Recording Payroll Entry With Tax

Description

How to fill out Employee Payroll Records Checklist?

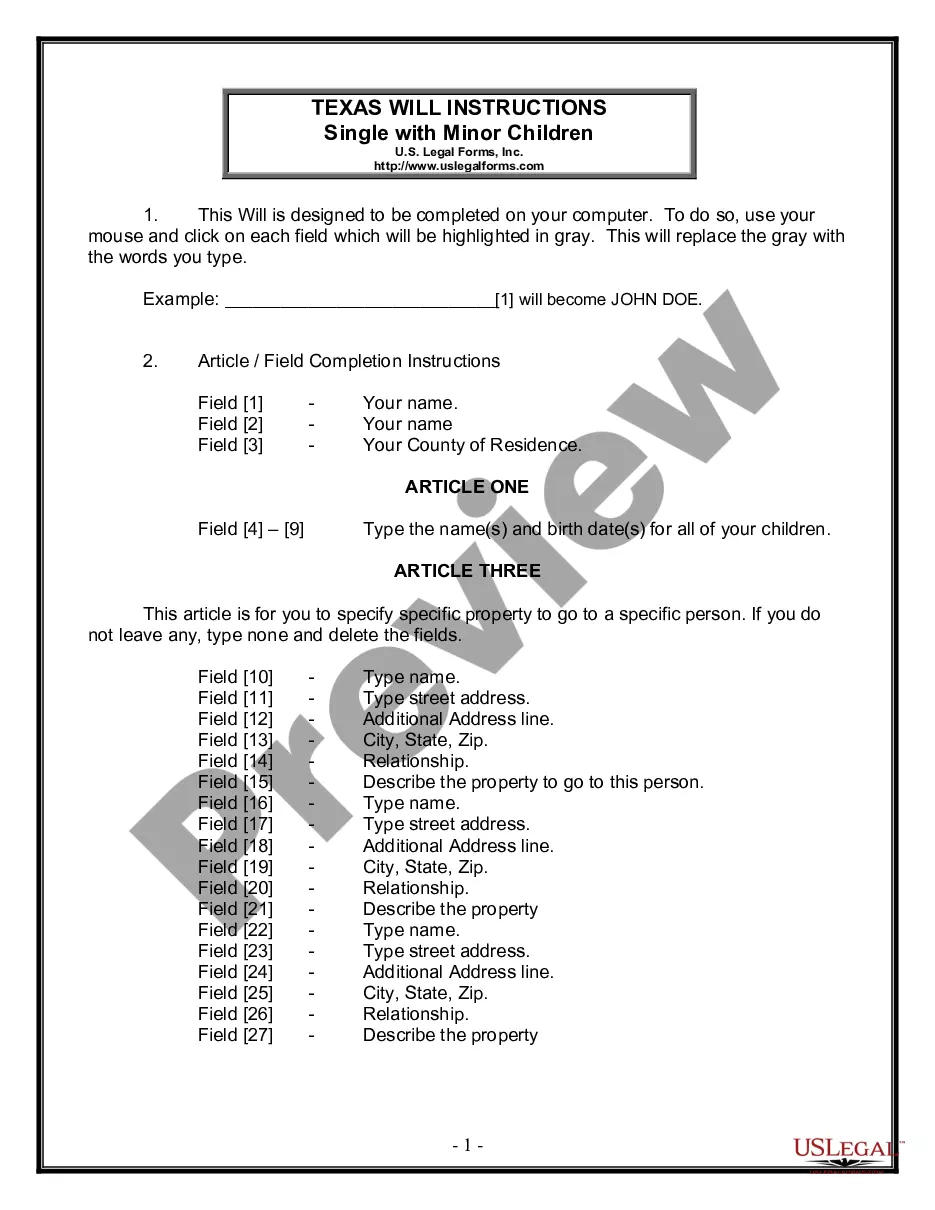

- Log in to your US Legal Forms account if you're already a member. Make sure your subscription is active. If it has expired, renew it according to your plan.

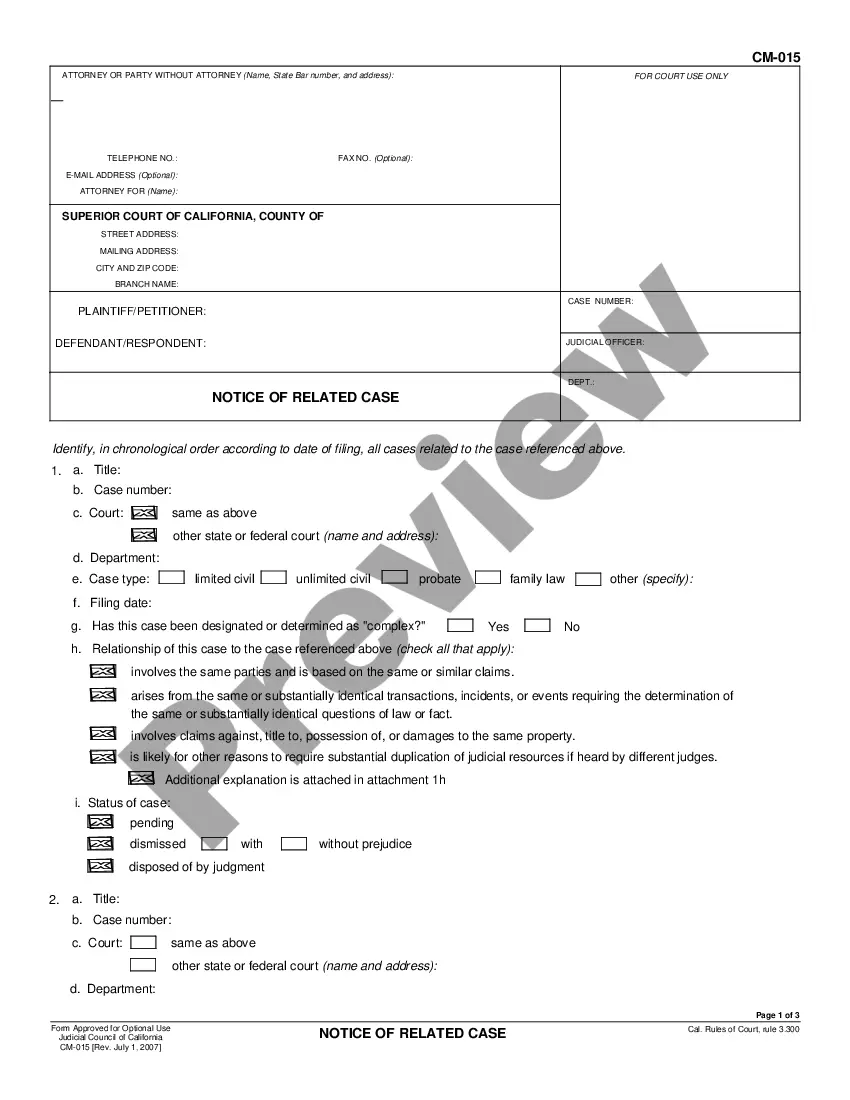

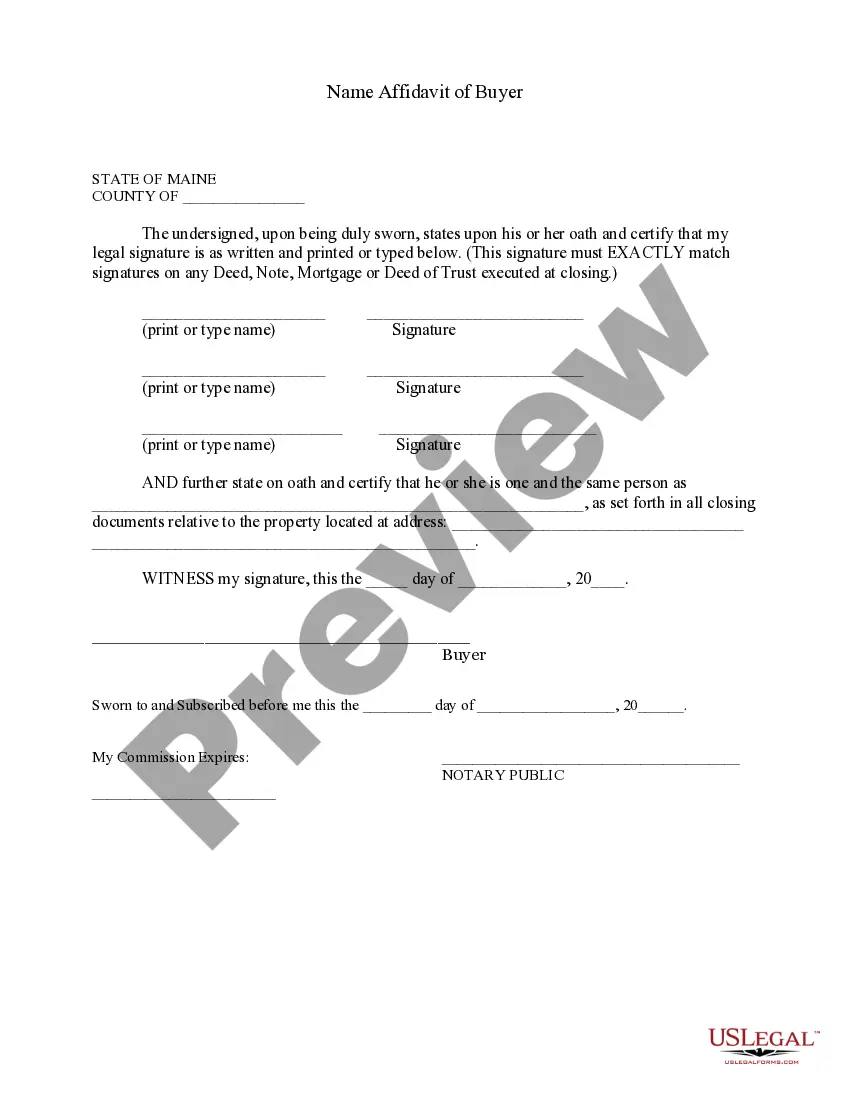

- If you're a new user, start by browsing the extensive online library. Preview the descriptions of various forms and select the one that matches your specific needs and complies with your local laws.

- If you don’t find the needed form, use the search feature to explore other options. Make sure the template chosen is accurate and suitable for your purpose.

- After selecting the right form, purchase the document by clicking on the Buy Now button. You may need to create an account to access the full library of resources.

- Complete your payment using either a credit card or a PayPal account to finalize your subscription.

- Download your form and save it to your device. You can access it anytime through the My Forms menu in your profile.

Using US Legal Forms offers a user-friendly experience with a robust collection of over 85,000 editable legal forms, empowering you to navigate legal requirements confidently.

Start today to ensure accurate payroll processing. Visit US Legal Forms and access the resources you need!

Form popularity

FAQ

When recording payroll entry with tax, the journal entry typically includes several components. You will debit the expense account, such as salaries or wages, to reflect the payroll expense incurred. Next, you credit the liability accounts for various taxes withheld, including federal, state, and local taxes, as well as Social Security and Medicare taxes. This accurate recording ensures compliance and provides a clear picture of your company's tax obligations.

A payroll record includes detailed information about an employee's work hours, earnings, deductions, and tax information. This record serves as a legal document that may be required for compliance and audits. It's essential to maintain these records accurately, as they assist in tracking employee payments and help combat potential disputes. Recording payroll entry with tax ensures that your payroll records align with IRS requirements.

To record a payroll entry with tax, start by gathering all relevant employee information, including hours worked and applicable tax rates. Next, input these details into your payroll system or software. Ensure that you also factor in any deductions or benefits. Once everything is accurate, finalize the payroll entry and keep a record for your financial documents.

Filing payroll taxes involves several steps to ensure compliance with federal and state regulations. First, gather accurate payroll records, as this will help in recording payroll entry with tax correctly. Next, you will need to complete relevant tax forms, such as the IRS Form 941 for federal tax deposits. Finally, submit your forms and payments on time to avoid penalties, or consider using platforms like US Legal Forms to simplify and manage the filing process effectively.

The journal entry for payroll taxes typically entails debiting the payroll tax expense account and crediting the payable accounts for Social Security, Medicare, and other payroll taxes. This approach ensures all tax liabilities are accurately recorded. By following this method, you will enhance the reliability of your payroll entry with tax.

Recording a payroll taxes journal entry involves identifying the total payroll taxes withheld from employee wages. Once determined, debit the payroll tax liabilities and credit the respective expense accounts associated with federal and state taxes. This careful documentation reinforces effective practices in recording payroll entry with tax.

The entry to record the employer's payroll taxes includes several components such as Social Security, Medicare, and federal or state unemployment taxes. You will want to debit the payroll tax expense and credit the appropriate liability accounts. This practice enhances accuracy in recording payroll entry with tax and ensures all employer obligations are properly tracked.

To account for payroll tax expenses, record the taxes incurred as a result of employee wages. You will need to create a journal entry that debits the payroll tax expense and credits the various payroll liability accounts. This method simplifies the process of recording payroll entry with tax, providing clarity in your financial statements.

When accounting for payroll tax expenses, start by recognizing the total payroll for accounting periods. Next, debit the payroll tax expense account and credit the related liability accounts for taxes due. This process is essential for accurate recording of payroll entry with tax, ensuring compliance and proper financial reporting.