Business Deductibility Checklist With Toddler

Description

How to fill out Business Deductibility Checklist?

Finding a go-to place to take the most recent and relevant legal samples is half the struggle of dealing with bureaucracy. Choosing the right legal documents requirements accuracy and attention to detail, which is why it is crucial to take samples of Business Deductibility Checklist With Toddler only from reputable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You may access and view all the information concerning the document’s use and relevance for the situation and in your state or county.

Take the listed steps to complete your Business Deductibility Checklist With Toddler:

- Utilize the library navigation or search field to locate your sample.

- Open the form’s information to check if it suits the requirements of your state and area.

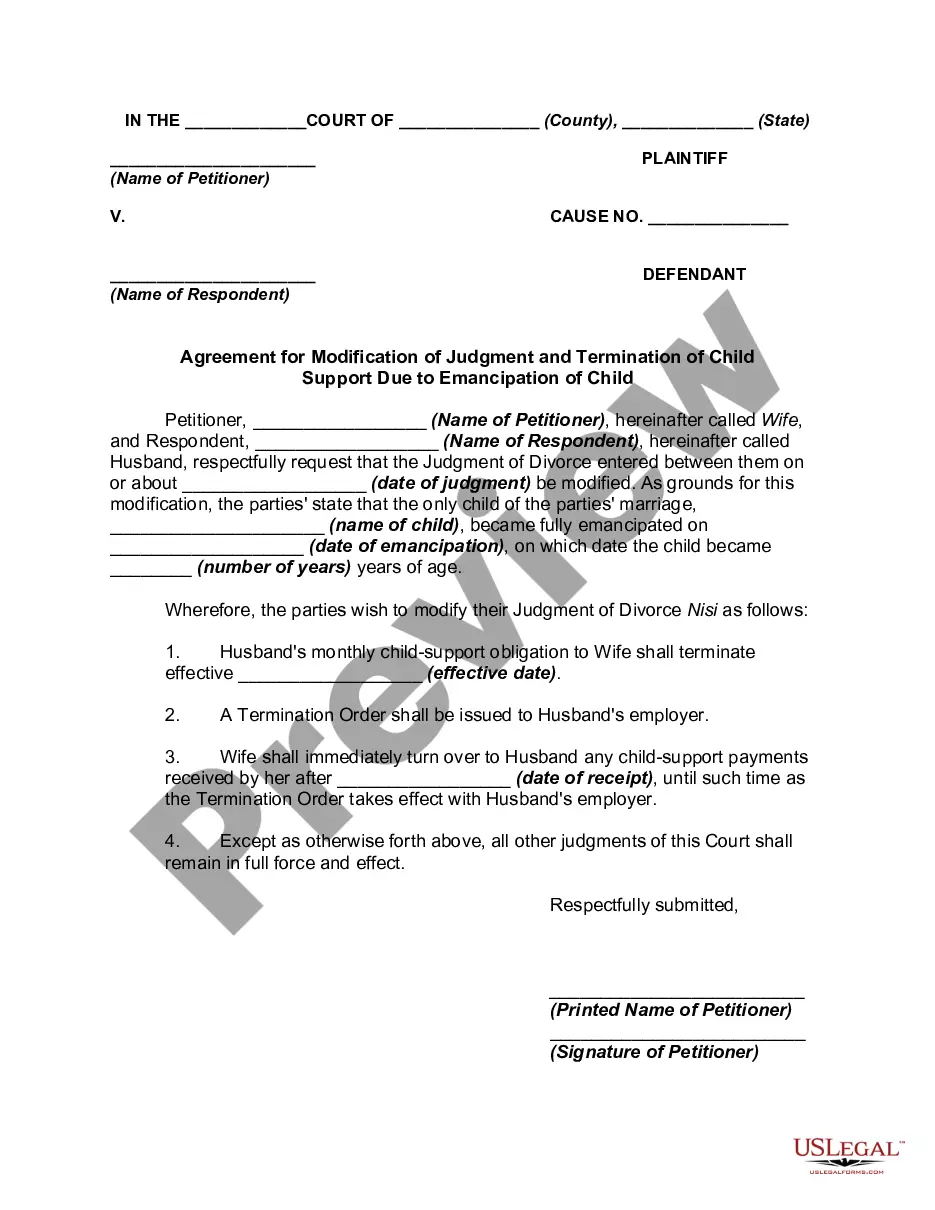

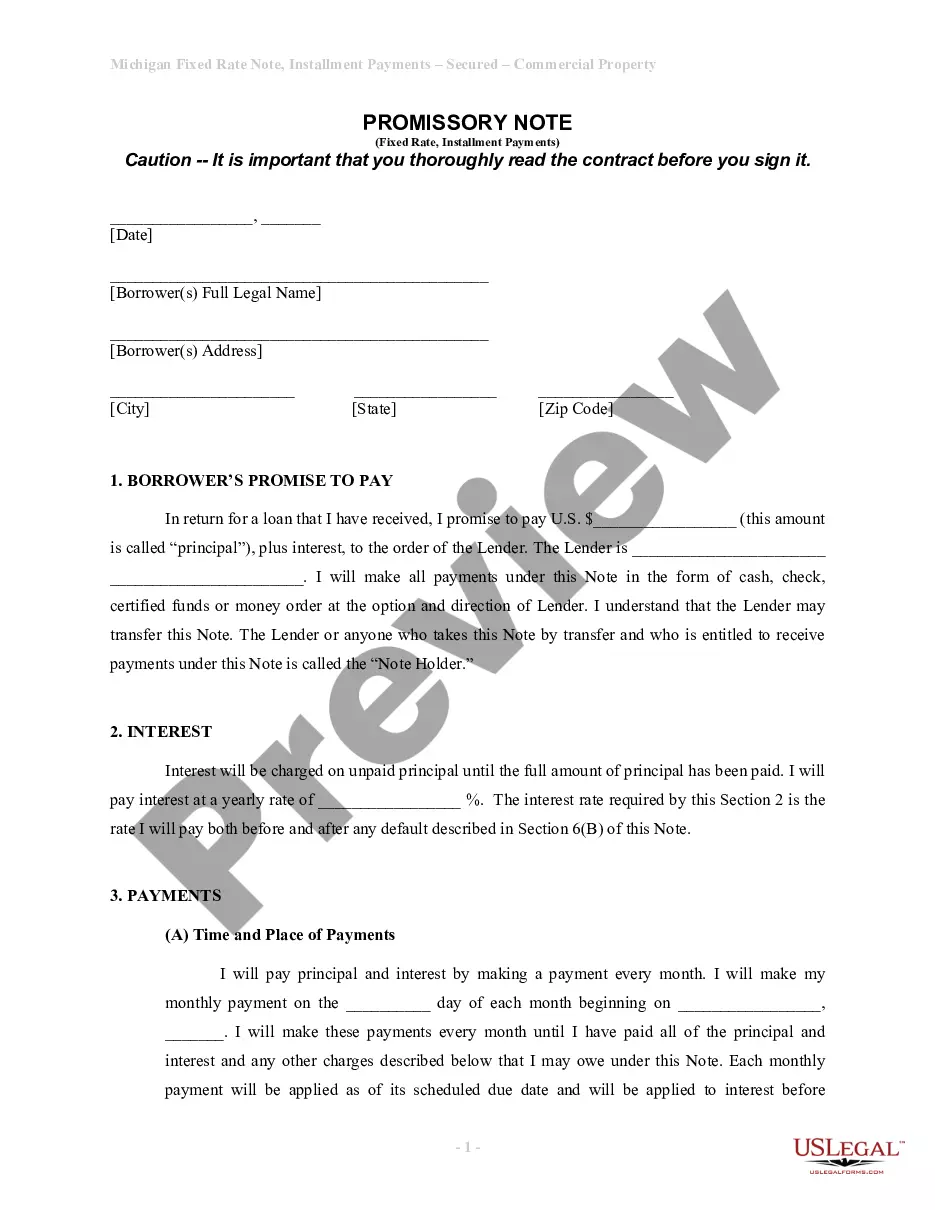

- Open the form preview, if there is one, to ensure the form is the one you are looking for.

- Get back to the search and locate the correct template if the Business Deductibility Checklist With Toddler does not match your requirements.

- If you are positive about the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Choose the pricing plan that suits your preferences.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by picking a payment method (bank card or PayPal).

- Choose the document format for downloading Business Deductibility Checklist With Toddler.

- Once you have the form on your gadget, you can modify it with the editor or print it and complete it manually.

Remove the inconvenience that comes with your legal paperwork. Check out the extensive US Legal Forms library to find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

For tax purposes, the custodial parent is usually the parent the child lives with the most nights. If the child lived with each parent for an equal number of nights, the custodial parent is the parent with the higher adjusted gross income (AGI).

You can claim child care expenses that were incurred for services provided in 2022. These include payments made to any of the following individuals or institutions: caregivers providing child care services. day nursery schools and daycare centres.

You can use form T778: Child care expenses deduction to claim child care expenses you paid for your child(ren) in 2022. You can claim child care expenses if you or your spouse or common-law partner paid someone to look after an eligible child so that you (or both of you) can: Earn income from employment.

In situations involving separated or divorced parents, CRA pays the benefit to the parent who resides with the child and who primarily fulfils the responsibility for the care and the upbringing of the child.

The SBD provides eligible small businesses with a reduced federal corporate tax rate of 9% on up to $500,000 of active business income (compared to the general federal corporate tax rate of 15%).