Gift Agreement Between Withdrawal

Description

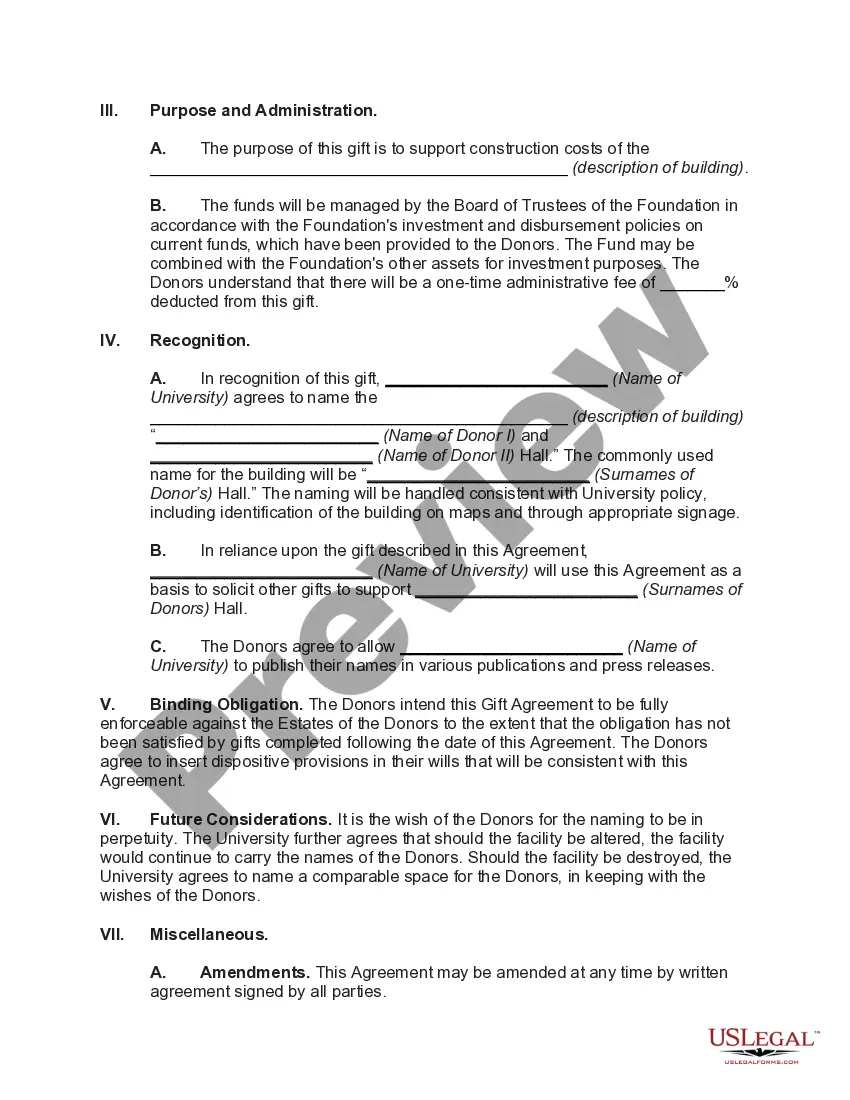

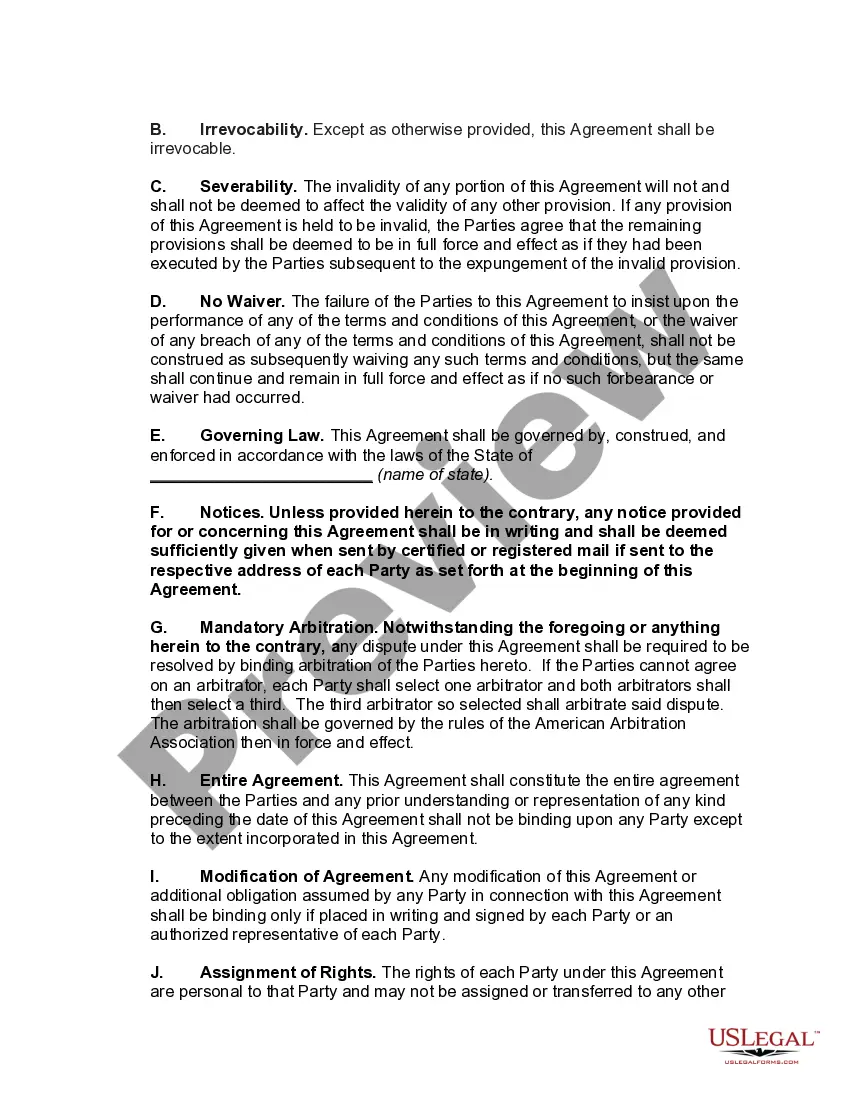

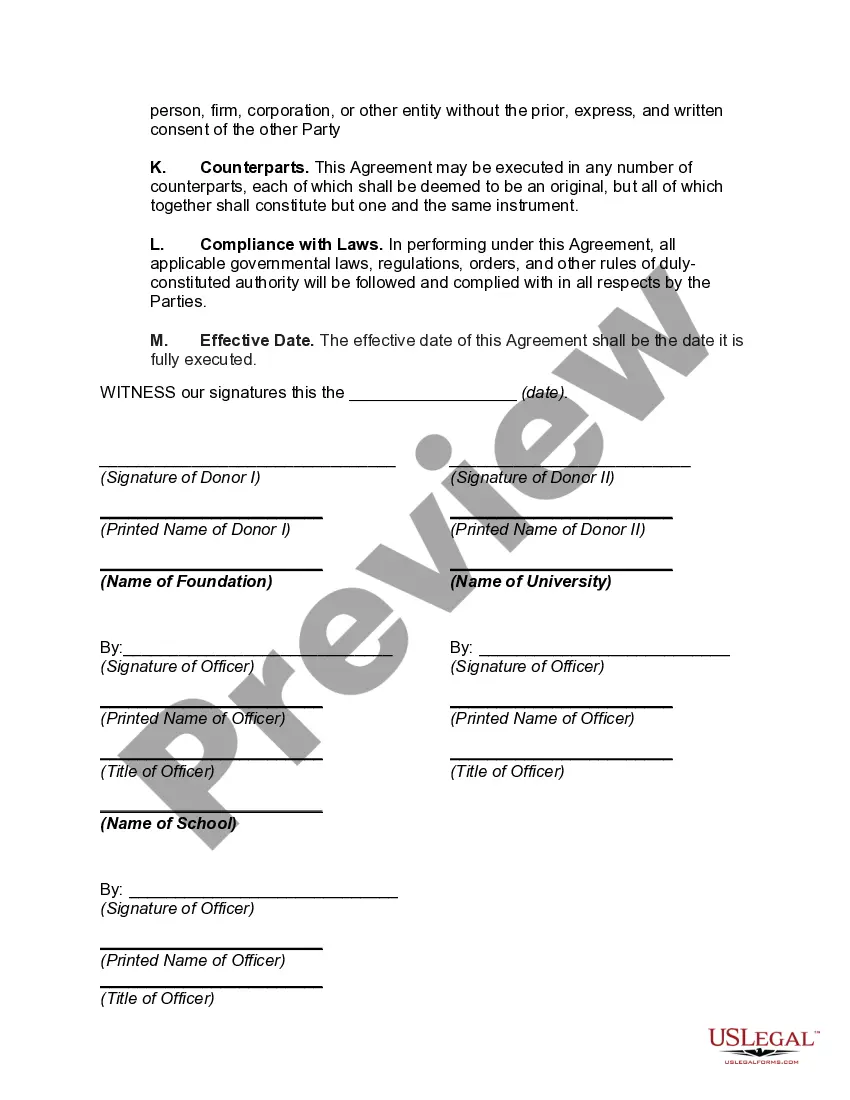

How to fill out Gift Agreement Between Donors And University Foundation With Purpose Of Gift To Construct Building To Be Named After Donors?

There is no longer any need to waste time searching for legal documents to meet your local state obligations.

US Legal Forms has gathered all of them in one location and made them easily accessible.

Our platform provides over 85,000 templates for all business and personal legal matters organized by state and area of application.

To explore further samples if the one displayed isn't suitable for you, use the search bar above. Once you find the right template, click Buy Now next to its title. Choose the preferred pricing plan and either create an account or Log In, then pay for your subscription using a credit card or PayPal to proceed. Choose the file format for your Gift Agreement Between Withdrawal and download it to your device. Print your form to fill it out manually or upload the template if you prefer using an online editor. Preparing legal documentation in compliance with federal and state laws is fast and straightforward with our platform. Give US Legal Forms a try today to keep your paperwork organized!

- All documents are expertly crafted and verified for authenticity, allowing you to be assured in obtaining a current Gift Agreement Between Withdrawal.

- If you are acquainted with our platform and have an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents whenever necessary by navigating to the My documents tab in your profile.

- If you are a new user to our platform, the process will require a few additional steps to finalize.

- Here’s how new users can locate the Gift Agreement Between Withdrawal in our catalog.

- Carefully read the page content to verify it contains the sample you are looking for.

- Utilize the form description and preview options if available.

Form popularity

FAQ

Most conventional mortgage loans allow homebuyers to use gift money for their down payment and closing costs as long as it's a gift from an acceptable source, such as from family members. Fannie Mae and Freddie Mac define family as the following: Parent. Children (including adopted, step and foster children)

Here's what your gift letter should include:The donor's name, address and phone number.The donor's relationship to the client.The dollar amount of the gift.The date the funds were transferred.A statement from the donor that no repayment is expected.The donor's signature.The address of the property being purchased.

How do I prove I received the gift money?A copy of the gift giver's check or withdrawal slip and the homebuyer's deposit slip.A copy of the gift giver's check to the closing agent.A settlement statement showing receipt of the donor's monetary gift.Copy of certified check.Proof of wire transfer.

Here's what your gift letter should include:The donor's name, address and phone number.The donor's relationship to the client.The dollar amount of the gift.The date the funds were transferred.A statement from the donor that no repayment is expected.The donor's signature.The address of the property being purchased.

A gift letter is a formal and legally binding document that states a large sum of money was gifted to you by a donor. It officially declares that the money is a gift and not a loan that needs to be paid back.