Reasonable Accommodation Examples For Anxiety

Description

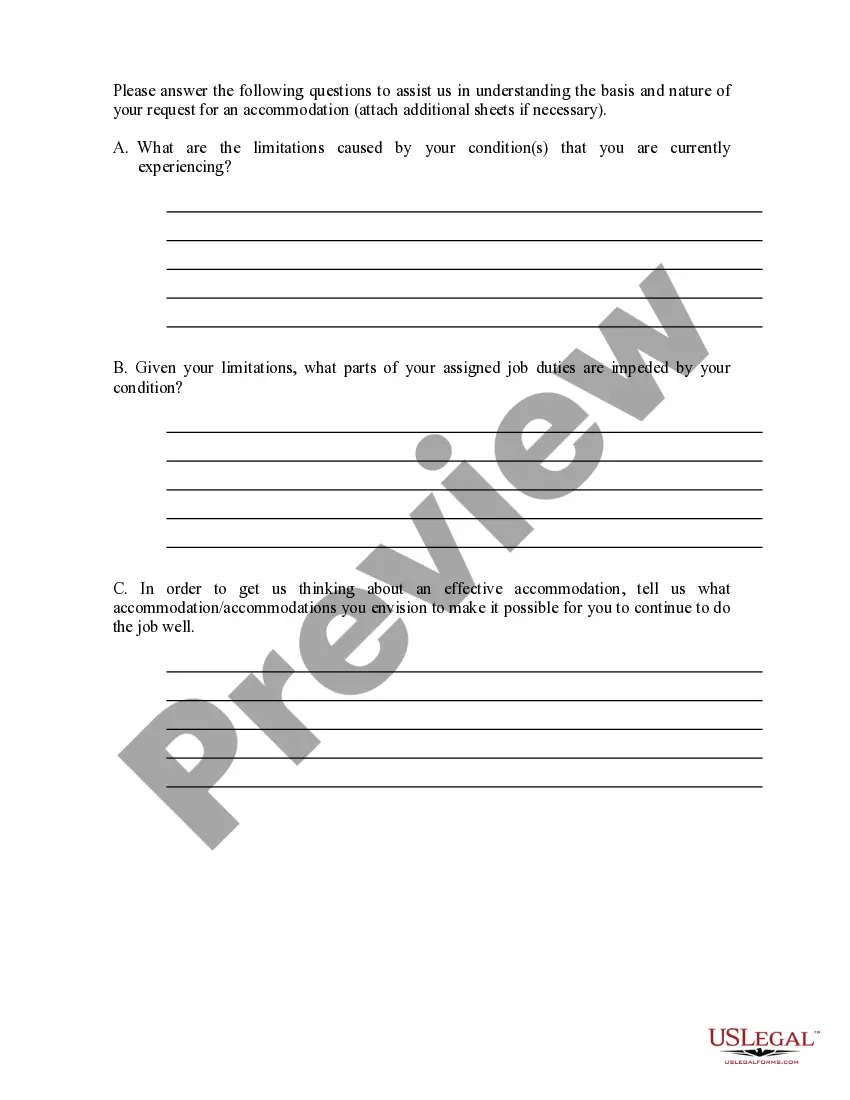

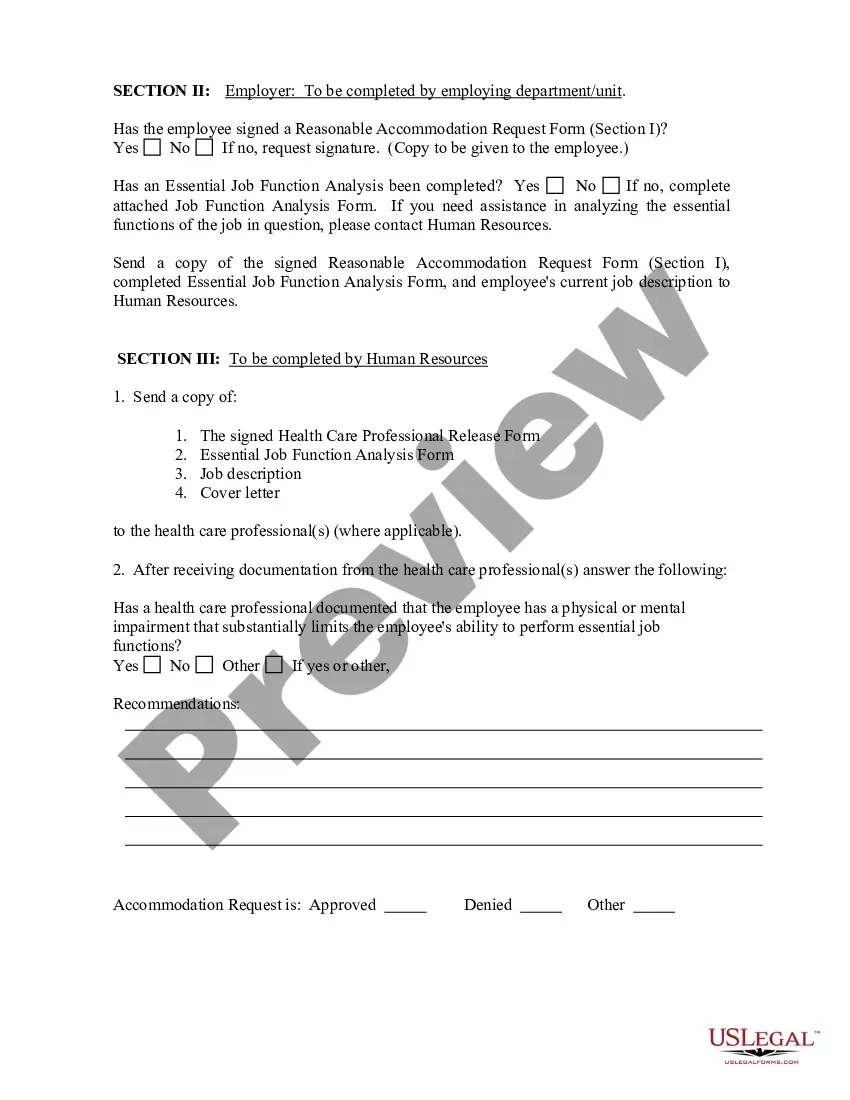

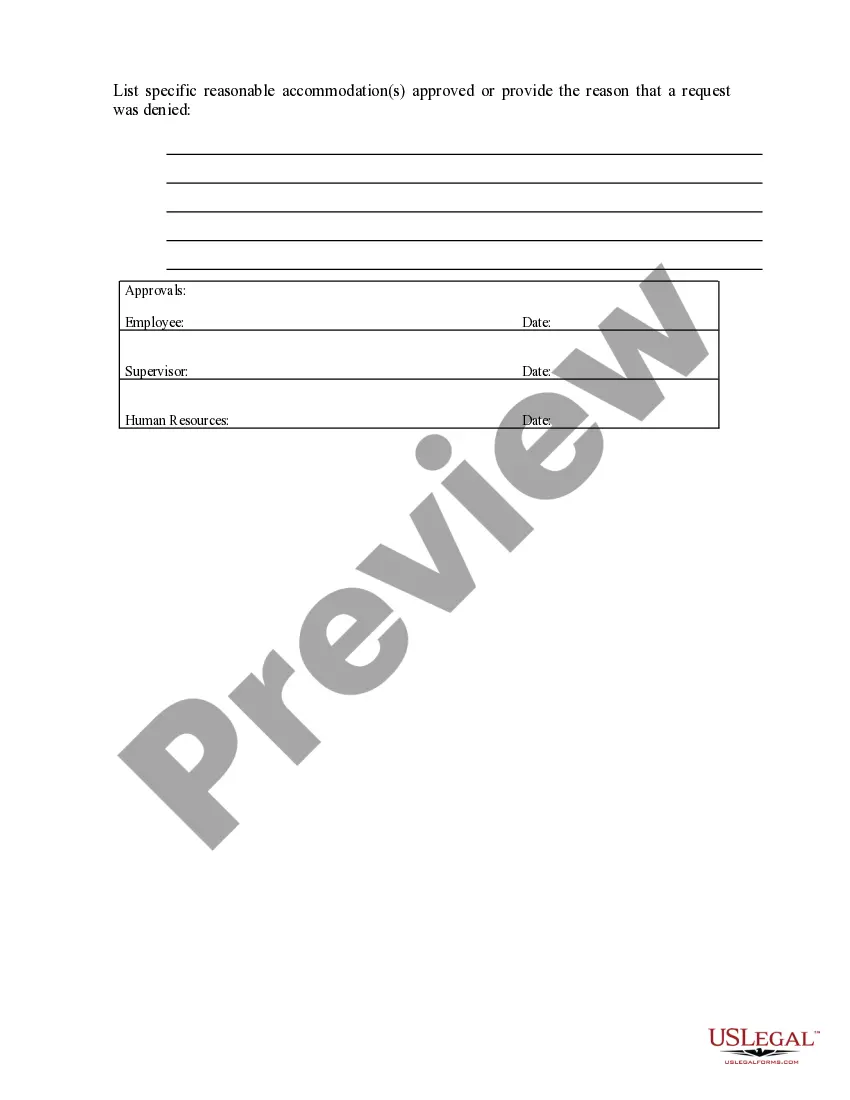

How to fill out Reasonable Accommodation Request Form?

Regardless of whether for corporate intentions or personal matters, every individual must confront legal situations at some point in their existence.

Completing legal documents requires meticulous care, beginning with selecting the appropriate form template.

Select your payment method: you may utilize a credit card or PayPal account. Choose the document format you prefer and download the Reasonable Accommodation Examples For Anxiety. Once it is downloaded, you can complete the form with the assistance of editing applications or print it and fill it out manually. With a broad US Legal Forms catalog accessible, you do not need to waste time searching for the right template online. Employ the library’s straightforward navigation to find the suitable template for any circumstance.

- For example, if you choose an incorrect version of a Reasonable Accommodation Examples For Anxiety, it will be rejected upon submission.

- Thus, it is vital to have a trustworthy source of legal documents, such as US Legal Forms.

- If you need to obtain a Reasonable Accommodation Examples For Anxiety template, adhere to these straightforward steps.

- Acquire the template you require by utilizing the search bar or catalog navigation.

- Review the form’s details to ensure it corresponds with your situation, state, and locality.

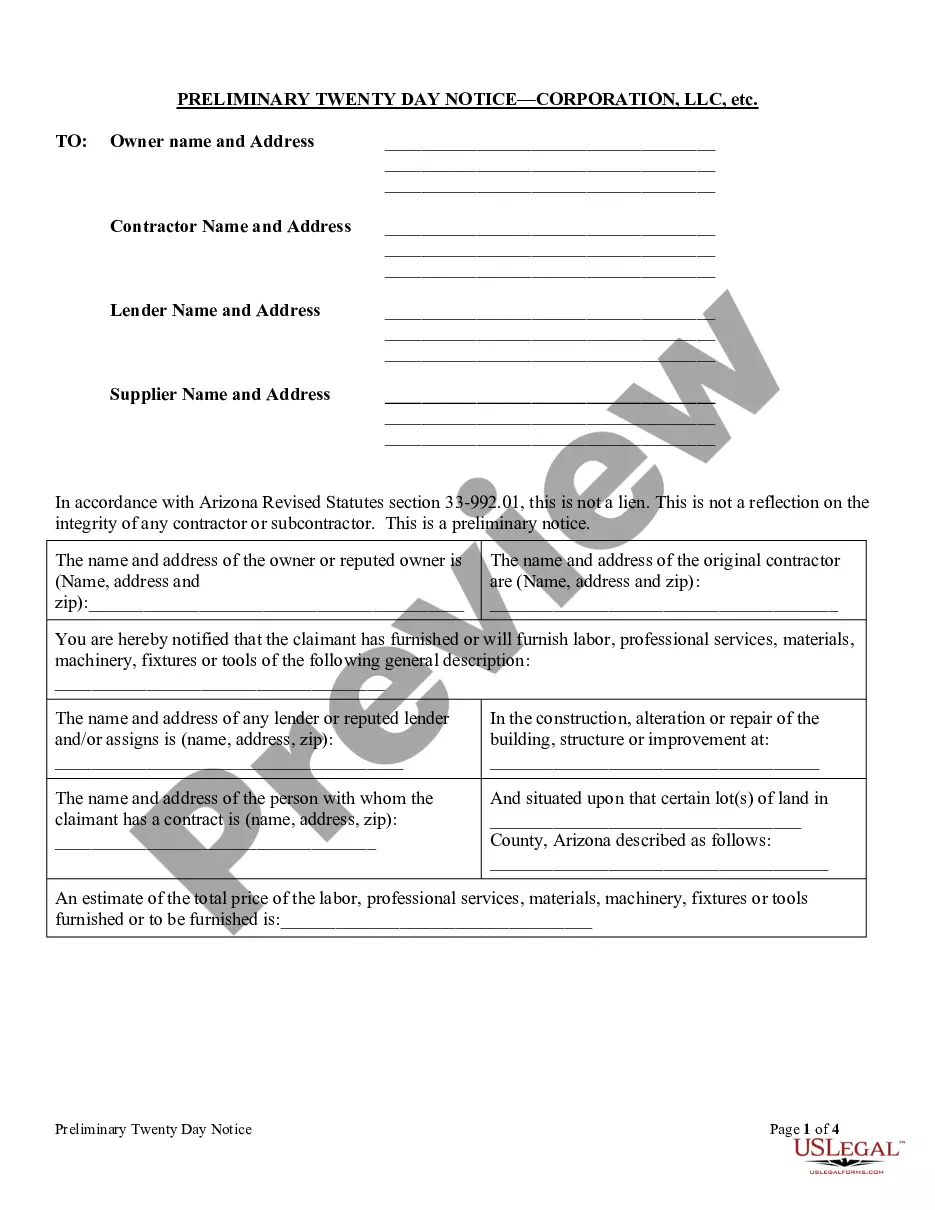

- Click on the form’s preview to inspect it.

- If it is the wrong document, return to the search function to find the Reasonable Accommodation Examples For Anxiety example you need.

- Download the file when it satisfies your conditions.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- If you do not yet have an account, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account sign-up form.

Form popularity

FAQ

Change your name with the North Carolina Secretary of State by calling 919-814-5400 . Once changed, begin using your new name on all filings with the Department.

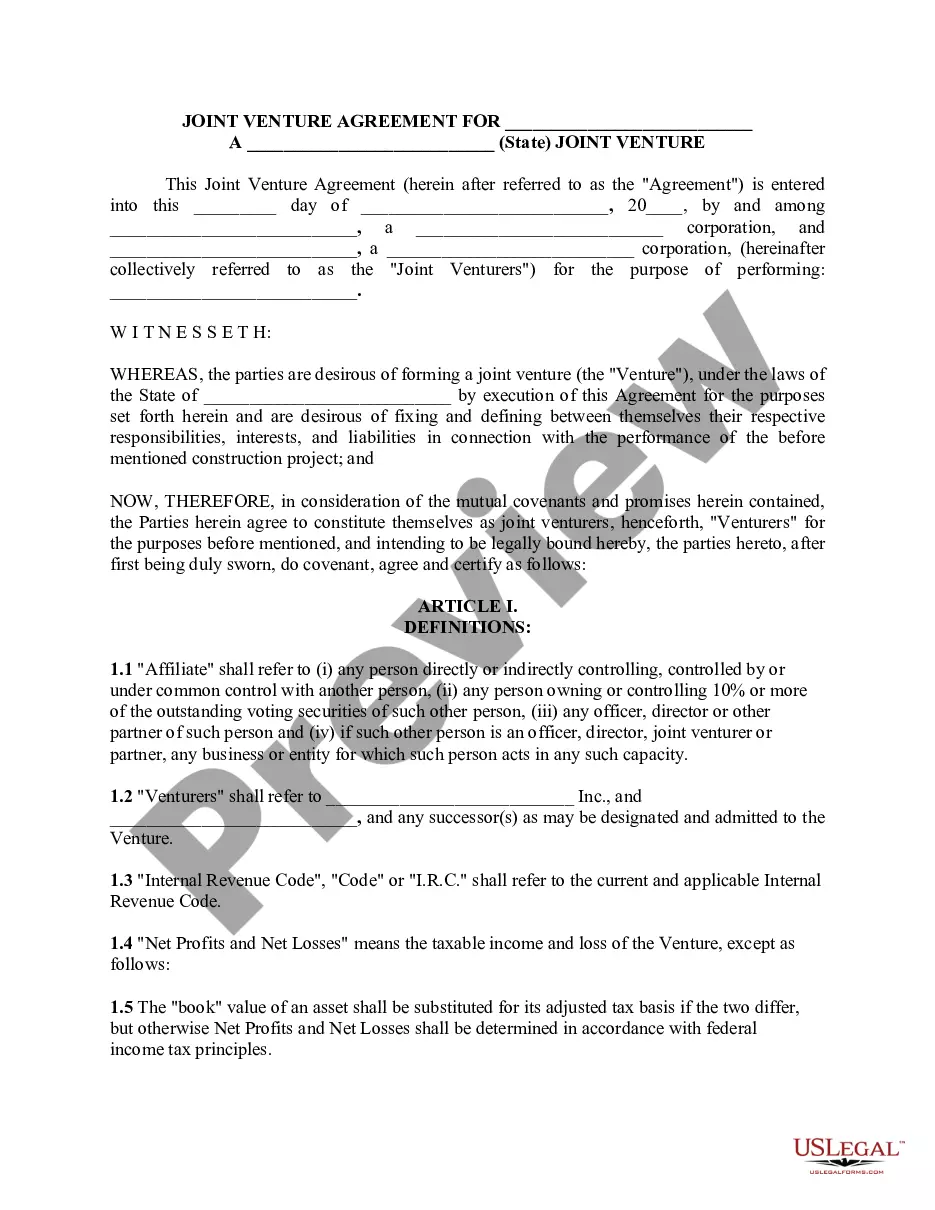

General partnerships must file a Certificate of Assumed Name with the County Register of Deeds. Limited partnerships must file a Certificate of Domestic Limited Partnership with the NC Secretary of State.

Draft and sign a partnership agreement. Comply with tax and regulatory requirements. Obtain business insurance.

How to form a North Carolina General Partnership ? Step by Step Step 1 ? Business Planning Stage. ... Step 2 ? Create a Partnership Agreement. ... Step 3 ? Name your Partnership and Obtain a DBA. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Research license requirements. ... Step 6 ? Maintain your Partnership.

Create a General Partnership in North Carolina Determine if you should start a general partnership. Choose a business name. File a DBA name (if needed) Draft and sign partnership agreement. Obtain licenses, permits, and clearances. Get an Employer Identification Number (EIN)

How to form a partnership: 10 steps to success Choose your partners. ... Determine your type of partnership. ... Come up with a name for your partnership. ... Register the partnership. ... Determine tax obligations. ... Apply for an EIN and tax ID numbers. ... Establish a partnership agreement. ... Obtain licenses and permits, if applicable.