Performance Evaluation With Example

Description

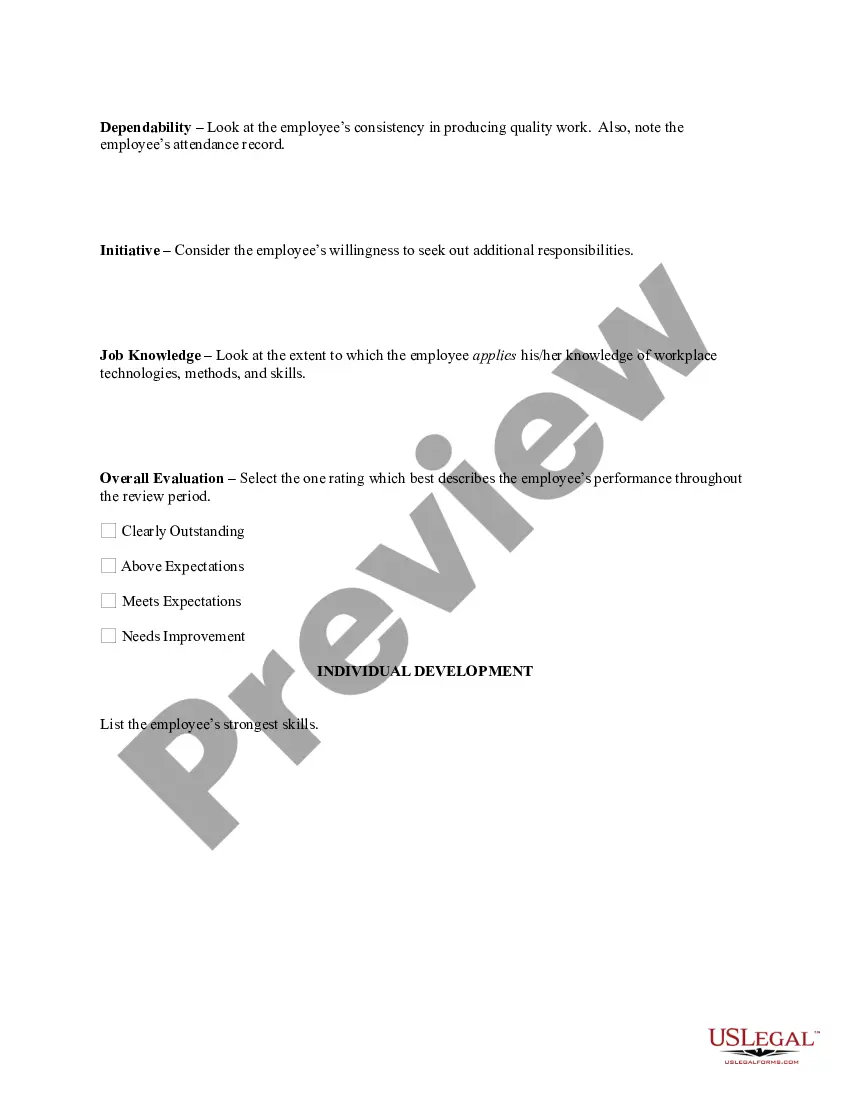

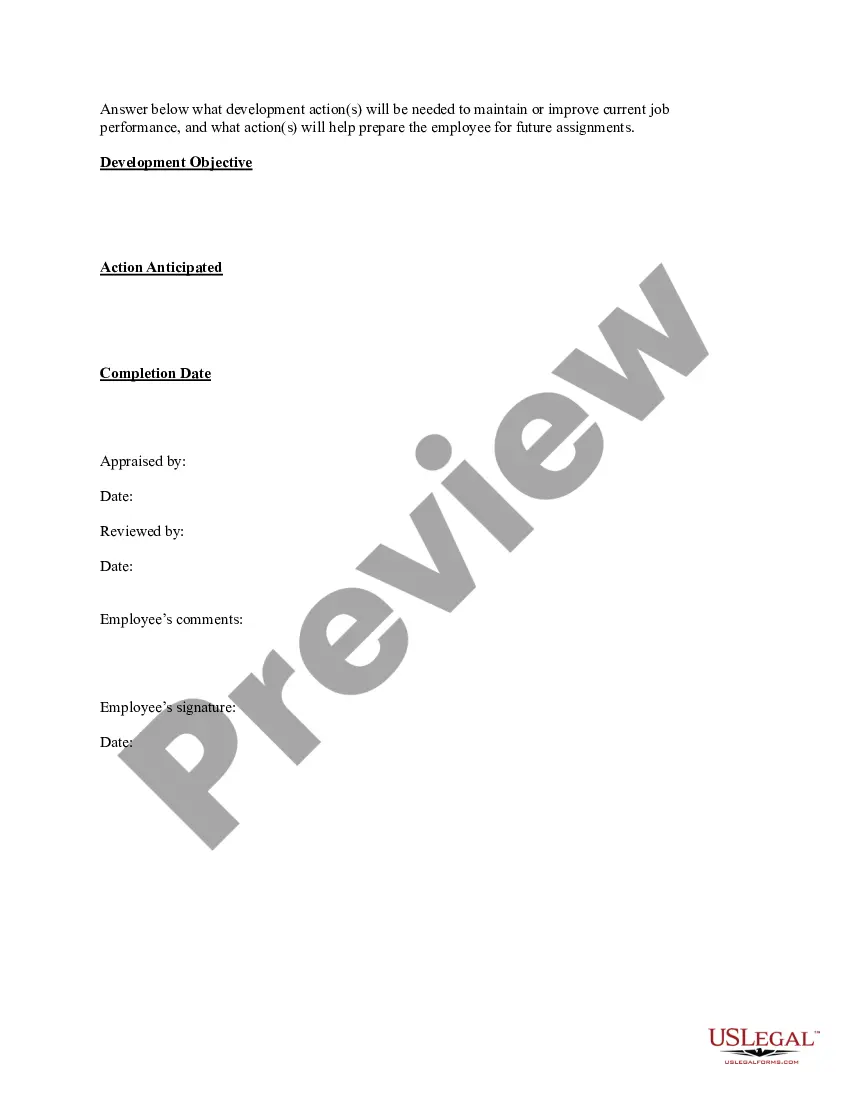

How to fill out Sample Performance Review For Nonexempt Employees?

The Evaluation of Performance With Sample you observe on this site is a versatile formal blueprint composed by expert attorneys in accordance with national and local statutes.

For over 25 years, US Legal Forms has delivered individuals, companies, and legal experts with more than 85,000 authenticated, state-specific documents for any corporate and personal event. It is the fastest, simplest, and most reliable method to access the paperwork you require, as the service assures bank-standard data protection and anti-malware safety.

Select the format you desire for your Evaluation of Performance With Sample (PDF, DOCX, RTF) and download the template onto your device.

- Search for the form you require and review it.

- Browse the file you looked for and preview it or assess the form description to confirm it meets your requirements. If it does not, utilize the search function to find the correct one. Click Buy Now when you have found the document you need.

- Opt and Log In.

- Choose the subscription plan that fits you and create an account. Use PayPal or a credit card to make a quick payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

The Pennsylvania LLC filing fee is $125 fee, plus $3 per page if you file paper copies. You only need to file your Certificate of Organization once. You'll also need to file what is considered an annual report in most states.

The only fee to register an LLC in Pennsylvania is $125 at initial registration. Then, every 10 years your business will be required to submit a decennial report with a registration fee of $70. If you are not yet ready to file your LLC, Pennsylvania offers a name reservation option.

How Much Does a Business License Cost in Pennsylvania? There is no cost when registering your business with the Department of Revenue. You won't be charged to obtain a sales tax license either. However, you may need to pay a fee if you register for a specific profession or industry.

In order to operate, LLCs require real humans (and other entities) to carry out company operations. Though it's not required by Pennsylvania law, any good lawyer will recommend having a written operating agreement for your LLC.

It's going to take 5-6 weeks if you file online and up to 8 weeks if you file by mail. Unfortunately, you can't form an LLC any faster in Pennsylvania. Pennsylvania used to have walk-in filings at the Department of State in Harrisburg. They stopped allowing this in 2020 and haven't resumed these type of filings.

How to Start an LLC in Pennsylvania? LLC Registration/Business License. Employer Identification Number. Business Bank Account. Bookkeeping and Taxes. Business Insurance. Operating Agreement.