Business Deductibility Checklist For Expenses

Description

How to fill out Business Deductibility Checklist?

Creating legal documents from the ground up can frequently feel a bit daunting.

Certain situations may necessitate extensive research and significant financial investment.

If you are seeking a simpler and more affordable method of preparing the Business Deductibility Checklist For Expenses or any other forms without navigating unnecessary obstacles, US Legal Forms is readily available to you.

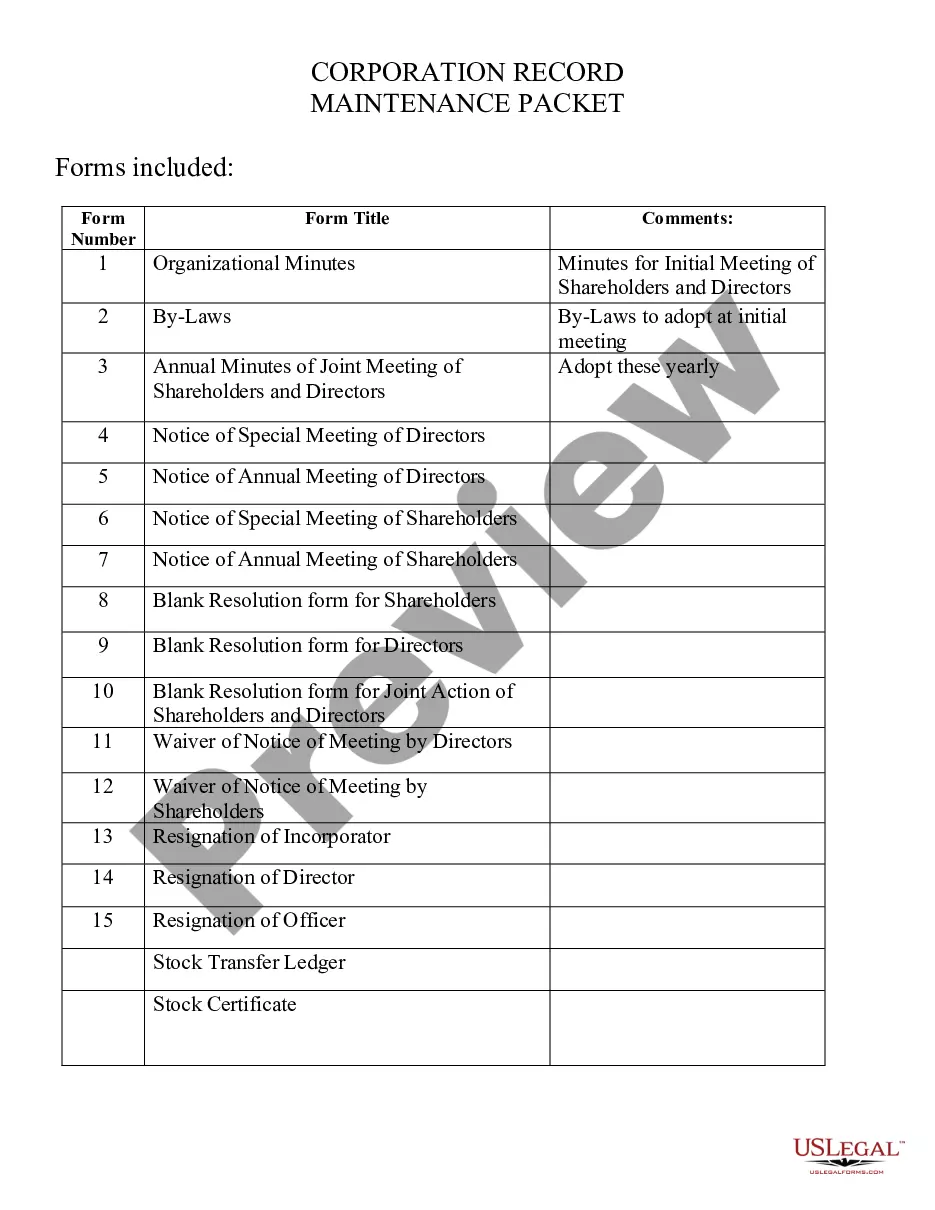

Our online collection of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can easily access state- and county-specific templates meticulously crafted by our legal professionals.

US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and turn form completion into a straightforward and efficient process!

- Utilize our platform whenever you require dependable and trustworthy services to swiftly locate and download the Business Deductibility Checklist For Expenses.

- If you are not a newcomer to our services and have previously established an account with us, simply Log In to your account, find the form, and download it or re-download it whenever you wish from the My documents section.

- Not having an account? No worries. Setting one up takes minimal time, allowing you to discover the library.

- Before you jump into downloading the Business Deductibility Checklist For Expenses, please adhere to these guidelines.

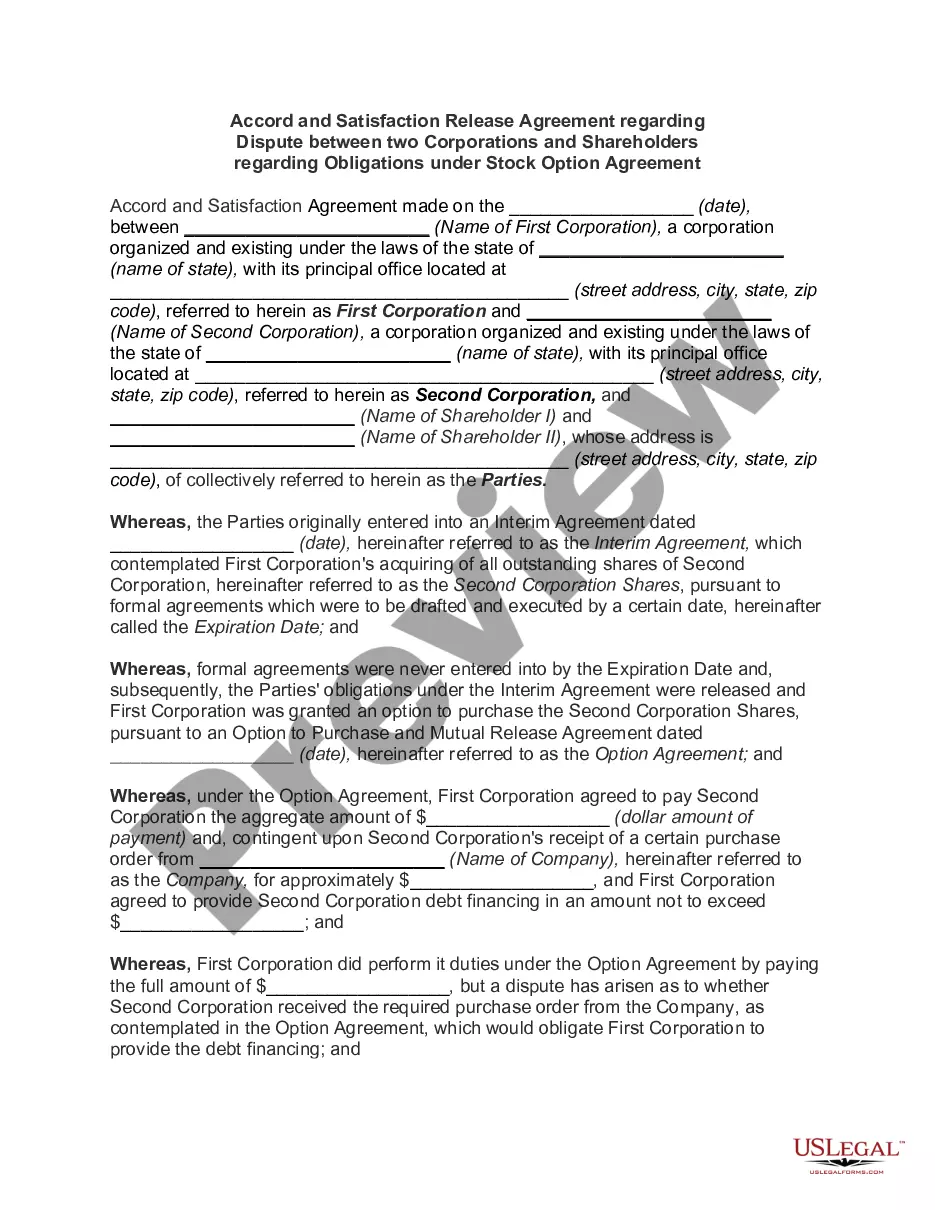

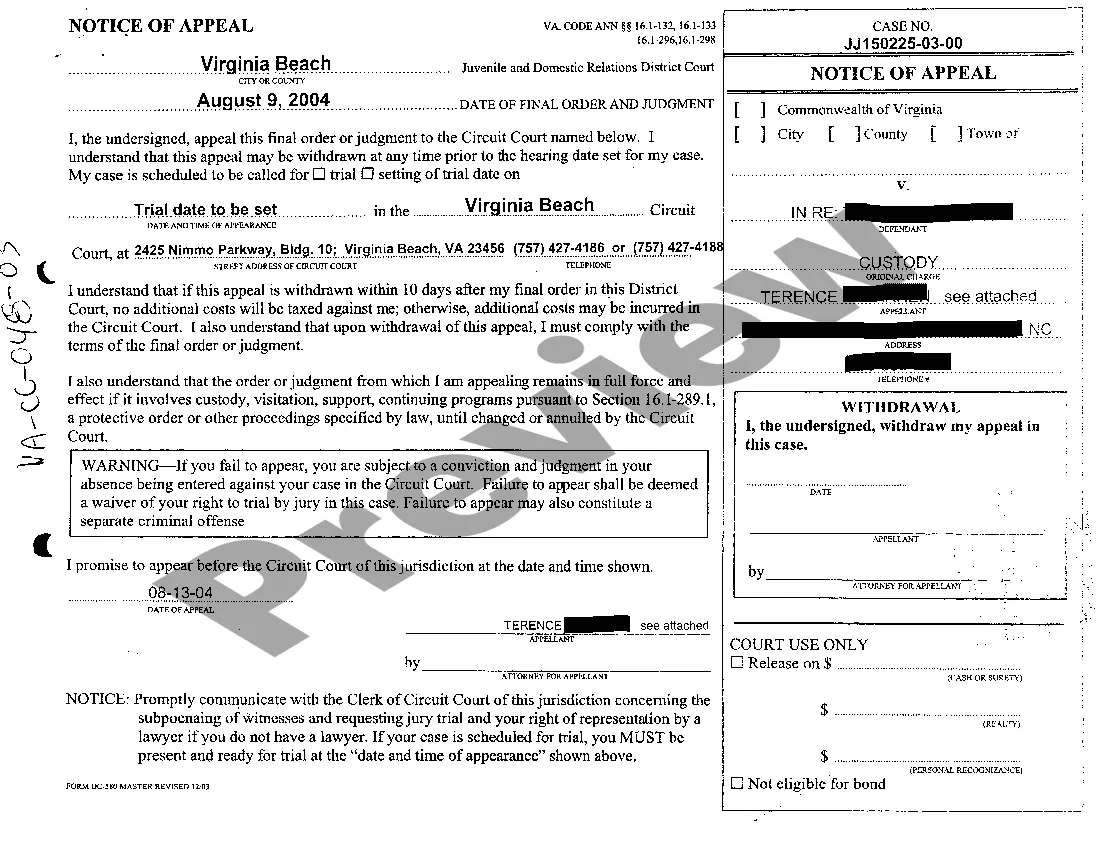

- Review the form preview and descriptions to confirm that you are on the correct document.

Form popularity

FAQ

Yes, the IRS may request proof of deductions if they have any reason to examine your tax return closely. This is why utilizing the Business deductibility checklist for expenses is so important. By preparing your documentation, such as receipts and invoices, ahead of time, you can effectively defend your claims. A well-documented approach not only safeguards your deductions but also aids in ensuring peace of mind during tax season.

The IRS can and often does check business expenses during audits. They use a variety of methods to verify the information you provide, so having a robust Business deductibility checklist for expenses is crucial. Keep your records accurate and maintain supporting documentation to stand up to scrutiny. By staying organized and compliant, you reduce your risk of complications during any review.

An effective taxes checklist should include all income sources, W-2 forms, 1099 forms, and your Business deductibility checklist for expenses. Additionally, consider tracking any potential deductions, such as home office expenses or travel costs. Gathering these documents in one place can streamline your tax filing process. Use this checklist as a guide to ensure you don’t miss out on any potential savings.

Yes, the IRS typically requires receipts as proof for business expenses, particularly for deductions greater than $75. Having a solid Business deductibility checklist for expenses helps ensure you have all necessary receipts on hand. Be proactive in collecting these documents to avoid any issues when filing your taxes. Proper tracking and storage of receipts can simplify your financial review and enhance your tax preparation.

To effectively use the Business deductibility checklist for expenses, you should keep documentation that supports your claims. This includes invoices, bank statements, and any contracts associated with your expenses. Keeping these records organized allows you to easily validate your deductions during tax time. Additionally, digital records are also acceptable, making it easier to maintain a comprehensive overview of your business expenses.

There are numerous things you can write off as business expenses ranging from equipment costs to marketing expenses. Commonly deductible items include software, subscriptions, and professional fees. Create a business deductibility checklist for expenses to track these items effectively and ensure you take full advantage of available deductions.

The $75 rule states that you can only deduct business meal and entertainment expenses if they exceed $75 and are directly related to your business activities. Keep receipts and records that support your claims to meet this requirement. When following your business deductibility checklist for expenses, ensure you are following this rule for meal-related deductions.

You can claim various expenses as long as they are necessary for running your business. Common examples include office supplies, utility bills, and salaries. To maximize your deductions, maintain a detailed business deductibility checklist for expenses that outlines all claimed items and their relevance to your operations.

Not everything can be written off as a business expense, but there is a wide range of expenses that are eligible. Expenses must be both ordinary and necessary for your business operations. Refer to your business deductibility checklist for expenses to ensure you only include qualifying items, and avoid potential tax issues.

The new $6000 tax deduction allows eligible taxpayers to deduct this amount from their taxable income if they meet specific criteria. This deduction can significantly reduce your taxable liabilities, making it a valuable aspect to consider in your business deductibility checklist for expenses. Always consult a tax professional to understand how this new deduction applies to your individual situation.