Cobra Coverage For Spouse Only

Description

How to fill out Cobra Coverage For Spouse Only?

Navigating through the red tape of official documents and formats can be challenging, particularly if one does not engage in that professionally.

Even locating the appropriate format to obtain Cobra Coverage For Spouse Only will be laborious, as it must be valid and precise to the very last digit.

Nonetheless, you will need to invest significantly less time finding a suitable format from a resource you can trust.

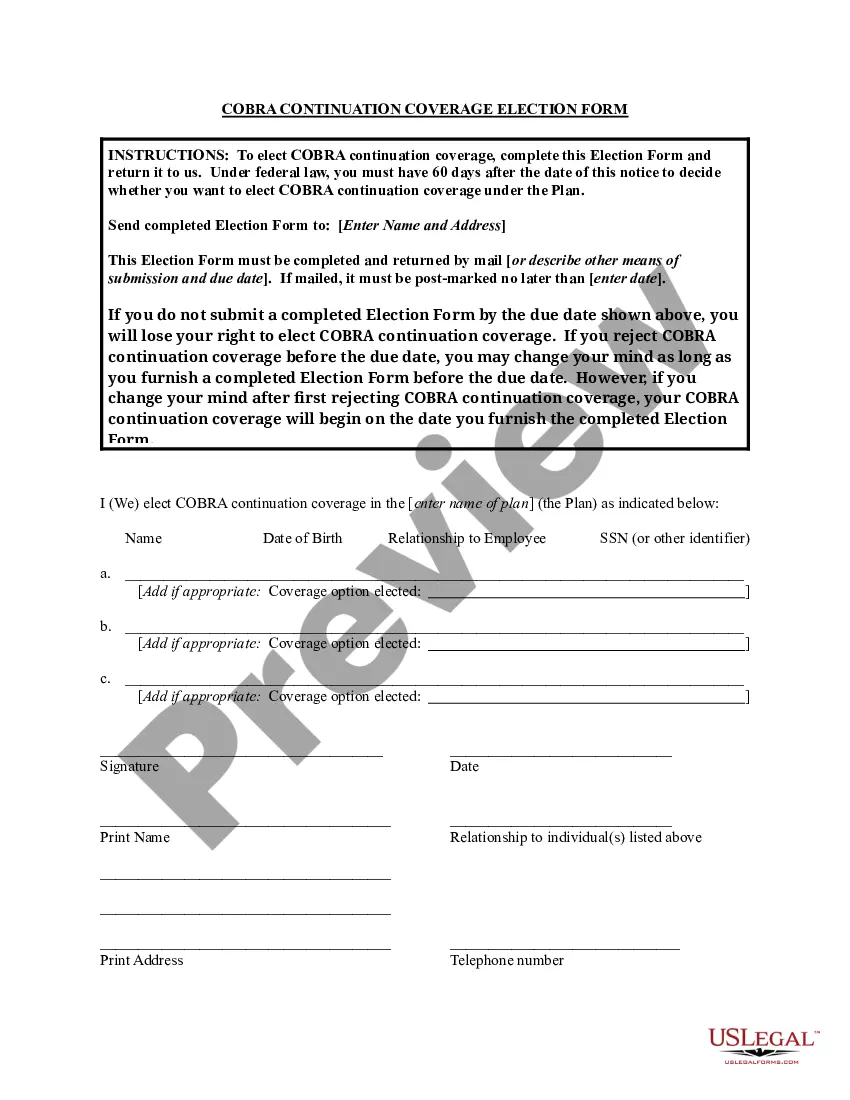

Acquire the correct document in a few simple steps: Enter the name of the file in the search box. Locate the right Cobra Coverage For Spouse Only from the results list. Review the description of the template or open its preview. If the document meets your requirements, click Buy Now. Continue to select your subscription plan. Use your email and create a password to register an account with US Legal Forms. Choose a credit card or PayPal as your payment method. Download the document file onto your device in your desired format. US Legal Forms will save you significant time in verifying if the document you found online is appropriate for your needs. Create an account and gain unlimited access to all the documents you need.

- US Legal Forms is a service that streamlines the searching process for the correct documents online.

- US Legal Forms is a singular location you require to discover the latest examples of documents, review their usage, and download these templates to fill them in.

- This is a compilation with over 85K documents applicable in diverse fields.

- When looking for Cobra Coverage For Spouse Only, you will not need to question its authenticity as all of the documents are validated.

- Creating an account at US Legal Forms will guarantee you have all the essential documents at your fingertips.

- Store them in your history or add them to the My documents collection.

- You can access your saved documents from any device by clicking Log In on the library site.

- If you do not yet have an account, you can always search again for the template you require.

Form popularity

FAQ

COBRA coverage for spouse only typically lasts for 18 months. However, in certain circumstances, this period can extend to 36 months, especially in cases of disability or other qualifying events. It's important to review specific details related to your situation and any applicable plans. USLegalForms can help you navigate the complexities of COBRA regulations and ensure you understand your coverage options.

Yes, you can obtain COBRA coverage retroactively if you elect it within the required timeframe. By electing COBRA coverage for spouse only, you can ensure that medical expenses incurred during the gap in coverage are covered. Keep in mind that addressing your situation quickly through platforms like uslegalforms can facilitate your understanding and enrollment process, making it easier to maintain continuous health coverage.

The seven COBRA qualifying events include job loss, reduction of work hours, death of the covered employee, divorce or legal separation, a dependent child losing eligibility, Medicare entitlement, and a second qualifying event. Each of these events allows you to elect COBRA coverage for spouse only, ensuring continued access to healthcare. Understanding these events can help you navigate your options effectively when facing sudden changes in your employment or family situation.

The COBRA 60-day loophole refers to the opportunity some individuals have to continue their health coverage beyond the standard 60-day election period. This can happen if you did not receive the required notice from your employer about your COBRA rights. If you find yourself in this situation, you might still be eligible for COBRA coverage for spouse only by addressing the oversight and seeking assistance promptly.

The 60-day rule for COBRA dictates that you must elect COBRA coverage within 60 days after losing your job or experiencing a qualifying event. For those seeking COBRA coverage for spouse only, it's essential to act quickly to ensure your spouse retains their health benefits. If you miss this window, you may lose the chance to enroll in COBRA coverage for your spouse, so be aware of the timeline.

The 60-day COBRA loophole refers to the window that allows individuals to elect COBRA coverage within 60 days of losing their previous health insurance. This gives you time to think and plan; you can choose Cobra coverage for spouse only during this period if eligible. It’s a beneficial option for those who need time to secure alternative health insurance.

No, a dependent cannot independently elect COBRA coverage without the employee's participation in the process. It is crucial that the employee initiates the COBRA election for dependent coverage. After starting this process, the dependent can select the coverage they need.

Yes, you can elect COBRA specifically for your spouse. If you want Cobra coverage for spouse only, you must indicate this choice during the enrollment process. This allows your spouse to maintain their healthcare insurance after you leave your job or if there is a qualifying event.

Typically, a dependent cannot elect COBRA coverage without the employee first initiating the process. The employee must be the one to notify the insurer about the COBRA election for spouse only. Once initiated, the dependent can then apply for their coverage as part of the family plan.

Yes, you can elect COBRA coverage for a dependent, but it must be done during the initial enrollment period. When considering Cobra coverage for spouse only, ensure you select the right option when applying. It's essential to adhere to all deadlines and guidelines to avoid any lapses in coverage.