Employee Final Pay Withholding

Description

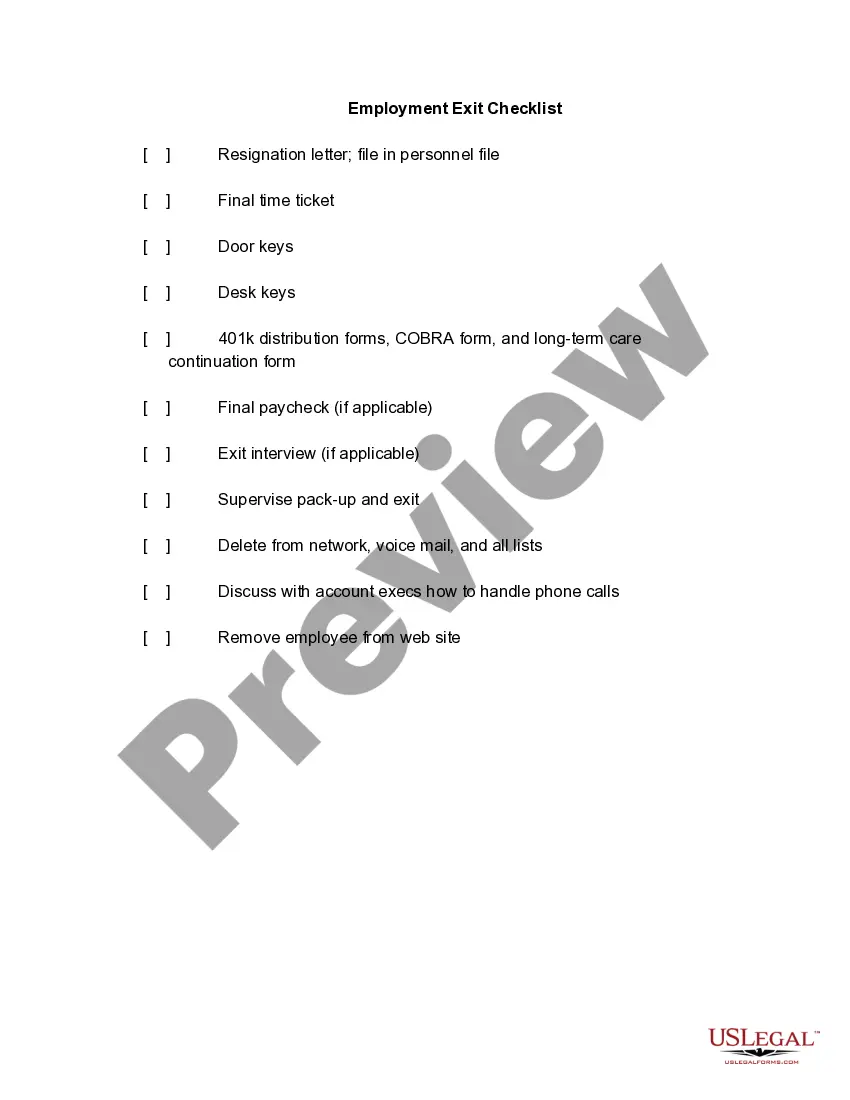

How to fill out Termination Meeting Checklist?

Locating a reliable source for the latest and suitable legal templates is a significant part of navigating through bureaucracy.

Selecting the correct legal documents requires precision and meticulousness, which is why it's crucial to obtain samples of Employee Final Pay Withholding solely from reputable providers like US Legal Forms. An incorrect template can squander your time and prolong your current situation. With US Legal Forms, you have minimal worries. You can view and access all necessary information regarding the document's applicability and significance for your situation and in your jurisdiction.

Dissolve the inconvenience associated with your legal documentation. Explore the comprehensive US Legal Forms catalog, where you can discover legal templates, evaluate their relevance to your situation, and download them instantly.

- Utilize the library navigation or search feature to locate your template.

- Review the form's details to determine if it meets your state's and region's requirements.

- Preview the form, if possible, to confirm that the template is indeed what you need.

- If the Employee Final Pay Withholding does not meet your requirements, continue searching for the correct document.

- When you are certain about the form's applicability, download it.

- If you are a registered client, click Log in to verify your identity and access your chosen templates in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Select the pricing option that fits your preferences.

- Proceed to registration to complete your transaction.

- Finish your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Employee Final Pay Withholding.

- Once the form is on your device, you can edit it using the editor or print it and fill it out by hand.

Form popularity

FAQ

Yes, withholding tax can be claimed back under certain conditions, typically during your annual tax filing. If you believe that you have overpaid on your taxes, filing your annual return is the way to initiate a refund. Utilize platforms like US Legal Forms to access detailed guidance on how to navigate the process of claiming back your employee final pay withholding.

You may receive a refund of your withholding tax if the total amount withheld exceeds the tax you owe for the year. This situation often occurs if your tax circumstances change, such as having more deductions or tax credits. To better understand your withholding tax and potential refunds, explore the resources provided by US Legal Forms related to employee final pay withholding.

Claiming 0 withholding typically results in higher tax withheld from your paycheck, which may lead to a refund during tax season. In contrast, claiming 1 allows for more take-home pay throughout the year. Assess your financial needs and tax situation carefully, and consider seeking advice through US Legal Forms to make informed choices about your employee final pay withholding.

When deciding what to claim for withholding, consider your total income, dependents, and other deductions. It's crucial to balance your tax obligations and avoid over-withholding, which can lead to a larger refund but less take-home pay. Tools and guidance available on US Legal Forms can help you optimize your employee final pay withholding for your specific situation.

The final withholding tax payment is the total amount of taxes withheld from your final paycheck. This payment contributes to your overall tax liability for the year. If you're uncertain about how this affects your taxes, consider resources from US Legal Forms, which offer insights into employee final pay withholding and how to manage it.

To claim your withholding, you'll need to review your pay stubs and tax documents to determine how much was withheld. Once you have that information, you can complete the appropriate forms during tax season. Utilizing services like US Legal Forms can simplify this process by providing clear instructions on claiming your employee final pay withholding.

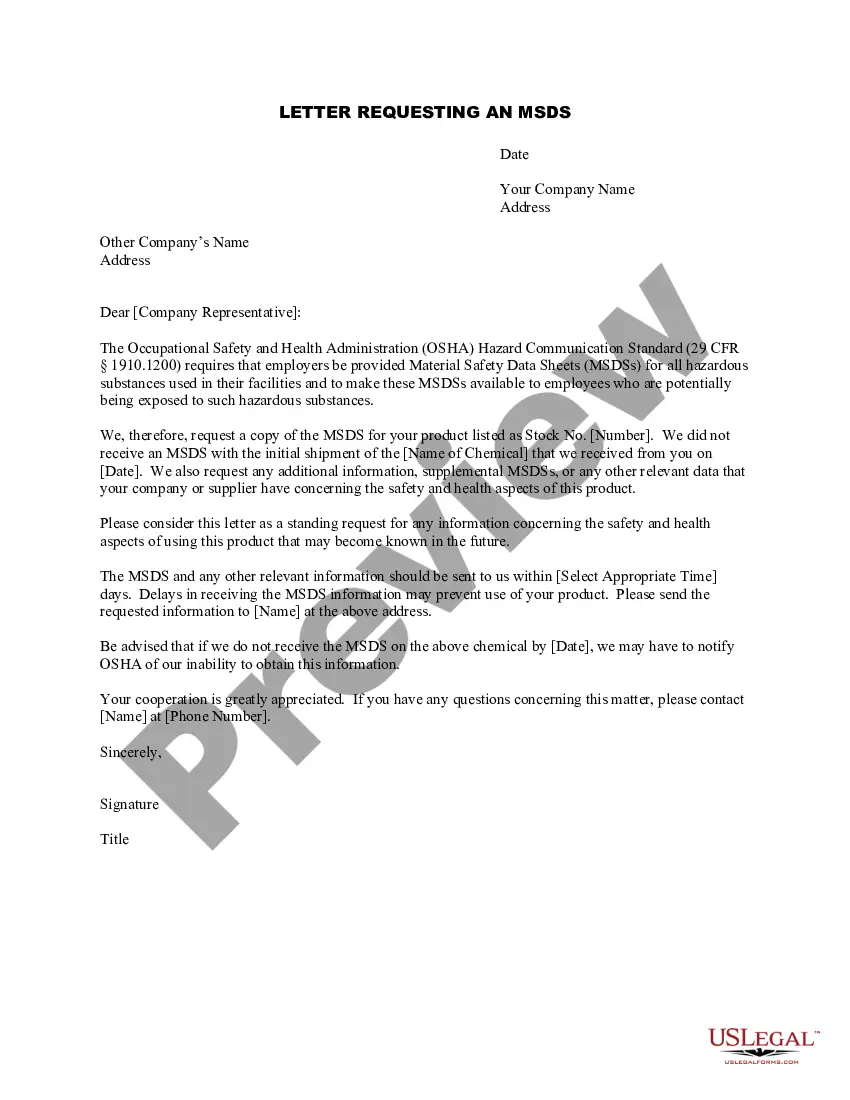

To file a withholding statement for employee final pay withholding, begin by gathering the necessary information about your earnings and deductions. Next, complete the required forms, ensuring that all details are accurate and up-to-date. Many find it helpful to use platforms like US Legal Forms, which provide templates and guidance for filing these statements correctly.

Final withholding refers to the practice of deducting certain amounts from an employee's final paycheck before they receive it. This process is crucial for ensuring that outstanding debts, taxes, or other obligations are settled. It helps employers comply with legal requirements while providing clarity to employees about any deductions they might see. Understanding employee final pay withholding ensures that you can navigate this important process smoothly.

Yes, filling out an employee withholding certificate is critical for ensuring the correct amount of tax is withheld from your paycheck. Employers rely on this document to calculate withholding for federal and state taxes. Addressing employee final pay withholding requires this step to avoid underpayment or overpayment of taxes.

Generating a withholding certificate typically involves completing the IRS Form W-4 or equivalent state forms. This process allows you to state your allowances and any additional withholding amounts. Be mindful of how this connects to employee final pay withholding, as it directly affects your tax situation upon departure.