Best Interview Questions And Answers

Description

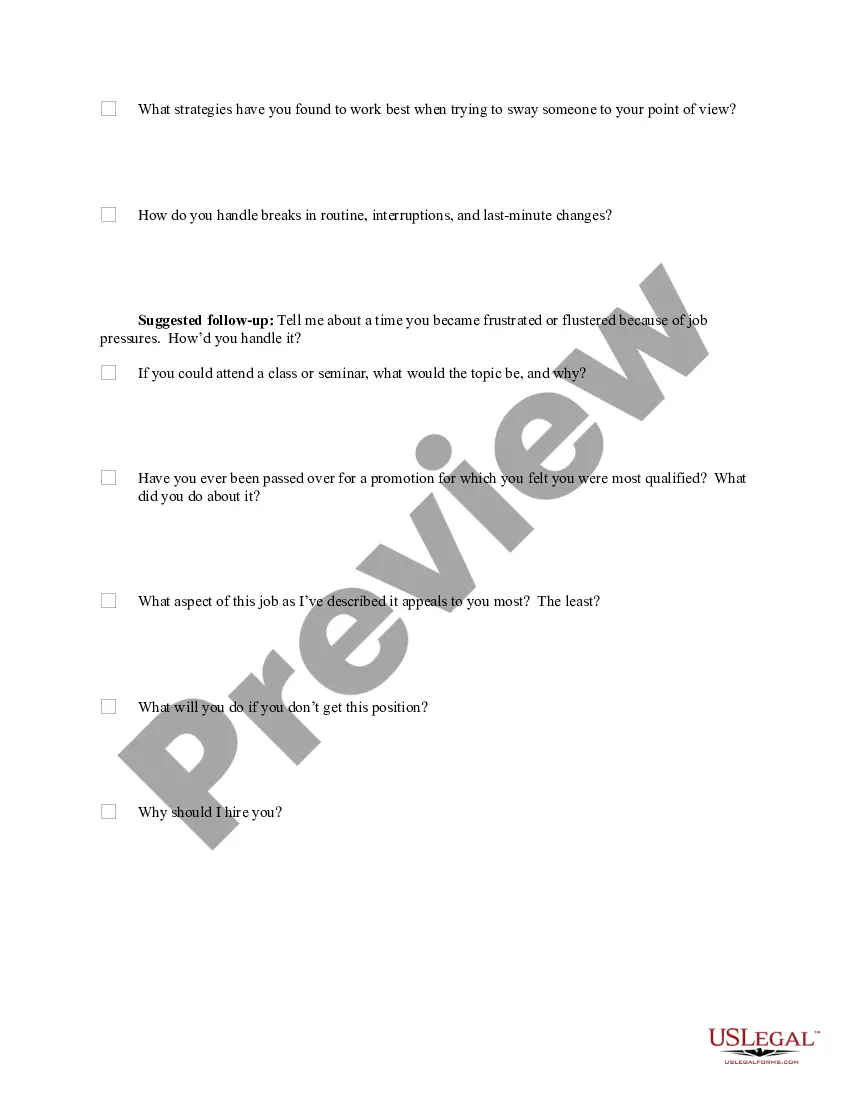

How to fill out Checklist Of Standard Hiring Interview Questions With Listening Tips And Suggested Follow-up Questions?

Handling legal documents and processes could be a lengthy addition to your schedule.

Top Interview Questions And Responses and documents like it generally require you to search for them and navigate the path to fill them out efficiently.

Consequently, if you are managing financial, legal, or personal issues, utilizing a comprehensive and functional online directory of forms at your disposal will significantly help.

US Legal Forms is the leading online service of legal templates, providing over 85,000 state-specific documents and various tools to help you complete your paperwork with ease.

Is this your first time using US Legal Forms? Register and create an account in a matter of minutes, and you’ll gain access to the template directory and Top Interview Questions And Responses. Then, follow the steps below to fill out your document: Be sure you have found the correct template using the Preview option and reviewing the document details. Select Buy Now when ready, and choose the subscription plan that suits your requirements. Click Download then complete, eSign, and print the document. US Legal Forms has 25 years of experience helping users manage their legal documents. Obtain the template you require now and simplify any procedure effortlessly.

- Explore the directory of relevant documents available to you with just a single click.

- US Legal Forms offers state- and county-specific templates accessible anytime for download.

- Protect your document management processes with top-notch support that enables you to generate any form within minutes without any additional or concealed fees.

- Simply Log In to your account, find Top Interview Questions And Responses and acquire it instantly within the My documents section.

- You can also access previously downloaded documents.

Form popularity

FAQ

In response to 'Are you organized?', provide concrete examples of how you manage tasks and prioritize responsibilities. Discuss any tools or systems you implement to stay organized. This type of answer gives concrete evidence of your skills, aligning with the best interview questions and answers.

When asked 'How do you organize?', provide specific methods or tools you use. You might mention project management software or digital filing systems that help maintain order. This answer connects well to the best interview questions and answers by emphasizing your systematic approach.

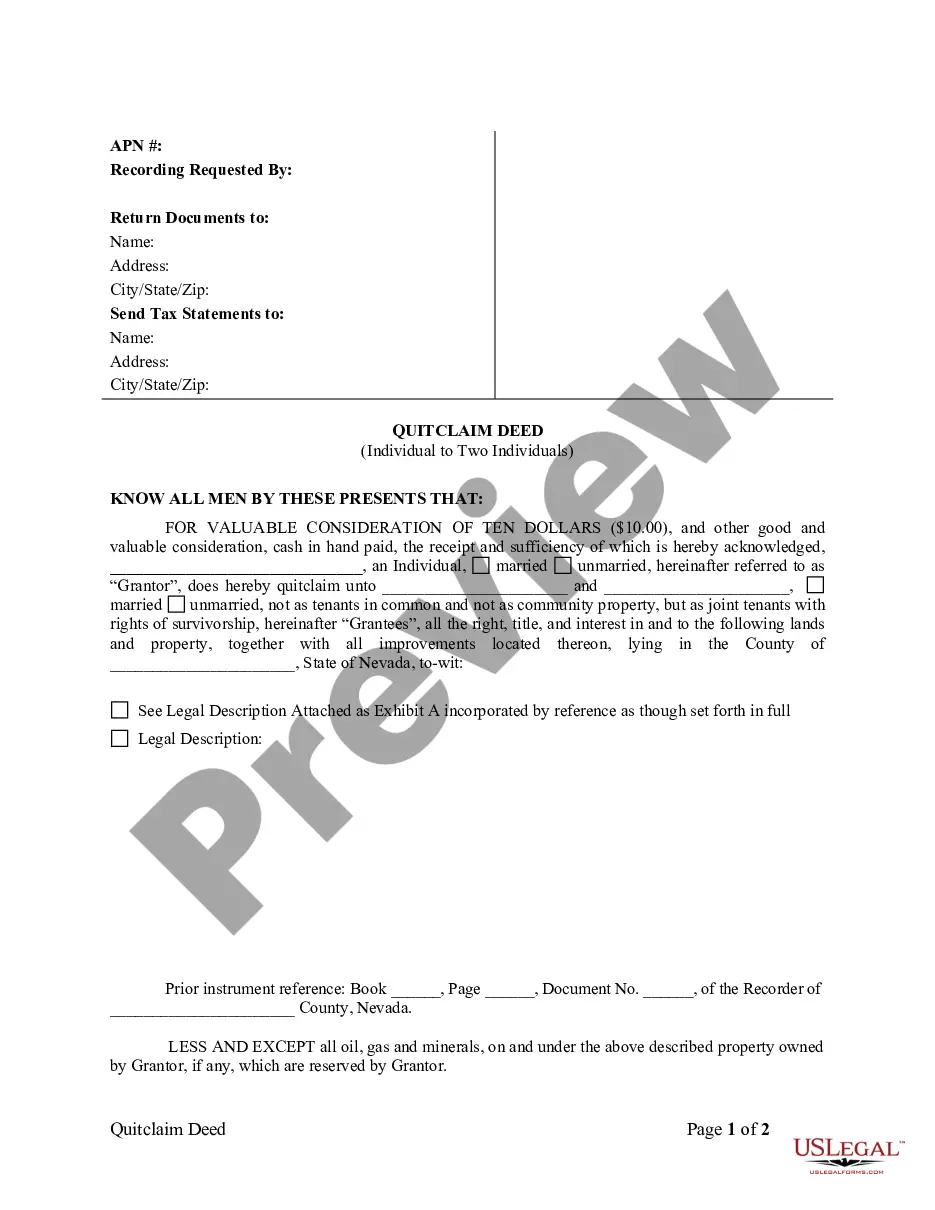

Promissory notes, also known as mortgage notes, are written agreements in which a borrower promises to pay the lender a certain amount of money at a later date. Banks and borrowers typically agree to these notes during the mortgage process.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

Before a bank can institute a foreclosure proceeding, the bank must record the assignment of the note. The bank must also be in actual possession of the note. If the bank fails to ?produce the note,? that is, cannot demonstrate that the note was assigned to it, the bank cannot demonstrate it owns the note.

Promissory Note Secured by Real Estate Otherwise known as a mortgage, in Texas a security interest in real estate is known as a deed of trust. Texas laws are very strict and unique in the form the documents must take to be enforceable.

Again, the loan transaction consists of two main documents: the mortgage (or deed of trust) and a promissory note. The mortgage or deed of trust is the document that pledges the property as security for the debt and permits a lender to foreclosure if you fail to make the monthly payments.

The Mortgage Electronic Registration System (MERS) is an electronic registry that tracks the servicing rights and ownership interests of residential and commercial mortgage loans. As a homeowner, you might never need to think about MERS.

The Mortgage or Deed of Trust is a legal document in which the borrower transfers the title to a third party (trustee) to hold as security for the lender. When the loan is paid in full the trustee transfers the title back to the borrower.

Mortgage Deed of Trust Although a Deed of Trust is similar to a Mortgage, which is used in other states, it is not a Mortgage. Good to know: Texas does not use mortgages. Instead, Texas uses Deeds of Trust. The document is referred to as a Deed of Trust because there is a Trustee named for the property.