Independent Contractor Based Without Business License

Description

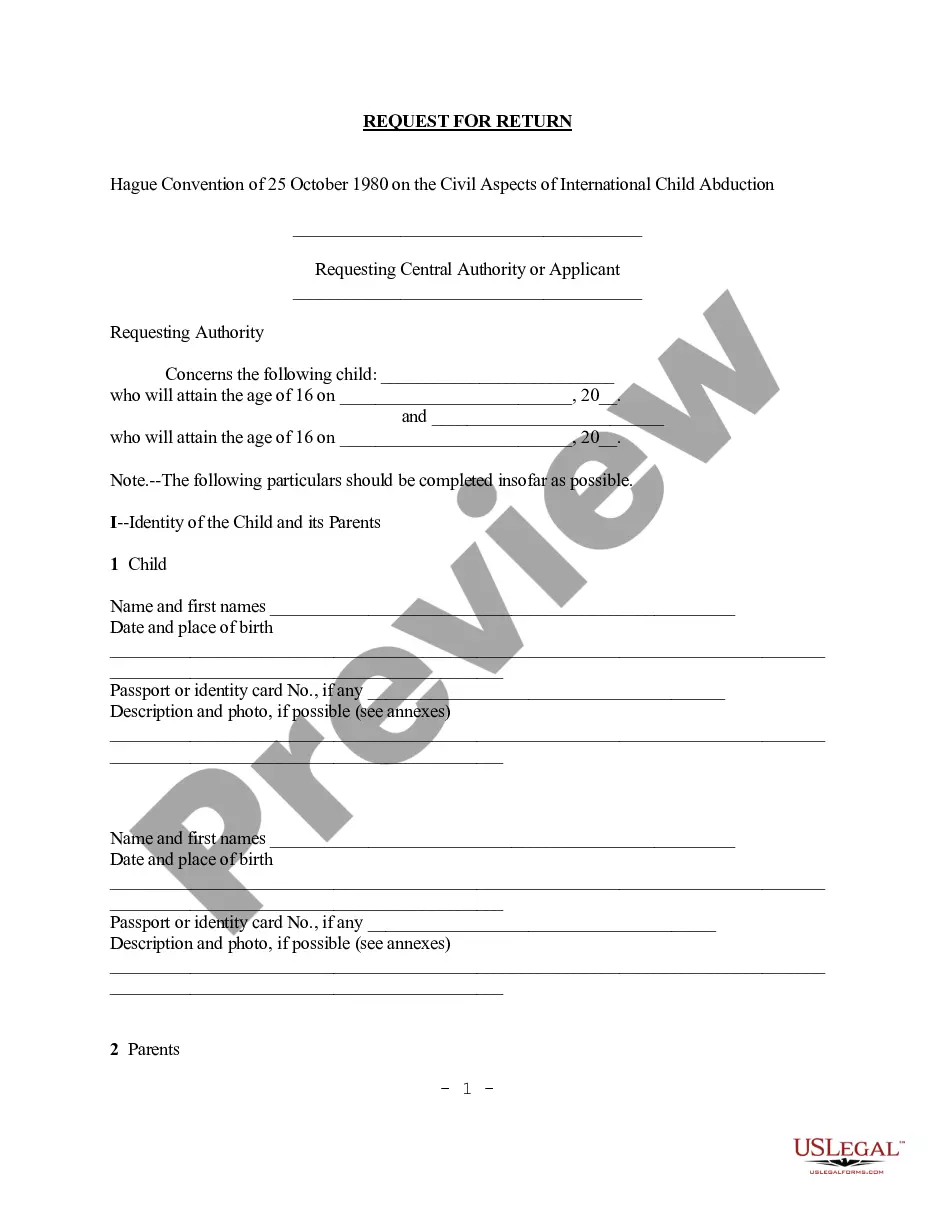

How to fill out Determining Self-Employed Independent Contractor Status?

Dealing with legal paperwork and procedures can be a time-consuming addition to the day. Independent Contractor Based Without Business License and forms like it typically require you to look for them and navigate the best way to complete them appropriately. Therefore, regardless if you are taking care of financial, legal, or individual matters, using a thorough and hassle-free online library of forms when you need it will greatly assist.

US Legal Forms is the number one online platform of legal templates, boasting more than 85,000 state-specific forms and a number of resources to assist you complete your paperwork easily. Check out the library of appropriate documents available to you with just a single click.

US Legal Forms offers you state- and county-specific forms offered at any moment for downloading. Protect your papers administration operations by using a top-notch services that allows you to make any form within a few minutes with no additional or hidden charges. Simply log in in your account, locate Independent Contractor Based Without Business License and acquire it straight away within the My Forms tab. You can also gain access to formerly downloaded forms.

Would it be the first time using US Legal Forms? Register and set up your account in a few minutes and you’ll get access to the form library and Independent Contractor Based Without Business License. Then, follow the steps listed below to complete your form:

- Make sure you have the correct form by using the Preview feature and looking at the form information.

- Pick Buy Now when ready, and select the subscription plan that fits your needs.

- Choose Download then complete, eSign, and print the form.

US Legal Forms has 25 years of expertise helping consumers deal with their legal paperwork. Get the form you want today and enhance any operation without having to break a sweat.

Form popularity

FAQ

Service-provider (independent contractor): First name, middle initial, and last name. Social Security number. Address. Start date of contract (if no contract, date payments equal $600 or more) Amount of contract, including cents (if applicable) Contract expiration date (if applicable)

The state of California doesn't require a business license to operate. But your city or county might. Depending on the goods or services you sell, you might also need a professional or occupational license.

If you are self-employed, your business address is outside the City of Los Angeles and you work within the City of Los Angeles for seven days or more in a calendar year, you are considered an eligible business and must apply for a Business Tax Registration Certificate.

How do I create an Independent Contractor Agreement? State the location. ... Describe the type of service required. ... Provide the contractor's and client's details. ... Outline compensation details. ... State the agreement's terms. ... Include any additional clauses. ... State the signing details.

Answer: If payment for services you provided is listed on Form 1099-NEC, Nonemployee Compensation, the payer is treating you as a self-employed worker, also referred to as an independent contractor. You don't necessarily have to have a business for payments for your services to be reported on Form 1099-NEC.