Bylaws Estate Withdrawal

Description

How to fill out Bylaws Of Condominium?

It’s well known that you cannot transform into a legal expert instantly, nor can you swiftly learn how to draft Bylaws Estate Withdrawal without possessing a specialized skill set.

Assembling legal documents is an extensive endeavor that necessitates specific training and expertise.

So why not entrust the development of the Bylaws Estate Withdrawal to the experts.

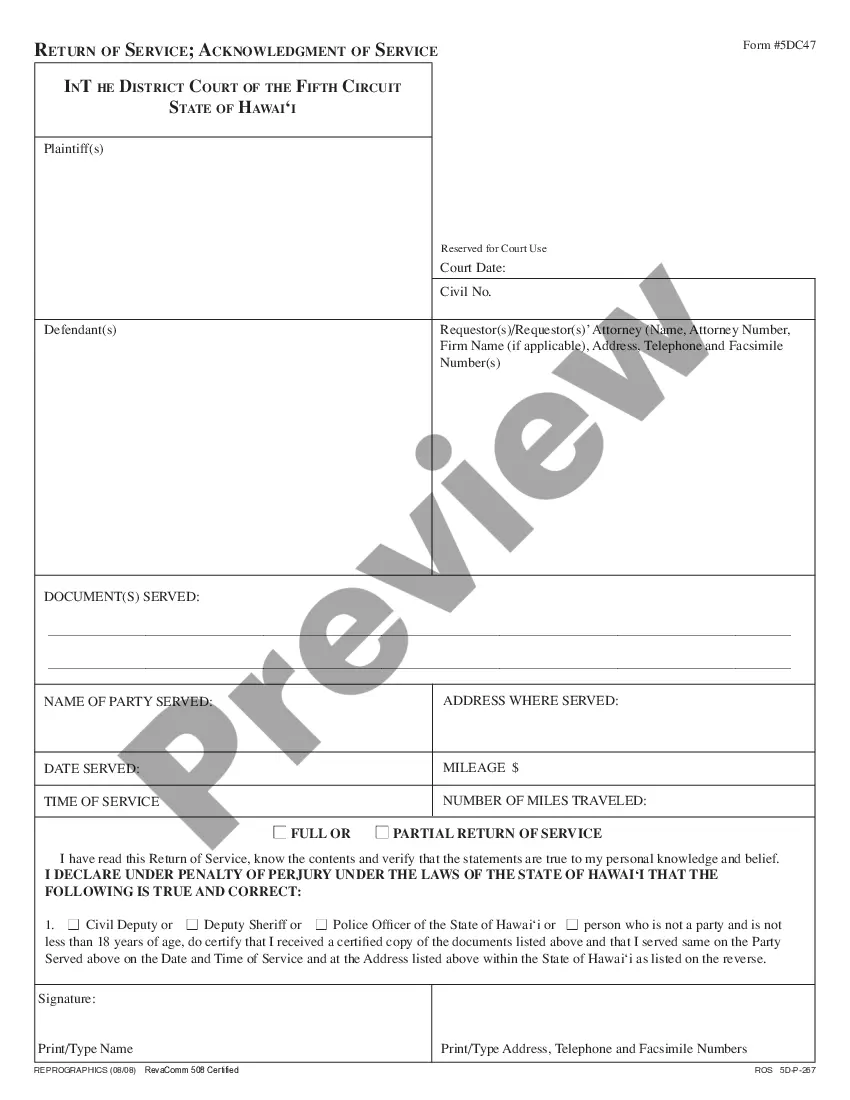

Preview it (if this option is available) and read the accompanying description to determine if Bylaws Estate Withdrawal is what you seek.

Create a free account and select a subscription plan to purchase the form. Click Buy now. Once the transaction is finalized, you can obtain the Bylaws Estate Withdrawal, complete it, print it, and send or mail it to the required individuals or organizations.

- With US Legal Forms, one of the most extensive legal document repositories, you can discover everything from court forms to templates for internal communication.

- We understand how vital compliance and adherence to federal and local regulations are.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how to get started with our platform and obtain the document you require in just a few minutes.

- Locate the form you require by utilizing the search bar at the top of the page.

Form popularity

FAQ

Amid this backdrop, the IRS in July 2023 released Notice 2023-54, which provides relief for Non-Eligible Designated Beneficiaries who inherited retirement accounts from an owner who died on or after their Required Beginning Date by eliminating any penalties for failing to take (potential) RMDs for 2023, essentially ' ...

Generally, a designated beneficiary is required to liquidate the account by the end of the 10th year following the year of death of the IRA owner (this is known as the 10-year rule). An RMD may be required in years 1-9 when the decedent had already begun taking RMDs.

Generally, a designated beneficiary is required to liquidate the account by the end of the 10th year following the year of death of the IRA owner (this is known as the 10-year rule). An RMD may be required in years 1-9 when the decedent had already begun taking RMDs.

If the money is withdrawn before the age of 59½, there's a 10% tax penalty imposed by the IRS and the distribution would be taxed at the owner's income tax rate. 4 If you inherit a traditional IRA to which both deductible and nondeductible contributions were made, part of each distribution is taxable.

Required minimum distributions (RMDs) are the minimum amounts you must withdraw from your retirement accounts each year. You generally must start taking withdrawals from your traditional IRA, SEP IRA, SIMPLE IRA, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after Dec. 31, 2022).