Types Of Guarantee In Contract Law

Description

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

Individuals typically link legal documents with complexity that only a specialist can manage.

In some respects, this is accurate, as formulating Types Of Guarantee In Contract Law demands a profound comprehension of subject requirements, encompassing state and regional statutes.

Nevertheless, with the US Legal Forms, everything has become simpler: pre-prepared legal templates for any life and business circumstance relevant to state laws are gathered in a single online directory and are now accessible to everyone.

Print your document or upload it to an online editor for a faster fill-out. All templates in our catalog are reusable: once obtained, they remain saved in your profile. You can access them anytime needed via the My documents tab. Explore all advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85k current forms categorized by state and application area, making it easy to search for Types Of Guarantee In Contract Law or any other specific template in just minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to access the form.

- New users will first need to create an account and subscribe before they can download any documents.

- Here is the step-by-step guide on how to acquire the Types Of Guarantee In Contract Law.

- Review the page content carefully to make sure it meets your requirements.

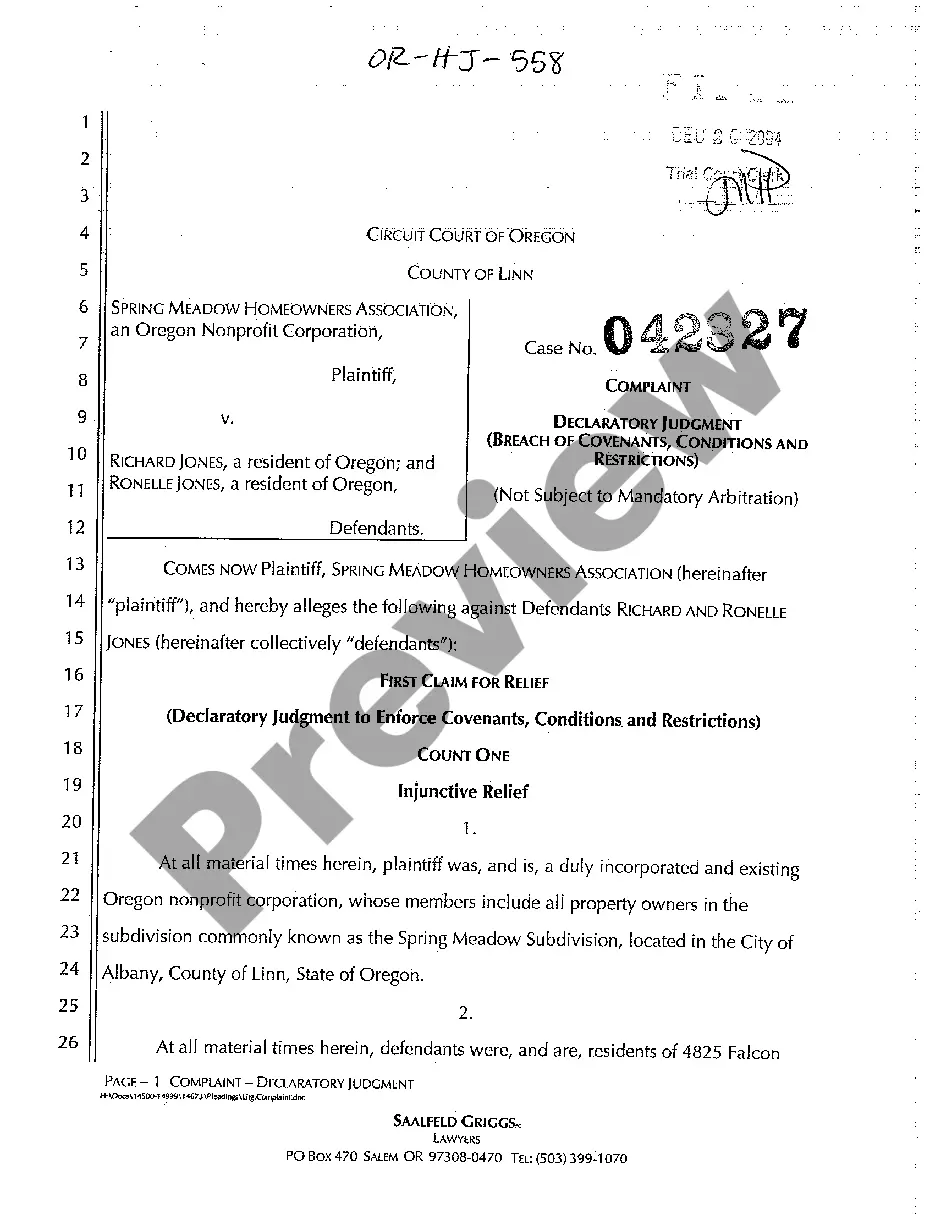

- Read the form description or view it through the Preview option.

- Search for an alternative sample using the Search bar above if the prior one doesn't fit your needs.

- Click Buy Now once you find the appropriate Types Of Guarantee In Contract Law.

- Select a subscription plan that fits your needs and financial situation.

- Create an account or Log In to continue to the payment page.

- Process your payment for your subscription through PayPal or with your credit card.

- Choose the format for your template and click Download.

Form popularity

FAQ

Example 1 : When A requests B to lend `10,000 to C and guarantees that C will repay the amount within the agreed time and that on C falling to do so, he will himself pay to B, there is a contract of guarantee.

In contract of guarantee there are 3 contracts, first is between principal debtor and creditor, second is between creditor and surety and third one is between surety and principal debtor.

Guarantee, in law, a contract to answer for the payment of some debt, or the performance of some duty, in the event of the failure of another person who is primarily liable. The agreement is expressly conditioned upon a breach by the principal debtor.

Guarantee is a legal term more comprehensive and of higher import than either warranty or "security". It most commonly designates a private transaction by means of which one person, to obtain some trust, confidence or credit for another, engages to be answerable for him.

Types of GuaranteesBid/Tender Guarantee. Issued in support of an exporter's bid to supply goods or services and, if successful, ensures compensation in the event that the contract is not signed.Performance Guarantee.Advance Payment Guarantee.Warranty Guarantee.Retention Guarantee.