Chapter 7 Fill For Night

Description

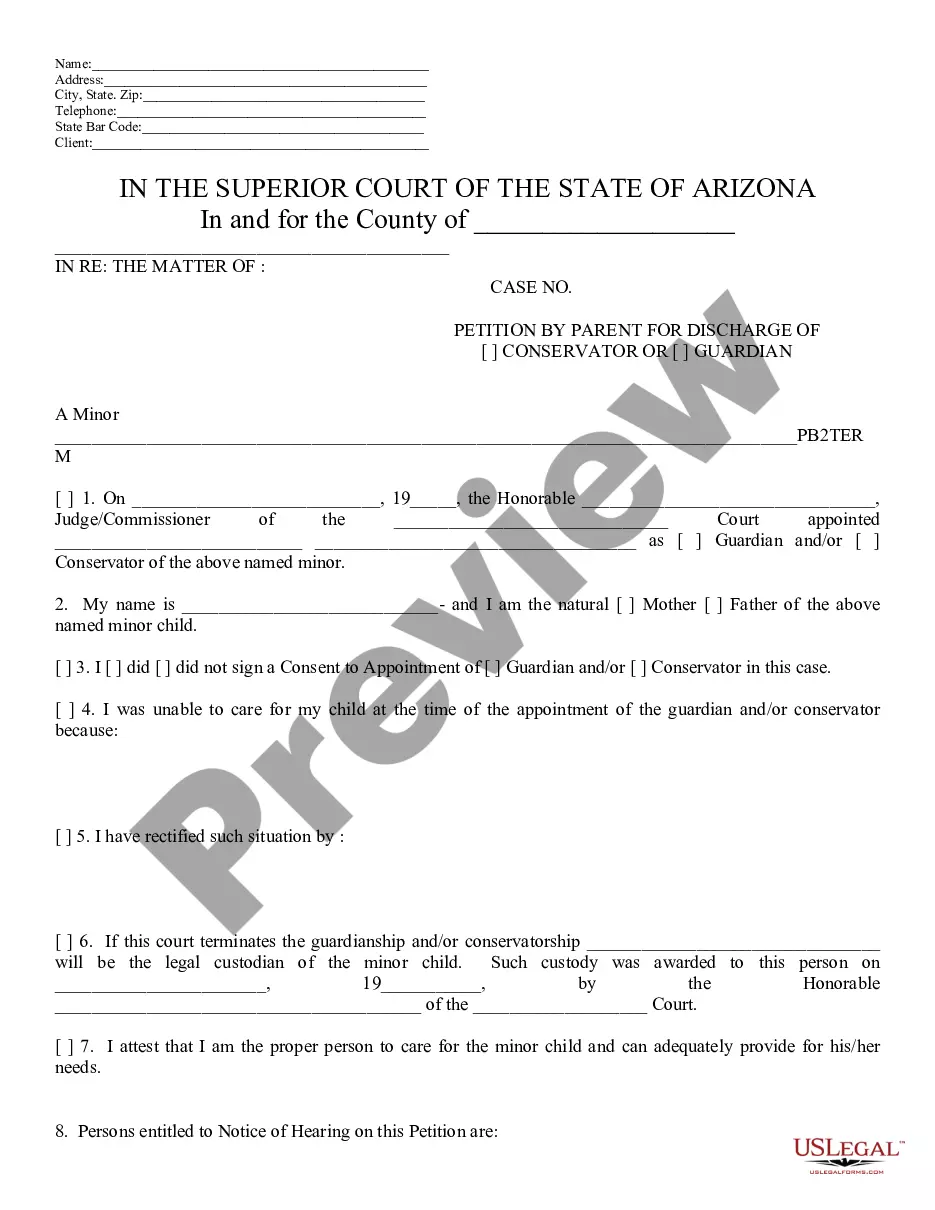

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

It’s well known that you cannot instantly become a legal expert, nor can you swiftly learn how to draft Chapter 7 Fill For Night without possessing a specialized set of abilities. Producing legal documents is a lengthy endeavor that requires specific education and expertise. So why not entrust the development of the Chapter 7 Fill For Night to the professionals.

With US Legal Forms, one of the most extensive legal document collections, you can find everything from court documents to templates for internal communication. We recognize how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all forms are location-specific and current.

Let’s begin with our platform and obtain the document you require in just minutes: Discover the form you need using the search bar at the top of the page. Preview it (if this option is available) and review the supporting description to ascertain whether Chapter 7 Fill For Night is what you’re looking for. If you need a different form, start your search again. Create a free account and choose a subscription plan to purchase the form. Select Buy now. Once the transaction is complete, you can access the Chapter 7 Fill For Night, fill it out, print it, and send or mail it to the necessary individuals or organizations.

- You can regain access to your documents from the My documents tab at any time.

- If you’re an existing client, you can simply Log In, and find and download the template from the same tab.

- Regardless of the purpose of your documents-whether they are financial and legal or personal-our platform has you covered.

- Try US Legal Forms now!

Form popularity

FAQ

Here's an overview of the steps involved in filing for Chapter 7 bankruptcy. Find an attorney. ... Attend credit counseling. ... Petition and prepare paperwork. ... A trustee is appointed to your case. ... Meet with your creditors. ... Complete debtor education course. ... Confirm your eligibility. ... Nonexempt property is liquidated.

While it may feel odd to pay fees to tell the courts you don't have enough money, you typically have to pay court fees to file for bankruptcy. The filing fee for a Chapter 7 bankruptcy is $338, while the filing fee for a Chapter 13 bankruptcy is $313.

That being said, here's what you're not allowed to do with a Chapter 7: Lie under oath about your financial or property assets. Keep property that must be used to discharge your debts. Miss payments to certain creditors in order to keep your home.

STEP ONE: THE PETITION IS FILED The moment a petition is filed, it creates what we call an automatic stay or a legal freeze on all pending collection activity. Shortly after the bankruptcy is filed, notices will go to all of your creditors and you'll receive a notice as well.

A Chapter 7 bankruptcy is also called a liquidation bankruptcy because you have to sell nonexempt possessions and use the proceeds to repay your creditors. You do get to keep exempt assets and possessions, up to a limit. Once the process is complete, the remainder of your included debts is discharged.