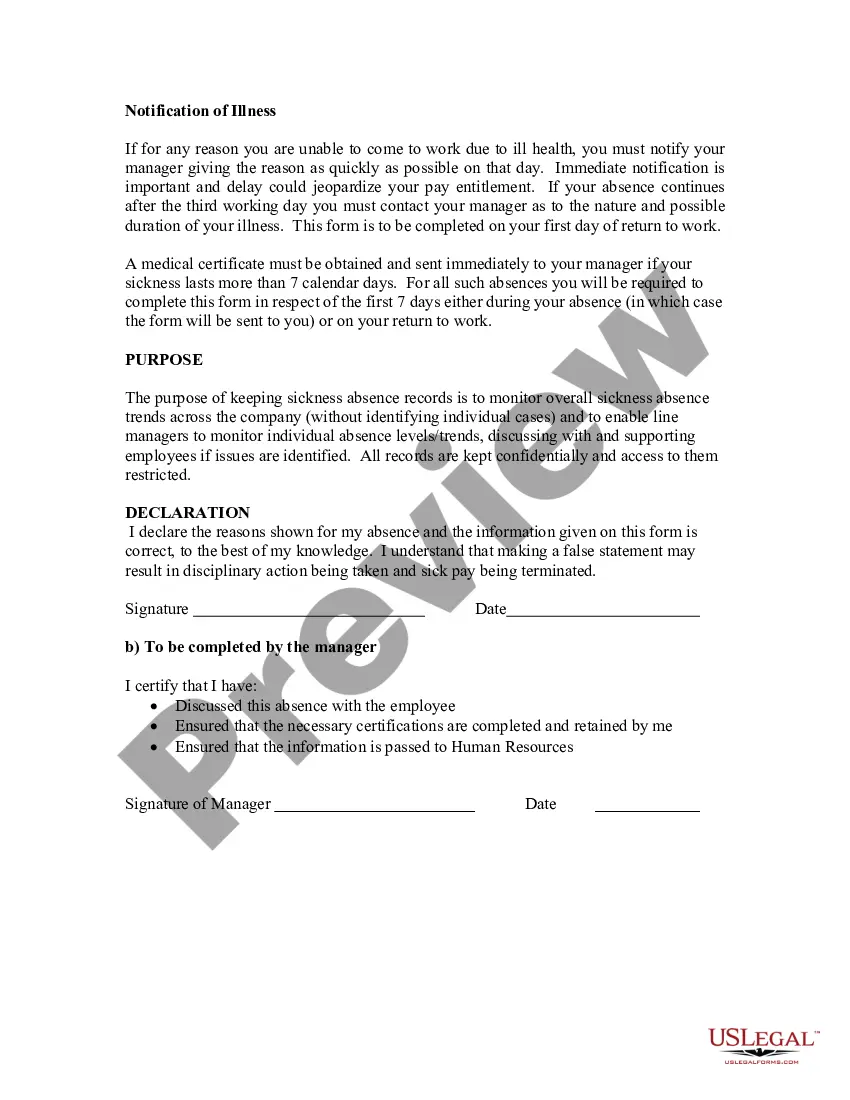

Record Absence Form Template For Counseling

Description

How to fill out Record Of Absence - Self-Certification Form?

Managing legal documents and processes can be a lengthy addition to your overall day.

Record Absence Form Template For Counseling and similar documents frequently necessitate that you search for them and navigate how to complete them efficiently.

For that reason, whether you are addressing financial, legal, or personal affairs, having a comprehensive and user-friendly online repository of forms at your disposal will significantly help.

US Legal Forms is the premier online platform for legal templates, featuring over 85,000 state-specific forms and a variety of resources to assist you in completing your documents with ease.

If it's your first time using US Legal Forms, register and create your account in a few minutes to gain access to the form library and Record Absence Form Template For Counseling. Then, follow the steps outlined below to finalize your form.

- Browse the library of relevant documents available with just one click.

- US Legal Forms provides you with state- and county-specific forms accessible anytime for download.

- Safeguard your document management tasks with top-notch support that allows you to prepare any form in minutes without any extra or concealed fees.

- Simply Log In to your account, search for Record Absence Form Template For Counseling, and obtain it directly in the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

Filing Articles of Incorporation in California costs $100 when providing for shares and $30 without providing for shares. If you want to include a statement converting your LLC, limited partnership, or general partnership into a corporation, the filing fee will be $150.

Name Change - Please note that the State Bar must approve all law corporation names. To request a name change, you must attach the following: An original certified copy of amended Articles of Incorporation reflecting the new name as certified by the Secretary of State.

Changing your LLP's name An original certified copy of the Secretary of State's Amendment to Registration (LLP-2), including the cover page with red date stamp. These forms may be obtained online or by contacting the Secretary of State's LLP filing unit at (916) 653-3795.

Updating the name of your law firm's business entity is easy. All you have to do is file an amendment with your state. I could update my company name in less than 10 minutes. But before you do that, call your bank to update your accounts.

To verify an attorney's status with the State Bar of California visit the State Bar's website (.calbar.ca.gov).

People with income less than 125% of the federal poverty guidelines are eligible and may qualify for assistance. Sometimes people with less than 200% of the federal poverty guidelines can qualify.

A member shall not form a partnership with a person who is not a lawyer if any of the activities of that partnership consist of the practice of law.

A law firm cannot be a limited liability company. Based on the Corporations Code section 17375, the State Bar of California does not certify LLCs for the purpose of practicing law. The only entity of choice for law firms that intend to practice and provide professional services in California is a corporation.