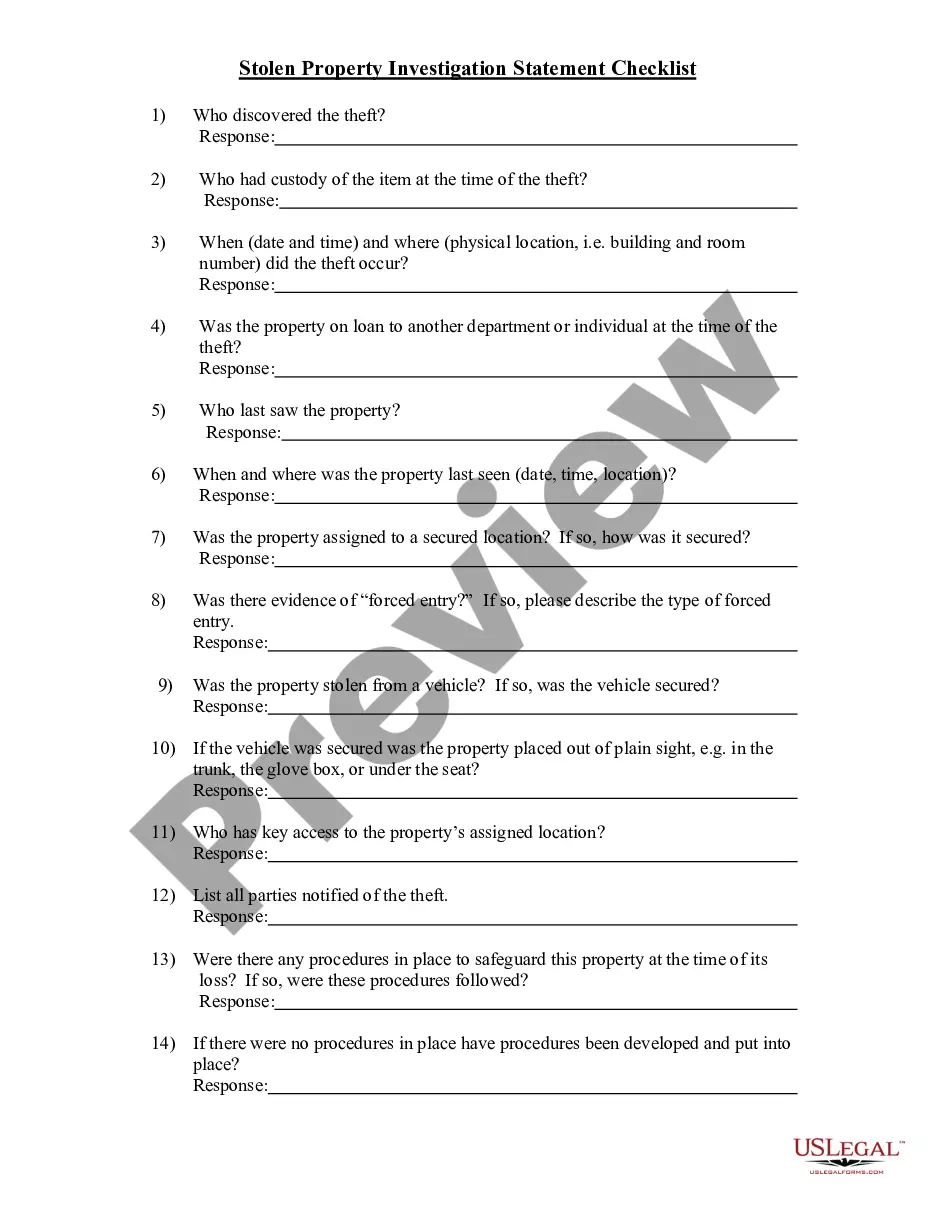

Time Theft Investigation Questions

Description

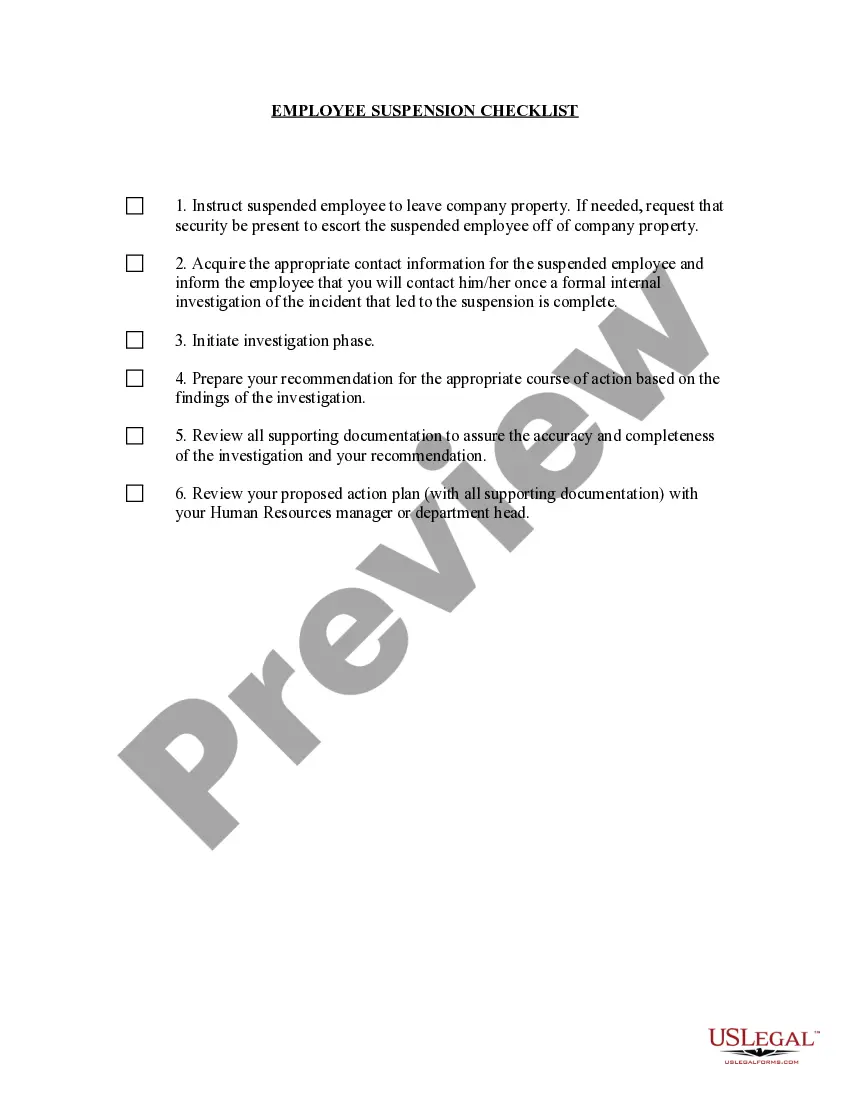

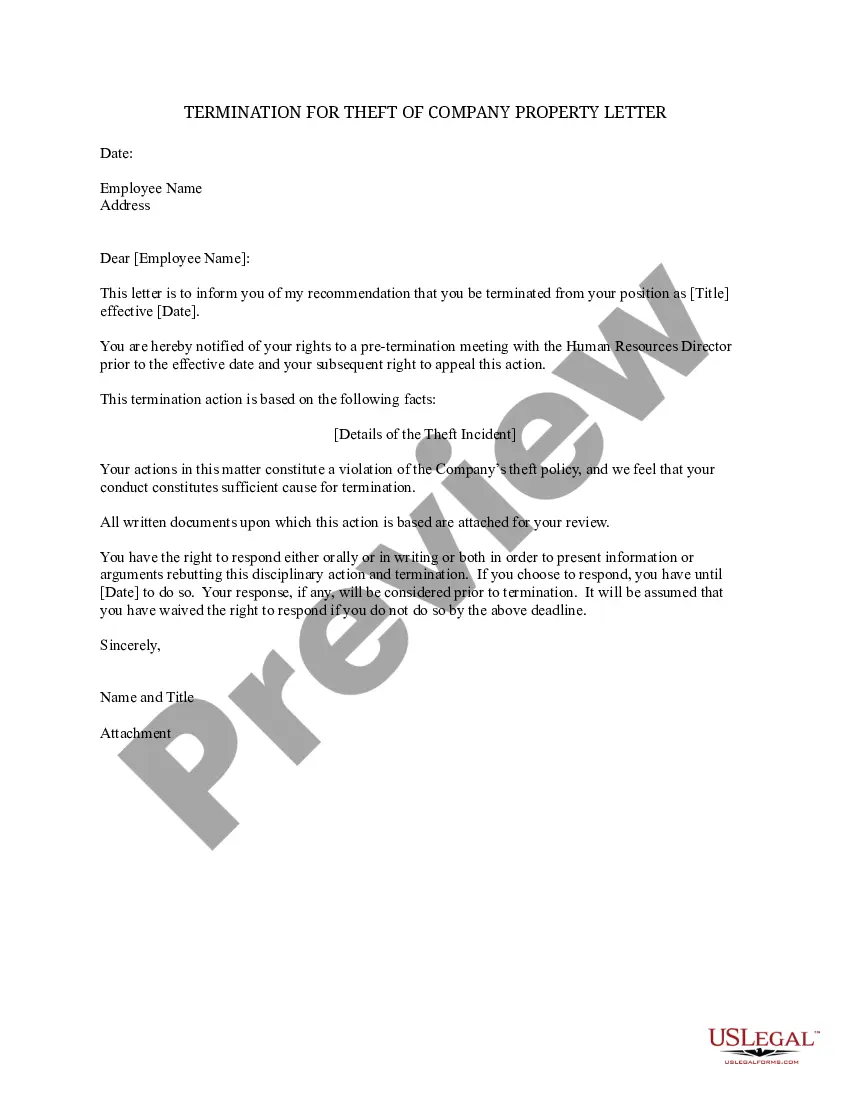

How to fill out Theft Investigation Checklist?

It’s no mystery that you cannot transform into a legal authority in a single night, nor can you swiftly understand how to rapidly create Time Theft Investigation Questions without possessing a distinct set of competencies.

Compiling legal documents is a labor-intensive endeavor that necessitates specific training and expertise.

So why not entrust the formulation of the Time Theft Investigation Questions to the professionals.

Preview it (if this option is available) and review the accompanying description to determine if Time Theft Investigation Questions is what you are looking for.

Restart your search if you need another template.

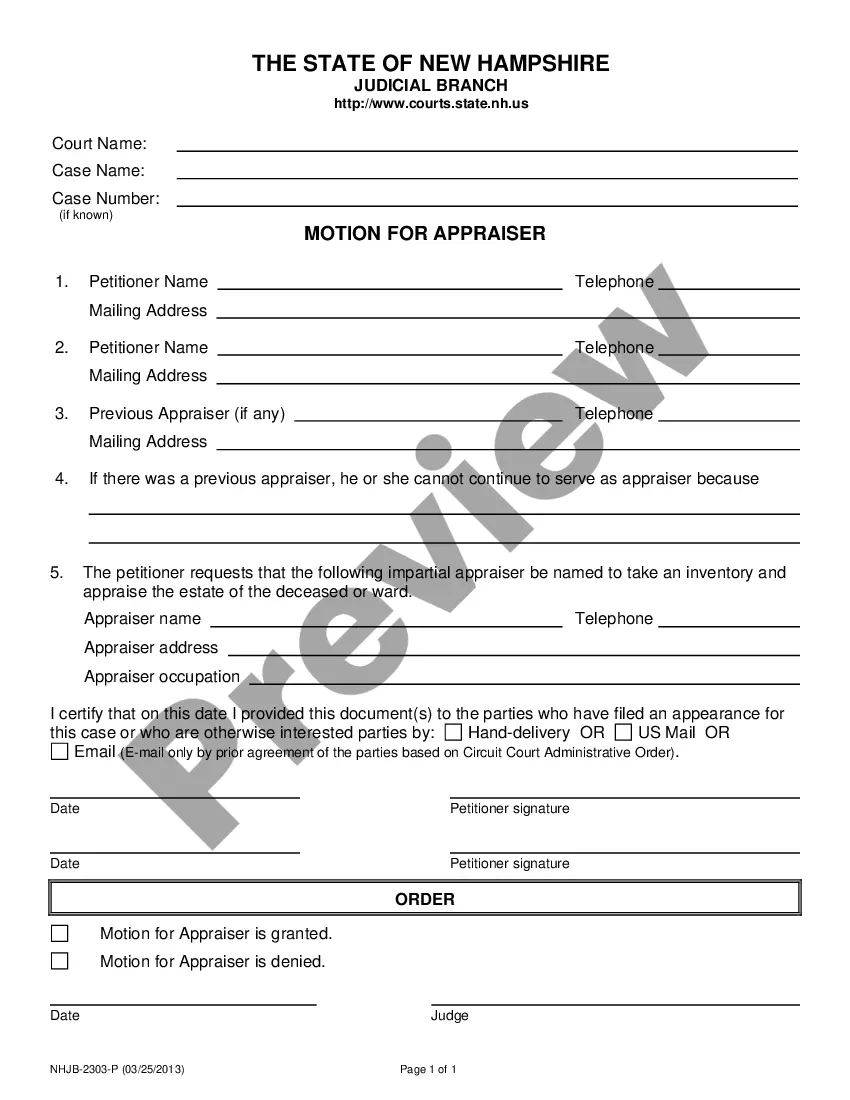

- With US Legal Forms, one of the most extensive collections of legal templates, you can locate anything from court documents to templates for in-office communication.

- We understand how essential it is to comply with and observe federal and state regulations.

- That’s why, on our website, all forms are region-specific and current.

- Begin with our website and acquire the form you need in just a few minutes.

- Find the form you’re searching for with the search bar at the top of the page.

Form popularity

FAQ

A personal loan agreement is a legally binding contract that defines the expectations for both a borrower and a lender. It can be drawn up with an official lender, like a bank or credit union, or used in a more informal situation, such as with a friend who's lending you an amount of money.

How to Draft a Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

No. Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable. A witness may be helpful if one party contests the note, but a notary is not necessary.

Do you need to notarize a Loan Agreement? First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

A Loan Agreement, also known as a Loan Contract or Personal Loan Agreement, is used to loan or borrow money with or without interest included. It typically covers the amount of the loan, the interest rate, the repayment terms, and other specific provisions and terms that will be explained in more detail below.