Llc Business Owner Forever

Description

How to fill out Resolution Of Meeting Of LLC Members To Remove The Manager Of The Company And Appoint A New Manager?

Creating legal documents from the ground up can at times be daunting.

Certain situations may require extensive research and significant financial investment.

If you’re searching for a simpler and more cost-effective method of preparing Llc Business Owner Forever or any other forms without excessive hurdles, US Legal Forms is always accessible.

Our online collection of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal affairs.

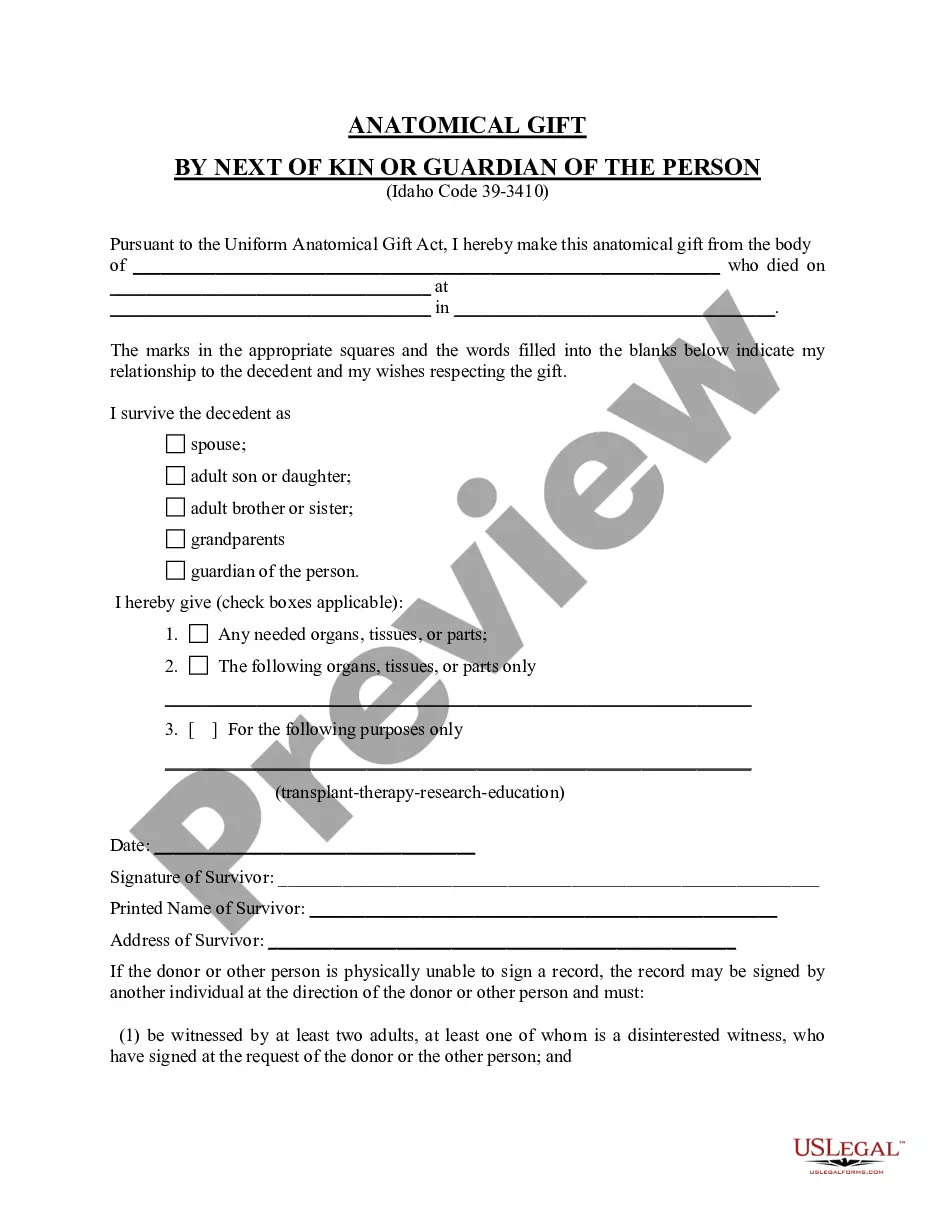

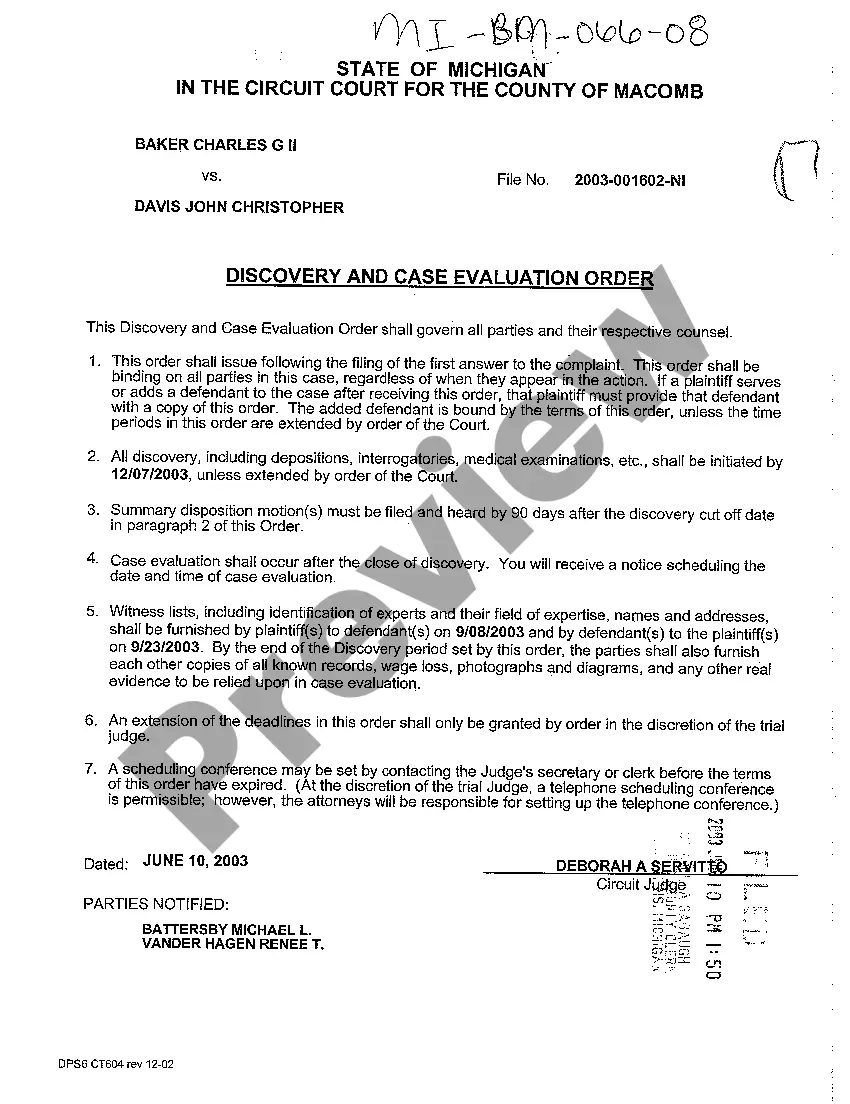

However, before you dive straight into downloading Llc Business Owner Forever, heed these suggestions: Check the form preview and descriptions to confirm that you are on the exact document you need. Ensure the form you select adheres to the statutes and regulations of your state and county. Choose the most appropriate subscription plan to acquire the Llc Business Owner Forever. Download the file. Then complete, sign, and print it out. US Legal Forms enjoys a solid reputation and over 25 years of experience. Join us now and make document preparation a simple and efficient process!

- With merely a few clicks, you can promptly acquire state- and county-specific forms meticulously assembled for you by our legal experts.

- Utilize our website whenever you require dependable and trustworthy services through which you can swiftly locate and retrieve the Llc Business Owner Forever.

- If you’re familiar with our site and have previously established an account, simply Log In, select the form, and download it immediately or retrieve it again later in the My documents section.

- Not possess an account? No problem. It takes minimal time to sign up and browse the catalog.

Form popularity

FAQ

Most states require LLCs to file annual reports or renewals at specified intervals, which helps keep the business in good standing. Regular maintenance is crucial for an LLC business owner forever. Utilizing platforms like US Legal Forms can simplify this process and ensure your LLC remains compliant with all state regulations.

An LLC can remain operational without generating profits for an extended period; however, diligent record-keeping and payment of taxes are required. As a business owner forever, you need to consider the implications of running a non-profitable LLC, especially for tax purposes. It is important to evaluate your business strategy and enhance your operations during lean times.

Yes, an LLC can theoretically last indefinitely if the members comply with relevant regulations and keep the company in good standing. This makes it a strong option for an LLC business owner forever, offering stability and security. Proper management and adherence to state requirements will ensure your LLC continues to thrive.

The lifespan of an LLC can vary based on state regulations, but generally, it can last for many years or even indefinitely. As an LLC business owner forever, you have the advantage of flexibility in determining your business's longevity, as long as you fulfill state obligations and maintain good standing.

An LLC stays active as long as it meets state requirements, such as filing annual reports and paying necessary fees. If an LLC owner remains compliant, their LLC can function indefinitely. This ensures that as an LLC business owner forever, you maintain your business without interruptions.

There is no upper limit on the number of people who can be listed as members in an LLC. Each member can actively participate in the business operations without the constraints typically found in other business structures. By forming an LLC, you ensure stability and security as an LLC business owner forever, all while fostering diverse involvement in your company's journey.

Absolutely, an LLC can feature an unlimited number of owners or members. This characteristic enables innovative business structures, providing the opportunity for diverse talents and resources within your company. As an LLC business owner forever, you can easily integrate new members and expand, fostering a collaborative environment.

Choosing to make your LLC perpetual often means ensuring its continuity beyond the lifespan of any member. This decision can benefit you as an LLC business owner forever since it allows your company to thrive even if ownership changes. You can manage transitions seamlessly, securing the future of your business without unnecessary disruptions.

Yes, LLCs can have unlimited owners, known as members. This feature allows multiple individuals to share ownership, making it easier for businesses to grow and adapt. As an LLC business owner forever, you can enjoy the flexibility of bringing in new members when needed, which can enhance your business's capabilities.

An LLC remains valid as long as it meets state regulations, which often include annual filings and fees. Without these, an LLC may become inactive or be automatically dissolved after a certain period. As an LLC business owner forever, it's critical to stay informed about your state’s requirements to keep your business operational.