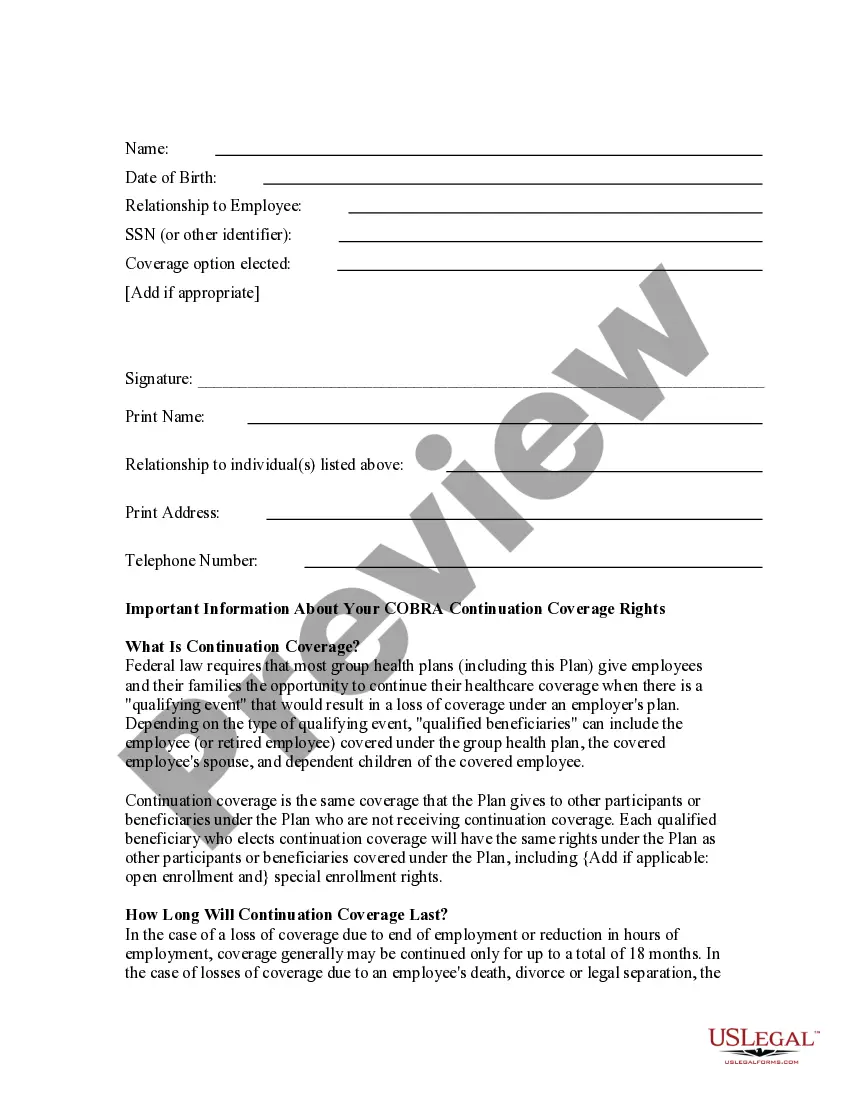

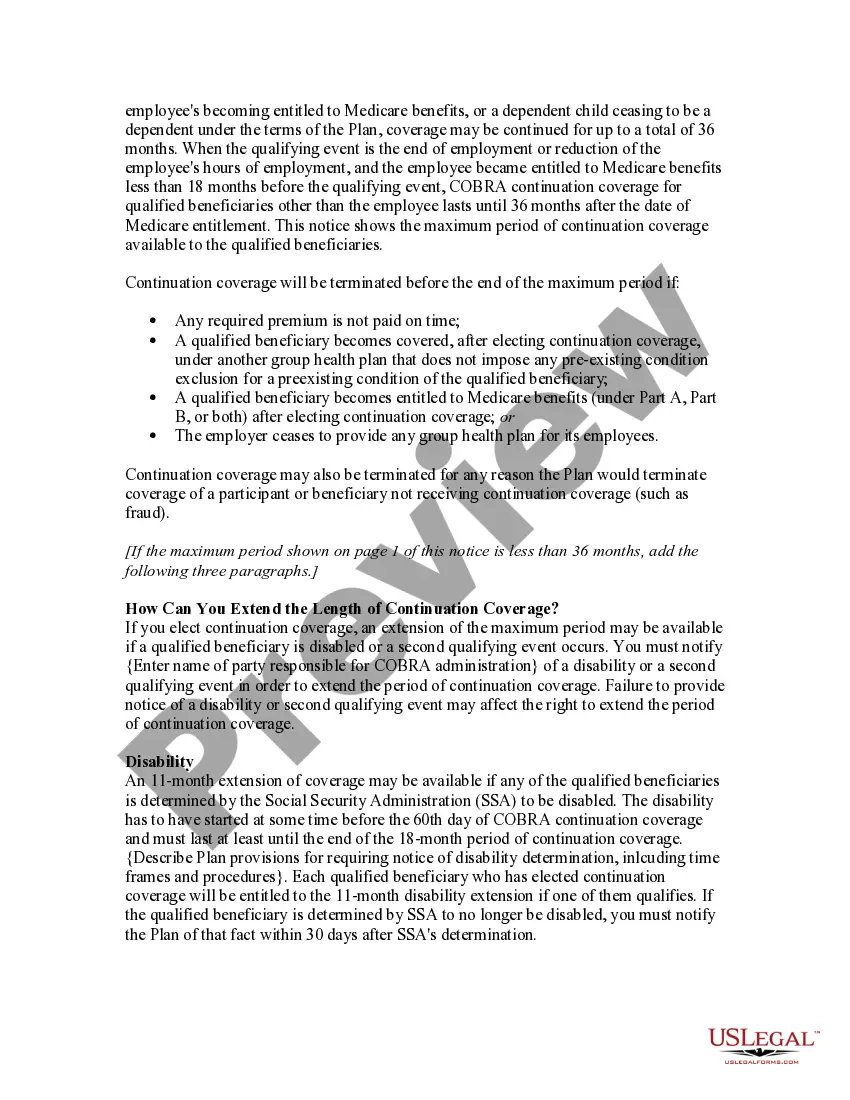

Employer COBRA notice requirements refer to the regulations set by the Consolidated Omnibus Budget Reconciliation Act (COBRA) that employers must follow when providing notifications to employees regarding their continuation of health insurance coverage after leaving the company's employment. Under COBRA, employers with 20 or more employees are mandated to offer employees and their dependents the opportunity to continue their health insurance benefits for a limited period of time, usually up to 18 months, in certain qualifying events such as termination of employment, reduction in work hours, or a dependent losing their eligibility. To meet these requirements, employers must provide various notices to employees at different stages of the COBRA process. The types of COBRA notice include: 1. General Notice: This notice must be provided to employees and their dependents within 90 days of their coverage becoming effective. It explains their rights under COBRA, including the right to continue coverage, the duration of coverage, and the cost associated with COBRA continuation. 2. Qualifying Event Notice: When a qualifying event occurs, such as termination of employment or reduction in work hours, employers must provide a notice to the employee and their dependents within a certain timeframe (e.g. 44 days). This notice details the specific event and provides instructions on how to elect COBRA coverage. 3. Notice of Unavailability: If an individual is not eligible for COBRA continuation due to certain circumstances, such as the employer terminating the group health plan or the individual not being a qualified beneficiary, the employer must provide a written Notice of Unavailability explaining why COBRA is not available. 4. Notice of Early Termination: In some cases, COBRA coverage may end before the maximum duration due to certain circumstances such as non-payment of premiums or becoming entitled to Medicare benefits. In such instances, employers must provide a Notice of Early Termination to notify the individual of the premature termination of their COBRA coverage. It is crucial for employers to comply with these COBRA notice requirements to avoid potential penalties and legal consequences. These notices should be clear, concise, and easily understandable to ensure employees and their dependents are aware of their rights and options for continued health insurance coverage.

Employer Cobra Notice Requirements

Description

How to fill out Employer Cobra Notice Requirements?

Obtaining legal document examples that adhere to federal and state regulations is essential, and the web provides numerous choices to select from.

However, why squander time seeking the suitable Employer Cobra Notice Requirements example online if the US Legal Forms digital library already has such templates gathered in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 fillable templates created by attorneys for various business and personal circumstances. They are simple to navigate with all files organized by state and intended usage. Our experts keep up with legislative updates, ensuring you can rely on your form being current and compliant when obtaining an Employer Cobra Notice Requirements from our platform.

Click Buy Now once you’ve located the right form and choose a subscription plan. Establish an account or Log In and process a payment via PayPal or a credit card. Select the format for your Employer Cobra Notice Requirements and download it. All documents you discover through US Legal Forms are reusable. To re-download and complete previously acquired forms, access the My documents tab in your profile. Enjoy the most comprehensive and user-friendly legal documentation service!

- Acquiring an Employer Cobra Notice Requirements is straightforward and fast for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document example you require in the appropriate format.

- If you are new to our site, adhere to the steps below.

- Examine the template using the Preview feature or through the text outline to confirm it fulfills your requirements.

- Search for another sample using the search tool at the top of the page if necessary.

Form popularity

FAQ

Yes, employers must mail initial COBRA notices to eligible employees. This ensures that all individuals know their rights and options under COBRA for continued health coverage. Timely mailing of these notices is essential to comply with employer COBRA notice requirements. Using platforms like US Legal Forms can simplify this process, helping you meet your legal obligations efficiently.

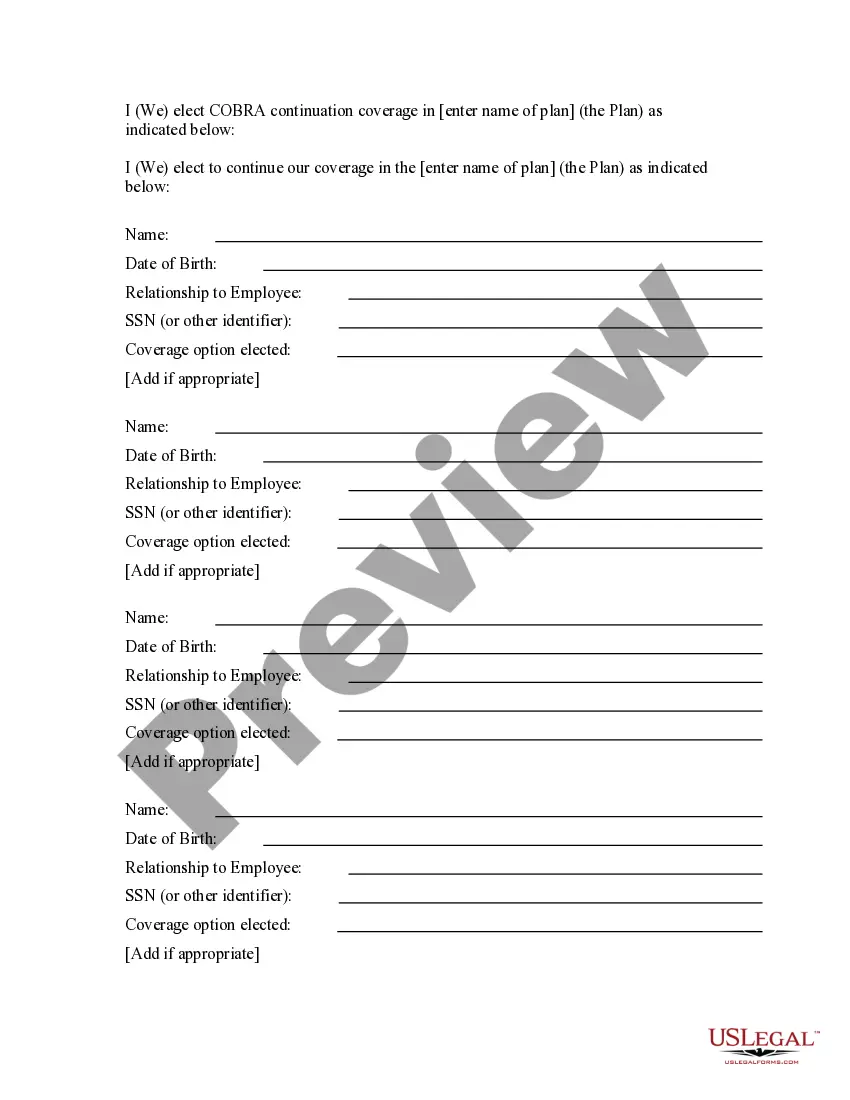

Under COBRA, one required notice is the election notice, which informs employees about their right to choose continuation coverage. This notice must carry specific information regarding their rights and options. Compliance with employer COBRA notice requirements ensures that employees are well-informed and can act on their health insurance choices.

In California, employers are responsible for sending Cal COBRA notices to eligible employees. This is an essential part of fulfilling employer COBRA notice requirements. Ensuring these notices are distributed correctly helps protect the rights of former employees to continue their health coverage.

A variety of events can trigger the need for a COBRA letter to be sent out. Triggers include job loss, a reduction in hours, or other qualifying circumstances affecting health coverage eligibility. Recognizing these triggers is vital for employers to adhere to employer COBRA notice requirements.

COBRA regulations mandate several notifications that employers must deliver. These include an initial coverage notice and subsequent notices when coverage is lost or extended. Timely and accurate notifications are essential to comply with employer COBRA notice requirements and ensure employees are fully informed.

Employers have a specific timeframe to issue COBRA letters to qualifying former employees. They must send these letters within 44 days following a qualifying event. Meeting this timeline is crucial to fulfilling employer COBRA notice requirements and avoiding penalties.

Understanding the timeline for COBRA notifications is essential for compliance with employer COBRA notice requirements. Employers must notify employees of their rights to COBRA coverage within 14 days after a qualifying event. This prompt notification ensures that employees can make timely decisions regarding their health insurance options.

If you haven’t received your COBRA paperwork, the first step is to contact your employer’s HR department. They can provide the necessary documents and clarify your coverage options. If issues persist, consider looking into legal resources that specialize in employers’ COBRA notice requirements to ensure you receive what you need. Utilizing a platform like US Legal Forms can offer templates and guidance to navigate this situation effortlessly.

If your employer did not send a COBRA notice, you should first reach out to HR for clarification. It is their responsibility to inform you of your rights under COBRA. If they still do not comply, consider seeking legal advice to understand your options. Familiarizing yourself with employer COBRA notice requirements keeps you informed and ready to advocate for your rights.

HR has a specific timeframe to provide a COBRA notice after a qualifying event, typically 30 days. This timeframe can vary slightly based on the type of qualifying event and the employer's size. The clock starts ticking from the date of the event, so timely communication is crucial. Being aware of these employer COBRA notice requirements helps in tracking the process effectively.