Annual Report Form Template Withholding Reconciliation

Description

How to fill out Notice Of Annual Report Of Employee Benefits Plans?

Creating legal documents from the ground up can occasionally be overwhelming.

Some situations may require extensive research and significant financial investment.

If you seek a more straightforward and cost-effective method of producing the Annual Report Form Template Withholding Reconciliation or any other documents without unnecessary hurdles, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can promptly access state- and county-specific forms carefully prepared by our legal experts.

Ensure that the form you select complies with the regulations and laws of your state and county. Choose the most appropriate subscription plan to acquire the Annual Report Form Template Withholding Reconciliation. Download the form, then fill it out, validate, and print it. US Legal Forms boasts an impeccable track record and over 25 years of experience. Join us today and transform document preparation into a seamless and efficient process!

- Utilize our platform whenever you require a dependable service to swiftly find and download the Annual Report Form Template Withholding Reconciliation.

- If you're familiar with our website and have set up an account previously, just Log In, choose the template, and download it immediately or re-download it at any moment via the My documents section.

- Not a member yet? No problem. It only takes a few minutes to register and browse the library.

- Before proceeding to download the Annual Report Form Template Withholding Reconciliation, consider these suggestions.

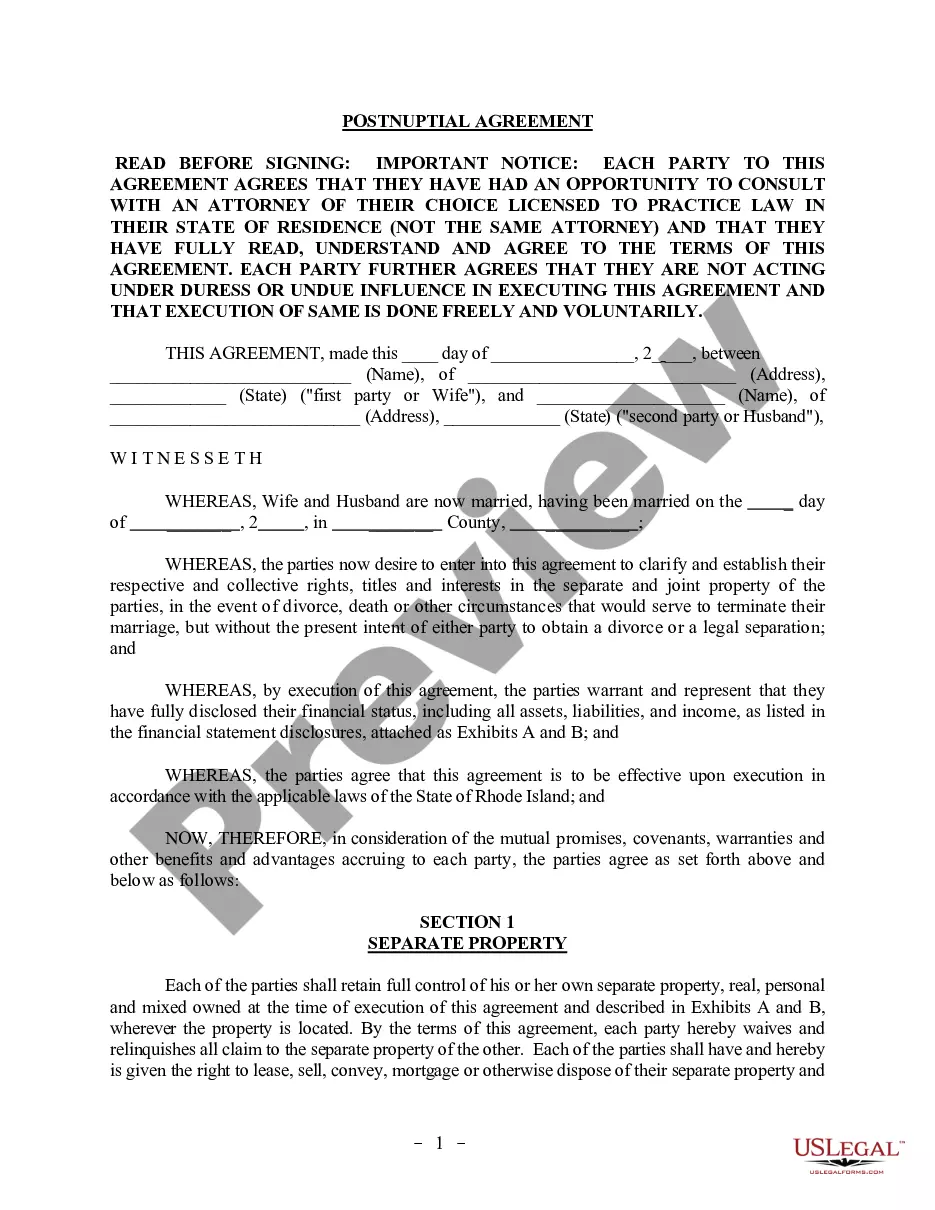

- Review the form preview and descriptions to ensure you are on the correct form.

Form popularity

FAQ

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

General Instructions Form NC-3 reconciles the total North Carolina income tax withheld as listed on the W-2 and 1099 statements with the amount of tax reported as withheld for the year. If you are required to withhold or you voluntarily withheld North Carolina income taxes, you must file Form NC-3.

Annual Reconciliation is the process in which employers reconcile total annual earnings reported periodically throughout the year to the total earnings reported in the Monthly Remittance Reports.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).