Cobra Continuation For Fsa

Description

How to fill out COBRA Continuation Coverage Election Form?

Regardless of whether for corporate reasons or personal issues, everyone must face legal circumstances at some point in their lives.

Filling out legal documents requires precise attention, beginning with selecting the appropriate form example.

With an extensive catalog from US Legal Forms available, you won’t have to waste time searching for the suitable template online. Use the library’s user-friendly navigation to find the correct template for any circumstance.

- For instance, if you select an incorrect version of a Cobra Continuation For Fsa, it will be rejected when submitted.

- Thus, it is essential to have a reliable resource for legal documents like US Legal Forms.

- If you need to obtain a Cobra Continuation For Fsa example, adhere to these straightforward steps.

- Retrieve the template you require using the search bar or catalog browsing.

- Review the form’s description to ensure it aligns with your situation, state, and county.

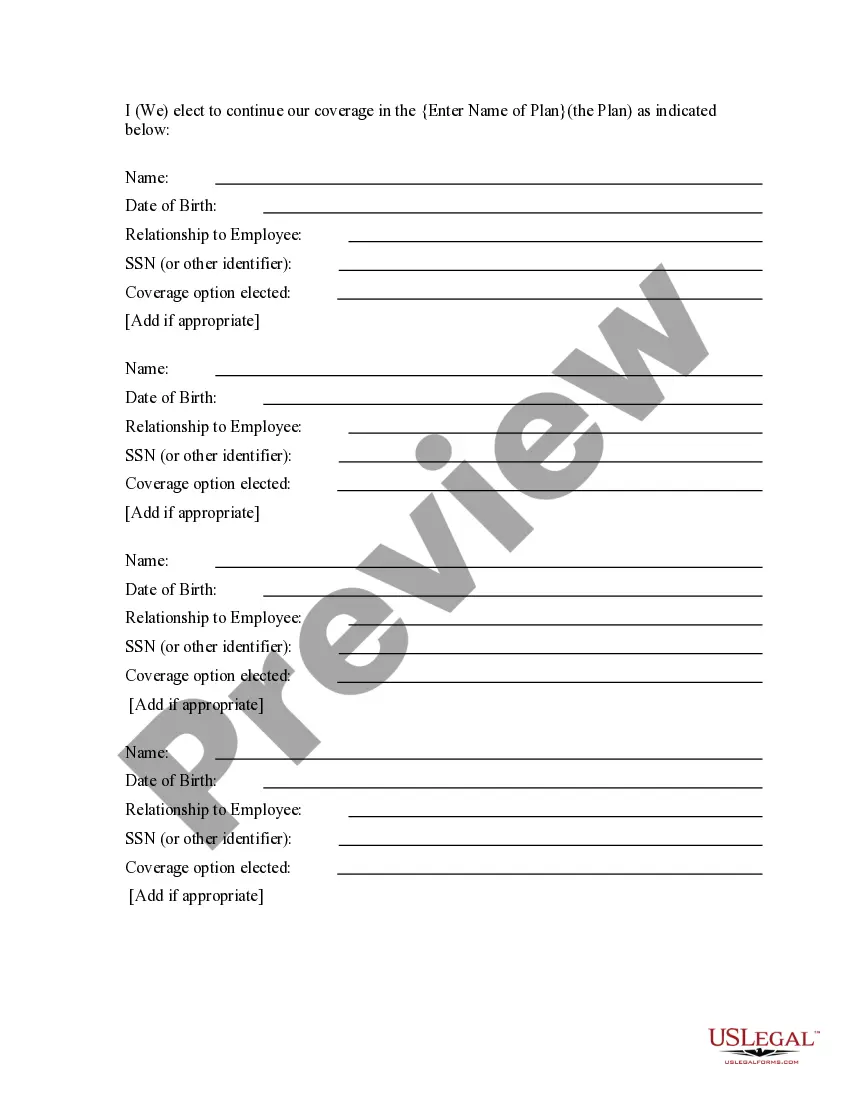

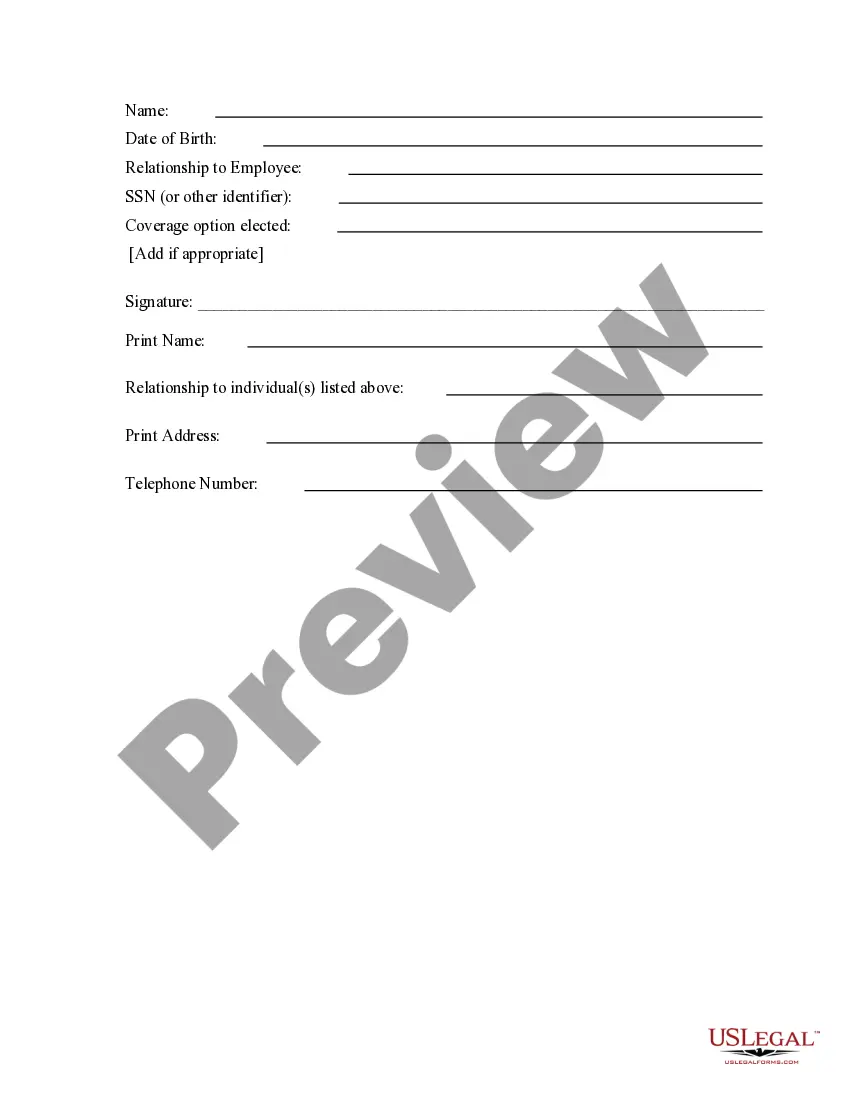

- Click on the form’s preview to inspect it.

- If it is the incorrect document, return to the search feature to find the Cobra Continuation For Fsa sample you need.

- Acquire the template once it suits your requirements.

- If you possess a US Legal Forms profile, simply click Log in to access previously stored files in My documents.

- If you don’t have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: you can utilize a credit card or PayPal account.

- Select the document format you prefer and download the Cobra Continuation For Fsa.

- After it is downloaded, you can complete the form using editing software or print it and fill it out manually.

Form popularity

FAQ

Once your COBRA coverage ends, you generally cannot access FSA funds unless your employer offers an extension. Cobra continuation for FSA provides peace of mind during your employment transition, but it is vital to understand the timelines and limitations. If you find yourself needing continued access to these funds, consider your options carefully to avoid losing benefits.

The Deadlines for a Regular Probate ing to Idaho's applicable statutes, (I.C. § 15-3-108) a regular probate must be completed within 3 years of a person's death. Again, this is regardless of whether the person who died had a written last will and testament or not.

An Idaho small estate affidavit, or 'Form CAO Pb 01', is a legal document that can be used by the heirs or beneficiaries of a person who died and left behind an estate not exceeding $100,000.

If you factor in all fees, the cost of a probate attorney and any Executor fees, a basic, simple probate could average somewhere between around $2,000 - $3,000. Of course this range could drastically change depending on how complicated the estate is and other factors we've mentioned.

If you factor in all fees, the cost of a probate attorney and any Executor fees, a basic, simple probate could average somewhere between around $2,000 - $3,000. Of course this range could drastically change depending on how complicated the estate is and other factors we've mentioned.

Typically, there are seven steps in Idaho's informal probate process: Initiate the Probate Proceeding. ... Acceptance of the Application and Issuance of Letters. ... Notice to Heirs and Devisees. ... Notice to Creditors. ... Inventory of Estate. ... Distribution of Estate assets.

Under normal circumstances, as listed above, a probate must be completed within 3 years of a person's death. However, Idaho has a specific statute that allows for a joint probate to be completed for both spouses regardless of how much time has gone by since the first spouse passed away.

Settling an Estate in Idaho The will and a petition to open probate is filed with the court. An executor or personal representative is chosen and approved by the court. They receive documents that allow them to act on behalf of the estate. The executor must notify the heirs that probate is open.

Specifically, in Idaho a probate is required after you die anytime your estate includes any assets that have a value of $100,000 or more.