Notice Cobra Coverage For Spouse

Description

How to fill out Notice Cobra Coverage For Spouse?

Well-prepared official documents serve as one of the essential safeguards to prevent issues and lawsuits, however, acquiring them without the aid of an attorney may consume time.

If you need to swiftly locate an updated Notice Cobra Coverage For Spouse or any other forms for employment, family, or business situations, US Legal Forms is consistently available to assist.

The procedure is even more straightforward for current users of the US Legal Forms collection. If your subscription is active, you just need to Log In to your account and click the Download button next to the selected file. Additionally, you can retrieve the Notice Cobra Coverage For Spouse anytime later, as all documents you have obtained on the platform remain accessible in the My documents section of your account. Conserve time and finances preparing formal paperwork. Utilize US Legal Forms today!

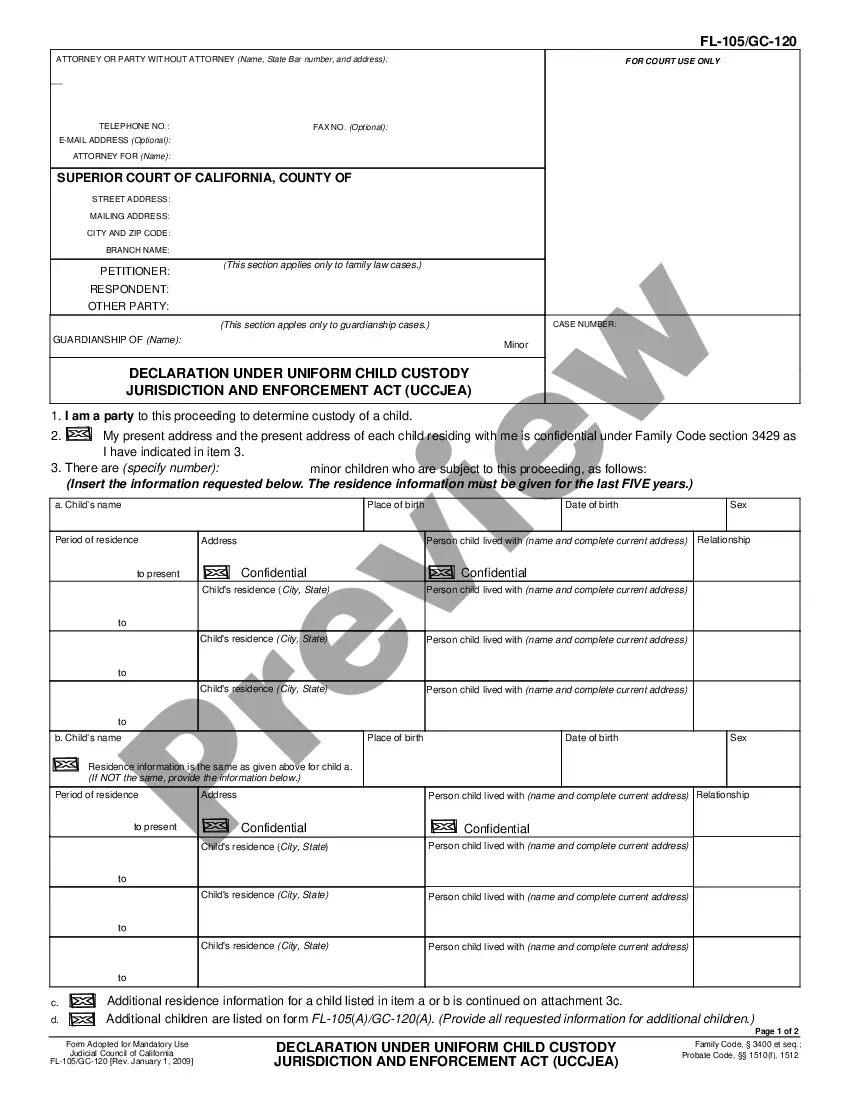

- Ensure that the document fits your situation and location by verifying the description and preview.

- Search for another example (if necessary) using the Search bar in the page header.

- Hit Buy Now once you find the appropriate template.

- Choose the pricing option, sign into your account or create a new one.

- Select your preferred payment method to acquire the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX format for your Notice Cobra Coverage For Spouse.

- Press Download, then print the document to complete it or integrate it into an online edit tool.

Form popularity

FAQ

COBRA insurance provides your spouse with continued health coverage after a qualifying event, such as job loss. The Notice COBRA coverage for spouse mandates that employers inform you and your spouse about this option. Typically, your spouse can enroll in COBRA coverage for up to 18 months, ensuring they receive necessary medical care during the transition. To navigate this process and understand your options, consider using USLegalForms for guidance and resources.

Yes, COBRA insurance does cover your spouse as long as they are listed as a dependent on your health plan. If you experience a qualifying event, such as job loss, they can maintain their coverage through COBRA. It's essential to send a Notice COBRA coverage for spouse to ensure they understand their options and the necessary steps to enroll. This coverage can be vital for their health and financial stability.

Generally, COBRA does not mandate coverage for domestic partners unless your plan specifically includes them as eligible dependents. However, you can choose to extend a Notice COBRA coverage for spouse to domestic partners if desired. This option could provide important health security for relationships that may not qualify under traditional definitions. Always check your specific health plan for coverage details.

The 60 days COBRA loophole refers to a provision allowing eligible individuals to enroll in COBRA coverage for up to 60 days after a qualifying event. This feature is beneficial, as it provides additional time to secure coverage without losing health benefits. You must provide a Notice COBRA coverage for spouse when relaying this information. Understanding this loophole helps families navigate their healthcare options effectively.

The initial COBRA notice should be sent within 14 days after the plan administrator learns of the qualifying event. This notice explains the continuation of health insurance coverage options available to the spouse and dependents. It is crucial to ensure that the notice of COBRA coverage for spouse is delivered promptly, as it helps the affected individuals understand their rights and responsibilities. Using a reliable platform like US Legal Forms can help streamline the process of creating and sending these important documents.

Setting up COBRA coverage for your spouse involves several straightforward steps. Begin by reviewing the COBRA notice, then fill out any forms it requires. Submit the completed forms within the specified timeframe to ensure timely setup of coverage. Services like USLegalForms can provide vital support in preparing and submitting these documents efficiently.

The responsibility for sending a COBRA notice lies with the employer or the plan administrator. After a qualifying event occurs, they must issue this notice to inform eligible individuals, including your spouse, about their rights to continue health coverage. Make sure to check your spouse’s records to confirm receipt of this important notice, as it initiates the COBRA enrollment process.

To start COBRA coverage effectively, you must follow the steps outlined in the COBRA notice you receive. Your notice will specify the required forms and the relevant deadlines. Ensure that you complete and return all necessary documents promptly to enroll your spouse in the coverage. Utilizing services like USLegalForms can simplify this process by providing the right forms and guidance.

Yes, you can elect COBRA coverage just for your spouse. When your family experiences a qualifying event, such as job loss or reduction in hours, your spouse will receive a COBRA notice. This notice will provide him or her with the option to continue health coverage independently. Make sure to review the details provided in the notice to ensure your spouse understands their rights.