Business Deductible Checklist For Self Employed

Description

How to fill out Business Deductibility Checklist?

Managing legal documents can be perplexing, even for seasoned professionals.

If you're seeking a Business Deductible Checklist For Self Employed but lack the time to find the correct and current version, the process can be overwhelming.

Utilize advanced tools to develop and manage your Business Deductible Checklist For Self Employed.

Access a valuable resource hub filled with articles, guidelines, and materials tailored to your circumstances and requirements.

Take advantage of the US Legal Forms online library, backed by 25 years of expertise and trust. Improve your daily document management through a simple and user-friendly process today.

- Save time and effort when looking for necessary documents by leveraging US Legal Forms’ sophisticated search and Preview feature to locate and acquire your Business Deductible Checklist For Self Employed.

- If you're a member, Log In to your US Legal Forms account, locate the form, and obtain it.

- Check your My documents section to view the documents you’ve previously retrieved and organize your folders as needed.

- If you’re new to US Legal Forms, create a free account to gain unlimited access to all the benefits of the library.

- Follow these steps after accessing the desired document: Validate that it’s the correct form by previewing it and reading its details. Ensure that the form is valid for your state or county. Click Buy Now when you're ready. Choose a subscription option. Select your preferred format, and Download, fill out, eSign, print, and send your document.

- An exceptional online form library can revolutionize how anyone handles such situations effectively.

- US Legal Forms is a leader in the online legal form space, offering over 85,000 state-specific legal documents accessible at any time.

- With US Legal Forms, you can meet all legal documentation needs, from personal to business affairs, all in one location.

Form popularity

FAQ

When you are self-employed, calculating the deductible part of your self-employment tax is quite straightforward. Generally, you can deduct half of your self-employment tax when filing, which helps reduce your taxable income. Utilizing a Business deductible checklist for self employed can aid you in identifying this deduction. This understanding ensures you make informed financial decisions and take advantage of available tax benefits.

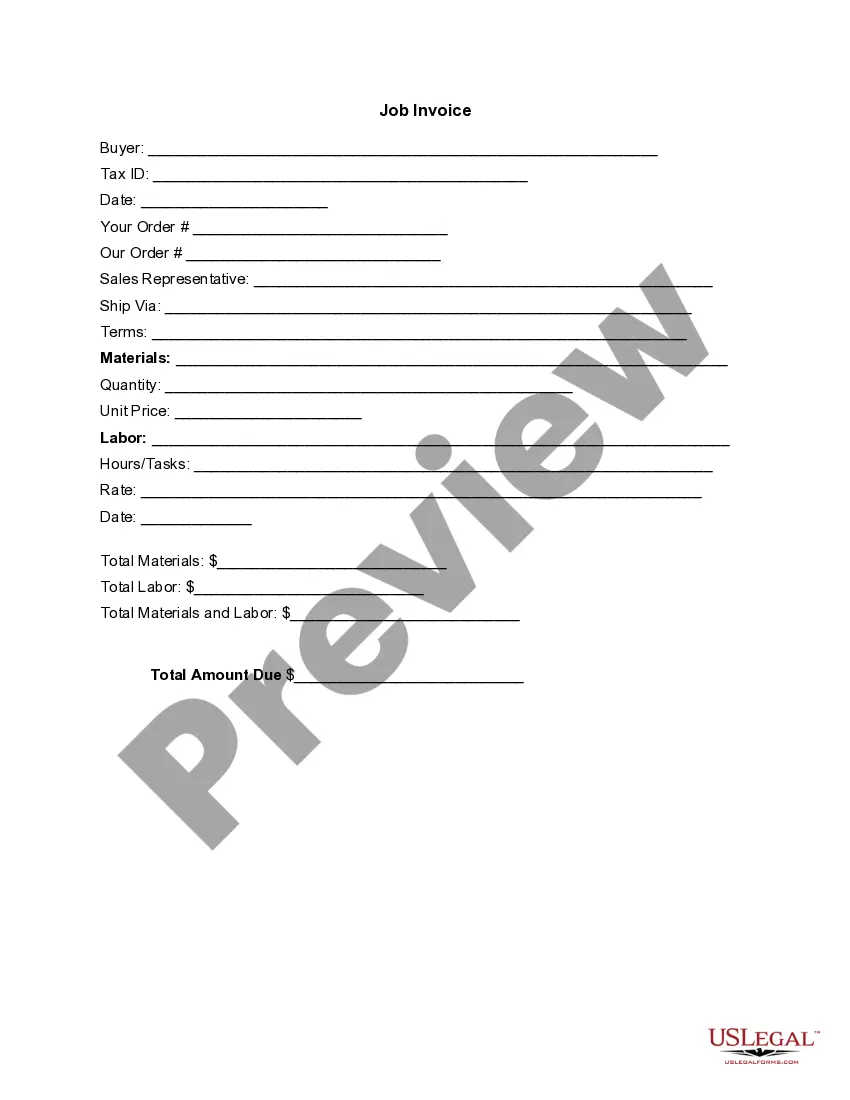

A deductible business expense includes any expense that is necessary and ordinary for running your business. Common examples are office supplies, marketing costs, and travel expenses directly related to your work. To help you navigate this process, our Business deductible checklist for self employed can provide clarity on what you can include. Understanding these expenses will ensure you maximize your tax deductions and keep more of your earnings.

The $2500 expense rule allows self-employed individuals to deduct certain items purchased for business use without needing to capitalize them. This rule simplifies record-keeping for smaller purchases, which can ease your tax preparation process. Integrating this rule into your business deductible checklist for self employed can help you maximize your deductions smoothly.

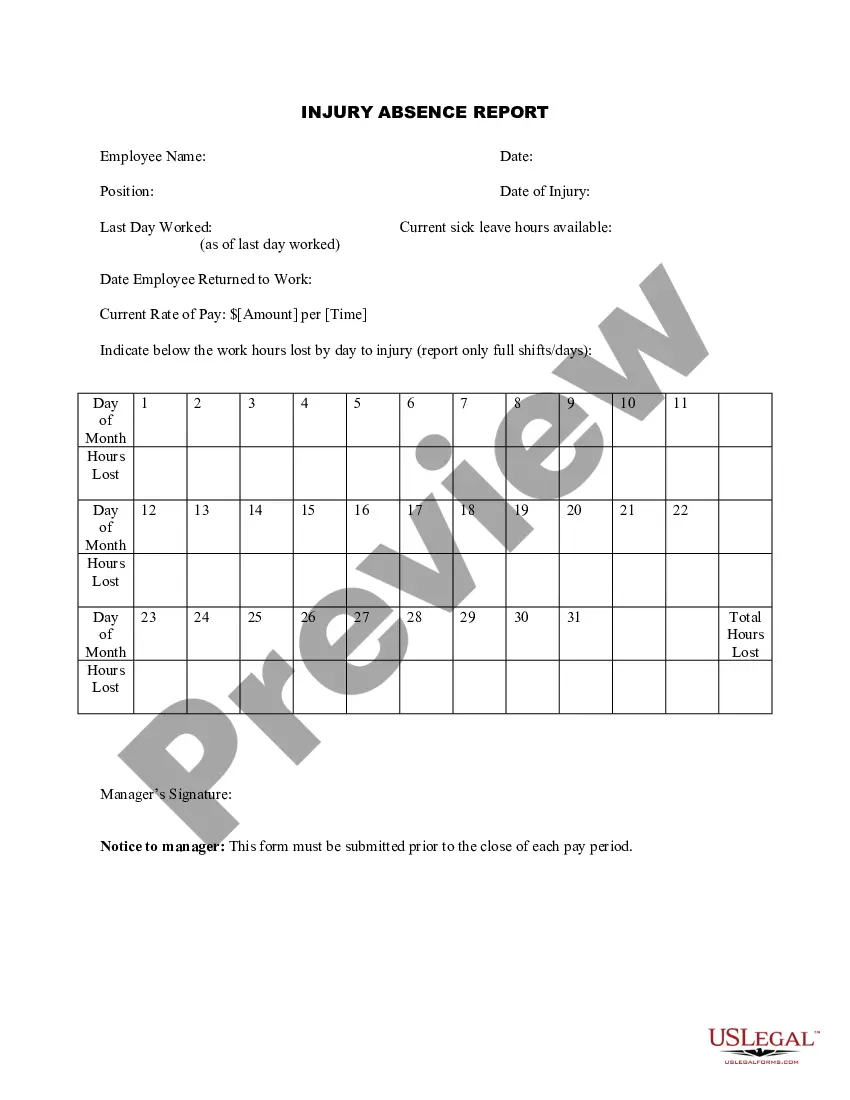

One common mistake is failing to keep adequate records of expenses, which can lead to missed deductions. Another is mixing personal and business expenses, creating confusion at tax time. To avoid these pitfalls, utilize a comprehensive business deductible checklist for self employed to keep your finances organized and compliant with tax regulations.

Expenses that are 100% deductible typically include necessary supplies, certain travel costs related to business activities, and advertising expenses. It's important to differentiate between personal and business expenses to ensure accuracy. A carefully managed business deductible checklist for self employed can guide you on what to include to optimize your deductions accurately.

To write off business expenses as a self-employed person, keep detailed records and receipts of your expenditures. You’ll then report these expenses on your tax return, typically on Schedule C. Creating a systematic business deductible checklist for self employed can help you track your expenses throughout the year, making the writing-off process straightforward and efficient.

Yes, self-employed individuals can write off a range of business expenses. These deductions reduce your taxable income, which can significantly lower your overall tax burden. By utilizing a business deductible checklist for self employed, you can ensure you’re capturing all eligible write-offs to maximize your tax advantages.

As a self-employed individual, you can deduct a variety of expenses, including home office costs, health insurance premiums, and professional fees. Business travel expenses, depreciation of equipment, and certain educational expenses can also be included. Using a business deductible checklist for self employed can streamline your record-keeping, making it easier to identify all possible deductions.

Certain expenses are fully tax deductible, such as business-related meals and entertainment, as long as they are directly associated with your business activities. Additionally, expenses for office supplies, equipment, and marketing materials can also be fully deducted. To keep track of these deductions, refer to a well-organized business deductible checklist for self employed, which helps ensure you maximize your tax benefits.