Continuation Of Coverage Vs Cobra

Description

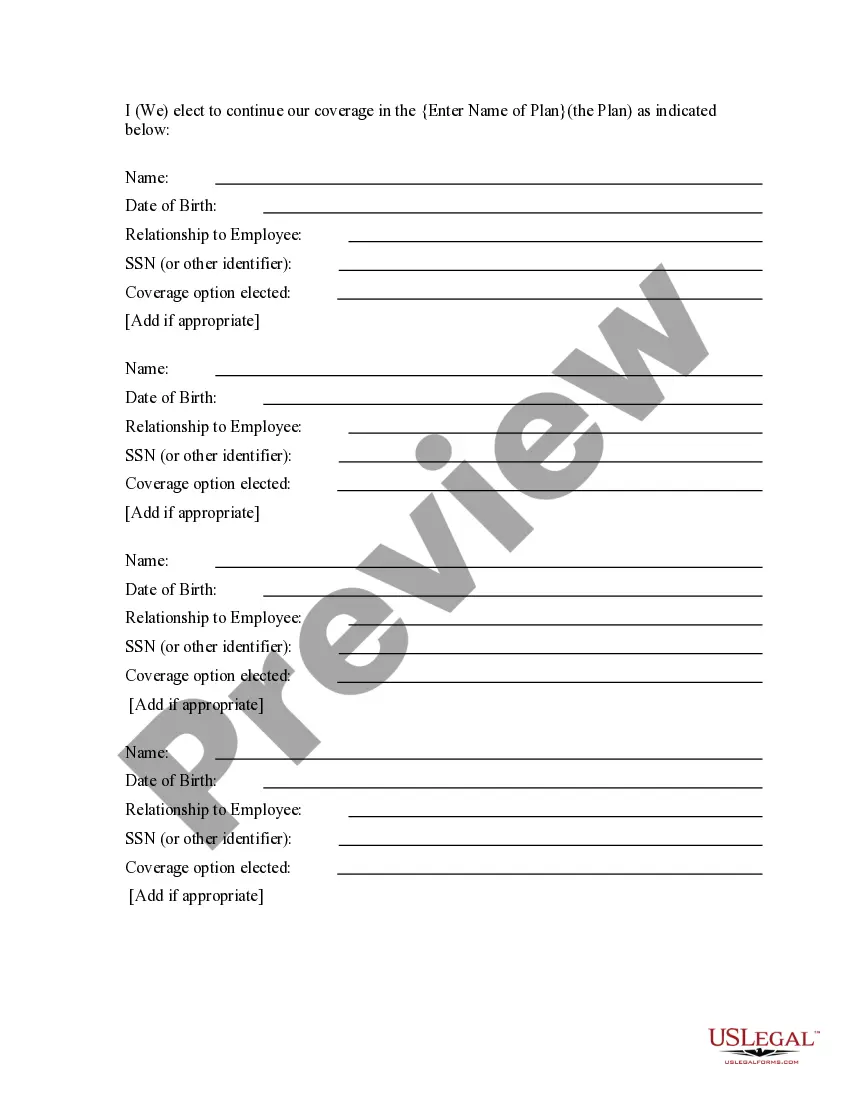

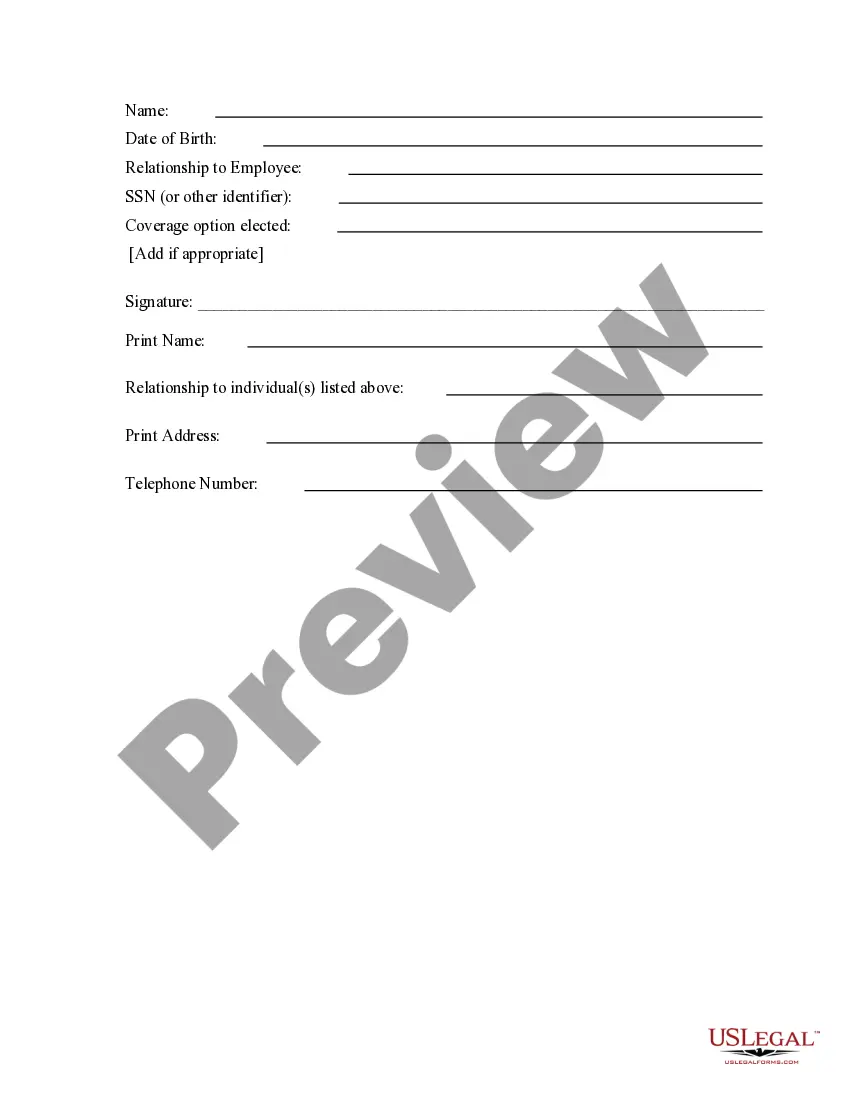

How to fill out COBRA Continuation Coverage Election Form?

Engaging with legal documents and processes can be an exhaustive addition to your day.

Continuation Of Coverage Vs Cobra and similar forms frequently require you to search for them and navigate the path to fill them out correctly.

Thus, whether you are managing financial, legal, or personal issues, having a comprehensive and functional online repository of forms readily available will be very beneficial.

US Legal Forms is the premier online platform for legal templates, providing over 85,000 state-specific forms and various tools to help you complete your documents with ease.

Are you using US Legal Forms for the first time? Sign up and create an account in just a few minutes to gain access to the forms catalog and Continuation Of Coverage Vs Cobra. Then, follow the steps outlined below to fill out your form: Ensure you have located the right form by utilizing the Preview feature and reviewing the form description. Choose Buy Now when ready, and select the monthly subscription plan that suits you best. Select Download then fill out, eSign, and print the form. US Legal Forms has 25 years of experience helping clients manage their legal documentation. Find the form you need today and streamline any process effortlessly.

- Explore the collection of relevant documents accessible to you with just one click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Protect your document management processes with a high-quality service that enables you to create any form within minutes without any additional or hidden fees.

- Simply Log In to your account, locate Continuation Of Coverage Vs Cobra and download it immediately from the My documents section.

- You can also access forms you have previously saved.

Form popularity

FAQ

The primary difference between COBRA and continuation revolves around the specific provisions and eligibility criteria outlined under COBRA laws. Continuation is a broader term that can encompass various state and federal laws allowing for extended coverage. Thus, understanding the continuation of coverage vs cobra is essential for maximizing your healthcare options.

Certain plans are not subject to COBRA, including small group health plans with fewer than 20 employees and plans offered by the federal government. Additionally, some church plans and certain health benefits don’t qualify under COBRA. Awareness of the continuation of coverage vs cobra facilitates clarity on which options you can pursue.

You should receive your COBRA letter from your employer or plan administrator shortly after your employment ends. This letter outlines your rights, options, and enrollment process for maintaining coverage. Understanding the continuation of coverage vs cobra can guide you as you review the details in your letter and make informed choices.

Under COBRA, you can stay on continuation coverage for up to 18 months in most situations. In some cases, such as disability or divorce, this coverage can extend up to 36 months. It's crucial to be aware of the continuation of coverage vs cobra to effectively manage your health care during this period.

The continuation timeline for COBRA typically begins the day after your employment ends and can last for up to 18 months. However, certain circumstances may extend this period. Understanding the difference between the continuation of coverage vs cobra can help you stay informed about your rights and options.

COBRA continuation means the ability to keep your health insurance plan for a limited time after leaving your job. It is a federal law that mandates certain employers to provide this coverage. Knowing the continuation of coverage vs cobra is vital, as it helps you navigate your options while ensuring you maintain access to necessary healthcare services.

A continuation COBRA refers to a provision that allows individuals to maintain their health insurance coverage after their employment ends or their job status changes. This type of coverage ensures that you remain insured during transitions. It's essential to understand the continuation of coverage vs cobra to make informed decisions about your health care options.

Generally, if you miss the initial 60-day enrollment window, you may lose your right to enroll in COBRA coverage. However, in specific circumstances, exceptions like the aforementioned loopholes may apply. It is crucial to approach such situations with care and to seek out specialized guidance, such as what USLegalForms offers, to fully understand your options regarding continuation of coverage vs COBRA. Don’t hesitate to ask questions to find the best solution for your healthcare needs.

COBRA qualifying events that might trigger coverage include job loss, reduction in work hours, transition between jobs, and several family-related events. These events create scenarios where you may need to continue your health insurance without interruption. By understanding these events, you can better compare the continuation of coverage vs COBRA benefits. It’s advisable to stay informed about how these events impact your policy.

The 105-day loophole allows you to obtain COBRA coverage beyond the standard 60 days if your initial election period was missed. This situation can arise if you experienced delays in receiving crucial information about your eligibility. Knowing about this loophole can empower you while assessing the differences between continuation of coverage vs COBRA. Always check with your provider to explore this option thoroughly.