Form Refund Memo With Attachments

Description

How to fill out Credit Memo Request Form?

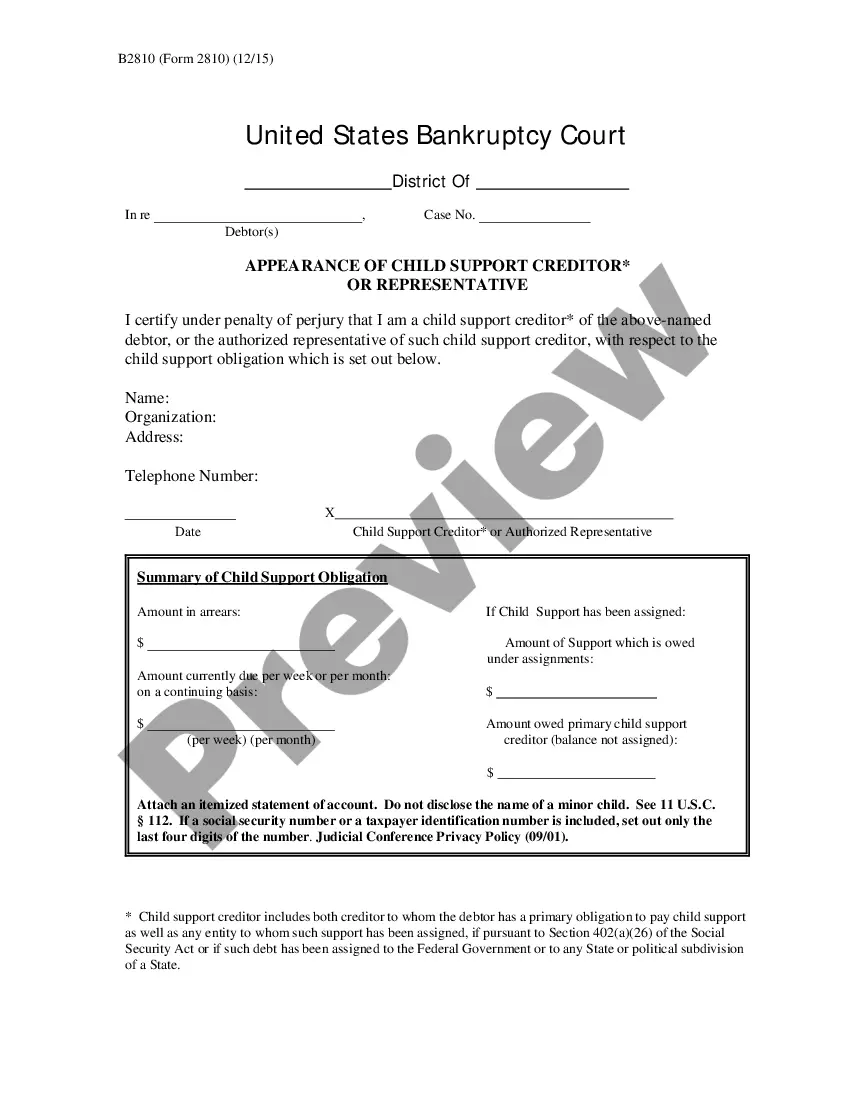

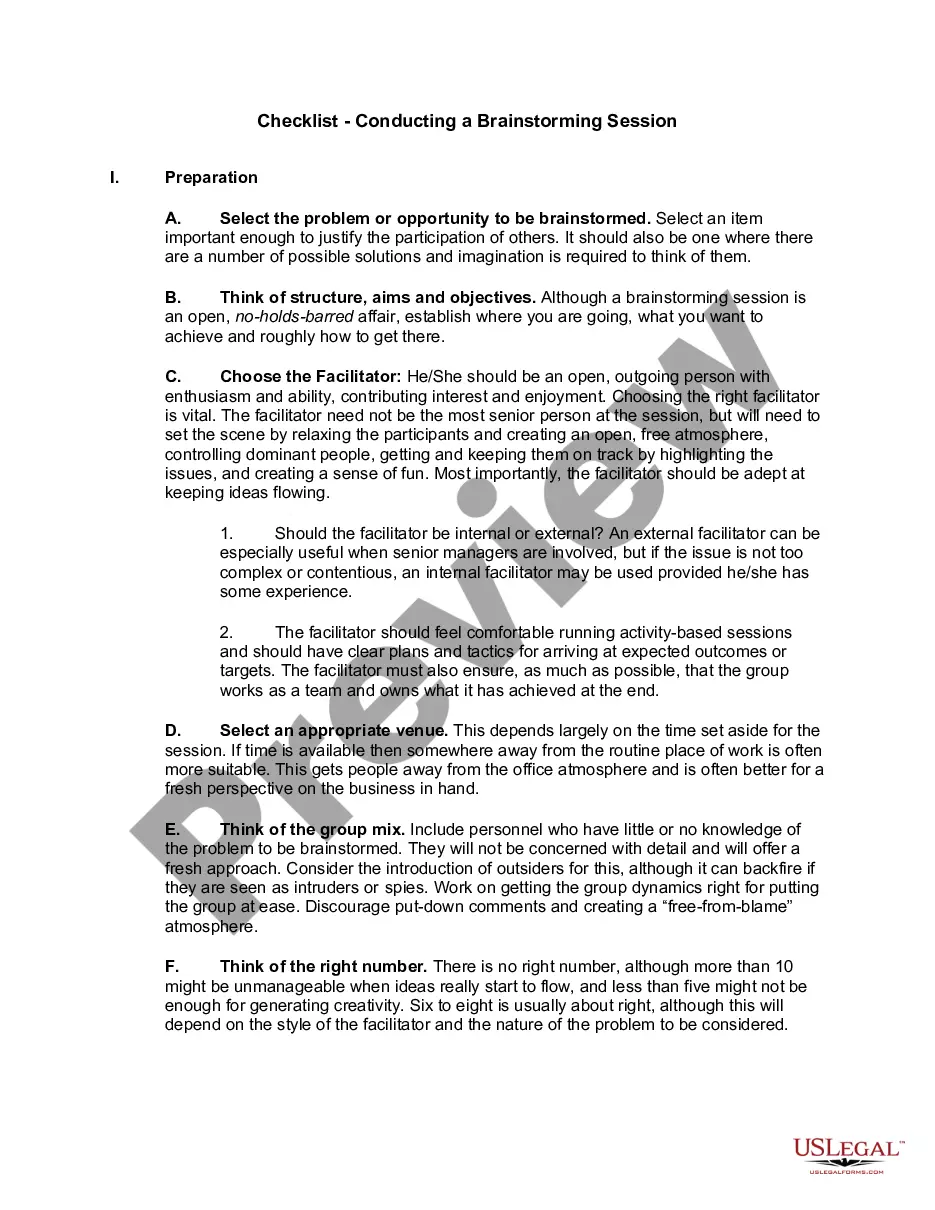

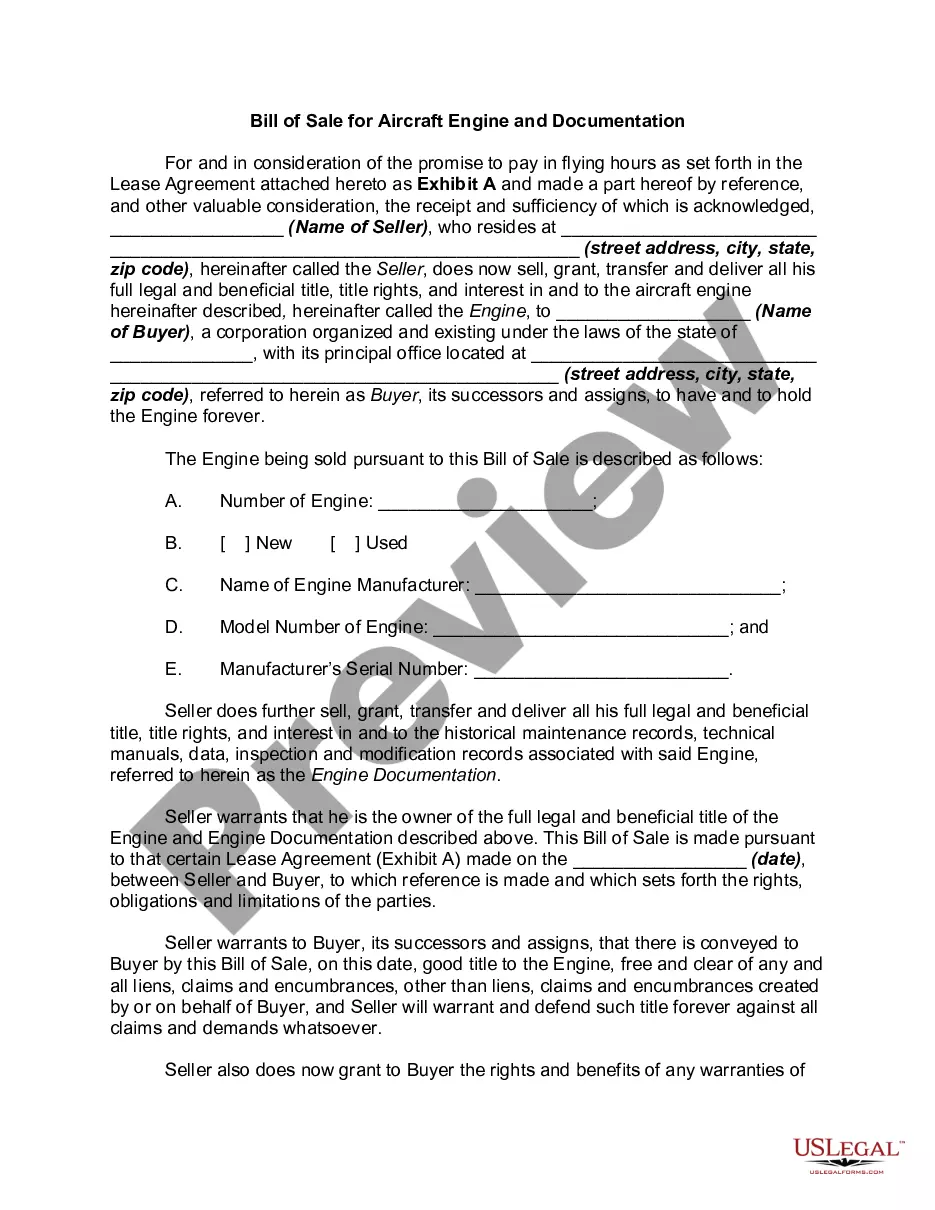

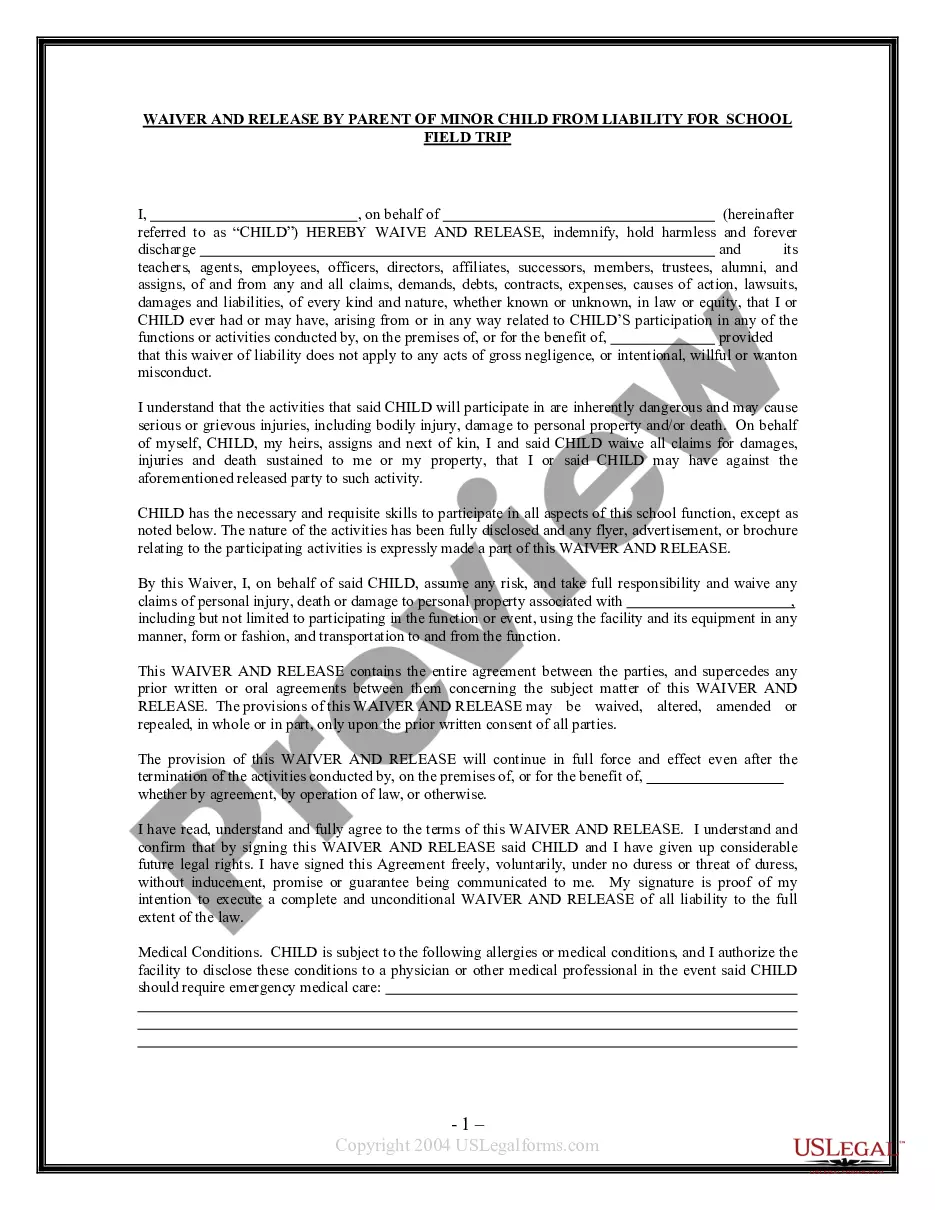

Accessing legal templates that meet the federal and local laws is crucial, and the internet offers numerous options to pick from. But what’s the point in wasting time looking for the right Form Refund Memo With Attachments sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and life situation. They are easy to browse with all files grouped by state and purpose of use. Our professionals stay up with legislative updates, so you can always be sure your form is up to date and compliant when acquiring a Form Refund Memo With Attachments from our website.

Obtaining a Form Refund Memo With Attachments is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, follow the steps below:

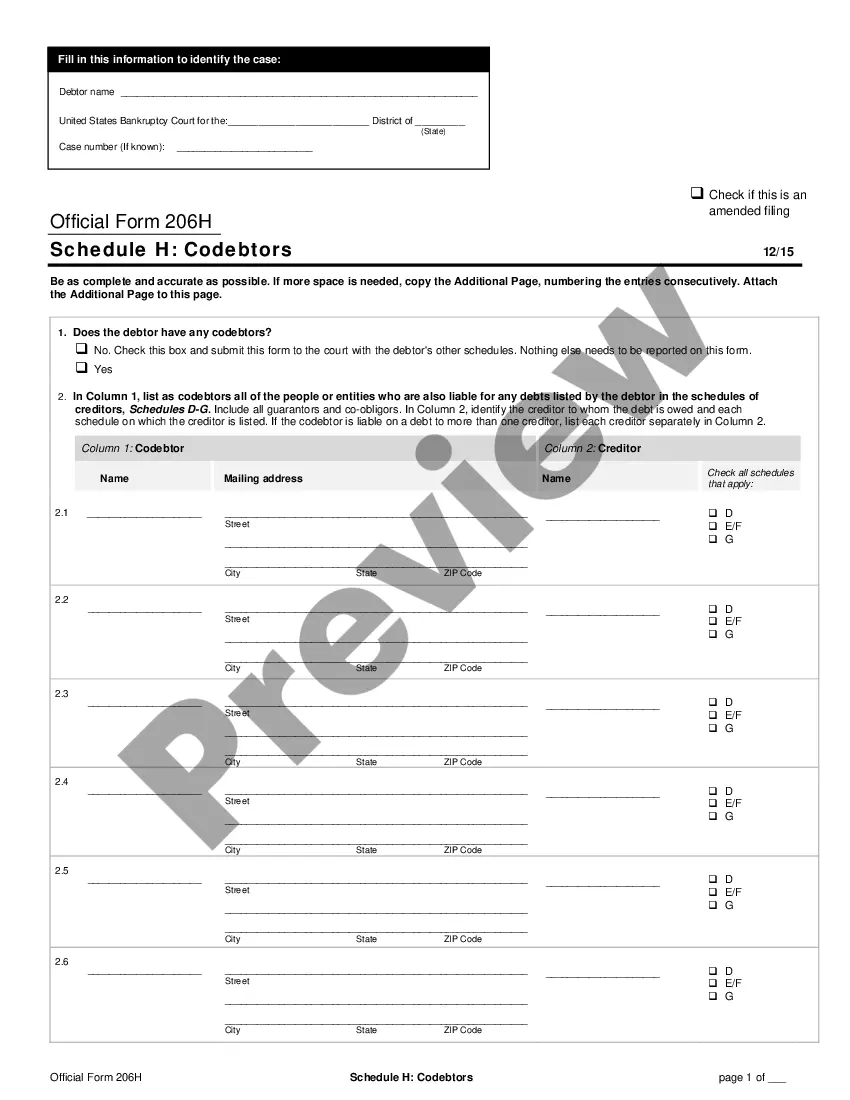

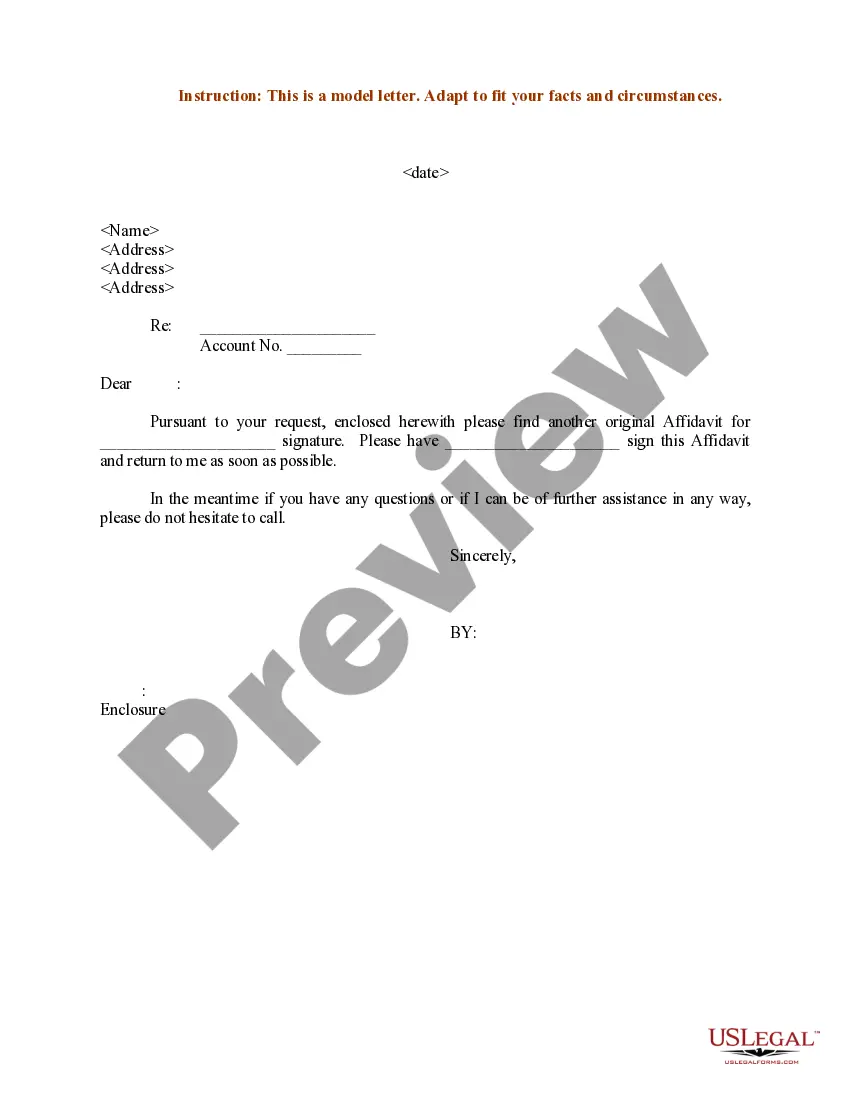

- Examine the template using the Preview option or via the text description to make certain it meets your requirements.

- Locate a different sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the suitable form and opt for a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Form Refund Memo With Attachments and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and complete previously purchased forms, open the My Forms tab in your profile. Benefit from the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

The IRS accepts returns that are stapled or paperclipped together. However, any check or payment voucher, as well as accompanying Form 1040-V, must not be stapled or paperclipped with the rest of the return, since payments are processed separately.

If the IRS sent the refund, but it was never received, use Form 3911 to request a ?refund trace.? Fill out Section I and Section II, then sign and date in Section III. Mail in the form, or fax it, to the appropriate office listed on the IRS website.

Before you mail Sign your tax return. If you're filing a joint return both people must sign the return. Make sure your name, address, and social security number(s) are correct. Check your math. Attach a copy of your federal return (if not using form 540 2EZ) Attach a copy of your W-2. File your original return, not a copy.

If you file a paper return, be sure to attach a copy of Form W-2 in the place indicated on the front page of your return. Attach it only to the front page of your paper return, not to any attachments. For more information, see Form W-2 in chapter 4. Form 1099-R.

To Upload Documents to IRS.gov: Open the link in any browser and enter the unique access code, first and last name, and Social Security, Individual Taxpayer Identification or Employee Identification number. Upload up to 40 files, including scans, photos, or digital copies of documents, with a maximum of 15MB per file.