt income.

Federal Tax Refunds During Bankruptcy You can receive tax refunds while in bankruptcy. However, refunds may be subject to delay or used to pay down your tax debts.

How can I notify the IRS that I've filed bankruptcy? If you listed the IRS as a creditor in your bankruptcy, the IRS will receive electronic notice about your case from the U.S. Bankruptcy Courts within a day or two of the petition date.

Administrative mail such as court documents, forms, general correspondence, and other bankruptcy-related communications should be sent to - Centralized Insolvency Operation Post Office Box 7346, Philadelphia, PA 19101-7346.