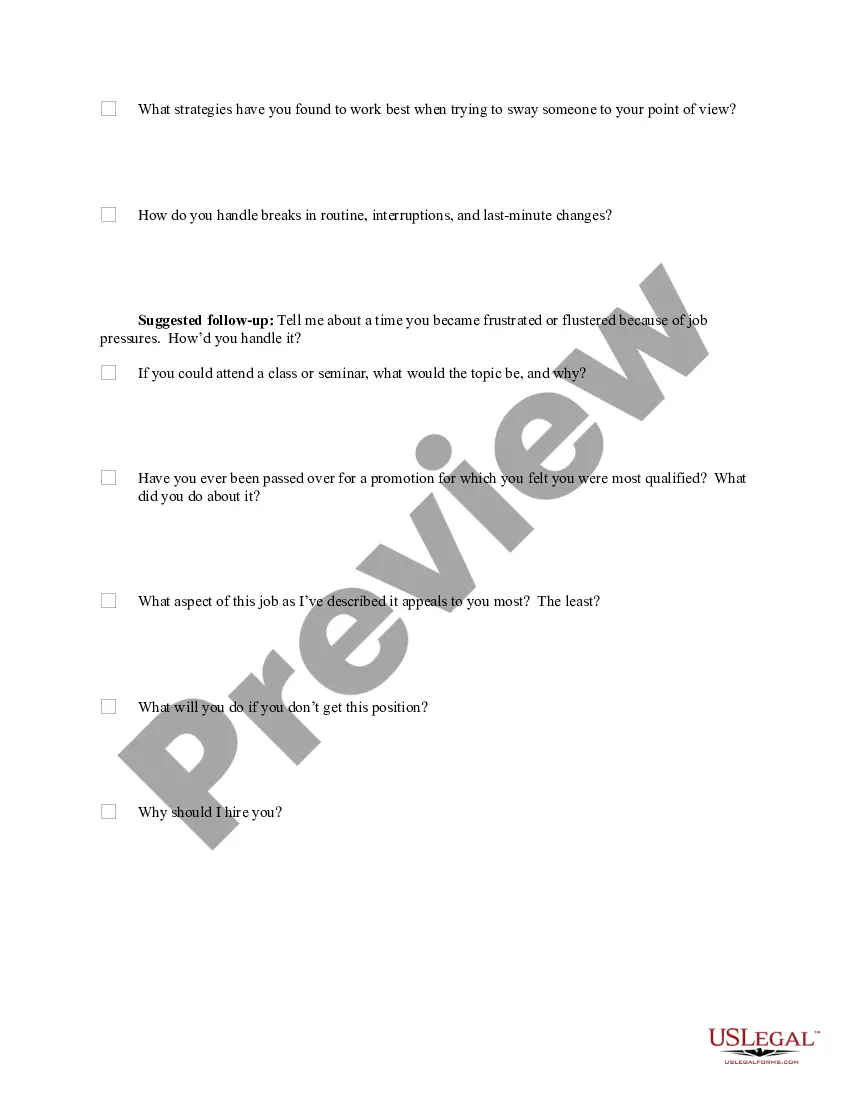

Supervisor Interview Questions To Ask

Description

How to fill out Checklist Of Standard Hiring Interview Questions With Listening Tips And Suggested Follow-up Questions?

Whether it’s for commercial reasons or personal issues, everyone must navigate legal affairs at some stage in their existence.

Filling out legal documents requires meticulous care, starting from selecting the right form template.

Once it is saved, you can fill out the form using editing software or print it to complete it manually. With an extensive US Legal Forms collection available, you no longer have to waste time searching for the suitable template online. Utilize the library’s intuitive navigation to find the right document for any circumstance.

- Acquire the form you need by using the search bar or catalog navigation.

- Review the form’s description to confirm it suits your situation, state, and locality.

- Click on the form’s preview to view it.

- If it is the incorrect form, return to the search tool to locate the Supervisor Interview Questions To Ask example you need.

- Download the document once it aligns with your specifications.

- If you already possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the account registration document.

- Select your payment method: you may use a credit card or PayPal account.

- Choose the file format you prefer and download the Supervisor Interview Questions To Ask.

Form popularity

FAQ

Debt settlement is a risky way to reduce your debts. It will help you avoid bankruptcy, but depending on the settlement amount, you may be stuck paying extra taxes. Many debt settlement companies charge high fees and take years to negotiate your debts fully.

Debt settlement is when your debt is settled for less than what you currently owe, with the promise that you'll pay the amount settled for in full. Sometimes known as debt relief or debt adjustment, debt settlement is usually handled by a third-party company, although you could do it by yourself.

?Offering 25%-50% of the total debt as a lump sum payment may be acceptable. The actual percentage may vary depending on the circumstances of the borrower as well as the prevailing practices of that particular collection agency.? One benefit of negotiating settlement terms is likely to reduce stress.

A debt agreement is a legal contract between a debtor and a creditor to settle outstanding debt. These agreements are used when the debtor cannot pay the full amount of debt and is facing bankruptcy. In a debt agreement, the creditor allows a debtor to negotiate down the total debt owed.

Most unsecured debt is eligible for debt settlement ? if the creditor agrees! The creditor is under no obligation to accept a settlement proposal. Unsecured debt includes things like credit card debt, store cards, personal loans, medical bills ? any debt that isn't tied to property that the creditor can take back.

If your lender agrees to let you settle a debt for less than what you owe, you'll need a written agreement that includes: - Information about the debt - What you'll be expected to pay - How much will be forgiven - What the repayment terms are If your lender doesn't send an agreement, you can use the template in this ...

When drafting a debt settlement agreement, it is essential to include the following: Necessary information about the loan agreement. The contact information of both parties. The date of the agreement. The terms of the agreement. The amount of debt.

It is often used when a borrower cannot keep up with their unsecured debts. With credit card debt, for example, you might be able to cut your balance by up to 50%. 1 For example, if you owe $20,000 on a credit card, and can scrape up $10,000 in cash, you might be able to settle for that amount.