Chapter 13 B Withdraw From 401k

Description

How to fill out Order Fixing Time To Object To Proposed Modification Of Confirmed Chapter 13 Plan - B 231B?

Handling legal documents and processes can be a lengthy addition to your schedule.

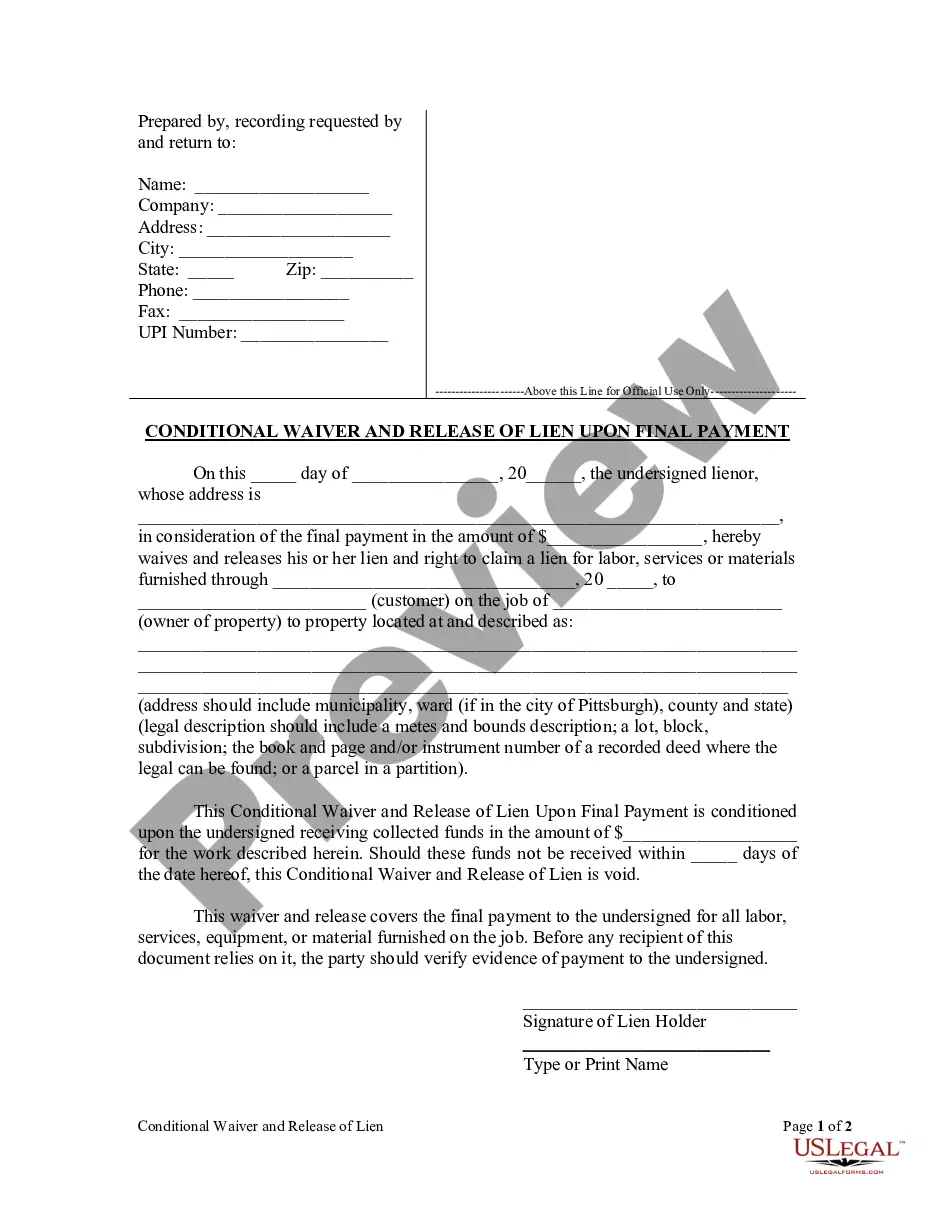

Chapter 13 B Withdraw From 401k and similar forms often require you to search for them and figure out how to fill them out correctly.

Thus, whether you are managing financial, legal, or personal issues, utilizing an extensive and user-friendly online library of forms will be extremely beneficial.

US Legal Forms is the leading online platform for legal templates, featuring over 85,000 state-specific documents and various tools that assist you in completing your paperwork with ease.

Simply Log In to your account, search for Chapter 13 B Withdraw From 401k, and get it instantly in the My documents section. You can also access previously saved forms.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms provides you with state- and county-specific forms available for download anytime.

- Protect your document management processes with a high-quality service that allows you to prepare any form in minutes without any extra or unexpected charges.

Form popularity

FAQ

A hardship withdrawal from a 401k often includes situations such as medical expenses, purchasing a primary home, paying for education, or avoiding eviction. However, when considering a Chapter 13 b withdraw from 401k, it is crucial to establish that the withdrawal is necessary to meet immediate financial needs. Always check your plan’s specific requirements, as they can vary. The US Legal Forms platform can help you understand the conditions and process related to these withdrawals.

To write off your 401k withdrawal while in Chapter 13, you need to correctly report it during your bankruptcy proceedings. You may need to detail how the funds contribute to your repayment plan. Consulting with a qualified attorney or using a platform like uslegalforms can help streamline the process and ensure compliance with the rules surrounding Chapter 13 b withdraw from 401k.

Yes, a Chapter 13 trustee can review your bank account as part of their duties. They assess your financial situation to determine how much you can contribute to your repayment plan. It's important to maintain transparency about all your financial activities, including any Chapter 13 b withdraw from 401k, to ensure your plan meets legal requirements.

Chapter 13 generally does not seize your pension, but it may consider pension funds as part of your overall financial picture. The court looks at your income when determining your repayment plan. If your pension provides a steady income, it could affect your monthly payments. Consult an expert on the implications, and US Legal Forms can provide helpful documentation to navigate this aspect.

Yes, during Chapter 13, the trustee may monitor your bank account. The trustee's role involves ensuring that you adhere to your repayment plan and that all income is reported accurately. It’s vital to maintain transparency with your finances to avoid complications. For clarity on what the trustee can access, consider using resources from US Legal Forms.

Yes, it is possible to withdraw from Chapter 13, but the process requires legal approval. You must file a motion with the court explaining the reason for your withdrawal. Working with a bankruptcy attorney can help ensure the motion is correctly submitted, increasing your chances for a successful outcome. Using platforms like US Legal Forms can simplify your paperwork and provide the guidance you need.

Yes, you can withdraw from your 401k while under Chapter 13, but it's important to be cautious. The funds you withdraw may affect your repayment plan and could be subject to tax penalties. Before proceeding, discuss your options with a bankruptcy attorney to understand how a Chapter 13 b withdraw from 401k could impact your case. Resources available through US Legal Forms can help make this process clearer.

Withdrawing from Chapter 13 involves submitting a motion to the bankruptcy court. You will need to provide valid reasons for the withdrawal, such as a change in financial circumstances. It's essential to consult with your bankruptcy attorney, who can guide you through the specific requirements. Consider using US Legal Forms for necessary documentation and support.

Filling out Chapter 13 involves several steps, including gathering your financial documents and completing the necessary forms. Start by listing your debts, income, and expenses accurately. You may need to consider a Chapter 13 b withdraw from 401k to fund your repayment plan. Using UsLegalForms simplifies this process by offering templates and resources that help you fill out the forms correctly and navigate the complexities of bankruptcy.