Trustee Power Of Sale

Description

How to fill out Power Of Attorney By Trustee Of Trust?

Acquiring legal templates that align with federal and state regulations is crucial, and the web provides numerous selections to choose from.

But what's the use in spending time searching for the appropriate Trustee Power Of Sale example online when the US Legal Forms digital library already houses such templates consolidated in one place.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by attorneys for various professional and personal circumstances. They are user-friendly with all documents organized by state and usage purpose. Our experts stay updated with legislative changes, ensuring you can trust that your form is current and compliant when obtaining a Trustee Power Of Sale from our site.

All documents you discover through US Legal Forms are repeatable. To re-download and complete previously saved templates, access the My documents section in your profile. Enjoy the most comprehensive and user-friendly legal paperwork service!

- Obtaining a Trustee Power Of Sale is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the template you need in the appropriate format.

- If you are unfamiliar with our site, follow the instructions below.

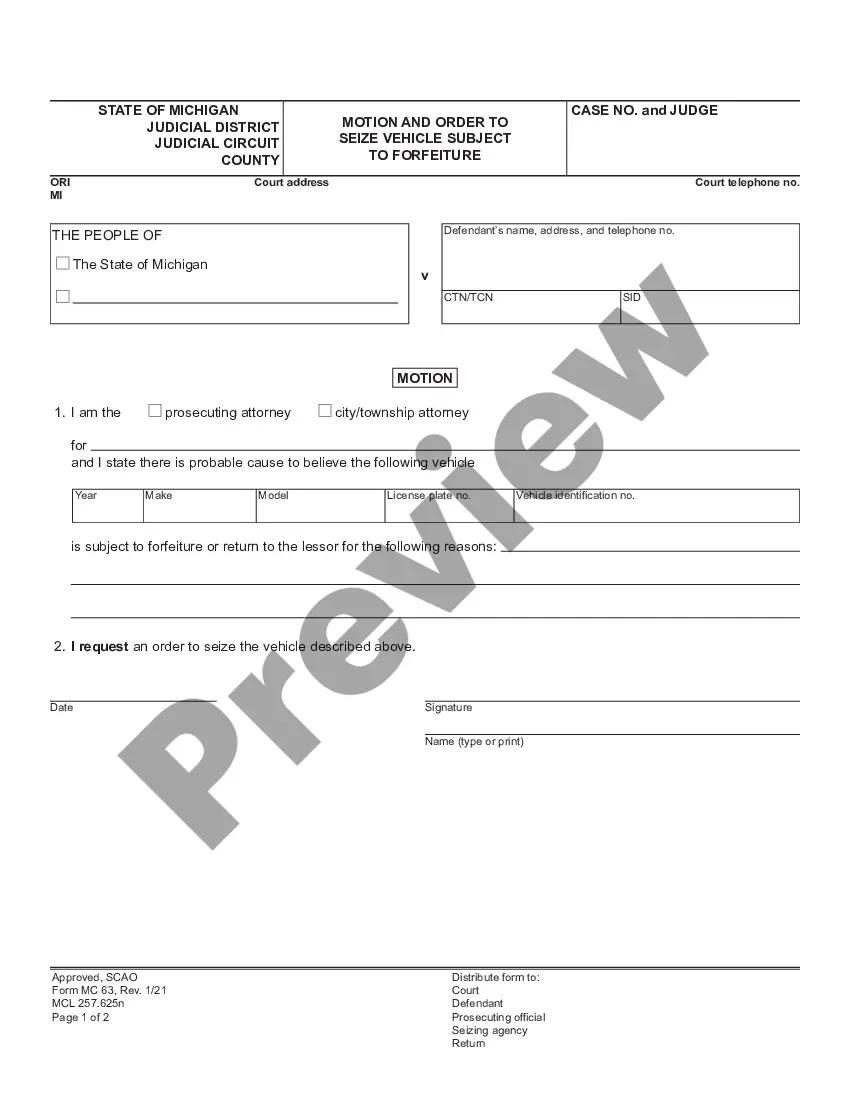

- Review the template using the Preview feature or through the text description to confirm it meets your requirements.

- Search for another template using the search function at the top of the page if necessary.

- Click Buy Now once you find the suitable form and select a subscription plan.

- Create an account or Log In and process your payment via PayPal or a credit card.

- Choose the preferred format for your Trustee Power Of Sale and download it.

Form popularity

FAQ

In the UK, a trustee can sell property without all beneficiaries approving, provided the trust deed grants them this authority. The trustee power of sale allows the trustee to make decisions that are in the best interest of the trust. However, it's crucial for trustees to communicate with beneficiaries and provide transparency regarding such actions. Failure to do so may lead to discontent or legal challenges from beneficiaries.

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

If the trustee has money to give you, they should do so. There is no way the trustee can refuse to provide you with accounting information or financial information. They can also speak with you. Nevertheless, many beneficiaries are struggling with these horror stories.

Deeds of trust almost always include a power-of-sale clause, which allows the trustee to conduct a non-judicial foreclosure - that is, sell the property without first getting a court order. See Foreclosure.

In a trust sale, the buyer won't have to take any special action. The instructions for the sale of the home are left in the trust by the deceased homeowner. This allows the estate to act without the court system becoming involved. Usually, this results in significant savings of both time and money.

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations.