Trustee power of maintenance is a crucial aspect of trust law that encompasses various responsibilities and duties carried out by a trustee in managing and preserving trust assets. This power is granted to a trustee to ensure the continued maintenance, upkeep, and enhancement of the trust property, as well as the overall trust's financial well-being. Keywords: trustee power of maintenance, trust law, responsibilities, duties, managing, preserving, trust assets, maintenance, upkeep, enhancement, trust property, financial well-being There are different types of Trustee power of maintenance, which include: 1. Repairs and Maintenance: A trustee is entrusted with the duty of maintaining the trust property, ensuring that it remains in good condition. This involves carrying out repairs, renovations, and necessary maintenance work to preserve the value and functionality of the property. 2. Property Management: Trustees often have the power to manage the trust property's day-to-day operations. This includes collecting rent, paying bills, hiring necessary staff, and ensuring the property is adequately insured, inspected, and adheres to applicable regulations. 3. Investments: Trustees may be authorized to manage the trust's investments to generate income and grow the trust estate. They have the power to make investment decisions, diversify the trust portfolio, and monitor the performance of investments to meet the trust's financial objectives. 4. Financial Planning: Trustee power of maintenance may involve creating and implementing financial plans to meet the trust's ongoing and future obligations. This includes budgeting, allocation of resources, and developing strategies to ensure sufficient funds are available for specific purposes like education, healthcare, or charitable donations. 5. Tax Planning: Trustees are responsible for ensuring the trust's tax obligations are met. They may engage in tax planning, utilizing available tax strategies, and making informed decisions to minimize tax liabilities, ultimately preserving the trust assets. 6. Risk Management: Trustees should actively assess and manage risks associated with the trust assets. This involves adopting suitable insurance coverage, implementing risk mitigation measures, and seeking professional advice to protect the trust property from potential threats. 7. Reporting and Accounting: Trustees are obligated to maintain accurate and transparent records of all financial activities related to the trust. They must prepare regular financial statements and reports, provide beneficiaries with necessary information, and ensure compliance with accounting standards and legal requirements. In conclusion, Trustee power of maintenance encompasses a wide range of responsibilities and duties that trustees undertake to maintain, manage, and enhance trust assets. Repairs and maintenance, property management, investments, financial planning, tax planning, risk management, and reporting are some key aspects of this power.

Trustee Power Of Maintenance

Description

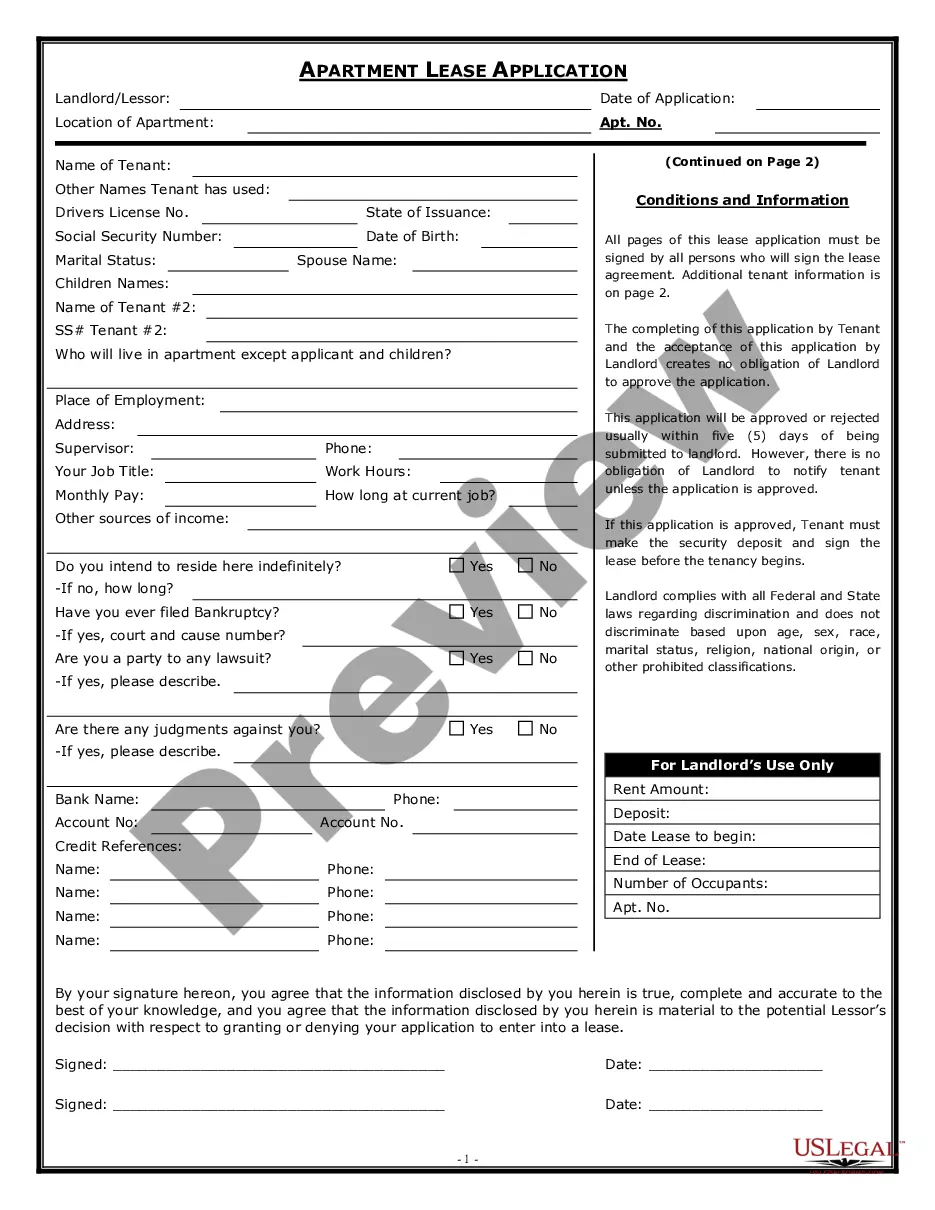

How to fill out Power Of Attorney By Trustee Of Trust?

Whether for business purposes or for individual affairs, everybody has to manage legal situations at some point in their life. Filling out legal papers needs careful attention, beginning from choosing the correct form template. For instance, if you choose a wrong version of the Trustee Power Of Maintenance, it will be turned down once you send it. It is therefore crucial to have a dependable source of legal files like US Legal Forms.

If you need to obtain a Trustee Power Of Maintenance template, stick to these easy steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Examine the form’s description to ensure it fits your case, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong form, go back to the search function to find the Trustee Power Of Maintenance sample you need.

- Download the template when it matches your requirements.

- If you already have a US Legal Forms account, simply click Log in to gain access to previously saved files in My Forms.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Finish the account registration form.

- Pick your transaction method: you can use a credit card or PayPal account.

- Choose the document format you want and download the Trustee Power Of Maintenance.

- When it is downloaded, you can fill out the form with the help of editing applications or print it and finish it manually.

With a large US Legal Forms catalog at hand, you never need to spend time seeking for the appropriate template across the internet. Make use of the library’s straightforward navigation to find the proper form for any occasion.

Form popularity

FAQ

Here's an example of how the HEMS standard may appear in your trust documents: "After my death, my trust assets should be distributed when my beneficiaries turn 35. Before age 35, a beneficiary may request distributions from the trust to cover expenses related to their health, education, maintenance, and support."

With Powers of Maintenance, the payments made to the beneficiary will depend upon the age of the child and their social status. Future payments will depend on if the child has already received any payments, how many payments they have received, and how much was given to them.

Maintenance Trust means the depository agreement between Owners, VOH and a designated depository for the purpose of receiving regular payments from the Owner to be held, managed, invested and disbursed for their benefit and in satisfaction of their obligations for maintenance, insurance, utilities, residential services ...

Support and maintenance are especially broad terms without a firmly understood definition under the law. But generally speaking, courts have interpreted these words to mean that the person benefiting from the trust should be living about the same lifestyle as they were previously.

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations.