Cobra Notice For Fsa

Description

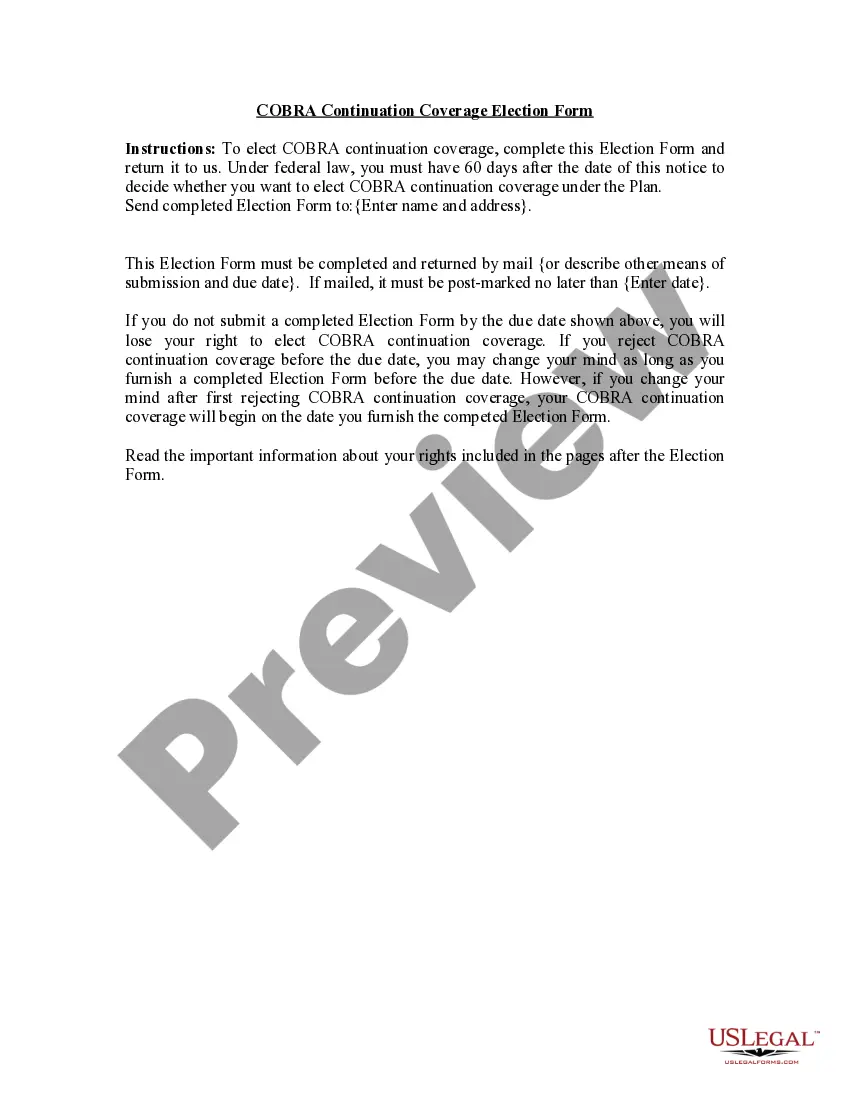

How to fill out COBRA Continuation Coverage Election Notice?

Individuals frequently connect legal documentation with something intricate that solely an expert can handle.

In a certain sense, it's accurate, as preparing Cobra Notice For Fsa requires considerable knowledge of subject criteria, including state and county regulations.

Nevertheless, with the US Legal Forms, everything has become more straightforward: ready-to-use legal templates for every life and business occasion specific to state laws are compiled in a singular online catalog and are now accessible to all.

All templates in our catalog are reusable: once obtained, they remain stored in your profile. You can access them whenever required via the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- Examine the content of the page carefully to ensure it fits your requirements.

- Review the form description or verify it through the Preview option.

- Find another sample using the Search field above if the previous one doesn't meet your needs.

- Press Buy Now when you identify the correct Cobra Notice For Fsa.

- Select a subscription plan that aligns with your needs and budget.

- Create an account or Log In to advance to the payment page.

- Process your payment via PayPal or using your credit card.

- Choose the format for your file and click Download.

- Print your document or upload it to an online editor for a faster completion.

Form popularity

FAQ

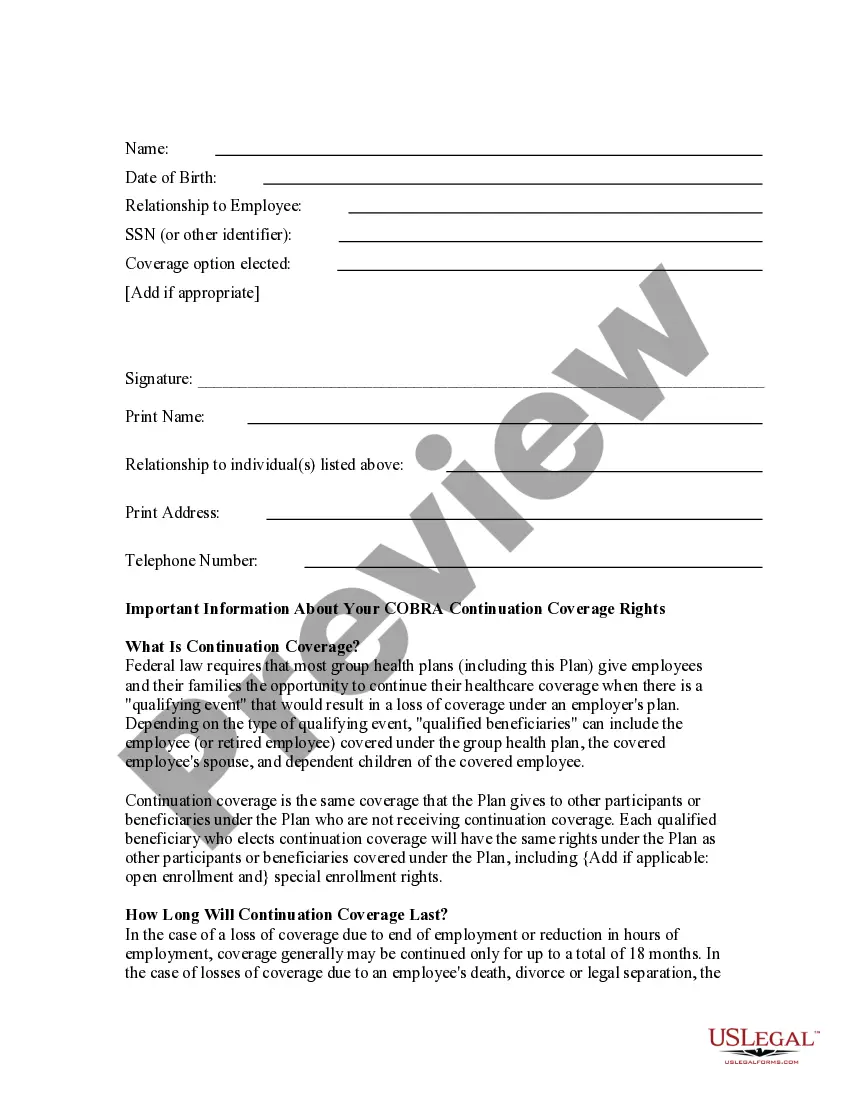

COBRA premiums are not eligible under a flexible spending account (FSA). They are eligible under a health savings account (HSA), and may be eligible under a health reimbursement arrangement (HRA).

How does it work? Once you've elected COBRA coverage, you'll continue to make contributions to your FSA on a taxable basis and your entire FSA balance will be available for you to use on FSA eligible expenses.

The employer will need to offer COBRA regardless of whether the account is over- or underspent. If an employee does not elect COBRA upon termination, he or she cannot access the FSA funds once terminated (except for claims incurred prior to termination date), and any balances are forfeited.

Any unused money in your FSA goes back to your employer once you leave your job. If you have a healthcare FSA, you could have the option to continue access to your funds through COBRA. But you can't use your FSA contributions to pay for health insurance premiums either through COBRA or in the private market.