Workers Compensation Document For Independent Contractors

Description

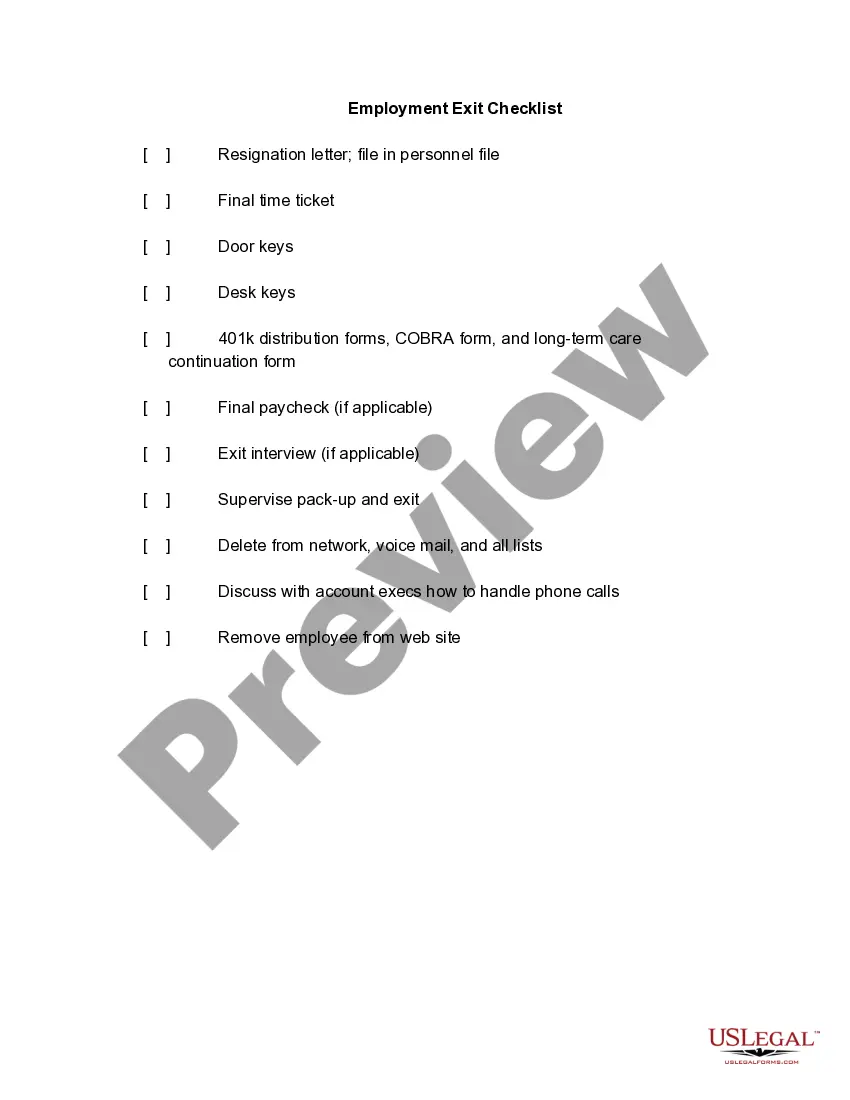

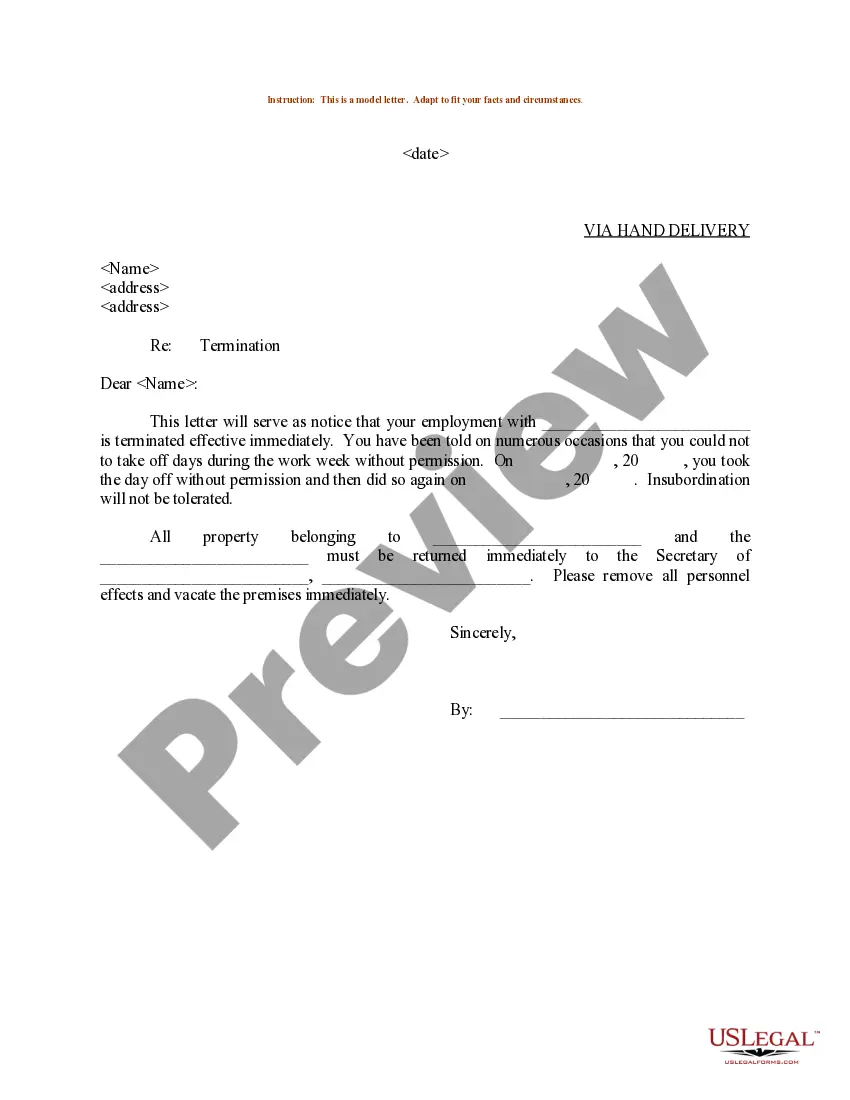

How to fill out Workers' Compensation Clearance Document?

What is the most dependable service to acquire the Workers Compensation Document for Independent Contractors and other up-to-date versions of legal paperwork? US Legal Forms is the answer!

It's the most comprehensive repository of legal forms for any situation. Each template is skillfully crafted and verified for adherence to federal and regional regulations. They are organized by area and state of application, making it easy to find what you need.

US Legal Forms is an excellent resource for anyone who needs to handle legal documentation. Premium users have even greater benefits as they can complete and sign the previously saved documents online at any time using the built-in PDF editing tool. Explore it today!

- Experienced users of the platform just need to Log In to the system, verify their subscription status, and click the Download button next to the Workers Compensation Document for Independent Contractors to retrieve it.

- Once saved, the template remains accessible for ongoing use in the My documents section of your profile.

- If you do not possess an account with our collection yet, follow these steps to create one.

- Form compliance review. Prior to acquiring any template, you must ensure it meets your case requirements and the regulations of your state or county. Read the form description and utilize the Preview if available.

Form popularity

FAQ

Independent contractors still have a remedy if they're injured at work. As with any injured party, the independent contractor can file a personal injury lawsuit against the company or other third parties for negligence.

Independent contractors generally report their earnings to the IRS quarterly using Form 1040-ES, Estimated Tax for Individuals. This covers both their federal income tax and self-employment tax liabilities. They may also have to pay state and local taxes according to their state and local government guidelines.

Every 1099-NEC comes with a Copy A and a Copy B. You'll file Copy A with the IRS and send Copy B to your contractor. Because the 1099-NEC is not part of the Combined Federal/State Filing Program, you may also need to provide a 1099-NEC to your state and/or the state where your contractor resides or works.

Some states, including Texas, don't require employers to have workers' comp insurance at all. If you're a freelancer, an IC, or a sole proprietor, you're legally self-employed and not automatically covered by workers' comp. Workers not classified as employees receive a 1099 form at the end of the tax year.

1099 vs W2 Employee for Workers Comp Insurance. The general rule is that employers do not have to carry workers' compensation insurance for workers who qualify as 1099 Independent Contractors.